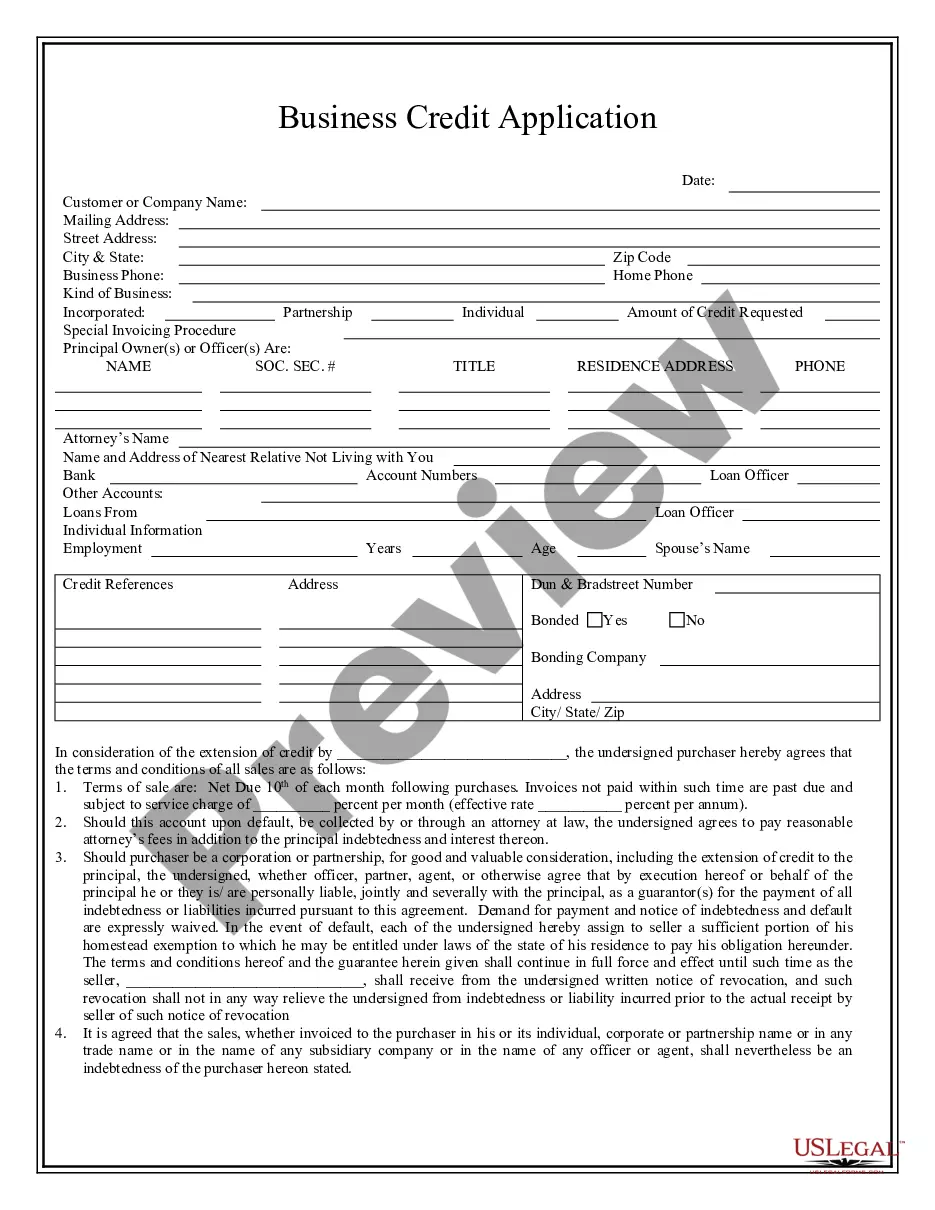

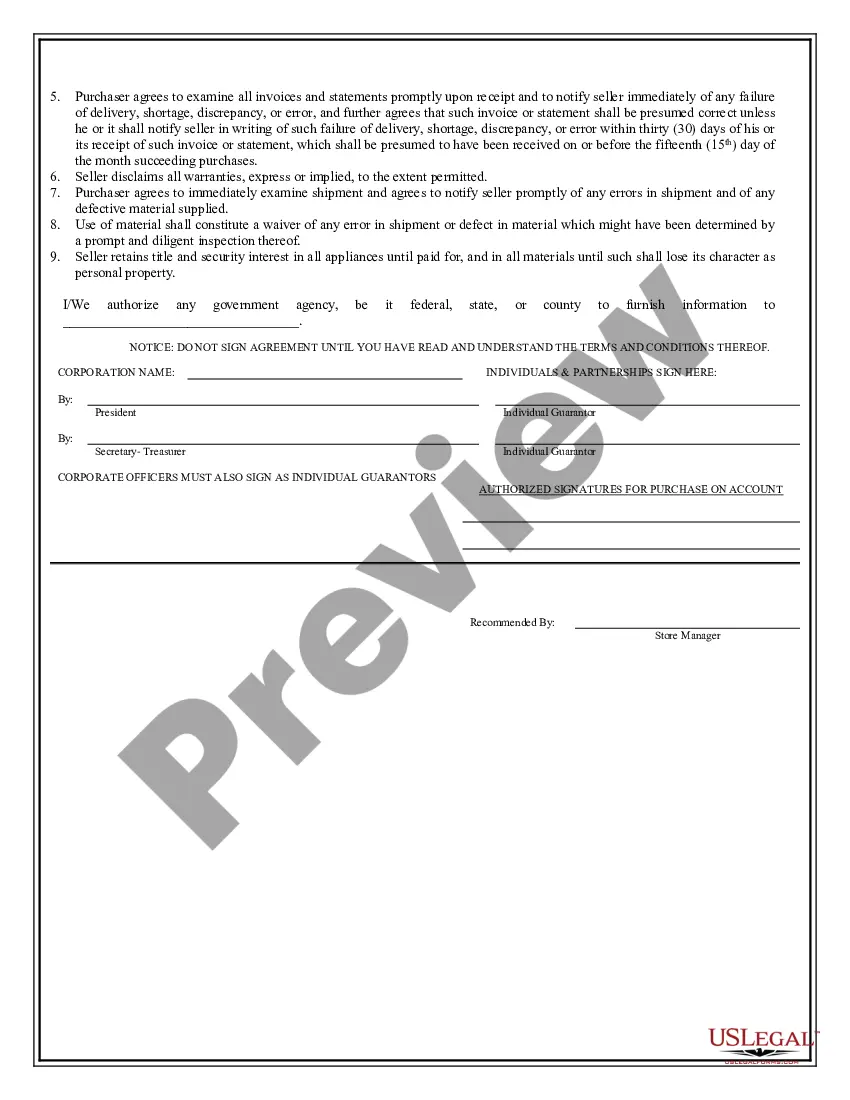

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Applications With No Annual Fee

Description

How to fill out Business Credit Applications With No Annual Fee?

Bureaucracy demands exactness and correctness.

If you do not manage completing forms like Business Credit Applications With No Annual Fee on a daily basis, it can result in some bewilderment.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avoid any complications of re-sending a file or repeating the same task entirely from the beginning.

Obtaining the correct and current samples for your documentation is just a matter of a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with paperwork.

- Find the template using the search bar.

- Ensure the Business Credit Applications With No Annual Fee you’ve located is pertinent to your state or region.

- Examine the preview or review the description containing the details on the usage of the sample.

- When the result aligns with your search, click the Buy Now button.

- Select the appropriate option among the suggested subscription plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal account.

- Download the document in your desired format.

Form popularity

FAQ

Sometimes, you can get the fee waived, a statement credit that offsets the fee, additional rewards or another type of offer if you pay the fee and keep your card open. Some card issuers also let you keep your account open and "downgrade" or "product change" to a different credit card that doesn't have an annual fee.

There are a few possible ways to convince an issuer to waive your fee.Call your issuer.See if your issuer will waive the fee in exchange for card usage.Ask your issuer to match another offer.Ask to cancel.Use military benefits.Switch to a different card.Earn rewards to offset the fee.Cancel your card.More items...?

Not all credit cards charge an annual fee. In fact, many Capital One cards don't have annual fees. For cards that do charge a fee, the amount can vary. Generally, you might see some annual fees as low as $35 and others as high as $500 or more.

What To Put on a Business Credit Card ApplicationEmployer Identification Number (EIN) This is the number assigned to you by the IRS when you registered your business.Type of Business.Birthdate and Address.Annual Income.Business Information.

Annual fee Most cards charge the same fee every year, though some cards may waive the annual fee for the first year you hold the card. How to avoid annual fees: If you don't want to pay a fee to have a credit card, simply opt for a no-annual-fee card.