Kentucky Dissolving Llc With Irs

Description

Form popularity

FAQ

To inform the IRS of a business closure, you must file your final tax return for the year in which the business ceased operations. Additionally, you should notify the IRS by writing a letter that includes your business name, EIN, the business closure date, and a statement indicating that you finalized all operations. Accurately addressing your tax responsibilities is vital when navigating Kentucky dissolving LLC with IRS matters. Resources from US Legal Forms can assist in meeting these notification requirements effectively.

When you dissolve an LLC, the Employer Identification Number (EIN) assigned to your business does not automatically go away. The IRS retains the EIN on file even after dissolution, which means that you cannot use the same EIN for a new business. It’s essential to report the closure to the IRS and other authorities to make sure your Kentucky dissolving LLC with IRS records are accurate. Consulting user-friendly services like US Legal Forms can simplify the necessary notifications to the IRS.

To remove a partner from an LLC in Kentucky, follow the procedures outlined in your LLC operating agreement. Generally, you may need to obtain the consent of the remaining members to effectuate the removal formally. Additionally, it’s crucial to handle this process in a way that aligns with Kentucky dissolving LLC with IRS regulations. US Legal Forms provides templates and guidance that can help ensure compliance in the removal process.

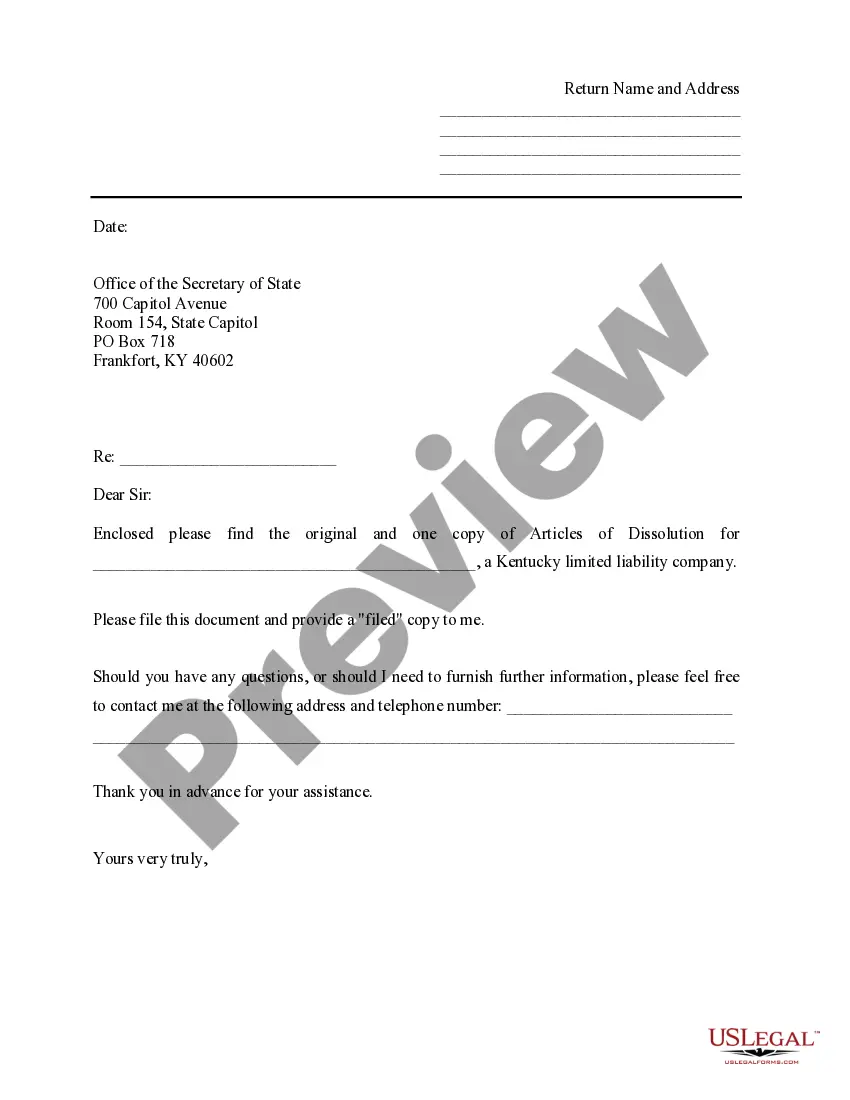

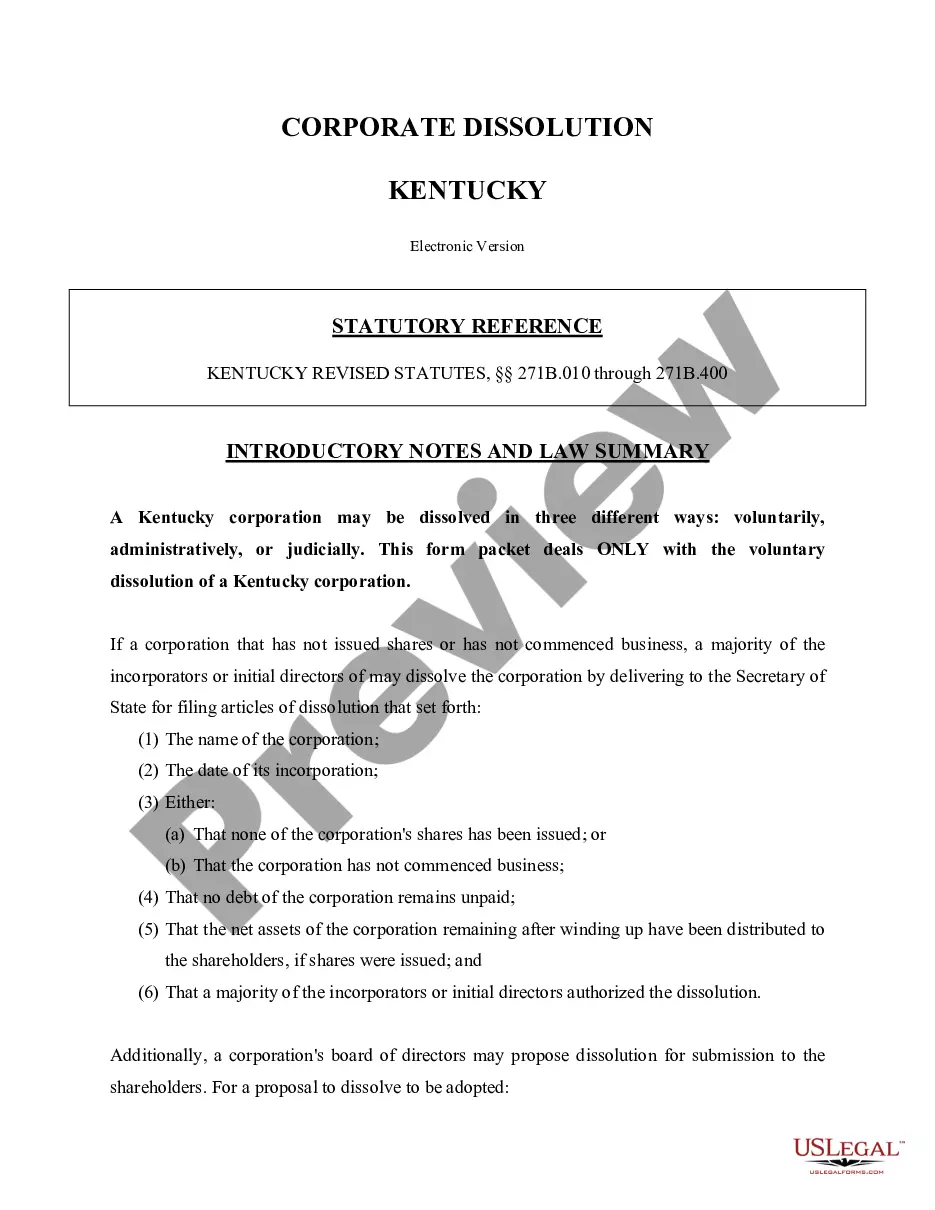

To dissolve a Kentucky LLC, you must file Articles of Dissolution with the Kentucky Secretary of State. This process includes settling any remaining debts and distributing any remaining assets to the members. It’s important to ensure that all tax obligations are met, particularly when considering Kentucky dissolving LLC with IRS matters. Using a reliable service like US Legal Forms can streamline the dissolution process and guide you through the necessary steps.

