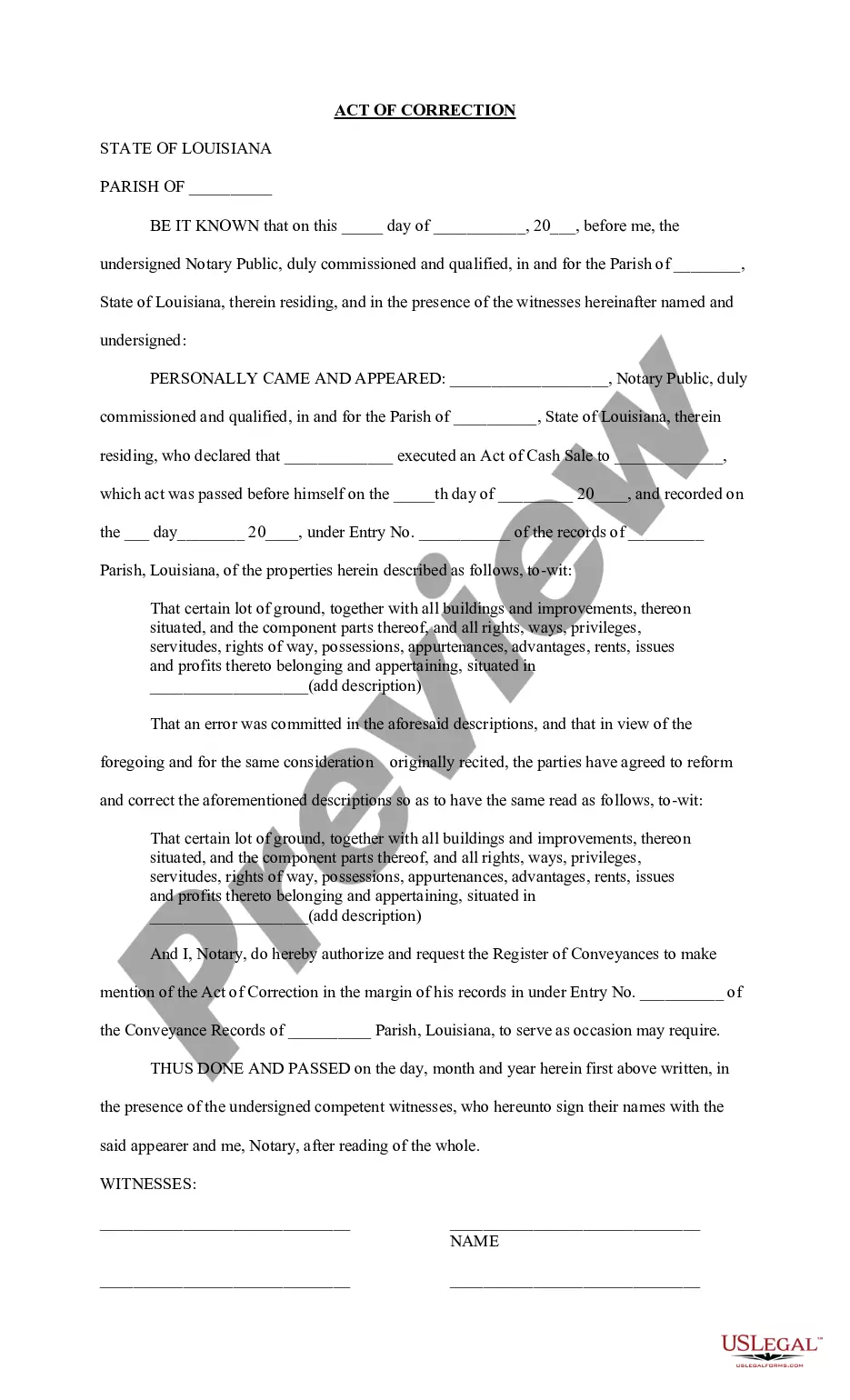

This form, an Act of Correction to Real Estate Description, is used to correct a faulty real estate description within the state of Louisiana.

Affidavit Of Correction For Title

Description

How to fill out Louisiana Act Of Correction To Real Estate Description?

It's clear that you cannot transform into a legal expert in a day, nor can you learn how to swiftly prepare an Affidavit Of Correction For Title without possessing a specialized background.

Assembling legal documents is a lengthy process that necessitates specific education and expertise. So why not entrust the creation of the Affidavit Of Correction For Title to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can locate everything from court paperwork to templates for in-office communication. We recognize how essential compliance and adherence to federal and local regulations are. That's why, on our platform, all forms are tailored to specific locations and current.

Click Buy now. Once the purchase is complete, you can download the Affidavit Of Correction For Title, fill it out, print it, and deliver or mail it to the specified individuals or organizations.

You can retrieve your documents from the My documents tab anytime. If you're an existing client, you can simply Log In, and find and download the template from the same tab.

- Initiate your experience with our platform and obtain the document you need in just minutes.

- Find the document you’re looking for using the search bar at the top of the page.

- Preview it (if this option is available) and review the supplementary description to confirm whether the Affidavit Of Correction For Title is what you're seeking.

- Start your search over if you need a different form.

- Create a free account and choose a subscription plan to purchase the template.

Form popularity

FAQ

An affidavit of correction for title may become invalid if it contains false information, lacks required signatures, or does not adhere to local laws. Inaccurate details about the property or parties involved can also invalidate the affidavit. To ensure its legality, utilize resources like uslegalforms for accurate information and templates.

To write an affidavit of correction for title, start by clearly stating the purpose of the affidavit and identifying the error to be corrected. Include essential information such as the details of the title, the parties involved, and a statement affirming the correction. Uslegalforms offers templates and guidance to simplify this process.

An affidavit of correction for title is a legal document used to amend or clarify information on a title. It helps rectify errors or omissions, ensuring the title accurately reflects ownership. This document is vital for preventing disputes and facilitating smooth future transactions.

Filling out a statement of fact to correct an error on title requires accurate information about the title and the specific error being addressed. Start by identifying the incorrect information and providing the correct details in clear terms. Utilizing a properly formatted affidavit of correction for title can streamline this process and ensure legal compliance.

While some states use the Federal 8879 for E-File with individual returns, some states have their own E-File Authorization form.

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Some goods are exempt from sales tax under Michigan law. Examples include prescription medications, groceries, newspapers, medical devices, and some agricultural and industrial machinery.

Michigan does not require registration with the state for a resale certificate. How can you get a resale certificate in Michigan? To get a resale certificate in Michigan, you will need to fill out the Michigan Sales and Use Tax Certificate of Exemption (Form 3372).

Michigan return does not normally require its own Signature Form unless the Federal Form 1120 is not being filed. MI(Michigan) has the Form 4763 and it is only applicable when the Michigan return is not transmitted along with the federal return. If you turn the federal return off you will get MI(Michigan) Form 8879.

The Michigan Business Tax e-file Authorization MI-8879-MBT is the declaration document and signature authorization for a State Stand Alone (unlinked) return. If you e-file your Michigan return as a Fed/State (linked) return, Michigan will accept the federal signature method.