Account For Trust

Description

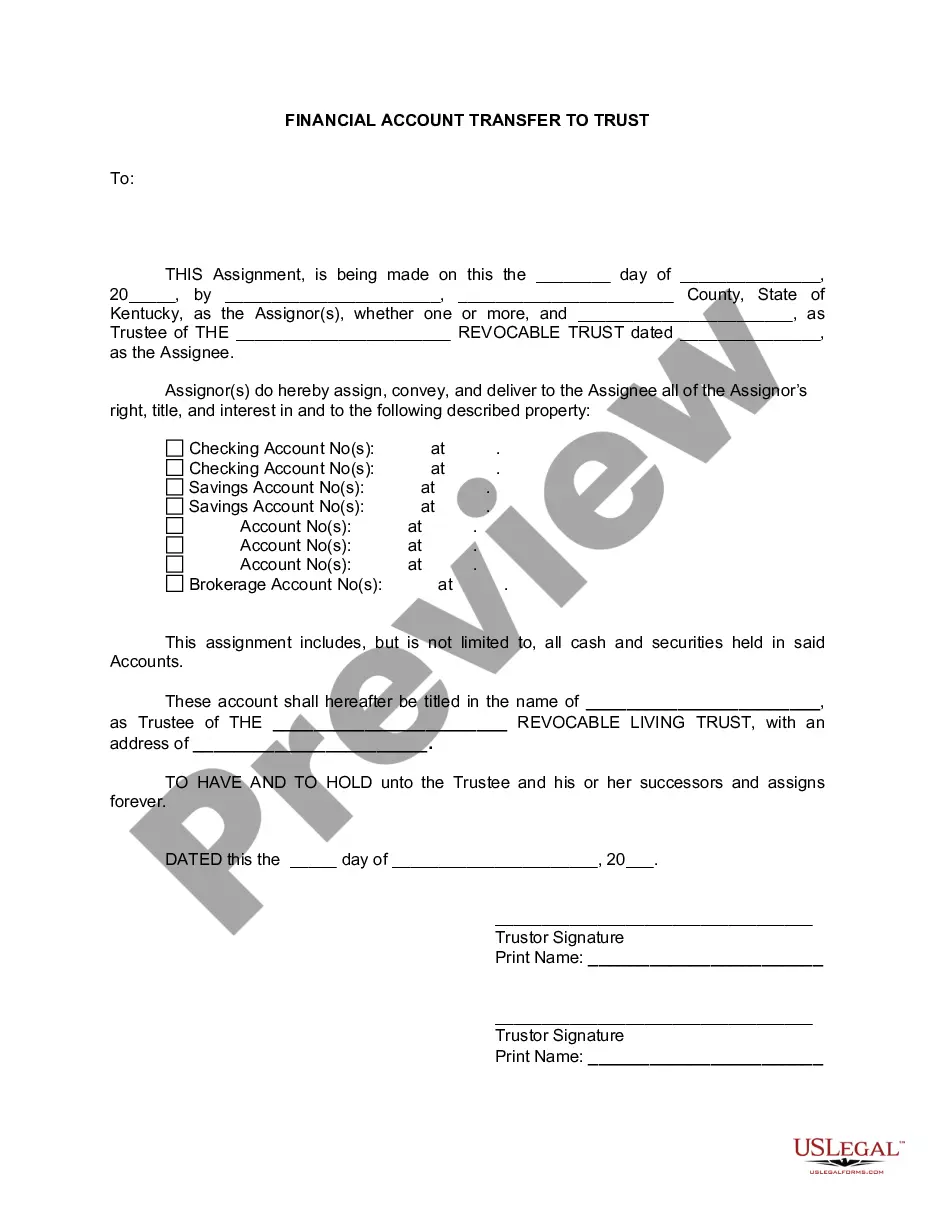

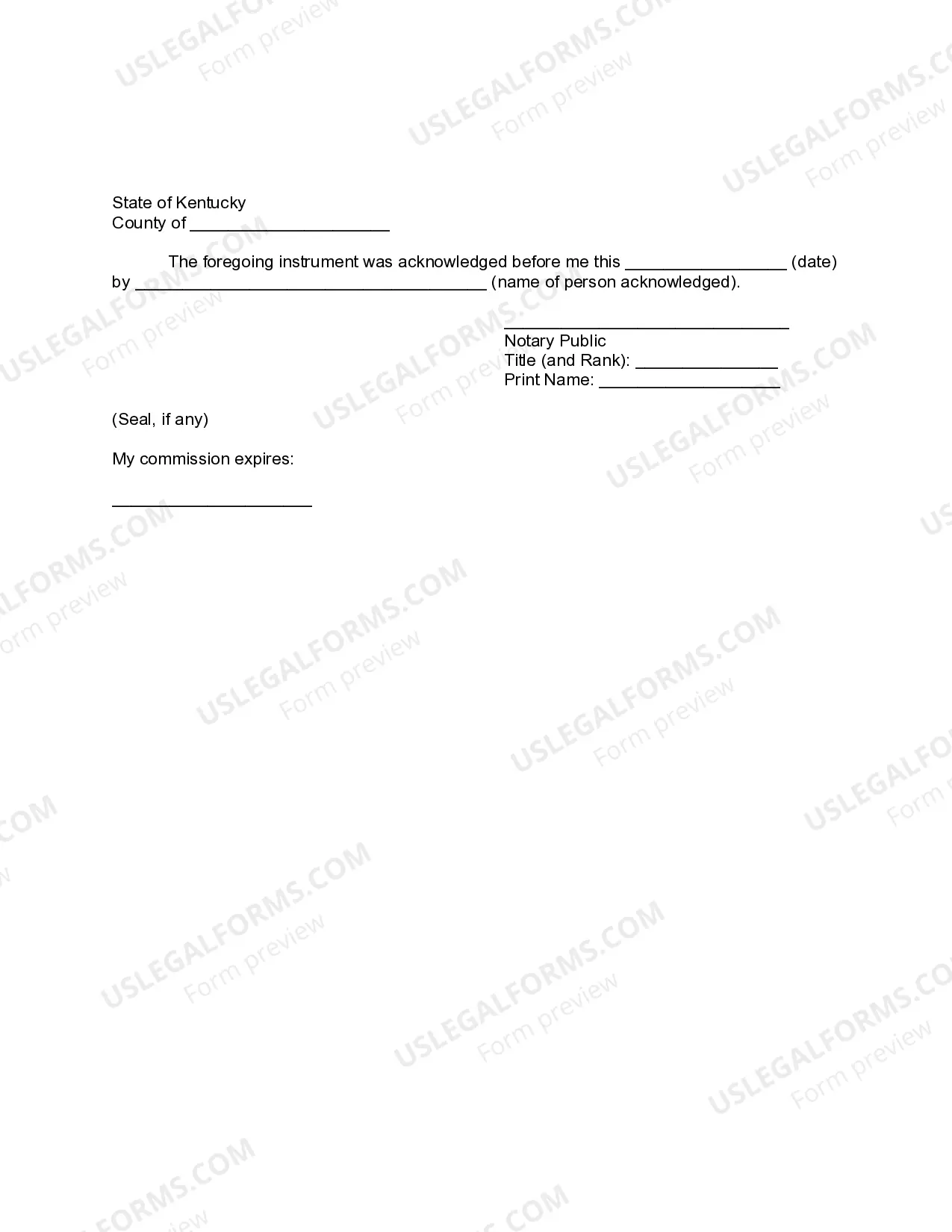

How to fill out Kentucky Financial Account Transfer To Living Trust?

- If you are a returning user, log into your account and verify your subscription status. Click the 'Download' button to save your required form template to your device.

- For first-time users, start by exploring the Preview mode and form description to confirm that the template aligns with your local jurisdiction’s requirements.

- If your initial choice doesn’t fit, utilize the Search tab to locate an alternative template that meets your needs.

- Proceed by selecting the 'Buy Now' button and choosing your preferred subscription plan. You will need to create an account to gain full access to the platform's resources.

- Complete your purchase by entering your payment details via credit card or PayPal to finalize your subscription.

- Once your payment is confirmed, download the selected form and save it on your device. You can find it later in the My Forms section of your profile.

In conclusion, utilizing US Legal Forms allows you to easily access and manage essential legal documents tailored to your needs. With its extensive resources and expert support, you can ensure that your paperwork is both accurate and legally compliant.

Start your journey with US Legal Forms today and simplify your legal document management!

Form popularity

FAQ

When a bank account is in trust for someone, it signifies that the funds are designated for a specific beneficiary under the management of a trustee. This account allows the trustee to control the asset until certain conditions are met or until the beneficiary reaches a particular age. It safeguards the financial interests of the beneficiary, ensuring proper allocation of the assets.

To have an account in trust means that you have set aside funds managed by a trustee for a specific beneficiary. The trustee has a legal obligation to manage the assets according to the trust's terms. This arrangement provides a layer of transparency and security, ensuring that the benefactor's wishes are fulfilled.

The purpose of a trust account is to hold and manage assets specifically for the benefit of another person or entity. This account structure ensures that funds are used responsibly and in accordance with the trust document. Ultimately, it facilitates smooth financial transitions and protects the interests of the beneficiaries.

