Liability Company Llc With A Trust

Description

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- Visit the US Legal Forms website and check if you're a returning user. If so, log in and access your account to find and download your desired form template.

- If this is your first time using US Legal Forms, start by reviewing the available form descriptions and previews to ensure you select the one that aligns with your requirements and local regulations.

- Utilize the search feature if you don’t find the right document immediately. This tool will help you locate the exact form that meets your needs.

- Once you identify the correct template, click on the 'Buy Now' button and select your preferred subscription plan to proceed with the purchase.

- Complete the payment process by entering your credit card information or using PayPal to finalize your subscription.

- Download the form directly to your device. You can access this document anytime via the My Forms section of your profile.

US Legal Forms empowers users with a robust collection of over 85,000 fillable and editable legal forms while offering access to premium experts for guidance.

In conclusion, using US Legal Forms not only simplifies the process of acquiring your Liability Company LLC with a Trust but also ensures you have access to accurate, legally compliant documents. Start your journey today and explore their extensive library!

Form popularity

FAQ

Certainly, a trust can serve as a beneficial owner of a liability company LLC with a trust. This arrangement provides flexibility in managing the LLC's assets while protecting the interests of trust beneficiaries. Moreover, it facilitates the seamless transfer of ownership in the event of a trustor's passing. If you need guidance on structuring a liability company LLC with a trust, uslegalforms offers reliable resources and services to help you achieve your goals.

Yes, a trust can indeed be the only member of a liability company LLC with a trust. This setup allows the assets of the trust to be protected under the umbrella of liability offered by the LLC. It also simplifies estate planning by consolidating ownership and reducing the need for probate. If you are considering forming a liability company LLC with a trust, explore how uslegalforms can assist you in the process.

Yes, a trust can own 100% of an LLC. This arrangement allows the trust to fully control the liability company LLC with a trust, ensuring that all business operations align with the trust’s stipulations. This can provide the owner with enhanced estate planning benefits and simplify the transfer of ownership upon their passing.

The biggest mistake parents often make when setting up a trust fund is failing to clearly define their intentions for the assets. Without a clear plan, the liability company LLC with a trust may not operate as envisioned, leading to potential disputes or mismanagement. It’s crucial to communicate the goals and ensure the trust aligns with your family’s needs and values.

Putting your LLC in a trust can be a smart decision depending on your financial goals and circumstances. This strategy can enhance asset protection and ensure continuity in business management. However, each situation is unique, so evaluating your specific needs with a legal advisor is essential to determine if this approach benefits you.

One disadvantage of placing a liability company LLC with a trust is the complexity it introduces to business operations. Managing a trust involves ongoing administrative responsibilities, which can require legal and financial expertise. Additionally, there may be costs associated with setting up and maintaining the trust that might outweigh the benefits for some business owners.

An LLC owned by a trust can have unique tax implications. Usually, the liability company LLC with a trust remains a pass-through entity, meaning the income is reported on the trustee’s tax return. However, specific circumstances, such as the type of trust and how it is structured, may affect the tax liability, so consulting a tax professional is advisable.

Yes, an LLC can be managed by a trust. This approach allows the trust to control the operations and decisions of the liability company LLC with a trust. By doing so, the trust can effectively manage income, distribute profits, and maintain the continuity of the LLC in accordance with the trust’s terms.

People put their business in a trust for various reasons, including asset protection, estate planning, and tax benefits. By placing a liability company LLC with a trust, owners can separate their personal assets from business liabilities. This strategy can provide peace of mind, ensuring that business interests are handled according to an owner’s wishes after their passing.

