Limited Liability Company Llc Advantages

Description

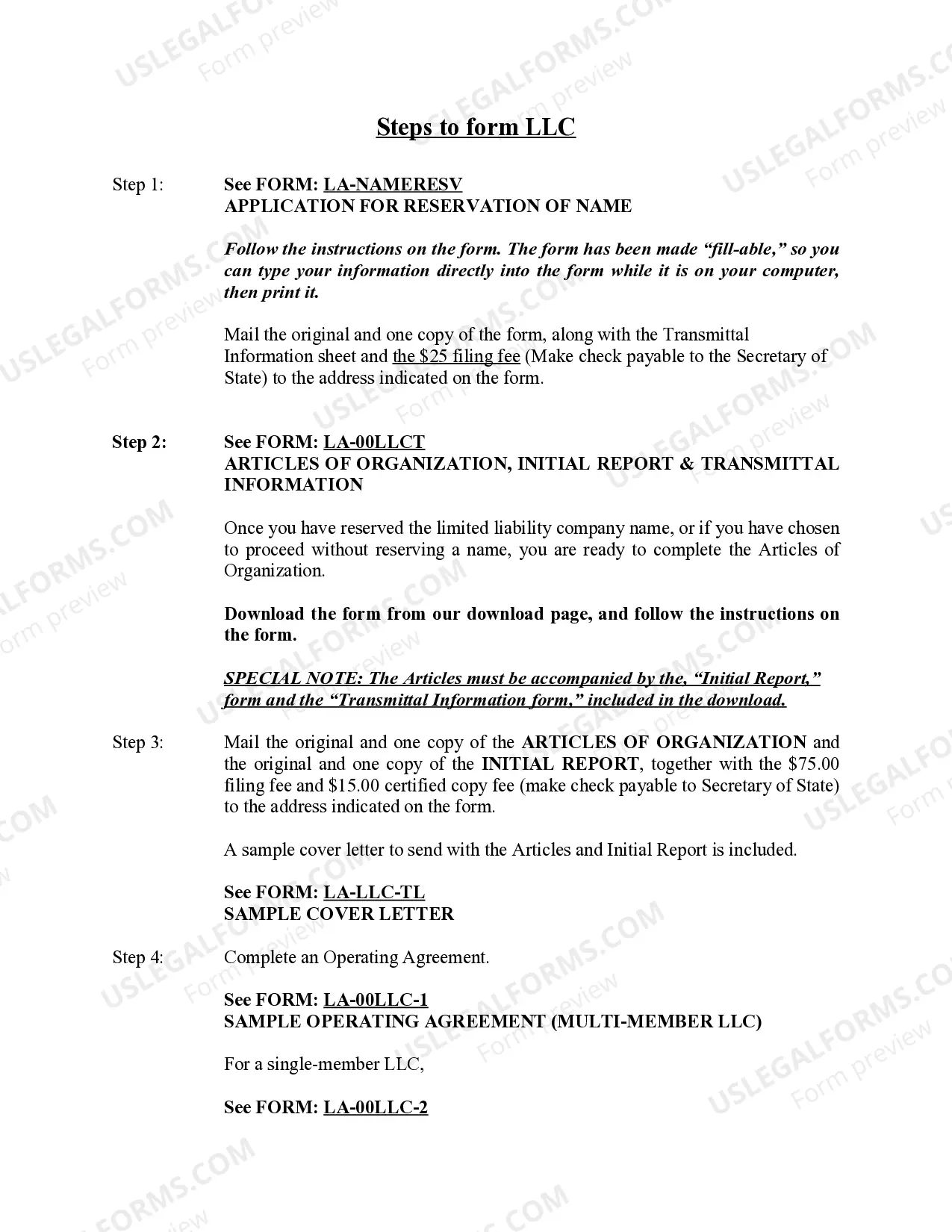

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- If you're a returning user, start by logging into your account to download the necessary template. Ensure your subscription is active; if not, renew it according to your plan.

- For new users, begin by reviewing the form description and preview mode to confirm you’ve selected the right document that meets your local jurisdiction’s requirements.

