Cash For Title Loans

Description

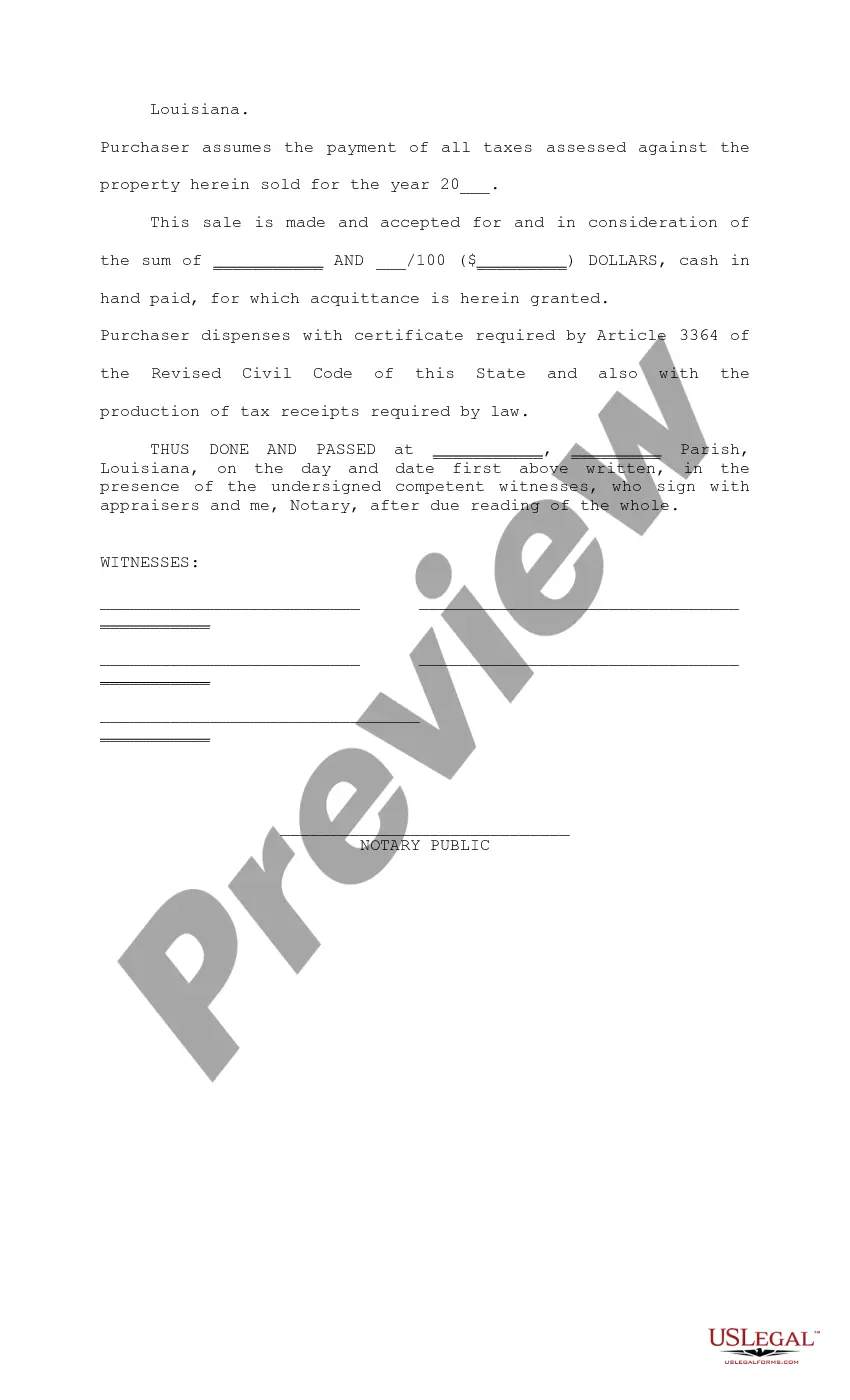

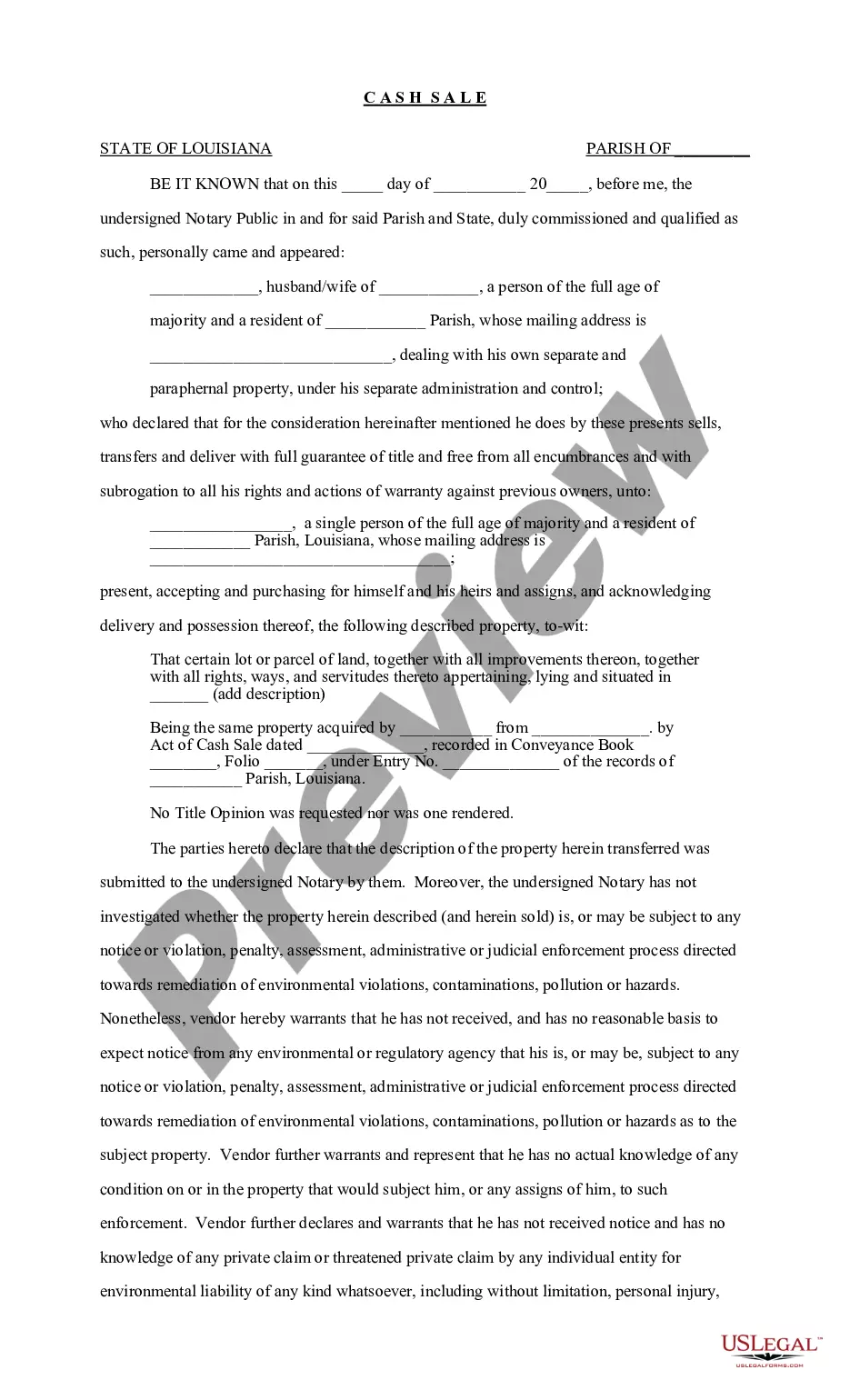

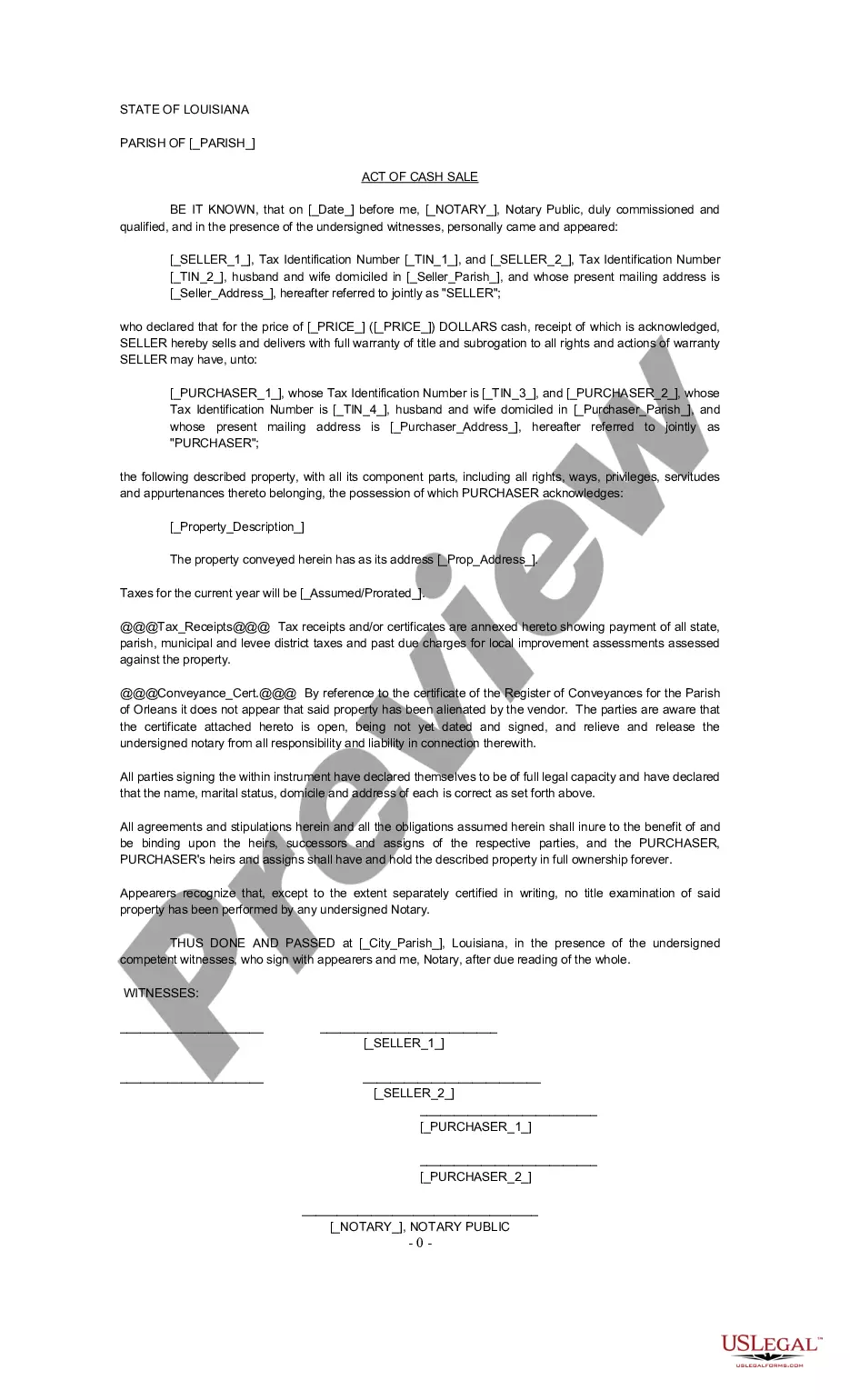

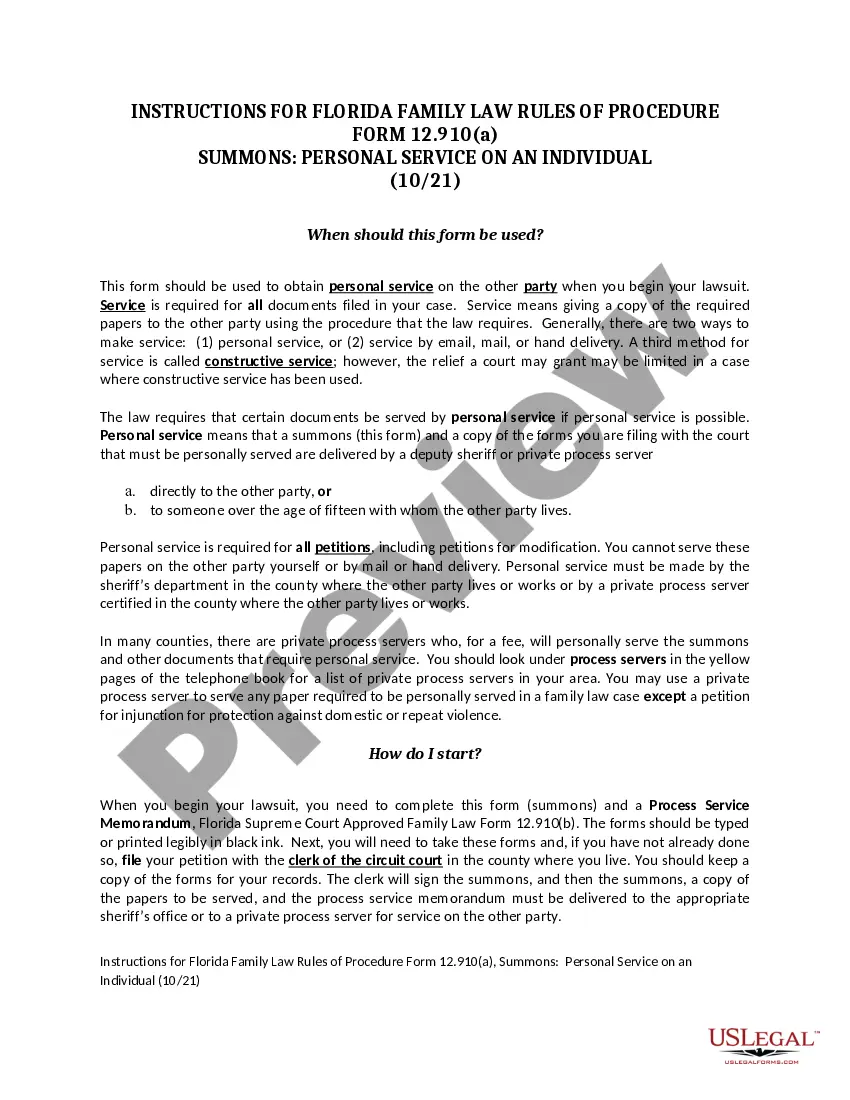

How to fill out Louisiana Cash Sale?

Legal administration can be perplexing, even for seasoned experts.

When you are looking for a Cash For Title Loans and lack the time to search for the suitable and updated version, the processes can be overwhelming.

Utilize a valuable resource base of articles, guides, and manuals pertinent to your circumstances and needs.

Save time and effort finding the documents you require, and leverage US Legal Forms’ sophisticated search and Review feature to locate Cash For Title Loans and download it.

Ensure that the sample is recognized in your state or county.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously saved and manage your folders as you see fit.