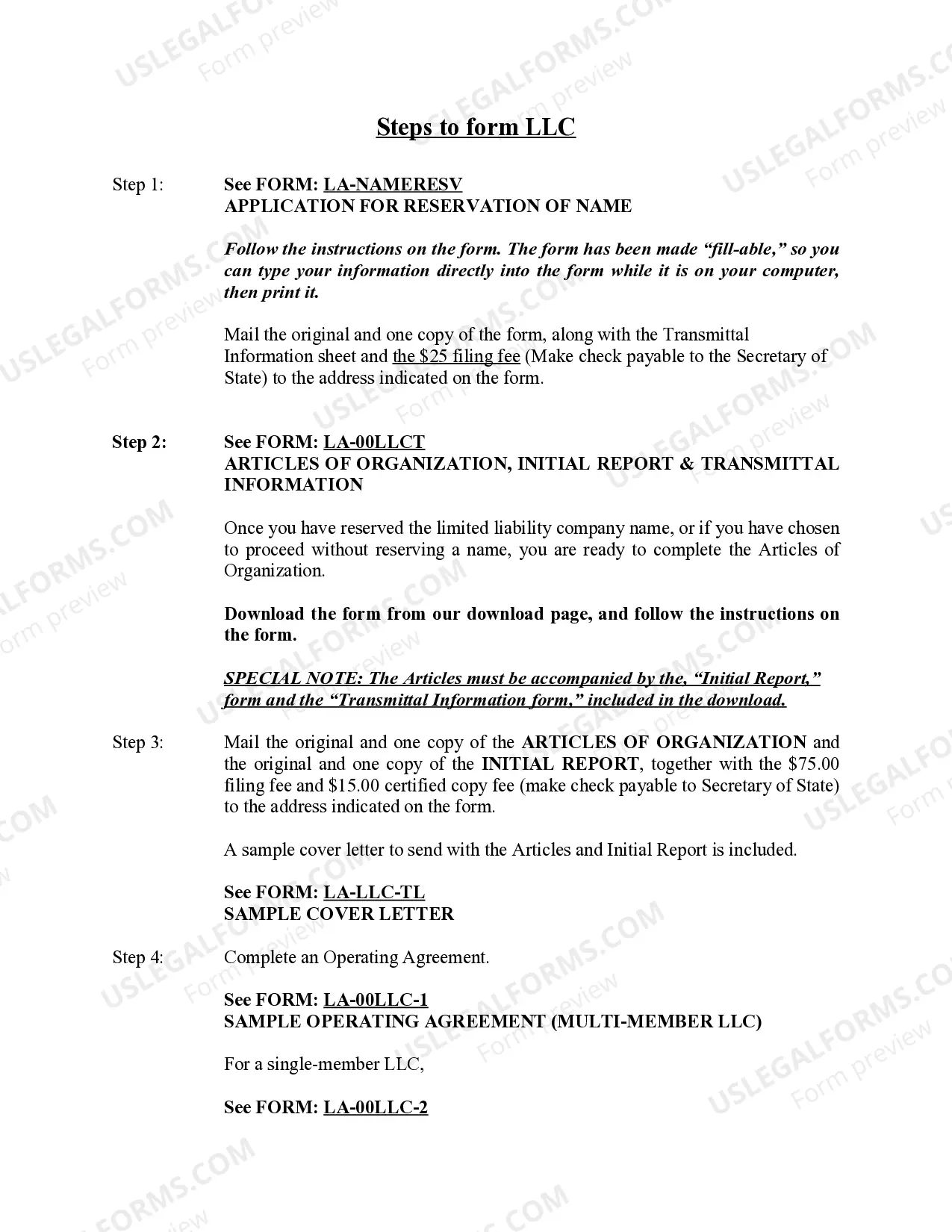

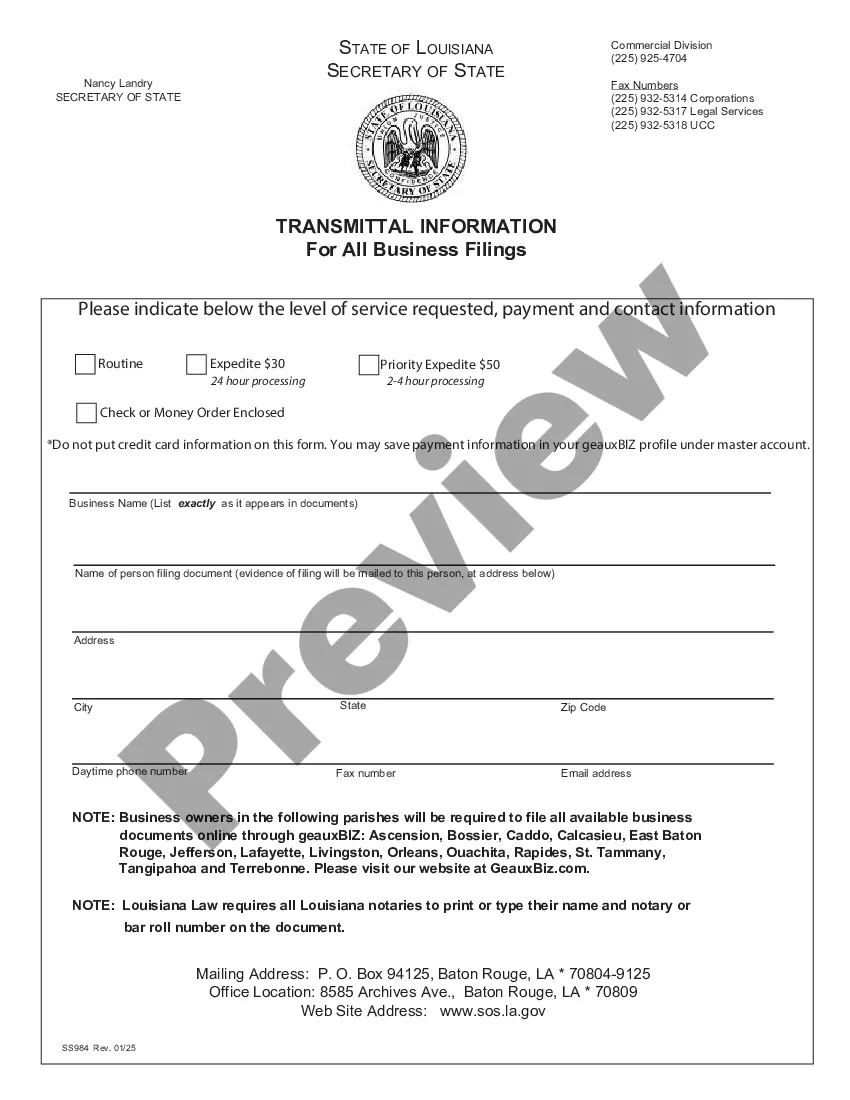

Setting up a liability company LLC with a trust involves several key steps. First, you need to establish a trust and designate it as the owner of the LLC. Next, file the Articles of Organization for the LLC and include the trust as the member. Finally, consider utilizing platforms like uslegalforms to streamline the process, ensuring that all legal documents are properly completed and compliant.