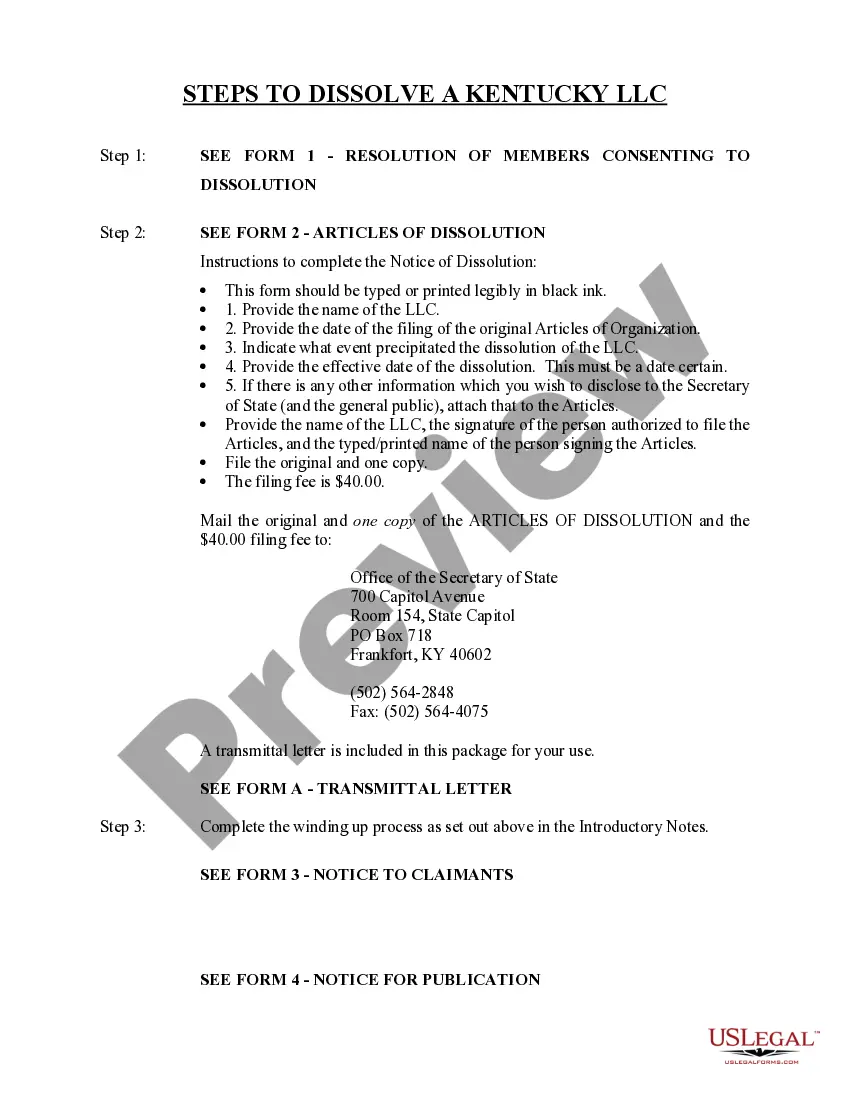

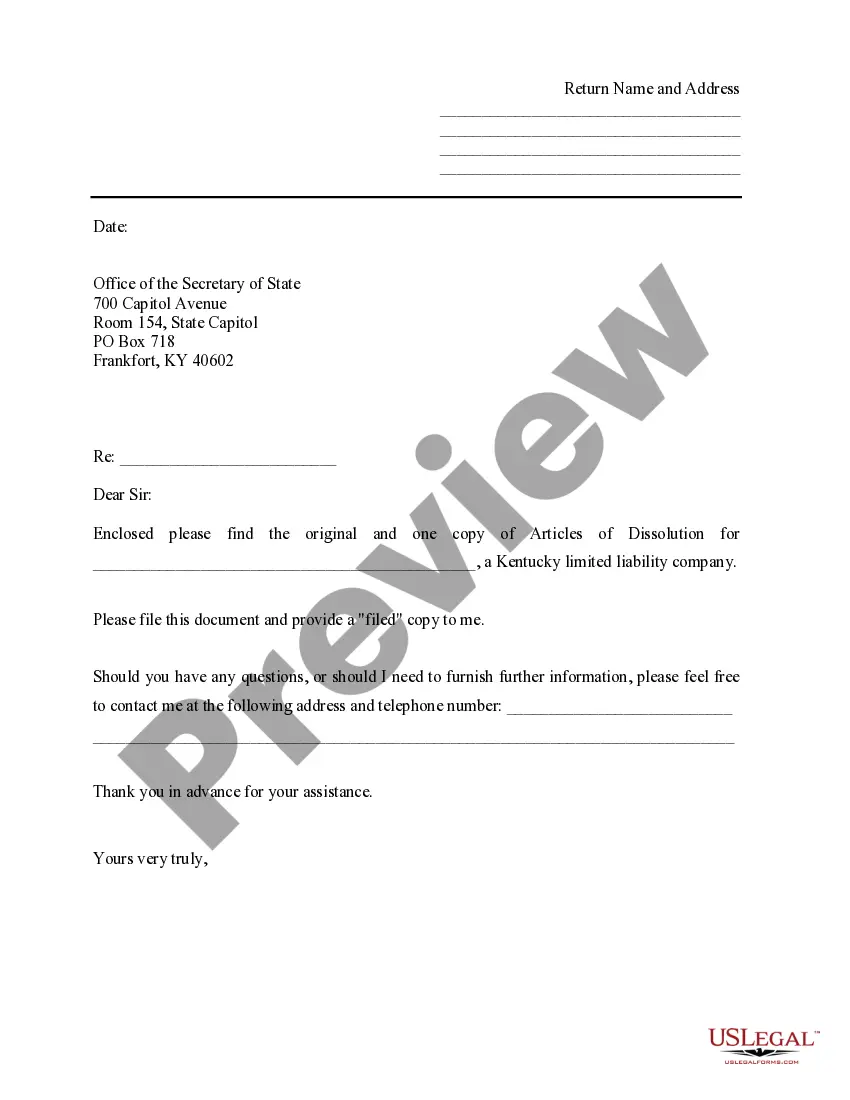

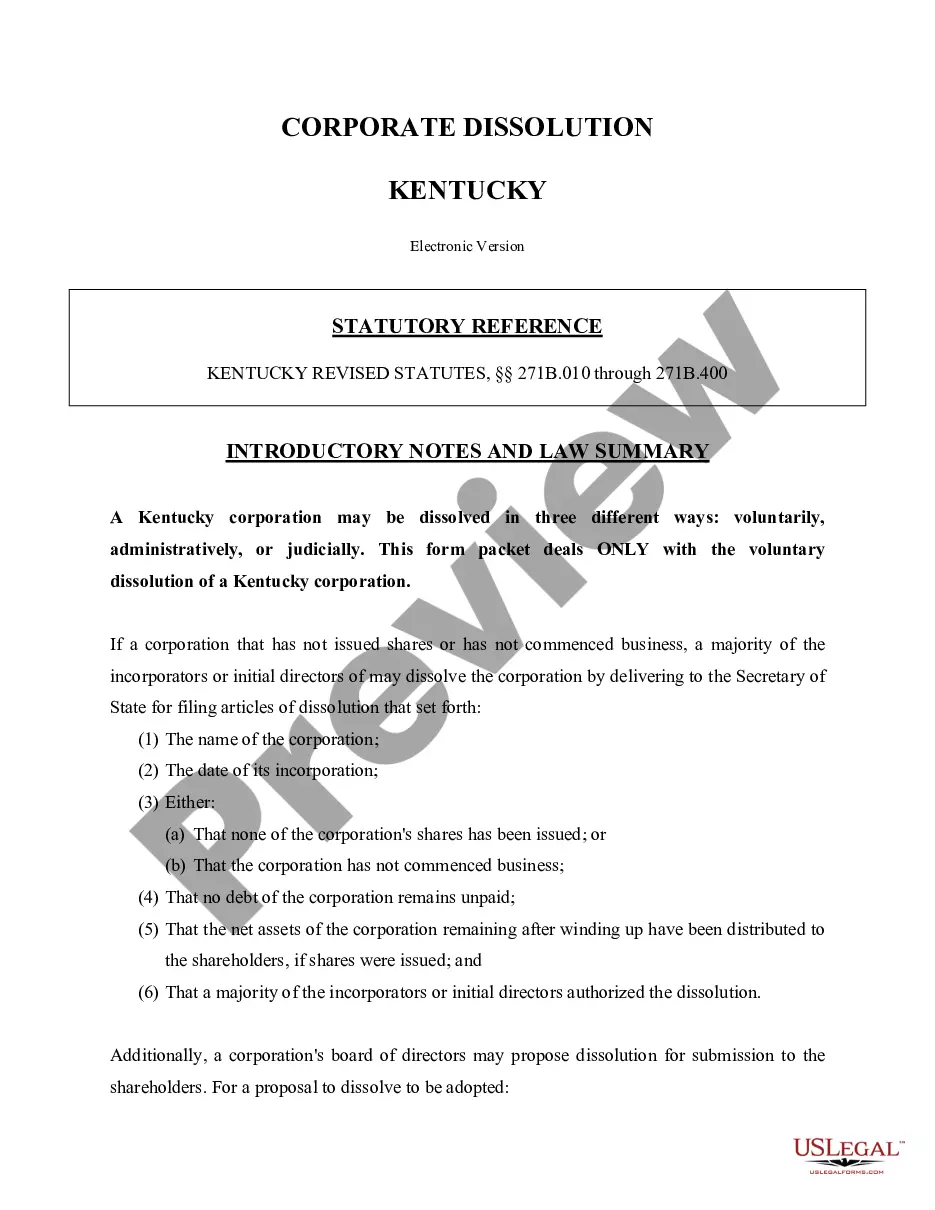

The dissolution package contains all forms to dissolve a LLC or PLLC in Kentucky, step by step instructions, addresses, transmittal letters, and other information.

Limited Liability Company With The Ability To Establish Series

Description

How to fill out Kentucky Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log in to your account and download the required form template from your dashboard after confirming your subscription is active.

- For first-time users, start by browsing the Preview mode and form description to select the right document that adheres to your local jurisdiction's requirements.

- If adjustments are necessary, utilize the Search tab to find alternative templates until you locate the most suitable one.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan, ensuring you create an account for full access.

- Complete your purchase using valid credit card information or your PayPal account for a secure transaction.

- Once purchased, save your selected template on your device. You can access it later in the My Forms section of your profile.

US Legal Forms provides a superior collection of over 85,000 customizable legal forms, making it easy for individuals and attorneys to find exactly what they need. The platform's commitment to accessibility ensures you can complete legal documents confidently and accurately.

In conclusion, US Legal Forms is an invaluable tool for anyone looking to establish a limited liability company with the ability to create series. Save time and ensure accuracy by leveraging their comprehensive library today!

Form popularity

FAQ

