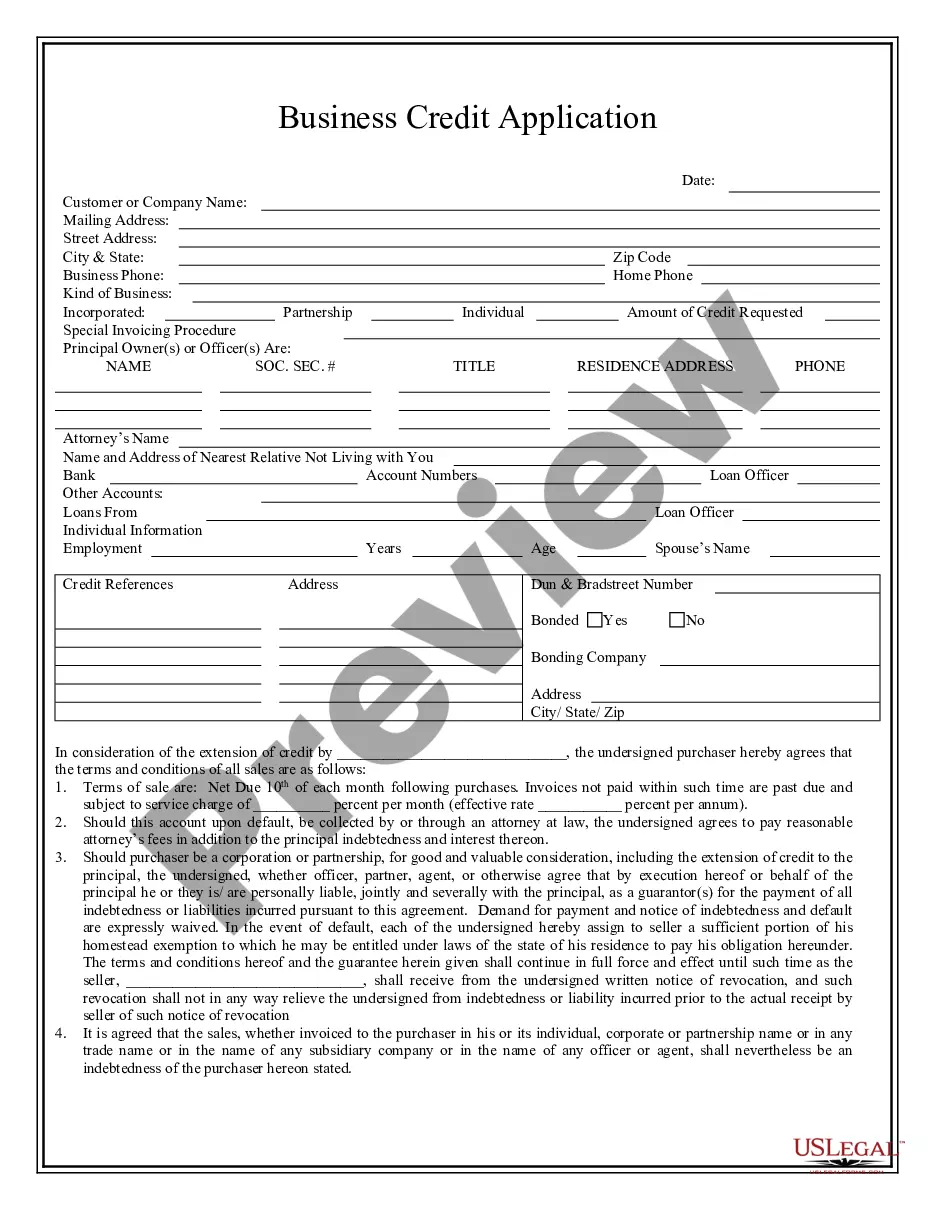

Ford Business Credit Application Form

Description

How to fill out Louisiana Business Credit Application?

