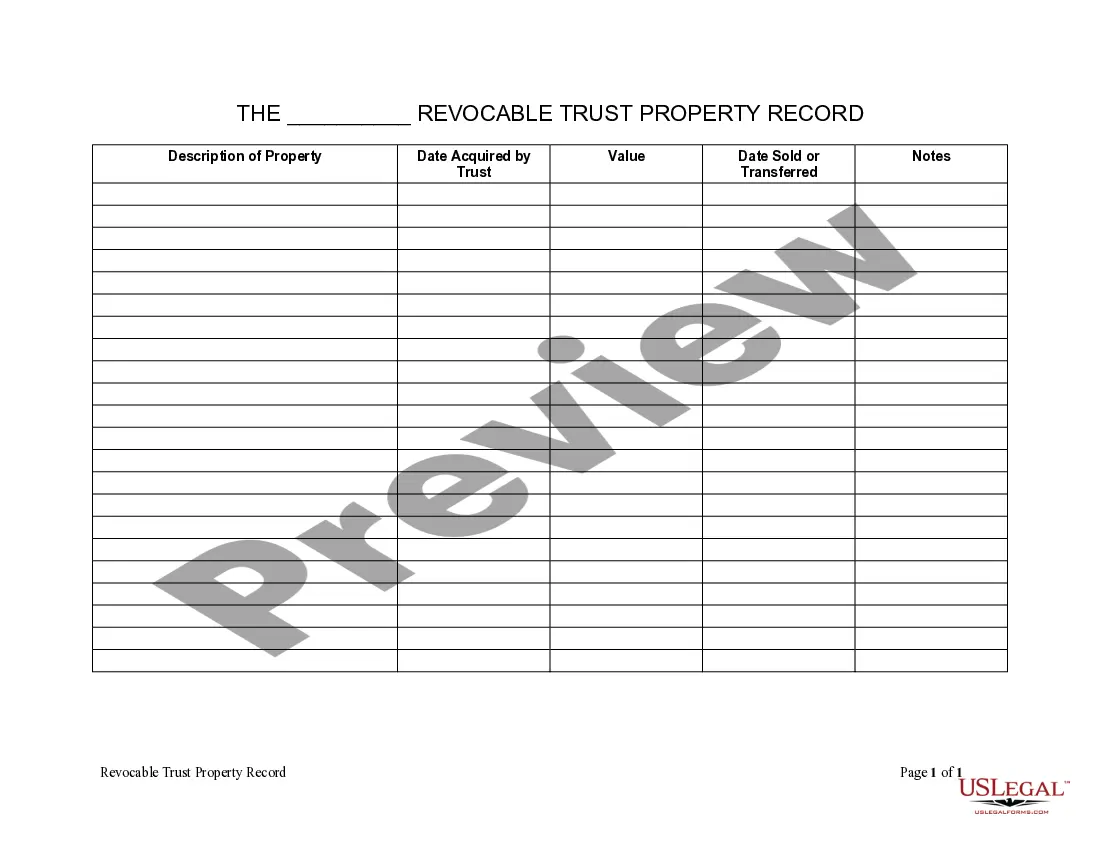

Revocable Living Trust For Property

Description

How to fill out Kentucky Living Trust Property Record?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is current to access the necessary templates.

- For first-time users, start by exploring the available templates. Check the Preview mode and descriptions to find a form that suits your needs and complies with local regulations.

- If adjustments are needed, utilize the Search tab to find a more suitable document. Ensure the selected template aligns with your requirements.

- Select the document and proceed to purchase. Click the Buy Now button and choose your preferred subscription plan. You'll need to create an account if you haven’t done so already.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Download your chosen form onto your device to begin filling it out. You can always revisit it later through the My Forms section in your profile.

In conclusion, using US Legal Forms simplifies the process of establishing a revocable living trust for property. With an extensive library of over 85,000 editable legal forms and access to expert assistance, users can ensure their documents are legally sound and tailored to their specific circumstances.

Start your journey towards property management today by visiting US Legal Forms and unlocking the resources you need!

Form popularity

FAQ

Some bank accounts may be better off outside of your revocable living trust for property. Accounts that have joint ownership should typically remain separate to maintain access for co-owners. Furthermore, custodial accounts for minors or certain educational savings accounts can complicate trust management and should be kept out.

When creating a revocable living trust for property, consider including real estate, bank accounts, and investments. These assets benefit from the streamlined management and avoid probate. Additionally, other valuable items like business interests can also be great additions to ensure they pass smoothly to your beneficiaries.

You should avoid placing certain assets into a revocable living trust for property. For example, assets like precious metals, collectibles, and personal items with subjective value may complicate the trust. You might also choose to keep some financial accounts out of the trust to retain flexibility and direct access as needed.

Generally, a nursing home cannot take your house if it is placed in a revocable living trust for property. However, Medicaid may consider the house as an available asset during eligibility reviews unless specific protections are in place. It’s wise to consult a legal expert or service like US Legal Forms to ensure you understand the implications regarding nursing home care and your trust.

While a revocable living trust for property can hold many assets, certain items should typically be excluded. For instance, personal belongings that have significant emotional value may be better off left outside the trust, as well as certain retirement accounts, like 401(k)s. Additionally, you should consider keeping life insurance policies separate since their benefits may not be accessible through the trust.

Putting a house in a revocable living trust for property simplifies the transfer of ownership upon your passing. This setup allows your heirs to avoid the lengthy and costly probate process, providing them with quicker access to your assets. Furthermore, it maintains your control over the house while you are alive, as you can revoke or alter the trust at any time. Using platforms like US Legal Forms can streamline this process and help ensure your estate planning is executed correctly.

One downside to a revocable living trust for property is that it does not provide protection from creditors. If you face financial difficulties, assets in your trust can still be claimed by creditors. Additionally, establishing a revocable living trust may require upfront legal fees and time to transfer property into the trust. Although it offers many benefits, it's crucial to weigh these considerations before moving forward.

While a revocable living trust for property offers many benefits, it also has some notable disadvantages. One major drawback is that assets in a revocable living trust do not receive creditor protection, meaning creditors could still claim these assets in the event of bankruptcy. Additionally, setting up a revocable living trust can involve upfront costs and ongoing maintenance, which may be more complex compared to a straightforward will. Lastly, it may not provide the tax benefits that other estate planning tools might offer, so it is essential to assess your individual needs carefully with a professional.

One of the biggest mistakes parents make when setting up a trust fund is not clearly communicating their intentions to their children. Without clear guidelines, beneficiaries may face confusion or disputes regarding the trust fund's use. Additionally, failing to regularly update the trust as circumstances change can lead to complications. The process of creating a revocable living trust for property ensures that your wishes are adhered to, making communication and periodic reviews essential.

Putting your assets in a revocable living trust for property involves several straightforward steps. Begin by creating the trust document, detailing the trust's beneficiaries and management. Next, transfer title of your assets, such as real estate or bank accounts, to the trust by executing the necessary legal documents. Enlisting help from platforms like uslegalforms can guide you through these steps.