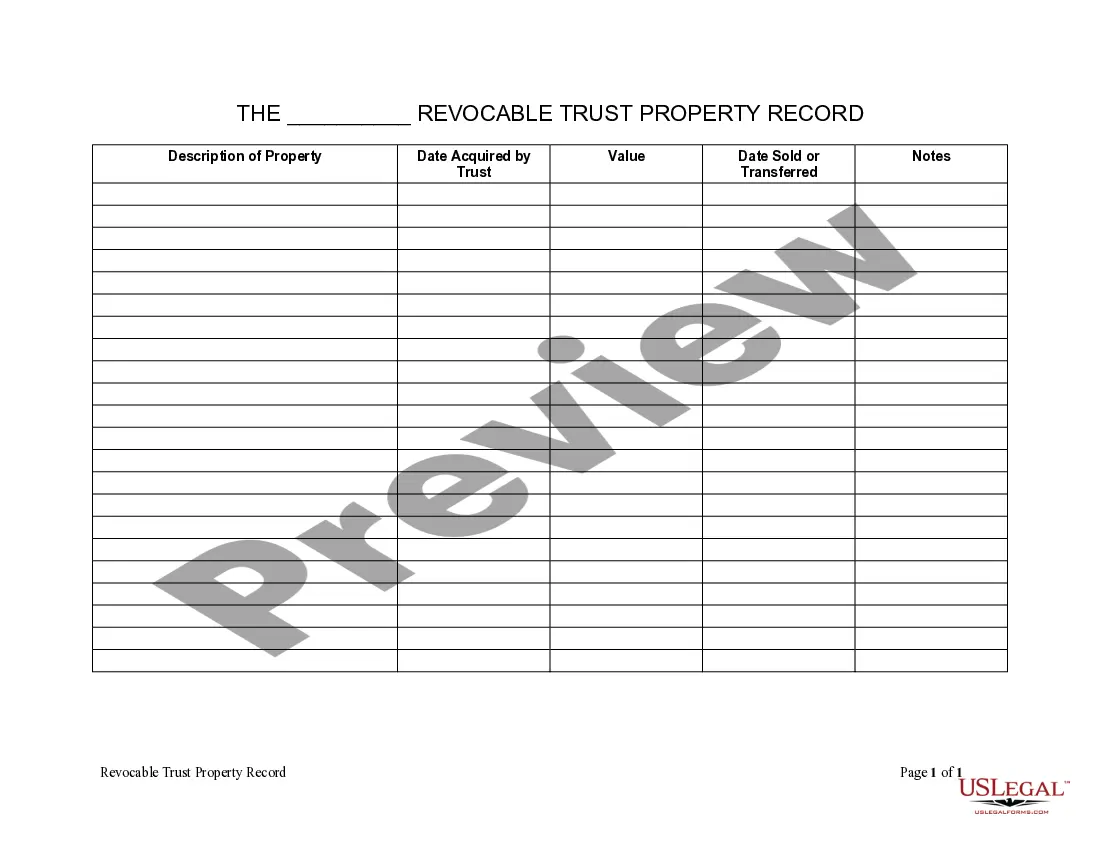

Living Trust Property With Title

Description

How to fill out Kentucky Living Trust Property Record?

- If you are a returning user, log into your account to access and download the necessary form template. Verify your subscription is active; otherwise, renew it accordingly.

