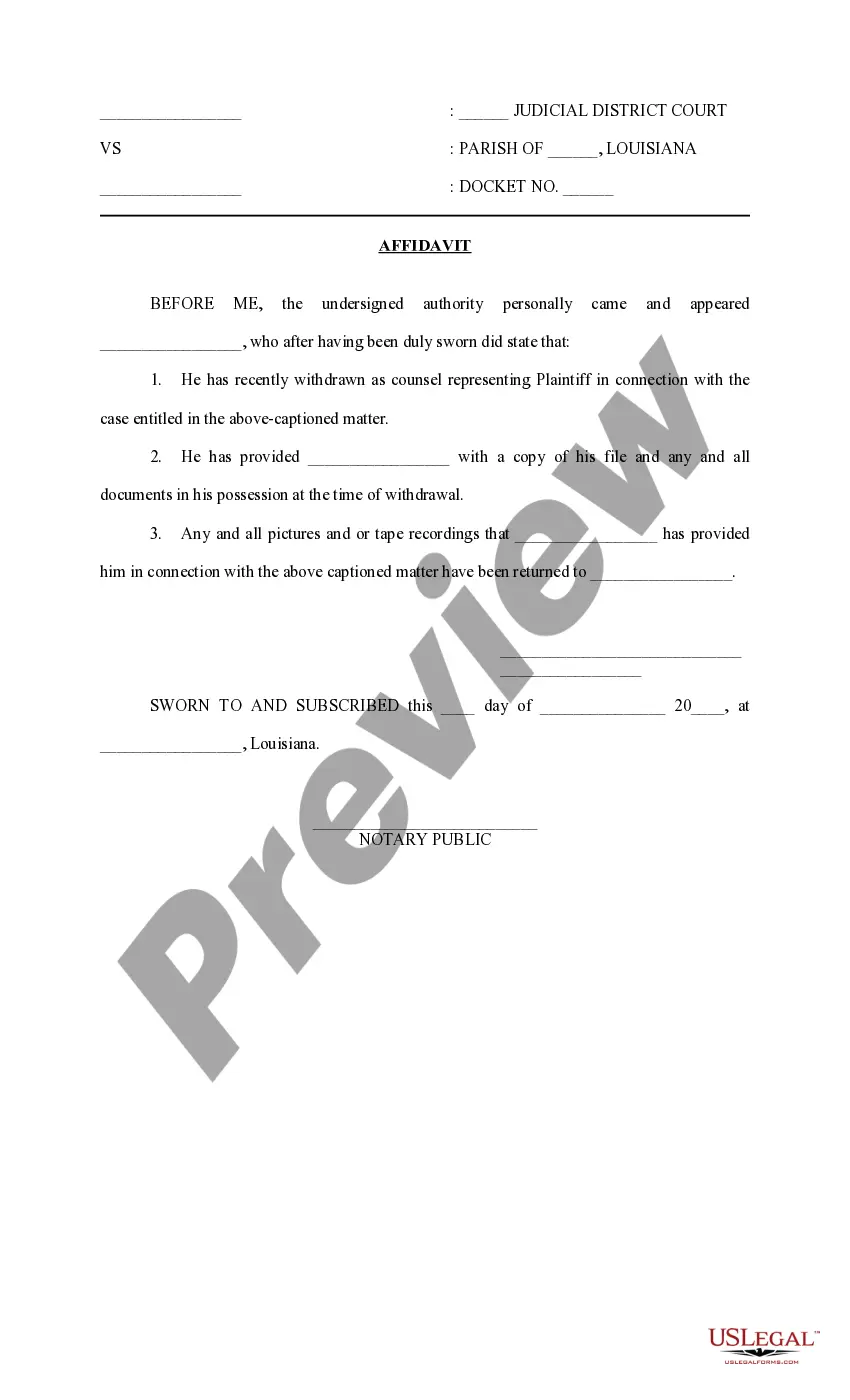

Affidavit Of Withdrawal For Home Purchase

Description

How to fill out Louisiana Affidavit Of Withdrawal Of Counsel?

When you are required to complete the Affidavit Of Withdrawal For Home Purchase in line with your local state's laws and guidelines, there may be various choices to select from.

There's no necessity to examine every document to confirm it meets all the legal standards if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

Navigating to the suggested page and verifying it for adherence to your requirements.

- US Legal Forms is the most extensive online repository with a compilation of more than 85k ready-to-utilize documents for business and personal legal matters.

- All templates are validated to comply with each state's laws and regulations.

- Therefore, when you download the Affidavit Of Withdrawal For Home Purchase from our website, you can be assured that you possess a legitimate and up-to-date document.

- Acquiring the necessary template from our platform is remarkably simple.

- If you already possess an account, just Log In to the system, confirm that your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the Affidavit Of Withdrawal For Home Purchase whenever you need.

- If it's your initial visit to our website, kindly adhere to the instructions below.

Form popularity

FAQ

If the heirs are only looking to transfer the real estate, with no personal possessions, Form DE-310 must be completed and filed. Signing Requirements Must be notarized (Prob. Code § 13104(e)).

California Small Estate Affidavit InstructionsObtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

California Small Estate Affidavit InstructionsObtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.