A series LLC can be a great idea, especially for businesses managing multiple ventures or properties. This structure allows you to limit liability and manage each series independently without the need to form separate entities. If you're considering this structure, uslegalforms can assist you in navigating the setup process and ensure your business meets all necessary legal requirements.

To make your LLC a series LLC, start by checking your state’s regulations regarding series LLCs. Then, modify your operating agreement to include provisions for the series, and submit any required forms to your state authorities. It is prudent to consult with a legal professional or use platforms like uslegalforms to ensure compliance and proper documentation.

A limited liability company with the ability to establish series is a type of LLC that allows you to create separate divisions or cells within the same LLC. Each series can have its assets, liabilities, and operations, providing flexibility and protection for your business endeavors. This structure is beneficial for businesses looking to minimize risks and streamline management.

Yes, you can change your current limited liability company to a series LLC. The process typically involves updating your operating agreement and filing the necessary paperwork with your state. By converting, you can create multiple series under one umbrella, which can help in managing different business units while limiting liability.

While a Series LLC offers various benefits, there are some downsides to consider. Many states have limited legal precedent regarding Series LLCs, which can lead to uncertainty in legal matters. Additionally, not all states recognize the Series LLC structure, which can complicate business operations if you plan to expand. It's essential to weigh these factors and consult with a legal professional for tailored advice before establishing your limited liability company with the ability to establish series.