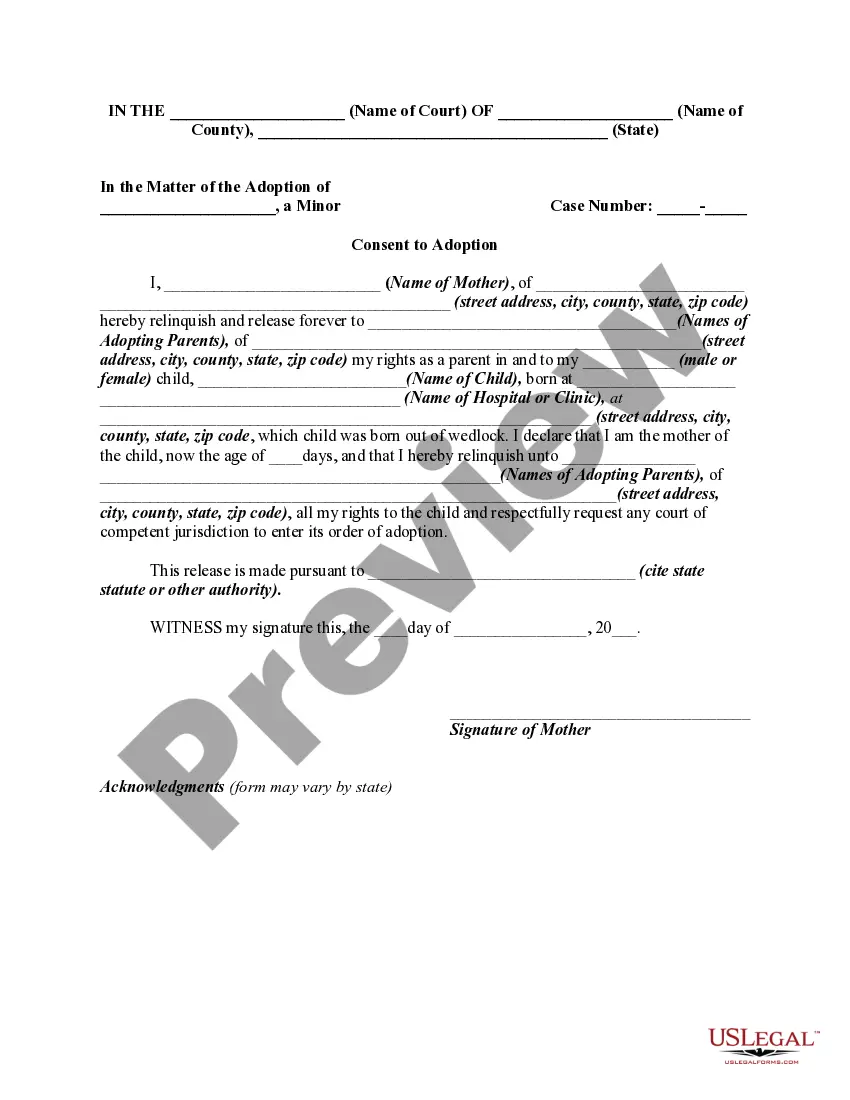

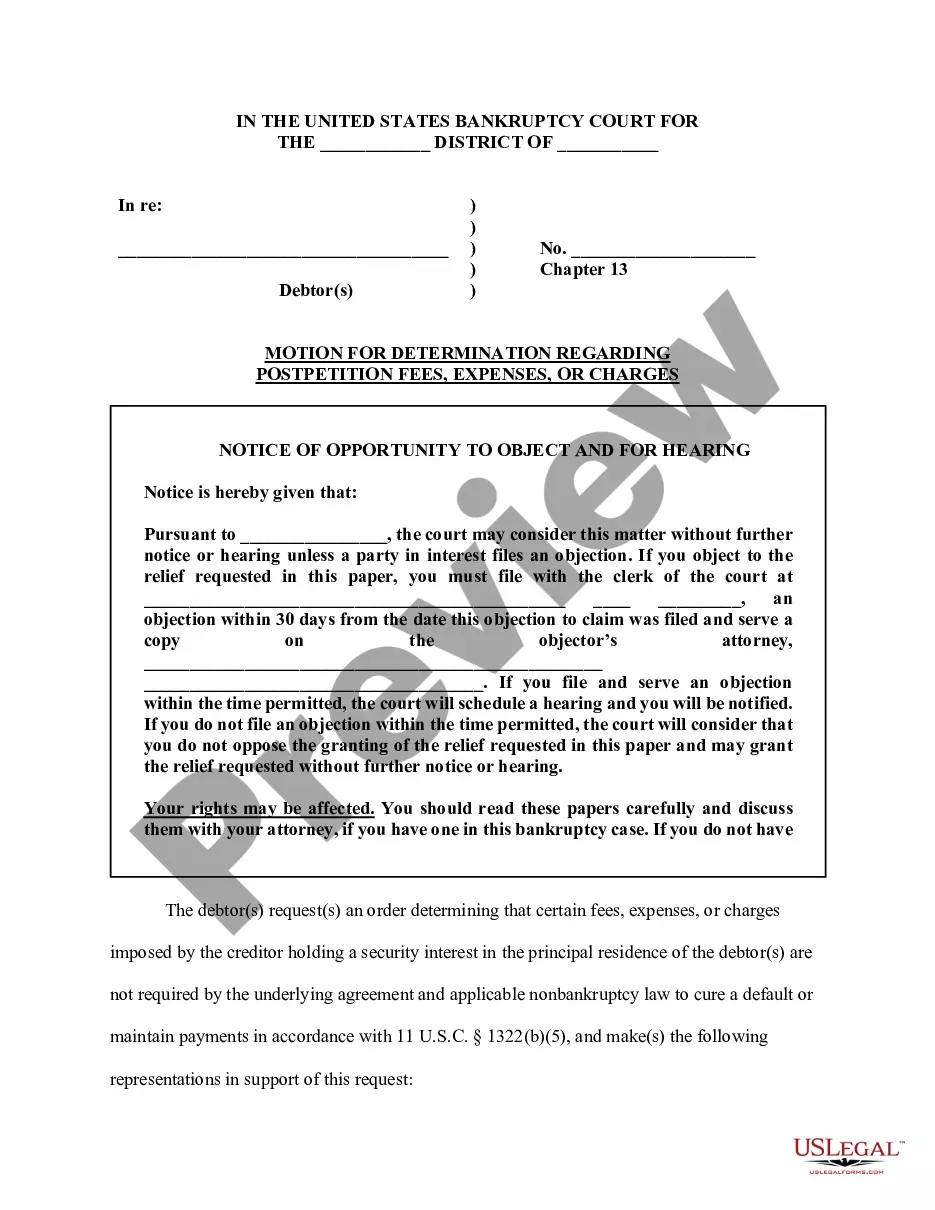

- For first-time users, begin by browsing the extensive library of forms. Check the Preview mode and form description to select the document that aligns with your local jurisdiction's requirements.

- If you need a different template, utilize the Search tab to find the appropriate form. Make sure the selected document meets all your criteria before proceeding.

- Once you have found the right form, click on the Buy Now button and select your preferred subscription plan. Registration is required to access the library's resources.

- Complete your purchase by providing payment information, either through credit card or PayPal, to secure your subscription.

- After purchasing, download the form to your device. You can also access your document in the My Forms section of your profile whenever needed.

Utilizing US Legal Forms ensures that your living trust property with title is handled accurately and efficiently. The vast collection of forms empowers users to create legally sound documents while benefiting from expert assistance if needed.

Start managing your living trust property today with US Legal Forms for a stress-free legal experience!

Form popularity

FAQ

Holding property in a trust has several benefits, including avoiding probate, providing asset protection, and ensuring a smooth transfer of ownership. However, it can also come with drawbacks like setup costs and the necessity of ongoing management. Considering a living trust property with title can enhance your estate planning, but it’s important to weigh these factors carefully and consult with professionals.

When a title is held in a trust, it means the legal title to a property is transferred to a trustee while the beneficial interest remains with the beneficiaries. This structure provides a layer of privacy and protection, as the property does not go through public probate processes. Utilizing a living trust property with title is an efficient way to manage your assets, offering peace of mind for you and your loved ones.

When land is held in trust, it indicates that a designated trustee has control over the land, managed for the benefit of specified beneficiaries. This allows for careful management and protection of the land, ensuring that it remains a valuable asset. Establishing a living trust property with title can simplify real estate transfer and maintain family ownership across generations.

When something is held in trust, it signifies that an asset is managed by a trustee for the benefit of a beneficiary. This arrangement provides legal protection and ensures that the asset is used in accordance with the grantor’s wishes. For instance, a living trust property with title protects your estate from probate and offers greater control over asset distribution.

