Louisiana Custody Agreement For Unmarried Parents

Description

How to fill out Louisiana Joint Custody Agreement?

Whether for business purposes or for personal affairs, everybody has to manage legal situations at some point in their life. Completing legal papers demands careful attention, starting with picking the proper form template. For example, if you pick a wrong edition of the Louisiana Custody Agreement For Unmarried Parents, it will be turned down once you submit it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you need to get a Louisiana Custody Agreement For Unmarried Parents template, stick to these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s description to ensure it suits your situation, state, and county.

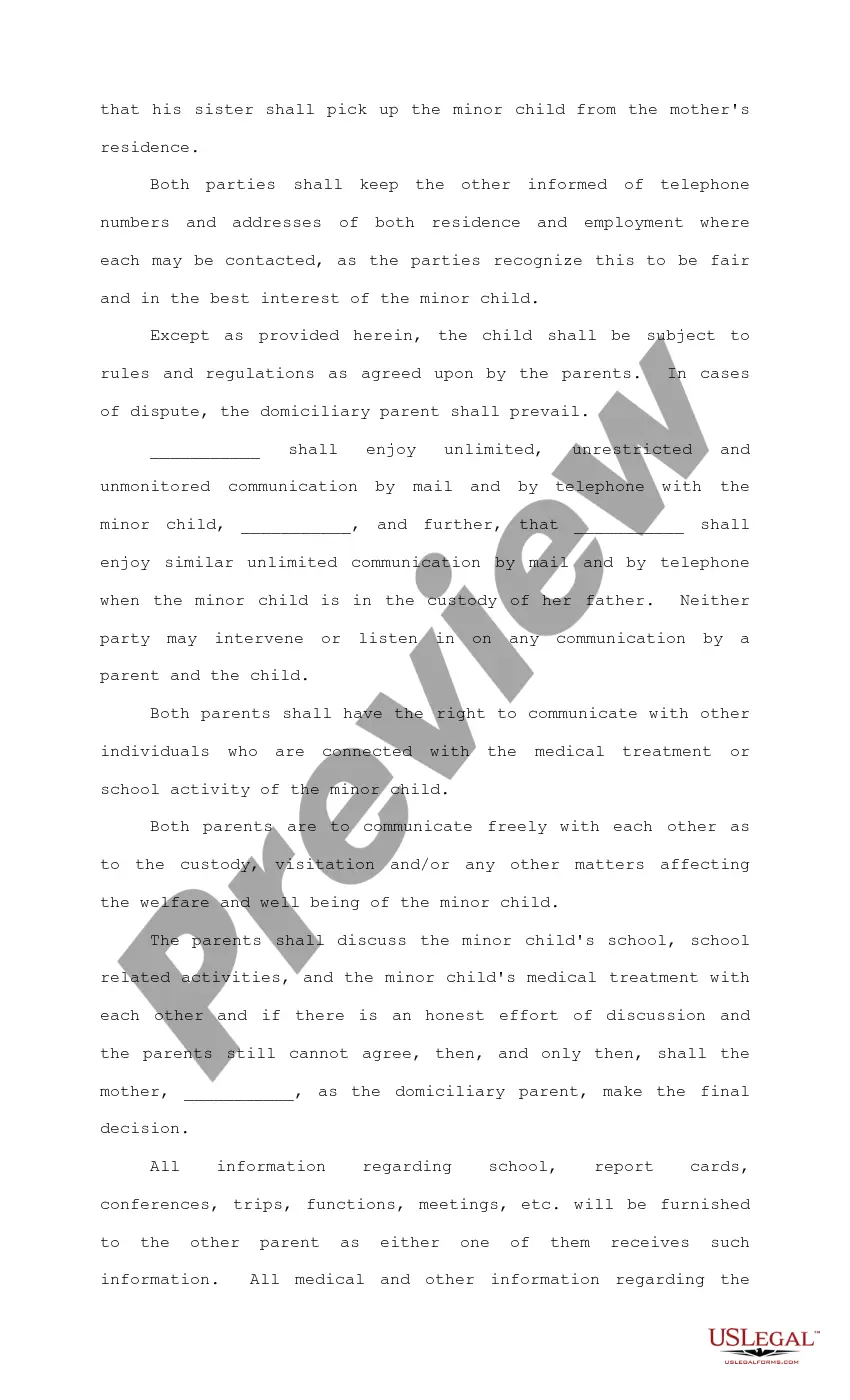

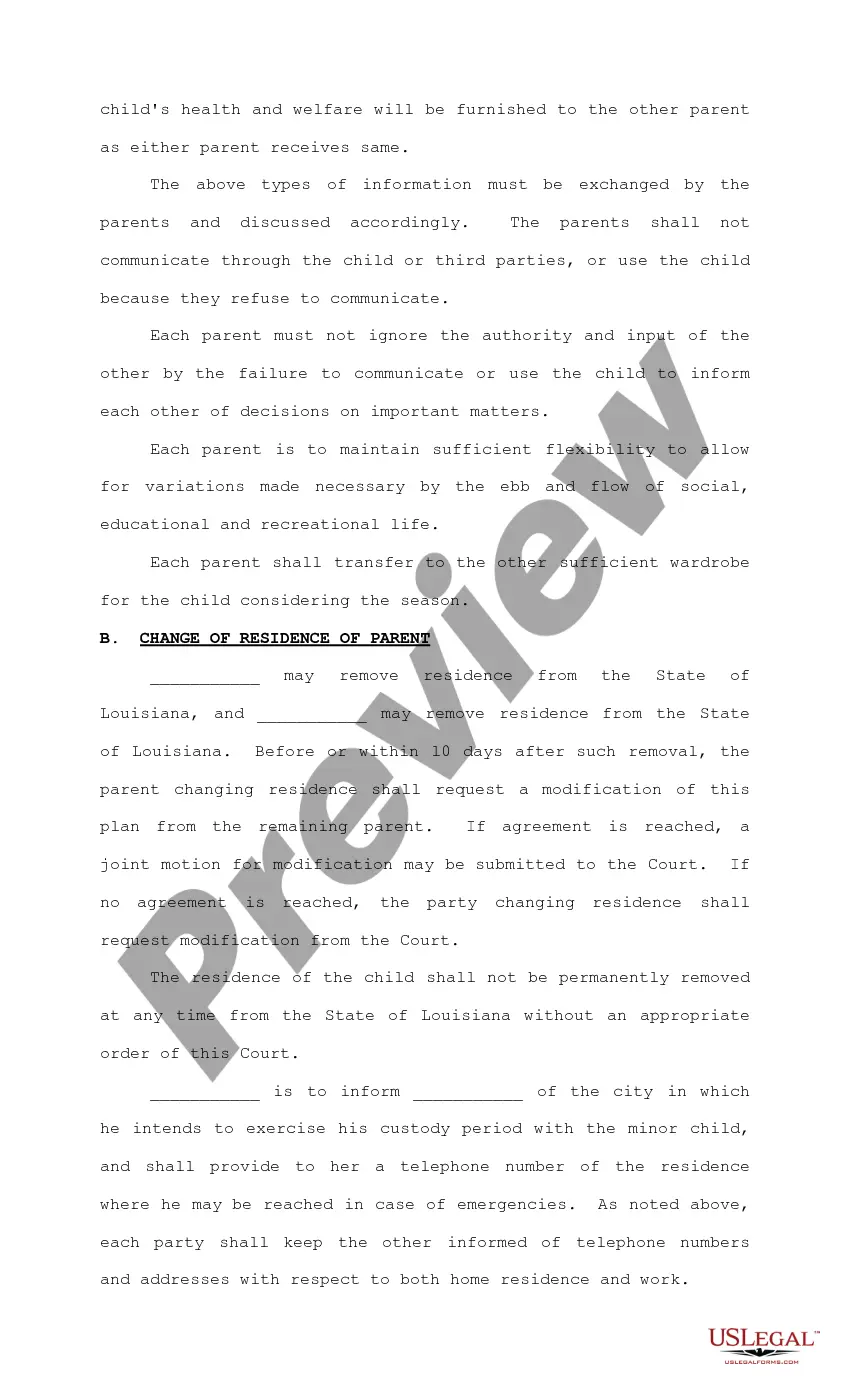

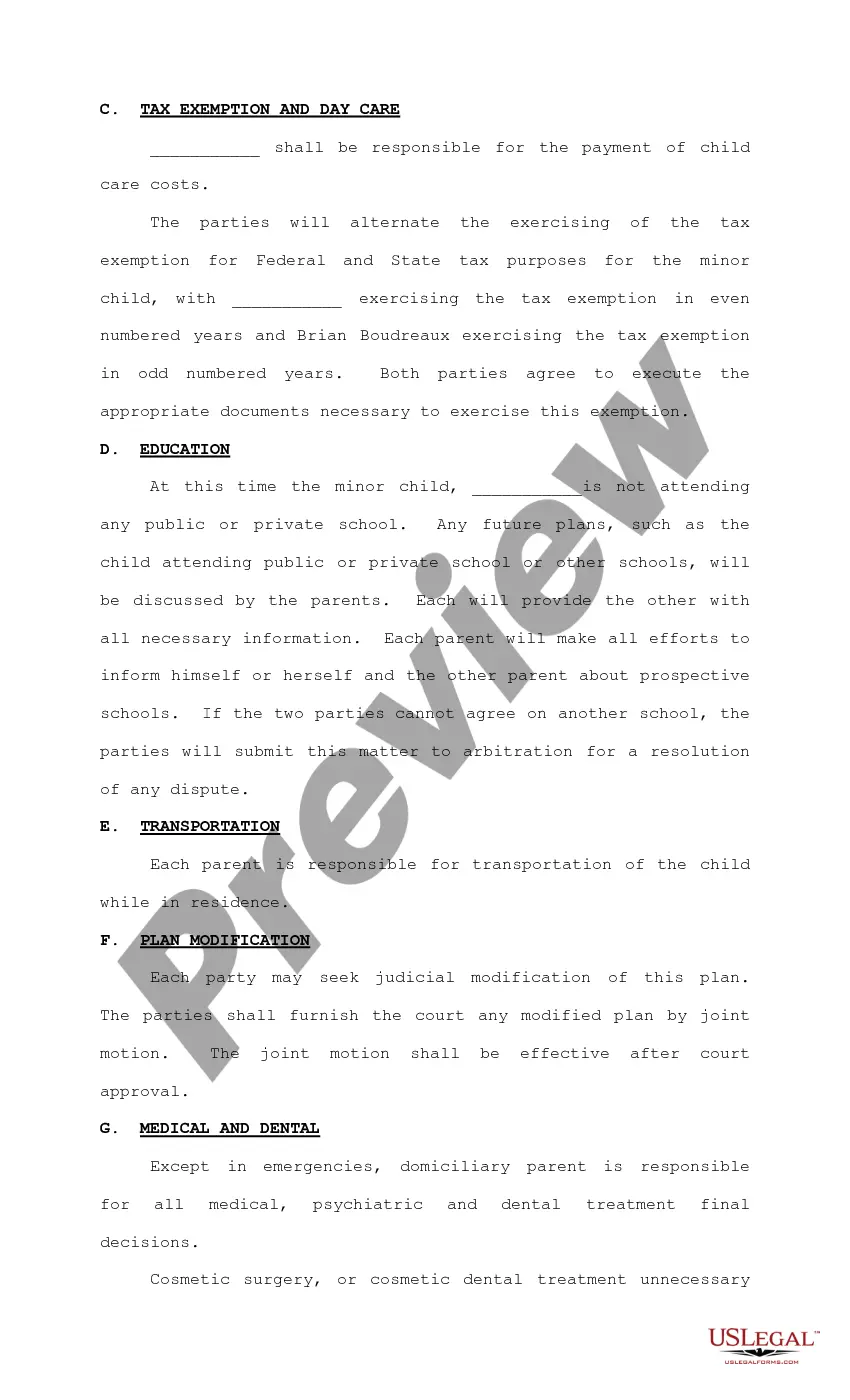

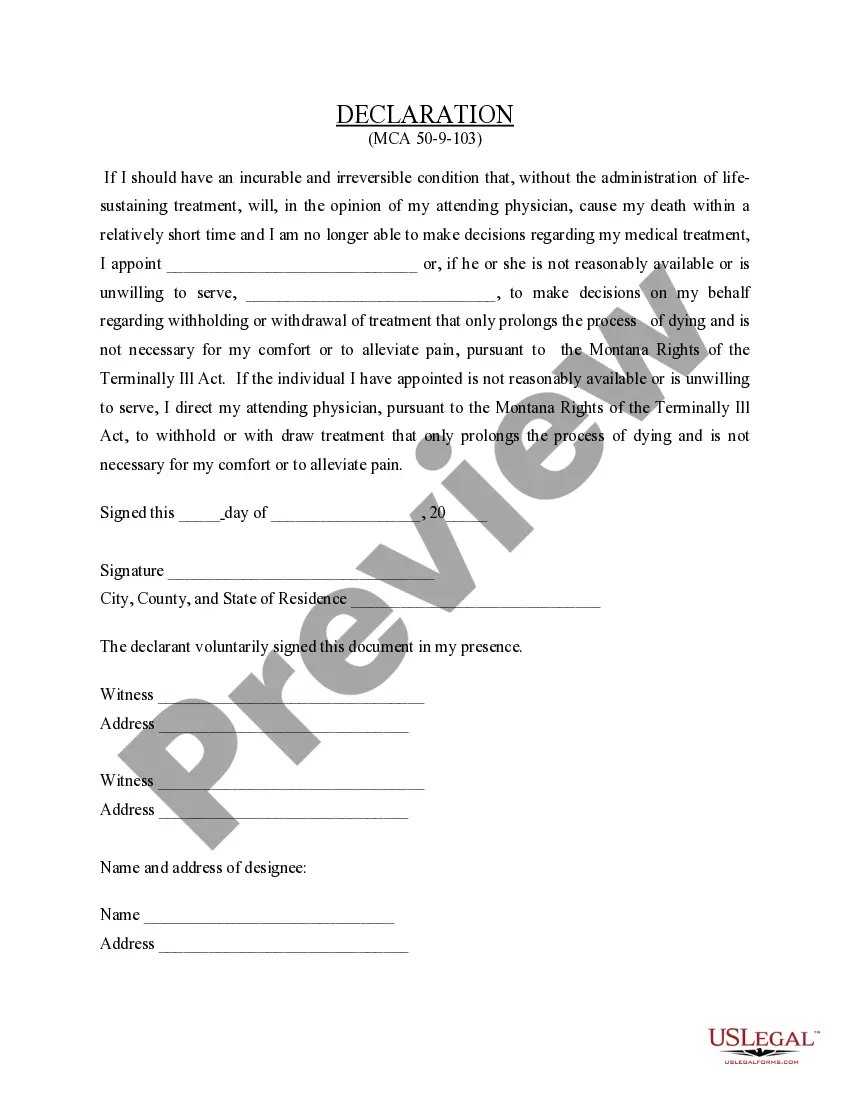

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Louisiana Custody Agreement For Unmarried Parents sample you require.

- Download the file when it meets your needs.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Choose your payment method: use a bank card or PayPal account.

- Choose the document format you want and download the Louisiana Custody Agreement For Unmarried Parents.

- When it is downloaded, you can fill out the form by using editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time looking for the right sample across the internet. Utilize the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

Unmarried Fathers and Child Custody For unmarried parents, all rights belong to the mother. Unmarried fathers have no legal rights to custody or visitation. Fighting for the right to see your child is possible with the help of a Louisiana lawyer. At the core of custody issues is the matter of paternity.

The Court will consider the "capacity and disposition of each party to provide the child with food, clothing, medical care, and other material needs." Capacity is not limited to whether the parent can afford to buy these things. A parent may have the ability to purchase them, but not the disposition to do so.

In the State of California, when people are legal parents of a child, whether biologically, or by joint adoption, and they split up, their child-related matters will normally be handled in the same way as if they were a divorcing married couple. In other words, the same rules apply to them as apply to a married couple.

A written petition has to be filed in the court that does juvenile cases where the parents or you live. At least one of the parents has to sign the petition. You will sign an affidavit attached to the petition saying you are willing to take custody of the child.

Either unmarried parent is entitled to the exemption so long as they support the child. Typically, the best way to decide which parent should claim the child is to determine which parent has the higher income. The parent with the higher income will receive a bigger tax break.