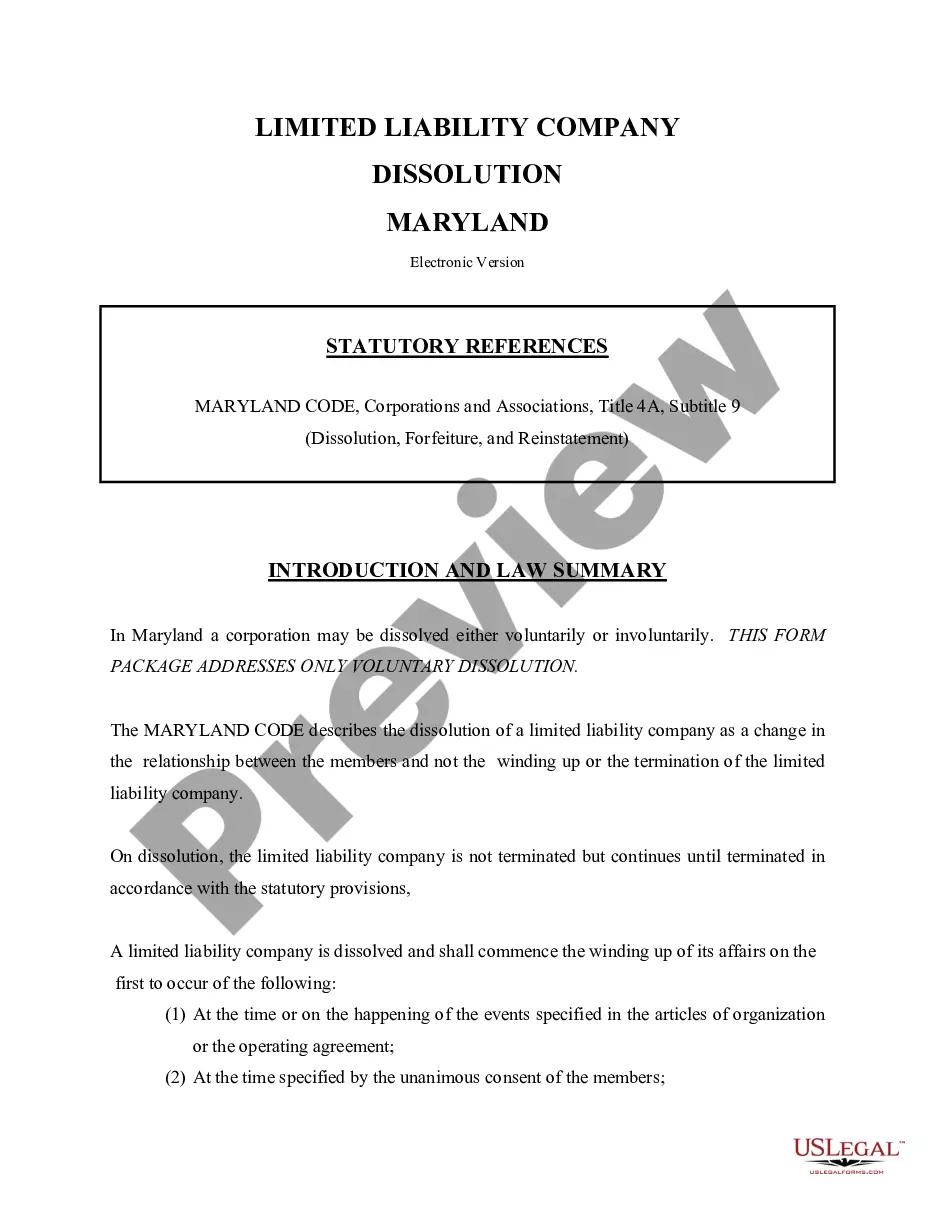

There's no longer a necessity to squander time looking for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our website provides over 85k templates for various business and personal legal situations organized by state and area of utilization.

Utilize the Search field above to find another sample if the previous one was unsuitable.

- All forms are expertly drafted and confirmed for accuracy, ensuring you can trust in acquiring an up-to-date Ford Business Credit Application Form.

- If you're acquainted with our service and already have an account, you must verify that your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all acquired documents whenever necessary by opening the My documents tab in your profile.

- If you've never used our service before, the process will involve a few additional steps to complete.

- Here's how new users can find the Ford Business Credit Application Form in our library.

- Scrutinize the page content closely to ensure it includes the sample you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

The time it takes to process a Ford business credit application form can vary, but most applications are reviewed within a few hours to a couple of days. Factors such as the completeness of your application and the current volume of requests can influence this duration. By providing accurate information and all required documents upfront, you can help speed up the process. Utilizing platforms like uslegalforms can streamline your application, ensuring you have everything in order.

To qualify for a Ford business credit application form, you typically need a credit score of at least 660. However, Ford Credit aims to help a diverse range of customers, so other factors may also be considered. A higher credit score can improve your chances of getting favorable terms. It's essential to review your credit report and understand how it impacts your application.