A title held in trust means that the legal ownership of a property is placed in the hands of a trustee for the benefit of another party. This setup allows the trustee to manage the property according to the trust's terms. By utilizing a living trust property with title, you can ensure that your assets are handled appropriately after your passing.

Yes, putting a house in a living trust property with title is often a good idea for many individuals. This strategy helps in avoiding the lengthy probate process and ensures that heirs receive their inheritance without unnecessary complications. Additionally, it allows you to maintain control over your home while providing clear instructions on asset distribution. Platforms like US Legal Forms can assist you in making informed decisions on this matter.

People commonly place their property in a living trust to avoid probate and ensure a quicker transfer of assets to their beneficiaries. A living trust property with title can also provide privacy, as these arrangements typically do not go through public probate. Furthermore, it allows for thoughtful planning during one's lifetime regarding how assets will be handled after death. Using US Legal Forms can guide you through this simple yet powerful process.

The most effective way to leave a house to your children is by placing it in a living trust property with title. This eliminates the stress of probate court and allows for a smoother transfer of ownership. In doing so, you can also maintain control over the property during your lifetime and specify terms for its use after your passing. US Legal Forms offers templates that can help you structure this transfer correctly.

One of the biggest mistakes parents often make when creating a trust fund is failing to properly fund the trust with their living trust property with title. Without transferring ownership of assets into the trust, it cannot serve its intended purpose. It's essential to revisit the trust regularly and ensure all relevant assets are included to avoid complications later. Using a platform like US Legal Forms can simplify this process and provide guidance.

Whether your parents should put their assets in a trust depends on their individual circumstances. A living trust can provide peace of mind by ensuring proper distribution of living trust property with title and avoiding probate. It may be wise for them to consult with legal professionals, like those at US Legal Forms, to decide if a trust aligns with their estate planning goals.