Kentucky Powers With Withholding

Description

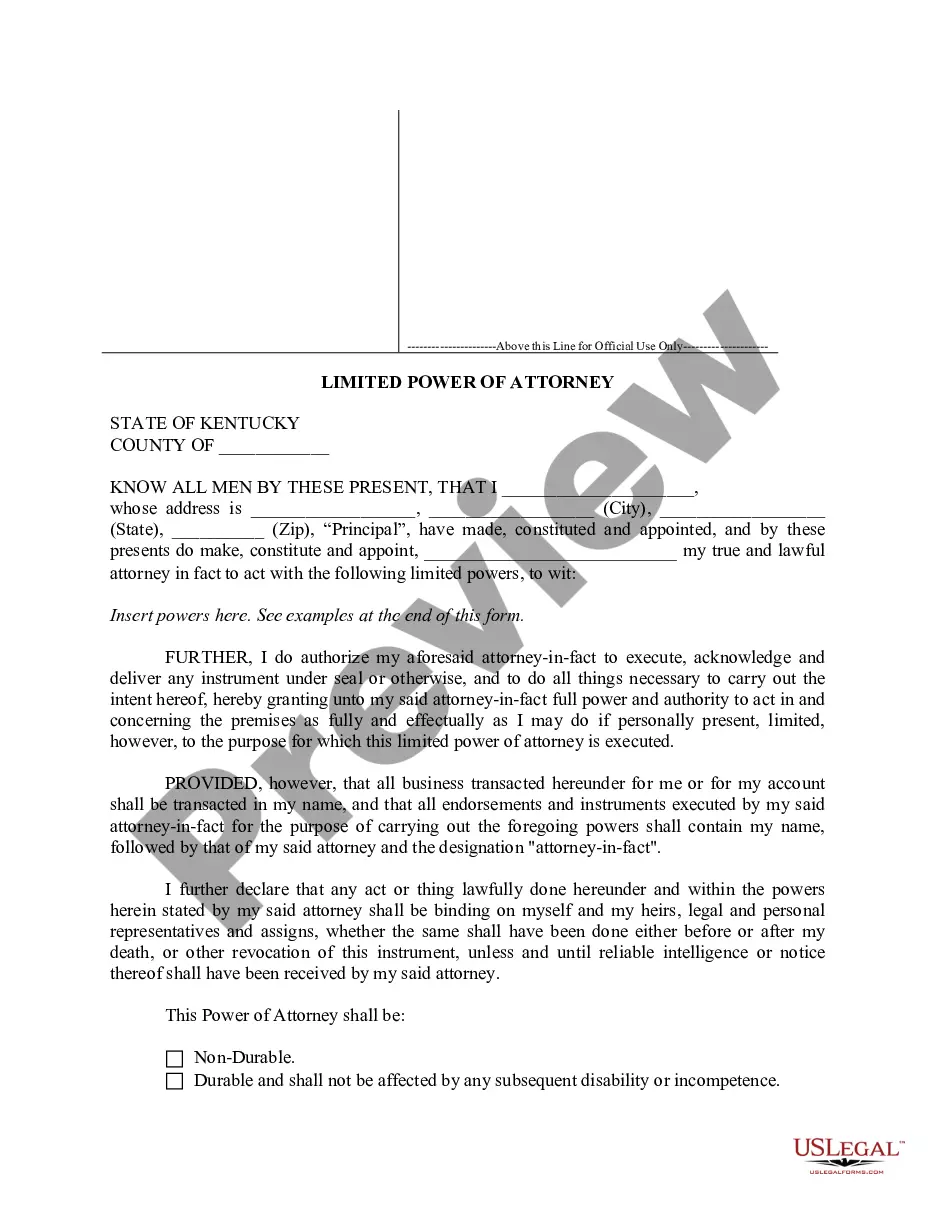

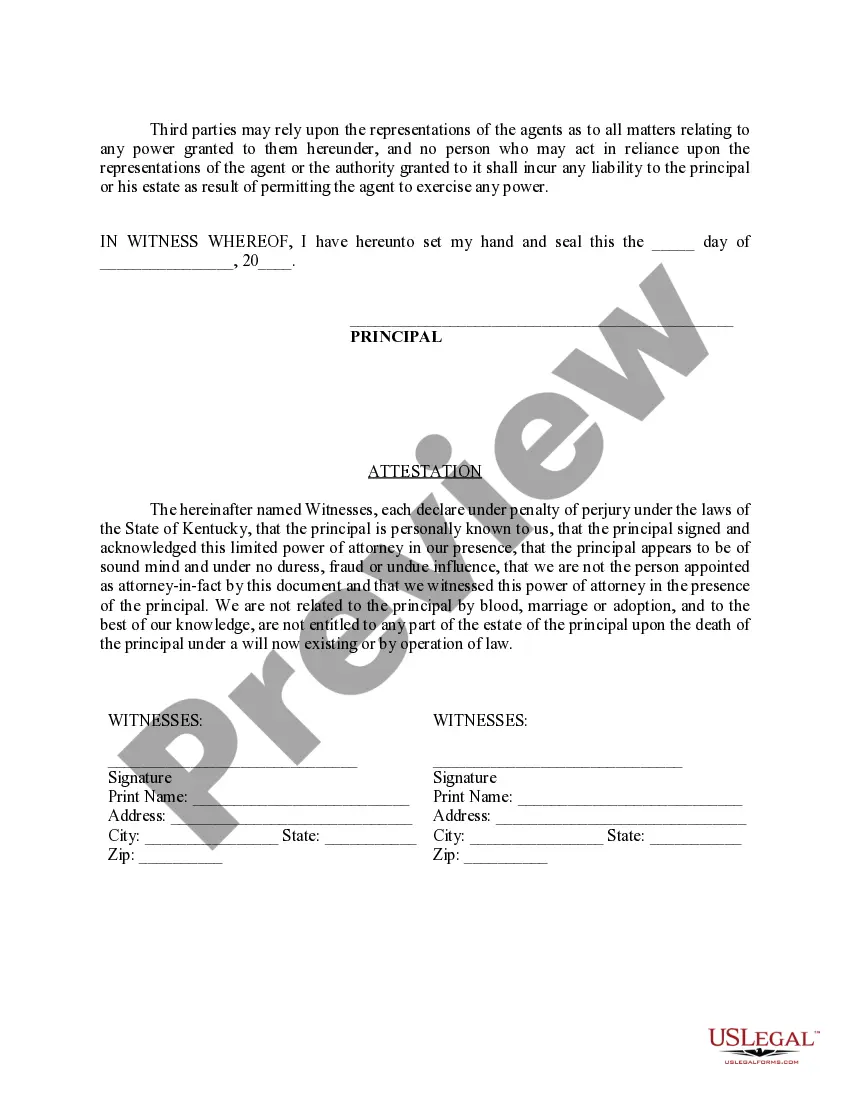

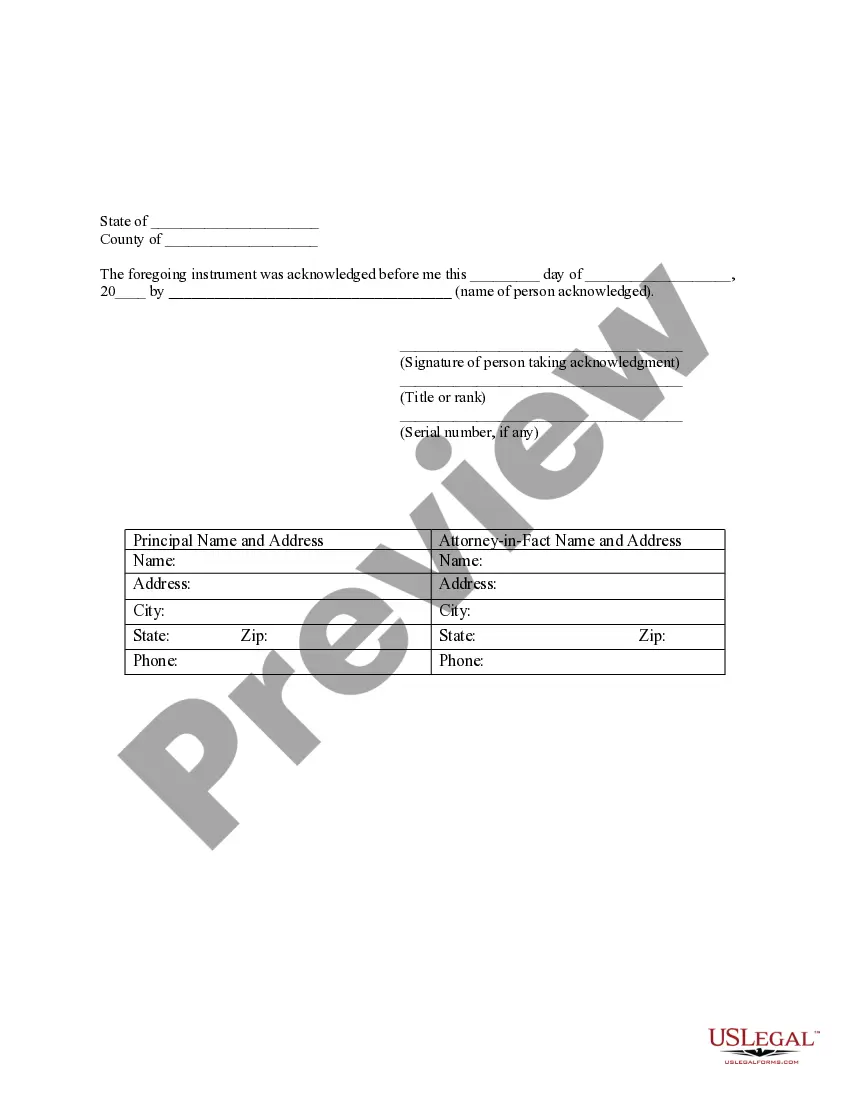

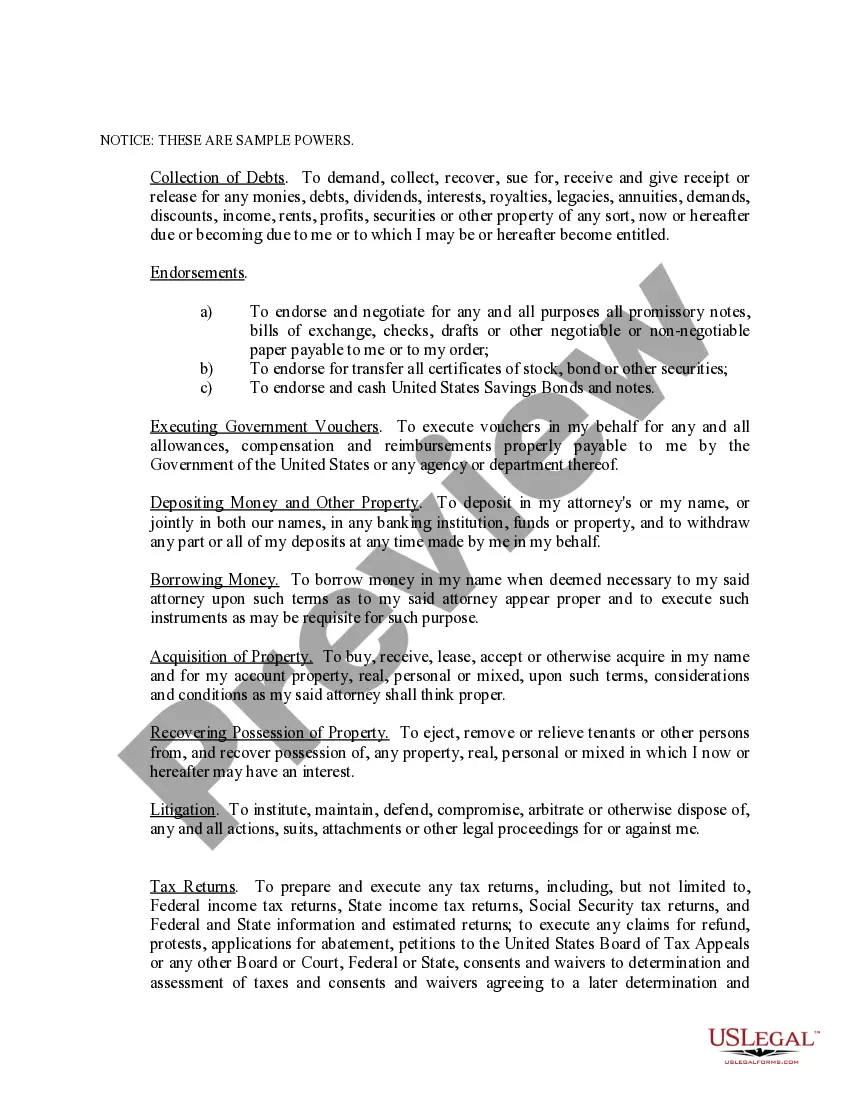

How to fill out Kentucky Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more cost-effective way of creating Kentucky Powers With Withholding or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific forms carefully prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Kentucky Powers With Withholding. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and navigate the catalog. But before jumping straight to downloading Kentucky Powers With Withholding, follow these recommendations:

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the form you select conforms with the requirements of your state and county.

- Choose the right subscription option to buy the Kentucky Powers With Withholding.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and turn document execution into something easy and streamlined!

Form popularity

FAQ

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

?Withholding Statement Filing Options EFW2 electronic file ? by web filing or on CD. Publication 1220 electronic file ? on CD only. Form K-5 ? online filing (complete and submit online) Form K-5 ? online fill-in form (complete, print, and mail to DOR) (can't exceed 25 withholding statements)

To determine the correct federal tax withheld from your pay, you will need to complete your W-4. Your employer withholds from your paycheck based on the information you fill in on your Form W-4, like: Your filing status (Ex: single or married filing jointly), The number of dependents or allowances indicated.

Kentucky's law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue.

Form K-4 is only required to document that an employee has requested an exemption from withholding OR to document that an employee has requested additional withholding in excess of the amounts calculated using the formula or tables.