Pafs 702 Proof Of No Income Without 1099

Description

How to fill out Kentucky Aging Parent Package?

Managing legal documents can be overwhelming, even for the most adept individuals.

If you need a Pafs 702 Proof Of No Income Without 1099 and can't spare the time to seek out the correct and current version, the process can be quite stressful.

US Legal Forms meets all your requirements, from personal to business paperwork, all in one location.

Utilize cutting-edge tools to complete and manage your Pafs 702 Proof Of No Income Without 1099.

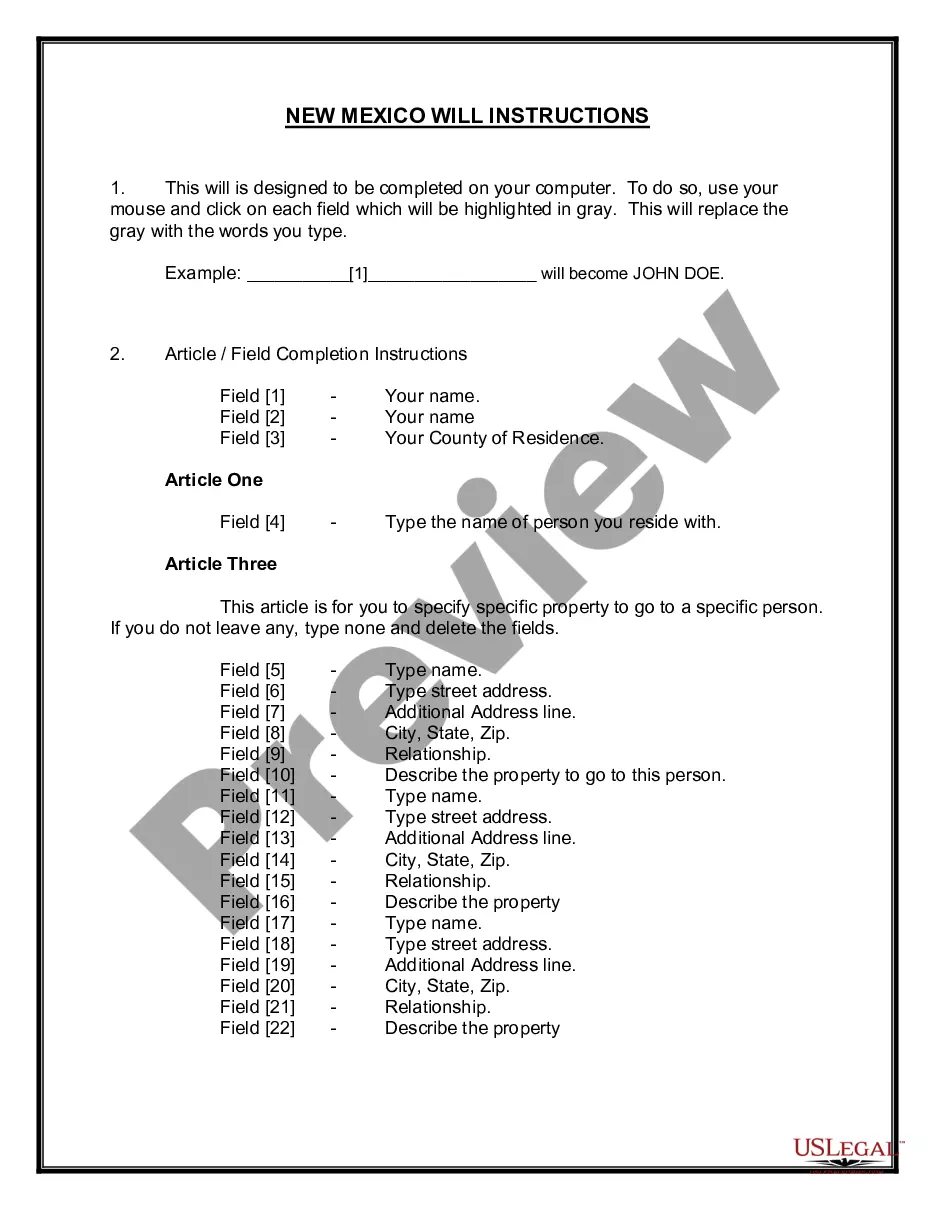

Here are the steps to follow after downloading your necessary form: Validate that it's the correct form by previewing it and reviewing its details.

- Gain access to a valuable repository of articles, guides, and relevant documents tailored to your needs.

- Save time and effort searching for the documents you require, and leverage US Legal Forms' advanced search and Review feature to obtain and download the Pafs 702 Proof Of No Income Without 1099.

- For members, Log Into your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see previously downloaded documents and manage your folders as desired.

- If you're new to US Legal Forms, create a complimentary account and enjoy limitless access to the benefits of the library.

- A comprehensive web form directory can significantly enhance how one handles these circumstances.

- US Legal Forms stands as a frontrunner in online legal forms, offering over 85,000 state-specific legal documents always accessible.

- With US Legal Forms, you can conveniently find state or county-specific legal and organizational forms.

Form popularity

FAQ

Edited By. If you're self-employed in Canada ? meaning you earn income from a sole proprietorship or partnership ? you're responsible for tracking your income and expenses and paying your taxes every year to the Canada Revenue Agency.

You can order a copy of the Proof of Income Statement (option "C" print) to be mailed to you by calling the automated Canada Revenue Agency (CRA) line at 1-800-267-6999. It can take up to 10 days to receive the Proof of Income Statement by mail.

A profit and loss (P&L) statement, which may also be called an income statement or income and expense statement, allows a business owner to see in one quick view how much money they are bringing in and spending?and how.

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

As an unincorporated business, you file your self-employment income through a T2125 form. If you're incorporated, you file personal taxes with a T1 form and your corporation's taxes through a T2 form.