The best account for trust varies depending on your specific needs. Generally, a dedicated trust account, often managed by a financial institution or attorney, provides clear oversight and benefits. It helps ensure that the funds are administered according to the trust's stipulations, maximizing financial security.

An account in trust is designed to manage assets on behalf of a beneficiary. It facilitates the safekeeping of funds, ensuring they are used in accordance with the trust's terms. This setup allows for effective asset management and disbursement, providing peace of mind to the benefactor.

The primary downside of placing assets in a trust is the potential loss of direct control over those assets. Once in a trust, the assets are managed according to the trust's terms, which might limit personal access. There may also be significant administration costs involved in maintaining the trust. To navigate these challenges, consider resources like US Legal Forms to help you properly account for trust.

One significant downfall of having a trust is the complexity it introduces into estate planning. Establishing a trust requires legal assistance and can involve substantial upfront costs. Additionally, families may face disputes over the trust's management and distribution of assets. Therefore, it's crucial to carefully consider how this approach will help you effectively account for trust.

Determining whether your parents should place their assets in a trust involves considering their financial goals. A trust can help manage assets and reduce estate taxes, but it may not be suitable for everyone. It's often beneficial for families with significant assets or specific wishes regarding inheritance. To evaluate this option further, consider using the US Legal Forms platform to understand how to account for trust assets efficiently.

Selecting the best bank for a trust account largely depends on your specific needs. Some banks provide specialized services tailored for trust accounts, while others may have lower fees. Factors to consider include customer service quality, online access, and fees. To ensure you make an informed choice, it's helpful to compare various options on how they can effectively account for trust.

A family trust can limit your control over the assets you place in it. While it provides benefits like asset protection and avoidance of probate, it may also come with costs such as legal fees and ongoing maintenance. In some cases, family members may disagree on how the trust is managed, leading to potential conflicts. Overall, it’s essential to weigh these factors when deciding how to account for trust.