- If it is your first time with US Legal Forms, create an account and gain unlimited access to all features of the platform.

- Here are the steps to follow after acquiring the form you need.

- Verify this is the correct form by previewing it and checking its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, from personal to business paperwork, all in a single location.

- Employ advanced tools to complete and manage your Cash For Title Loans.

Form popularity

FAQ

Yes, TitleMax can provide you cash for title loans on the same day you apply. When you bring in your vehicle title and meet the qualifications, the process is quick and straightforward. You can drive away with the funds you need, often within hours. This convenience can be essential when you need cash urgently.

Cash-out on title refers to the process where you can borrow against the equity of your vehicle and receive cash. Essentially, it's a way to access cash for title loans by leveraging the value of your title. This option can provide you with quick cash, helping you meet immediate financial needs while still keeping your vehicle. Understanding the details of cash-out options can help you make informed decisions.

Use collateral If you have assets such as a car, house, or FDs, you can use them as a collateral to secure a Personal Loan. Any collateral will reduce the lender's risk, and they may well offer you a loan without checking your credit history.

The terms ?title pawn? and ?title loan? mean the same thing. Both of these terms refer to a secured loan that borrowers can obtain by putting up the title to their car, motorcycle, or RV, as collateral. But it's important to understand the difference between pawning an item and taking out a title pawn.

How much can you borrow with a title loan? You can usually borrow 25% to 50% of the value of the car. ing to the FTC, the average loan amount is $100 to $5,500, but some lenders allow you to borrow up to $10,000, and even more. Once you're approved for a loan, you'll give the lender the title to your car.

The most common type of title loan is a car title loan, where the car itself is the asset put up as collateral. Title loans are usually taken on by individuals needing cash fast or those in financial difficulties.

Title loan lenders generally let customers borrow between 25% and 50% of the value of their title. Once you know how much your title is worth, you can use these percentages to find out how much you can get for a title loan.