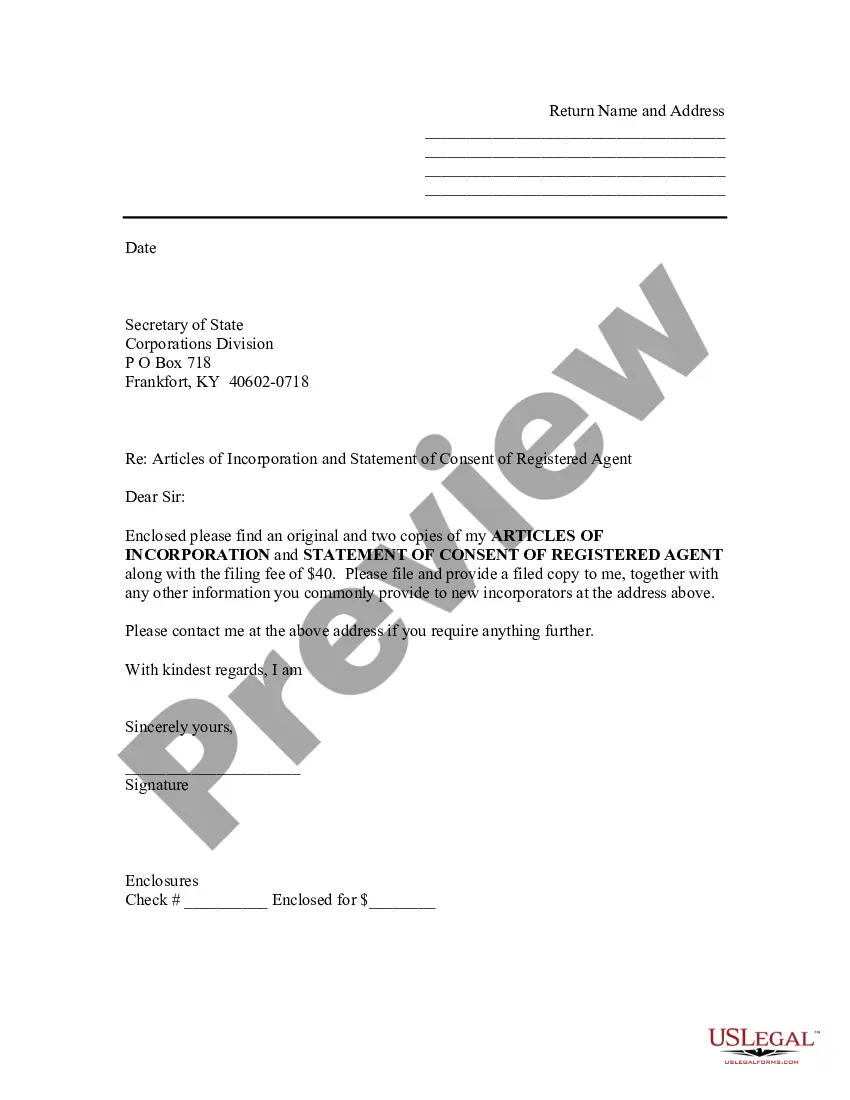

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

File Articles Of Incorporation For Nonprofit

Description

How to fill out Kentucky Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

- Log into your US Legal Forms account, or create a new one if you're a first-time user.

- Search for the articles of incorporation template specifically for nonprofits and verify it aligns with your local jurisdiction.

- If you need a different template, utilize the search function to find any additional forms required.

- Select the document and click 'Buy Now' to choose your subscription plan.

- Complete your purchase by entering your payment information securely.

- Download your completed form and save it conveniently to your device.

Upon downloading your completed form, you can also access it later through the 'My Forms' section in your profile. This secure access ensures you can retrieve and modify your documents as needed.

US Legal Forms empowers you to expeditely handle legal documents with ease. Take the first step towards forming your nonprofit by using US Legal Forms today.

Form popularity

FAQ

Articles of incorporation are legal documents that establish the existence of a nonprofit corporation. They outline key information, such as the organization's name, purpose, and structure. Filing articles of incorporation for nonprofit is crucial, as these documents play a significant role in defining your organization and may impact your tax-exempt status.

Incorporation is not mandatory for all nonprofit organizations, but it offers several benefits, including liability protection and credibility. If you plan to seek tax-exempt status, incorporating will become necessary. Therefore, filing articles of incorporation for nonprofit is a recommended practice that enhances your organization’s legitimacy and operational capacity.

Yes, in order to become a 501c3 organization, you must first incorporate as a nonprofit corporation. Incorporating protects your personal assets and provides legal recognition of your organization. Thus, filing articles of incorporation for nonprofit is a critical first step on your journey to obtaining 501c3 status and securing tax benefits.

To file nonprofit articles of incorporation, you first need to prepare the necessary documents that include your organization’s name, purpose, and registered agent information. After drafting these articles, submit them to your state’s Secretary of State office along with any applicable fees. Using platforms like USLegalForms can simplify this process and provide you with valuable guidance on how to properly file articles of incorporation for nonprofit.

A nonprofit corporation is a broad legal category that encompasses various organizations serving the public good. On the other hand, a 501c3 specifically refers to nonprofit organizations that qualify for federal tax-exempt status under the IRS code. To effectively file articles of incorporation for nonprofit, you must ensure it meets the requirements of a 501c3 if you desire that specific tax-exempt classification.

Yes, a 501c3 organization must file articles of incorporation for nonprofit to establish its legal status. These articles serve as foundational documents that outline the nonprofit’s purpose and structure. Filing articles of incorporation for nonprofit is essential, as it enables your organization to apply for tax-exempt status and strengthens its credibility.

Articles of incorporation set the foundational structure of your nonprofit, including its purpose and governance, while bylaws outline the internal rules that govern operations. When you file articles of incorporation for nonprofit, you create a legal entity, but the bylaws detail how the organization will function day-to-day. Bylaws can be amended as needed, while articles of incorporation are more permanent. Understanding both documents is crucial for effective management and compliance.

Yes, nonprofits can be unincorporated, but they face several challenges. When you choose to file articles of incorporation for nonprofit, you gain legal recognition, limiting personal liability for founders and offering tax benefits. Unincorporated nonprofits may have trouble securing grants and maintaining credibility. Therefore, incorporation is often a better choice to protect your organization and its members.

When you decide to file articles of incorporation for nonprofit, consider whether an LLC or Inc. is best for your organization. An Inc. offers greater credibility and access to funding, while an LLC provides more flexibility in management. Generally, nonprofits choose to incorporate as an Inc. to comply with state regulations and qualify for tax-exempt status. Therefore, the choice depends on your organizational goals and structure.

The Articles of Incorporation are typically created by the founders of the nonprofit organization or designated officers. It's essential that those involved have a clear understanding of the organization’s mission and structure. Many individuals turn to platforms like US Legal Forms for assistance, ensuring they accurately file articles of incorporation for nonprofit in compliance with state laws.