Kentucky Petition For Divorce

Description

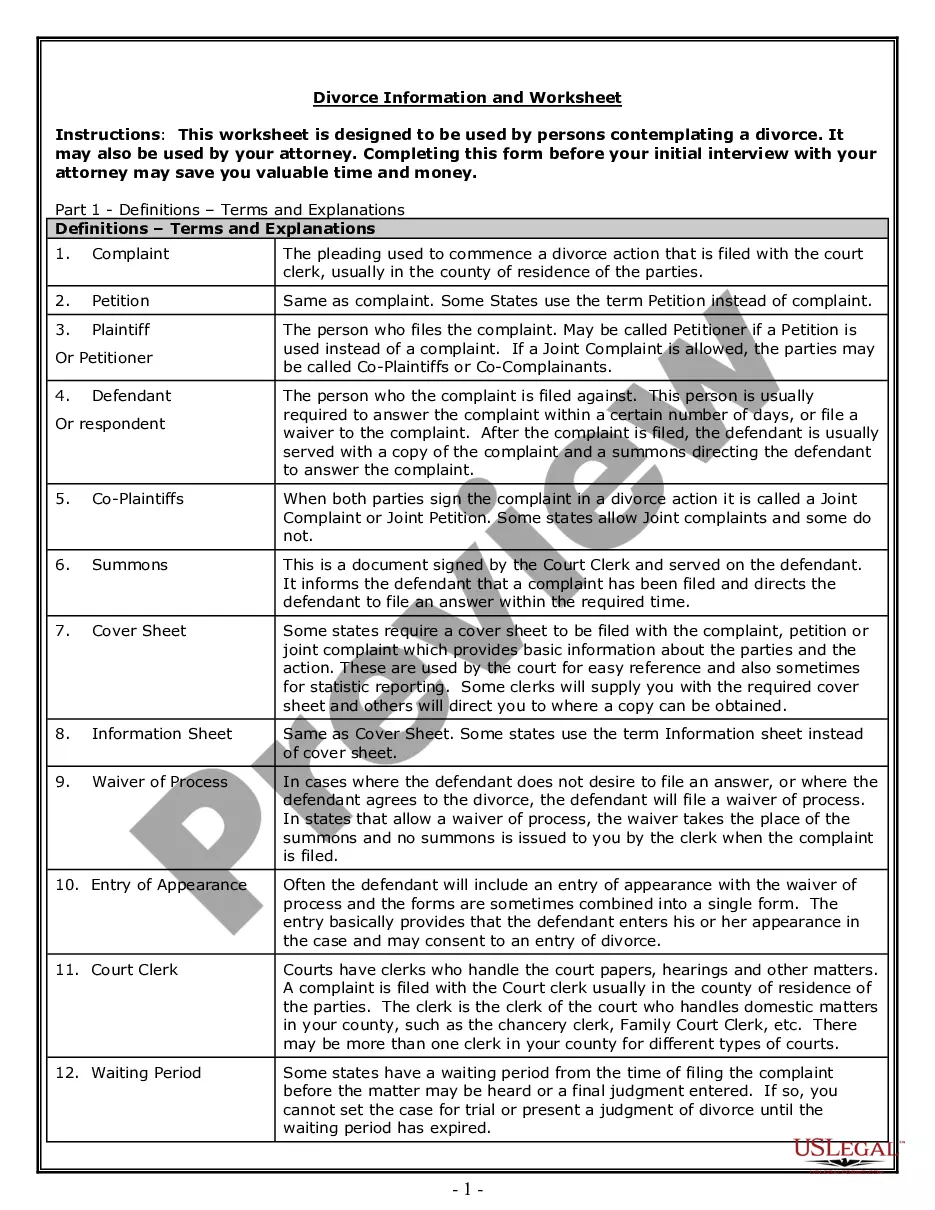

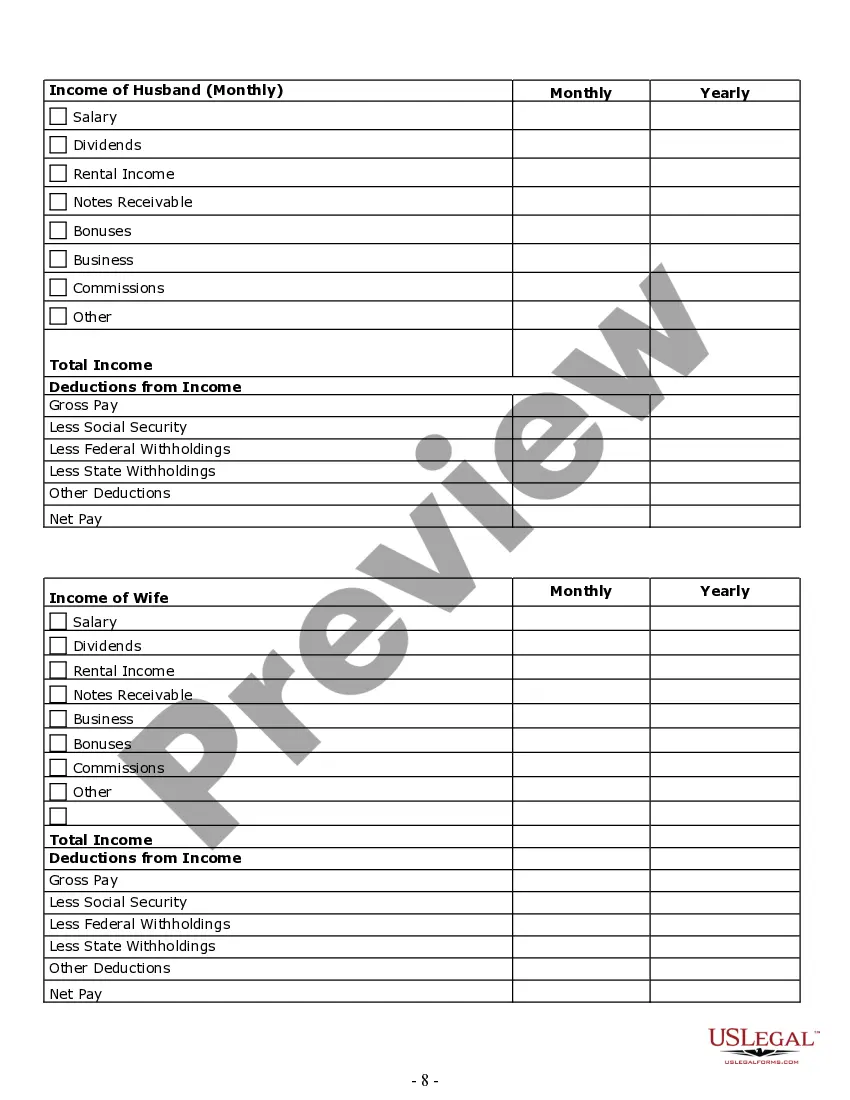

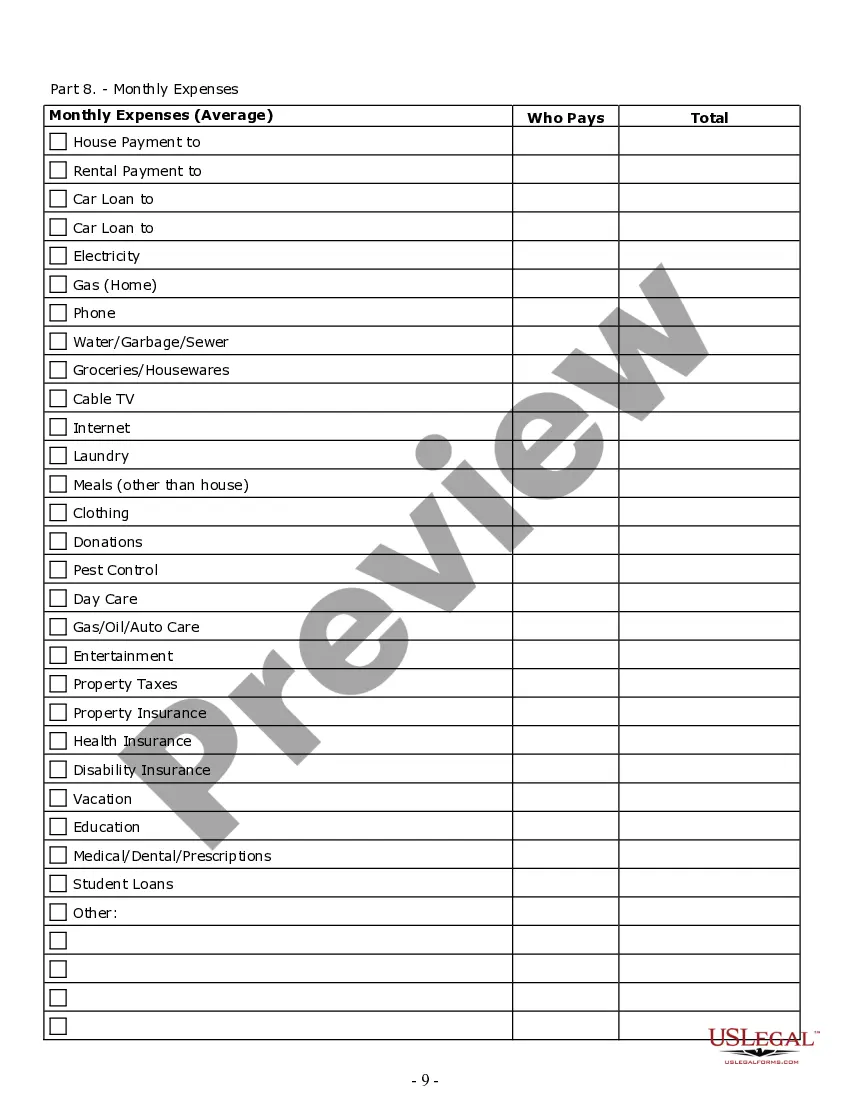

How to fill out Kentucky Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

The Kentucky Divorce Petition displayed on this page is a versatile legal template created by expert attorneys in adherence to federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal professionals with more than 85,000 authenticated, state-specific documents for various business and personal needs. It’s the quickest, simplest, and most dependable method to acquire the documentation required, as the service promises the utmost level of data protection and anti-malware security.

Fill out and sign the documents. Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature. Download your documents again as needed. Reuse the same document whenever required. Access the My documents tab in your profile to redownload any previously purchased templates. Subscribe to US Legal Forms to have authenticated legal templates for all of life's situations at your fingertips.

- Search for the document you require and examine it.

- Browse the sample you searched for and preview it or review the template description to confirm it meets your specifications. If it doesn't, use the search bar to locate the suitable one. Click 'Buy Now' once you've identified the template you want.

- Choose and Log Into your account.

- Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a quick payment. If you have an existing account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Pick the format you desire for your Kentucky Divorce Petition (PDF, Word, RTF) and save the document on your device.

Form popularity

FAQ

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

A satisfaction of mortgage is a crucial document for any homeowner. Not only does it prove your ownership, but it allows you to use your home as you see fit. Whether you want to put your home up for sale or refinance it, you'll need that document.

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Consumers can also go to the County Clerk's online record search at U.S. Land Records and print out a copy of your deed for free.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

020 sixty days from the date of such request or demand, the mortgagee shall forfeit and pay to the mortgagor damages and a reasonable attorneys' fee, to be recovered in any court having competent jurisdiction, and said court, when convinced that said mortgage has been fully satisfied, shall issue an order in writing, ...

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.