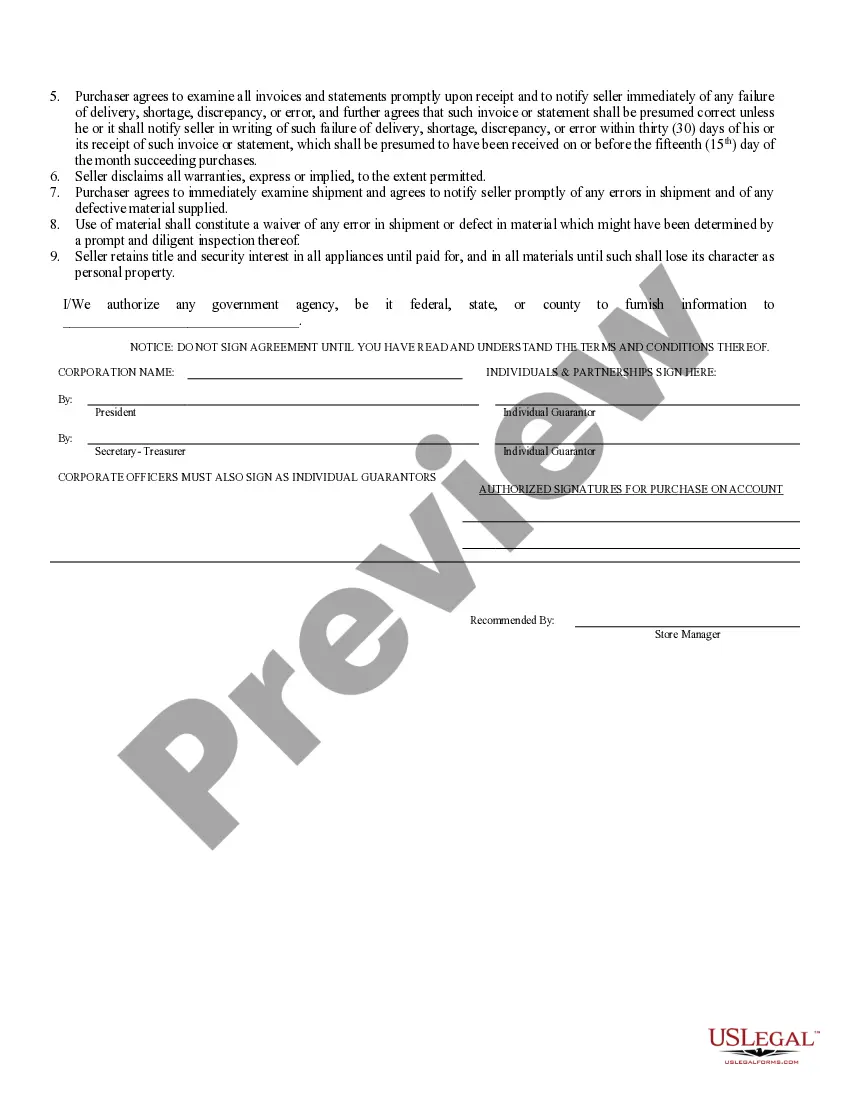

To create a credit application form, outline essential fields such as business name, contact information, financial history, and trade references. You can easily design this document using templates or services like US Legal Forms, which provide customizable options for your needs. Ensure that your form is clear and easy to understand, similar to the Ford business credit application form. This clarity will help streamline the application process and improve communication with potential vendors.

Creating a business credit file involves several steps, starting with registering your business with the necessary authorities. Begin by obtaining an EIN and opening a business bank account. Next, make sure to fill out the Ford business credit application form for various vendors and maintain timely payments. This consistent activity contributes to building a strong credit profile that lenders will recognize.

Yes, you can use your Employer Identification Number (EIN) to build business credit. Your EIN acts as a business's Social Security number and helps establish your business's identity with lenders and credit agencies. By including your EIN on the Ford business credit application form, you can streamline the process to obtain credit and open pathways for financial growth. Using your EIN strategically lays the groundwork for a robust business credit file.

A credit application from a vendor is a formal request for credit extended to a business. This application often requires detailed information about your company, including financial history and references. When you fill out the Ford business credit application form, you provide vendors with essential details that help them assess your creditworthiness. This process helps build relationships and enables you to secure the necessary resources for your business.

Obtaining a Ford Credit card generally depends on your creditworthiness and financial status. While some applicants may find the process challenging, submitting a well-structured Ford business credit application form can improve your chances. It's crucial to meet their guidelines and present your financial information transparently. By doing so, you set yourself up for a more favorable outcome.

Approval through Ford Credit can present challenges depending on your financial background. They review key factors such as credit score, business revenue, and overall financial health. However, with a solid Ford business credit application form and accurate documentation, you can improve your approval odds significantly. Being proactive in understanding the requirements is essential.

Getting approved by Ford Credit can be straightforward if you meet their requirements. They evaluate your financial stability, credit history, and income verification. With a well-prepared Ford business credit application form, you can present your case effectively. Ensuring that your documents are complete and accurate will enhance your chances for a swift approval.

Creating a business credit application form involves outlining key financial information about your business. You will need details such as your business name, contact information, and financial history. Using platforms like US Legal Forms can simplify this process, providing you with templates tailored to your needs. This way, you can create a professional application quickly and efficiently.