To obtain an EIN for your limited liability company with the ability to establish series, you will need to complete the IRS Form SS-4. Ensure you provide specific details about your Series LLC structure, as you can apply for a single EIN for the entire LLC or separate EINs for each series, depending on your needs. This process can be done online through the IRS website or by submitting a paper form. Using platforms like US Legal Forms can simplify this process and provide you with the necessary guidance.

A Series LLC allows for the creation of multiple distinct entities under a single limited liability company with the ability to establish series. This structure offers flexibility and efficiency by protecting the assets of each series from liabilities associated with other series within the LLC. It simplifies management while ensuring that each series can operate independently. If you are looking to streamline operations and reduce administrative burdens, a Series LLC might be the right choice for you.

Yes, a limited liability company can establish a series, provided it is structured as a series LLC under state law. Each series operates independently, allowing for distinct asset management and liability protection. This feature makes it a powerful tool for entrepreneurs looking to diversify their business ventures while retaining a solid legal structure.

You can change your existing LLC to a series LLC, provided your state allows such conversions. This change enables you to create multiple series under one main LLC, each with its own assets and liabilities. This structure can enhance your business operations and limit financial risks effectively.

Filing taxes for a limited liability company with the ability to establish series requires careful attention to detail. Each series acts as a separate entity for liability purposes, and you may need to file separate tax returns for each series, depending on your state's regulations. Consulting with a tax expert can help you navigate these regulations and optimize your tax strategy.