Reinstating a dissolved LLC in Iowa requires you to file a reinstatement application with the state. You must also settle any previously owed fees or taxes, including those due to the IRS. Keeping accurate records will help in this process. Utilizing services like UsLegalForms can assist you in navigating the reinstatement requirements effectively.

Yes, you can reinstate a dissolved LLC in Connecticut, but you need to follow specific steps set by the state. Generally, this involves submitting the appropriate form and paying any outstanding fees. It’s also important to resolve any tax issues with the IRS. If you're unsure about the process, platforms like UsLegalForms can provide the necessary support.

To dissolve your LLC in Kentucky, you must file the Articles of Dissolution with the Secretary of State. Ensure that all debts are settled, and tax obligations, including those owed to the IRS, are addressed. It's wise to notify members and stakeholders about the dissolution as well. For a smooth process, consider using a service like UsLegalForms.

Yes, you can reinstate a dissolved LLC in Kentucky. To do this, you need to file the necessary paperwork with the Kentucky Secretary of State. Additionally, you should resolve any outstanding issues, including taxes, before you approach the IRS about reinstatement. Engaging a reliable service like UsLegalForms can simplify this process for you.

In Kentucky, you do not have to renew your LLC every year, but you must file an annual report with the Secretary of State. This report keeps your business in good standing and helps you avoid issues with the IRS regarding your Kentucky dissolving LLC. Failing to file the annual report may result in penalties or even the dissolution of your LLC. For effective management and ease in navigating these requirements, consider using US Legal Forms to ensure compliance with the IRS and Kentucky state regulations.

Registering a foreign LLC in Kentucky involves submitting an Application for Certificate of Authority, along with a Certificate of Good Standing from your home state. You’ll also need to designate a registered agent within Kentucky. Understanding the nuances of Kentucky dissolving LLC with IRS will help ensure you meet all regulatory criteria for future compliance. Utilizing services like uslegalforms can guide you in effectively navigating this process.