- If modifications are needed, utilize the Search tab to find an alternative template. Once satisfied, proceed to the next step.

- Purchase your desired document by clicking the Buy Now button and opting for your preferred subscription plan. You'll need to register an account for full access.

- Complete your purchase using credit card details or a PayPal account to finalize your subscription.

- Download the form to your device. You can always access it later in the My documents section of your profile.

US Legal Forms is designed to empower both individuals and attorneys by providing a vast library of over 85,000 legal forms, making it easier than ever to execute required documents efficiently.

Take control of your legal needs today by utilizing US Legal Forms for all your LLC documentation needs—start your journey towards business success!

Form popularity

FAQ

The pros of forming a Limited Liability Company (LLC) include personal liability protection, tax flexibility, and minimal compliance requirements. However, potential downsides involve self-employment taxes and varying regulation across states. When evaluating the limited liability company LLC advantages, it's crucial to consider your specific business circumstances. Exploring these factors will help you make a well-informed decision about whether an LLC is right for you.

LLCs can strategically manage their tax obligations by taking advantage of specific deductions and credits. They can also elect to be taxed as an S corporation, which can help mitigate self-employment taxes on distributions. This flexibility is one of the limited liability company LLC advantages, allowing owners to explore different tax strategies. Consulting with a tax professional can help you navigate these options effectively.

While a Limited Liability Company (LLC) offers many advantages, there are some tax disadvantages to consider. One significant issue is that LLCs may face self-employment taxes on their profits, as income typically passes through to the owners. This can lead to higher overall tax liabilities, which may be a concern for some business owners. It's essential to weigh these factors carefully, especially when evaluating the limited liability company LLC advantages.

LLCs can fail due to various reasons, with poor financial management and lack of clear goals ranking high on the list. When members do not adequately plan or communicate, the business may struggle to adapt to changes in the market. Additionally, failing to adhere to legal requirements can lead to penalties. Using a platform like USLegalForms can help you navigate the complexities and maintain your LLC, reducing the chances of failure.

Certain scenarios can make an LLC less beneficial, particularly for large businesses or those seeking outside investors. The limited liability company LLC advantages might not outweigh the complexities involved in managing multiple members or the formalities required for regulatory compliance. If your business plans involve substantial funding or rapid growth, you may want to explore alternatives. Always weigh your options carefully before deciding on a business structure.

A limited liability company (LLC) offers notable benefits, making it a popular choice for many business owners. The limited liability company LLC advantages include protecting your personal assets from business debts and liabilities. This feature can provide peace of mind as you grow your business. Furthermore, the flexible management structure and favorable tax treatment make the LLC an attractive option.

Limited liability is a significant advantage of forming a Limited Liability Company (LLC) because it shields your personal assets from business risks. This means that if your LLC faces lawsuits or debts, your personal property, like your home or savings, is typically protected. This protection fosters entrepreneurship, allowing you to take business risks without fearing personal loss. With US Legal Forms, you can establish your LLC securely and leverage its limited liability benefits efficiently.

To take advantage of a Limited Liability Company (LLC), you can enjoy personal asset protection. This protects your personal finances from business debts and liabilities. Additionally, operating as an LLC offers tax flexibility, allowing you to choose between being taxed as a corporation or a sole proprietorship. By using the US Legal Forms platform, you can easily create and manage your LLC, making the most of its advantages.

The pros of an LLC include personal asset protection, flexible management, and favorable tax treatment. However, potential cons may involve self-employment taxes and varying state regulations. Weighing these pros and cons can unveil significant limited liability company LLC advantages tailored to your business needs. For tailored guidance, considering platforms like US Legal Forms can simplify the process and help you make informed decisions.

LLC owners can effectively manage their tax obligations by selecting their preferred tax classification. With options like pass-through taxation, profits are taxed at the owner's personal income rate, avoiding double taxation. Understanding these limited liability company LLC advantages can help owners design strategies to minimize tax liabilities. Consulting with a tax professional can maximize these benefits and ensure compliance.