Limited Limited

Description

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- If you're a returning user, log in to your account and select the desired form to download by clicking the Download button. Confirm that your subscription is active; renew it if necessary as per your chosen plan.

- For new users, start by previewing the forms. Review the descriptions to ensure they meet your specific legal needs and adhere to local jurisdiction requirements.

- If needed, utilize the Search tab to find alternative templates that might be more suitable. Once you identify a fitting option, proceed to the next step.

- Purchase the template by clicking the Buy Now button. Select your preferred subscription plan and create an account to unlock the extensive resources available.

- Complete your payment by entering your credit card information or utilizing your PayPal account for the subscription.

- Download your completed form to your device. You can also access it anytime via the My Forms section in your profile.

In conclusion, US Legal Forms provides a comprehensive legal form library, ensuring users can easily find and execute required documents accurately. With top-notch support from legal experts, your documentation process is simplified and stress-free.

Ready to streamline your legal paperwork? Explore US Legal Forms today!

Form popularity

FAQ

The phrase 'limit limited' generally emphasizes a restriction on liability or an offering that is finite in nature. It often refers to agreements or policies that define the boundaries within which businesses operate. By utilizing a structure that incorporates Limited Limited, entities can ensure that liabilities are confined to designated amounts, protecting stakeholders' interests. When forming such structures, it is beneficial to seek guidance from platforms like uslegalforms for tailored solutions.

'Limited and limited u' in Roblox refer to specific categories of virtual items that players can buy and trade. Limited items are only available for a certain period or in limited quantities, promoting rarity among players. Consequently, these items can appreciate in value, making them desirable for collectors. By understanding these terms, players can make informed decisions about their trades and investments in the Roblox marketplace.

AS Ltd stands for 'Aktieselskab Limited,' which is a company structure commonly found in Scandinavia. It indicates a limited liability company similar to the Ltd designation used in the US. Businesses may choose this structure to benefit from limited liability while operating within a regulated framework. This Limited Limited structure fosters growth and investment opportunities by clearly defining shareholder responsibilities.

In the United States, Ltd stands for 'limited,' which denotes a type of corporation where the shareholders' liability is limited to the amount they invested. This structure serves to protect personal assets from business debts and lawsuits. Businesses choose the Ltd designation to establish credibility, attract investment, and enjoy legal protections. Therefore, understanding the implications of Limited Limited in this context is essential for entrepreneurs.

Ltd. Ltd. is a designation used to indicate a limited company structure. In this context, 'limited' refers to the liability protection afforded to the company's shareholders. This means that shareholders typically do not risk their personal assets beyond their investment in the business. Therefore, if the company faces financial issues, the owners have a limited financial responsibility.

Even though both terms imply limited liability, they are associated with different forms of business entities. Using Limited instead of LLC can lead to confusion regarding your business's structure and legal implications. It is vital to choose the correct designation that reflects your business status, ensuring compliance with state regulations.

A private limited company offers limited liability protection similar to an LLC; however, they are not the same entity. The differences lie in the regulations, ownership structure, and tax implications. It is essential to understand these distinctions to make informed decisions about your business structure.

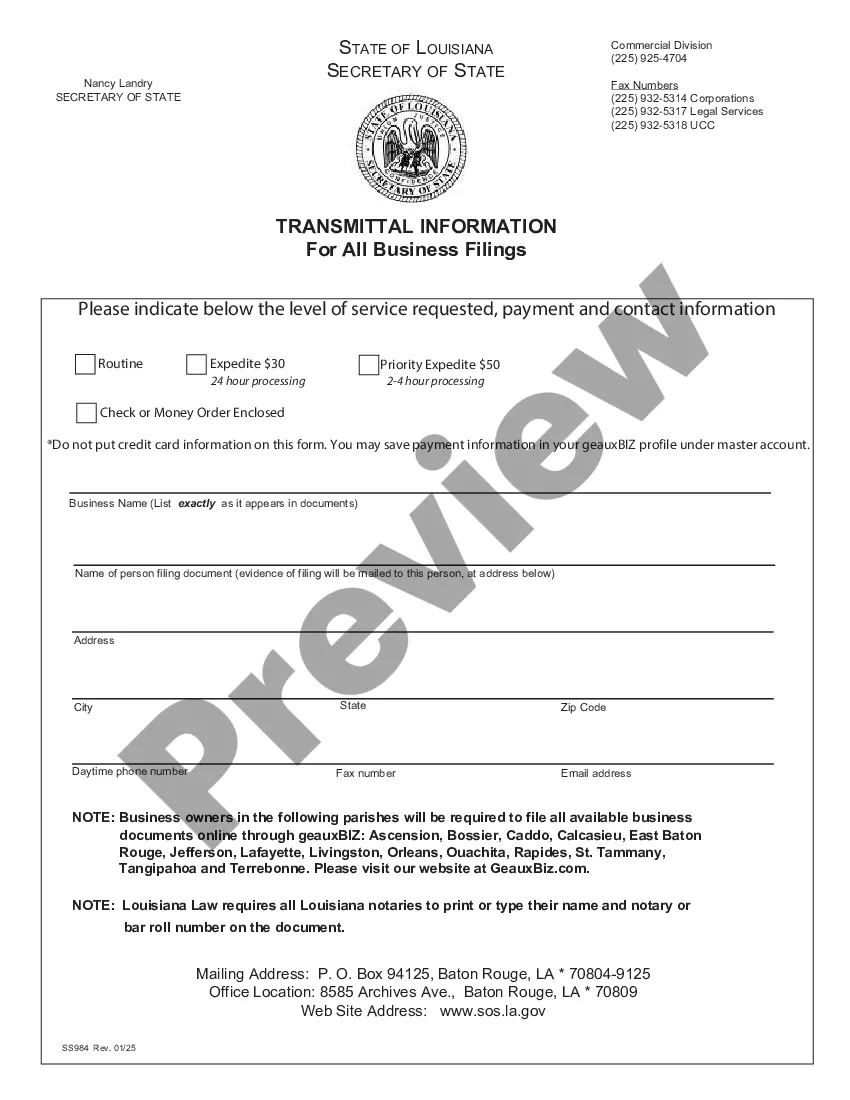

You can certainly file your LLC on your own, but this process can be complex and time-consuming. Many entrepreneurs benefit from using services like USLegalForms to ensure that all paperwork is completed accurately and efficiently. By doing so, you can save time and minimize the risk of errors that could delay your business operations.

Choosing a limited partnership may be beneficial for businesses with general and limited partners. A limited partnership allows passive investors to limit their liabilities while participating in the company's profits. It provides distinct roles for partners, which can be advantageous depending on your business structure and goals.

Both LTD and LLC structures offer limited liability protection, but their implications vary. An LTD company follows specific regulations and has stricter compliance requirements, while an LLC offers flexibility and is easier to manage. Assess your business goals, and consider using the USLegalForms platform to help determine which is best for your circumstances.