Ki-file

Description

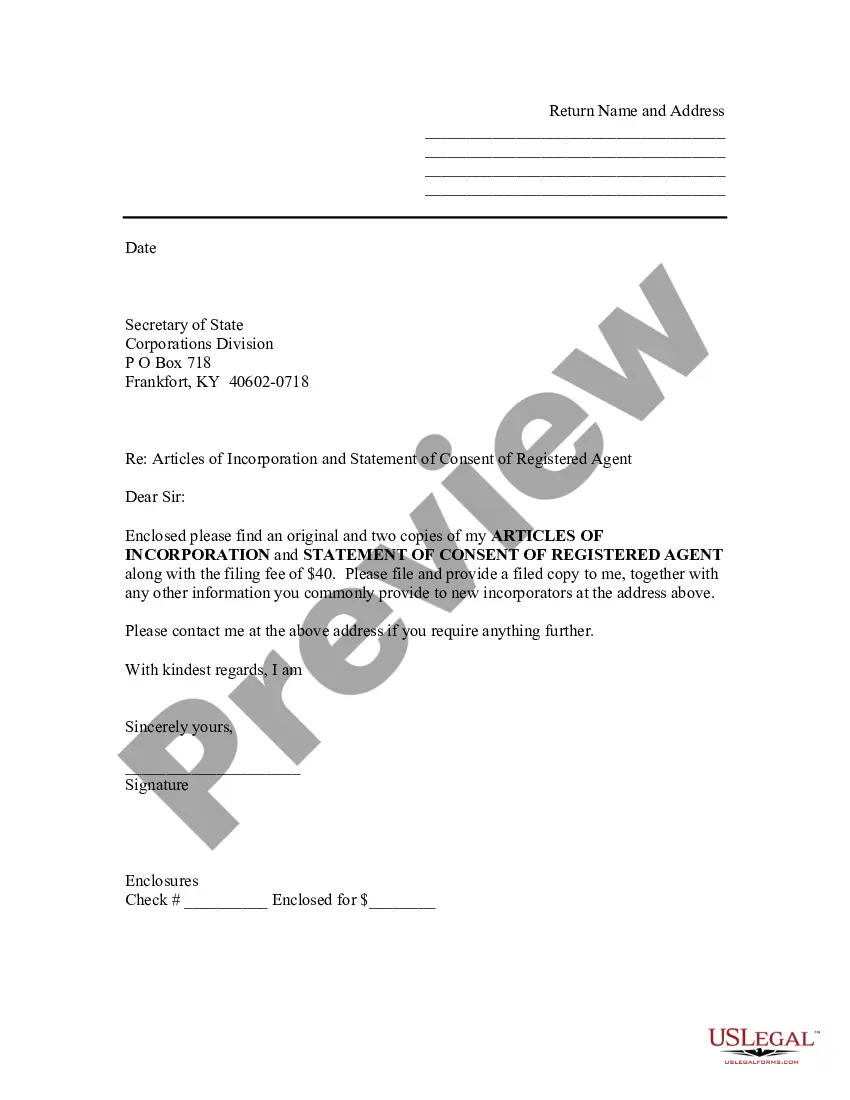

How to fill out Kentucky Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

- Log in to your account on US Legal Forms if you've used the service before. Ensure your subscription is active; renew it if necessary.

- For first-time users, explore the Preview mode and read the form descriptions carefully to select the right ki-file that fits your needs and local jurisdiction.

- If your chosen form isn't quite right, use the Search tab to find a more suitable template.

- Once you find the correct document, click the 'Buy Now' button to choose your subscription plan and set up your account.

- Proceed to make your payment with either your credit card or PayPal account to finalize the subscription.

- Download the completed ki-file to your device and access it later from the 'My Forms' section of your profile.

US Legal Forms not only provides a vast selection of legal documents but also gives users access to premium experts for assistance, ensuring all forms are accurately filled and legally sound.

Take advantage of US Legal Forms today to simplify your legal documentation; start exploring now and empower your legal process!

Form popularity

FAQ

To open a QIF file, utilize financial software like Quicken or other compatible tools that support QIF import. If you lack access to such software, numerous online converters or viewers might assist you in accessing the file. Don't forget to explore resources on US Legal Forms, as they can provide you valuable insights into managing various file types effectively. This ensures you can work with your QIF files with ease.

The file extension K often indicates a type of file used for specific purposes, but it is essential to verify its associated applications. Knowing what programs can open it is key to accessing its contents. Resources on US Legal Forms can guide you through understanding file extensions and selecting software tailored for your needs. This knowledge can greatly enhance your file management.

Several programs can open a QIF file effectively, including Quicken and other personal finance management software. When selecting a program, ensure it matches your financial management needs to work seamlessly. If you're unfamiliar with these options, US Legal Forms can help you navigate the tools best suited to your specific requirements. Their resources provide clarity on handling QIF files properly.

Filing a file extension involves knowing the appropriate programs that can handle that specific format. For instance, after identifying the type of file, research the software capable of opening it. Consider visiting US Legal Forms for guidance on filing various types of extensions effectively, ensuring you select the right tools for your needs. This way, you streamline your processes and enhance efficiency.

Opening a $2 k file usually requires specific software that can interpret its format. Many financial applications and specialized file viewers support this type of file. Explore options available on US Legal Forms to learn more about managing different file extensions, including the $2 k file. Through these guides, you can find the best approach to access your file.

Filling out your tax withholding form requires you to input your personal information and assess your allowances based on your financial situation. Review the guidelines carefully to align with the Ki-file process. Accuracy is crucial to ensure proper withholding, and mistakes could lead to complications later on. Consider using UsLegalForms to simplify and ensure the correctness of your forms.

When asked if you are exempt from withholding, respond based on your financial situation. If you meet the criteria for exemption, fill out the necessary information during the Ki-file process accordingly. Ensure you understand the implications, as inaccuracies may lead to future tax liabilities. Consulting a tax professional can provide clarity on your status.

Filling out a withholding exemption form involves indicating your personal information and providing valid reasons for claiming the exemption. You'll want to ensure that it aligns with the requirements laid out in the Ki-file process. Keep in mind that claiming an exemption inaccurately can lead to complications later. Consider utilizing services like UsLegalForms to simplify your submission.

To fill out a withholding allowance form, start by gathering your financial information, including income and dependent details. Follow the instructions carefully, and accurately enter your allowances based on your Tax situation. The Ki-file process generally requires ensuring that all information aligns with your expected obligations. UsLegalForms offers resources to simplify these forms for you.

The number of exemptions to withhold depends on your personal situation, including your income, dependents, and any additional deductions. Understanding how these factors interact with your Ki-file can help you make an informed decision. Using online resources may provide additional clarity. Always consider consulting a tax professional for personalized advice.