Kentucky Powers With Withholding Tax

Description

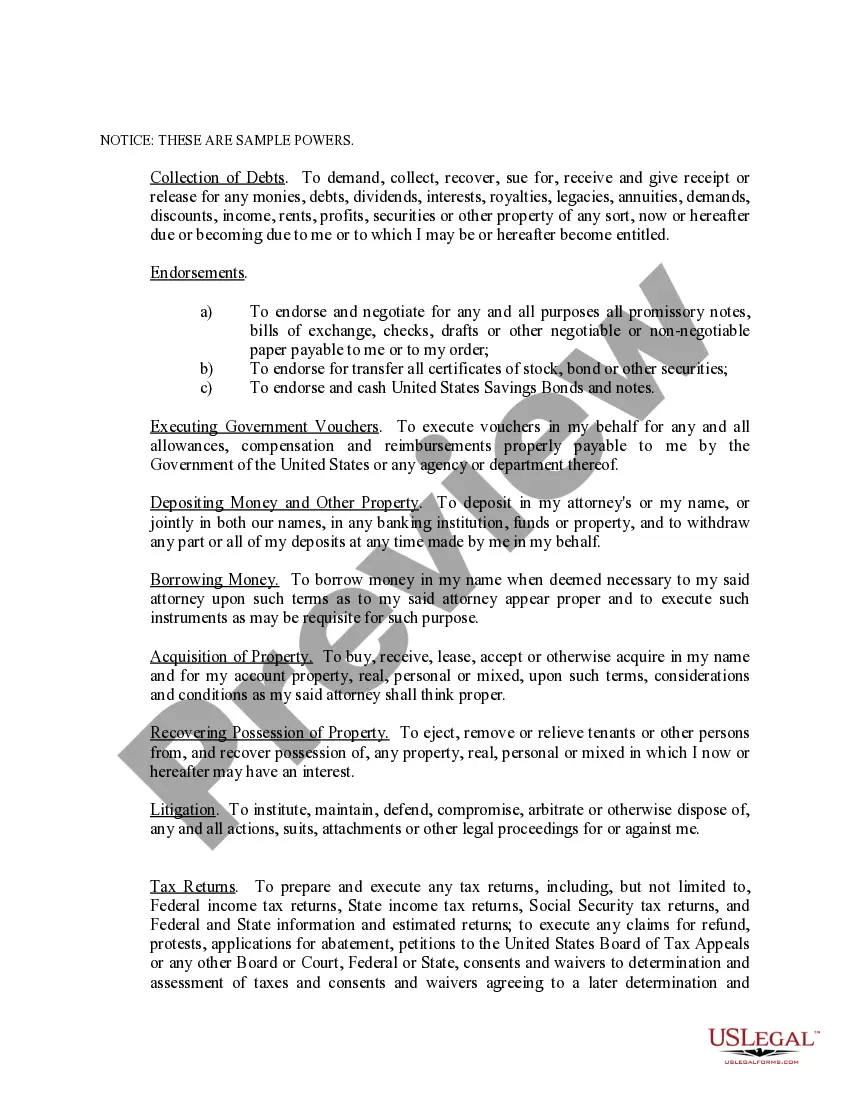

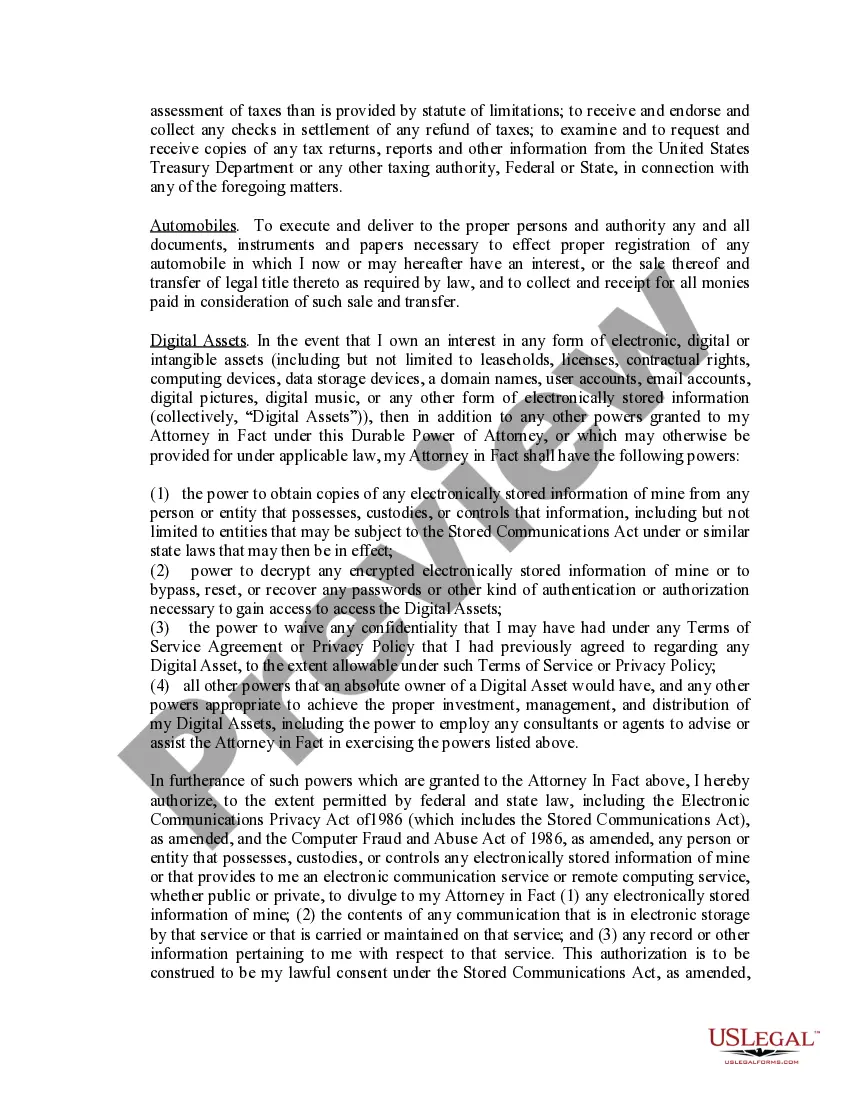

How to fill out Kentucky Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Dealing with legal papers and procedures could be a time-consuming addition to your entire day. Kentucky Powers With Withholding Tax and forms like it usually require that you look for them and understand the best way to complete them correctly. Consequently, if you are taking care of financial, legal, or individual matters, having a thorough and convenient online catalogue of forms on hand will help a lot.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and a number of tools to assist you complete your papers effortlessly. Discover the catalogue of pertinent papers accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Safeguard your papers managing processes by using a high quality service that lets you make any form in minutes without additional or hidden charges. Just log in to the profile, locate Kentucky Powers With Withholding Tax and download it straight away from the My Forms tab. You may also access formerly downloaded forms.

Is it your first time utilizing US Legal Forms? Register and set up up a free account in a few minutes and you will get access to the form catalogue and Kentucky Powers With Withholding Tax. Then, stick to the steps listed below to complete your form:

- Make sure you have found the proper form using the Review option and reading the form information.

- Pick Buy Now once all set, and choose the monthly subscription plan that suits you.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience helping consumers control their legal papers. Get the form you require today and enhance any process without having to break a sweat.

Form popularity

FAQ

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

You may be exempt from withholding for 2021 if both the following apply: ? For 2020, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. ? For 2021, you expect a refund of all your Kentucky income tax withheld.

?Withholding Statement Filing Options EFW2 electronic file ? by web filing or on CD. Publication 1220 electronic file ? on CD only. Form K-5 ? online filing (complete and submit online) Form K-5 ? online fill-in form (complete, print, and mail to DOR) (can't exceed 25 withholding statements)

To determine the correct federal tax withheld from your pay, you will need to complete your W-4. Your employer withholds from your paycheck based on the information you fill in on your Form W-4, like: Your filing status (Ex: single or married filing jointly), The number of dependents or allowances indicated.

Kentucky's law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue.