Remainder Estate

Description

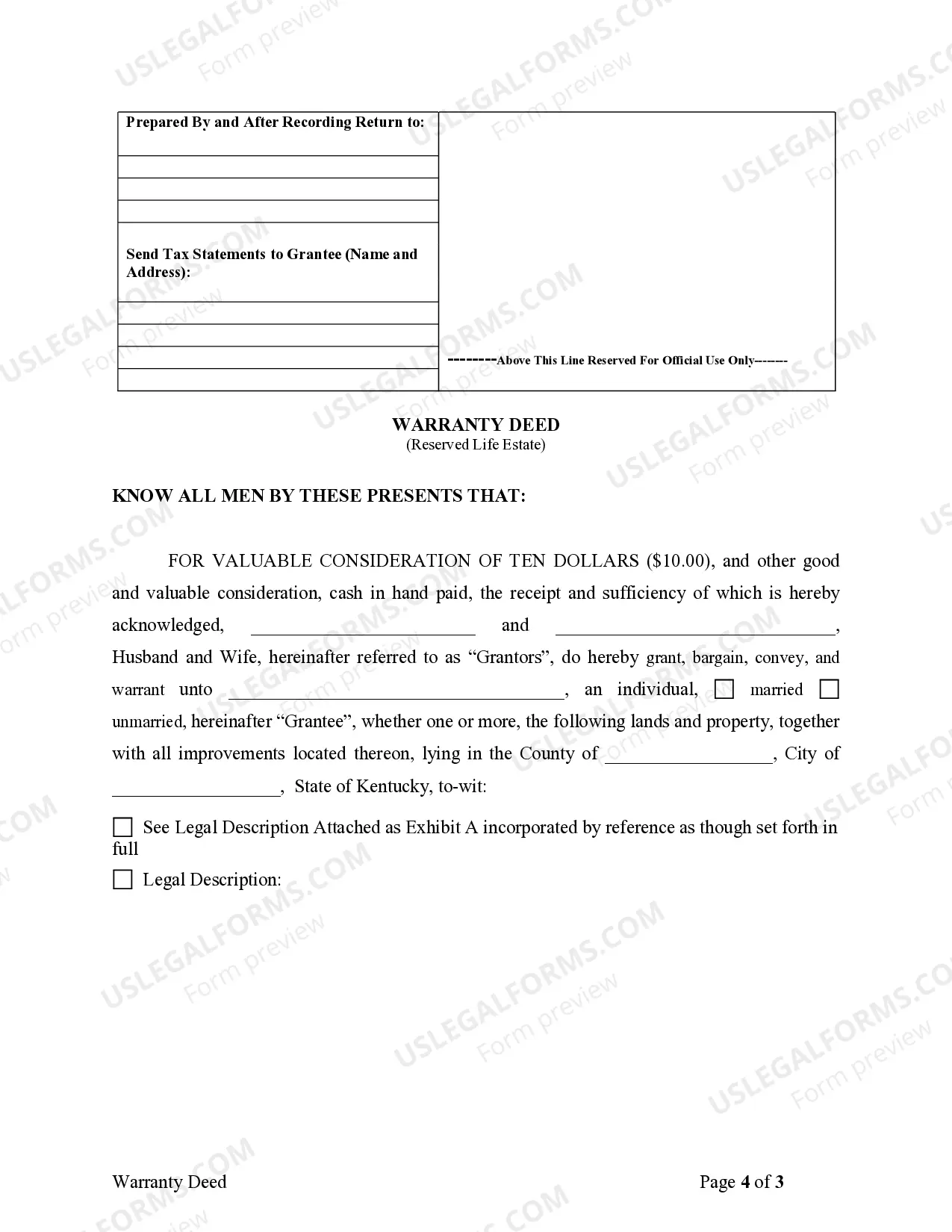

How to fill out Kentucky Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log in to your account at US Legal Forms if you're a returning user. Ensure your subscription is active; renew if necessary.

- Explore the Preview mode to review the details of the remainder estate form. Confirm that it aligns with your local jurisdiction requirements.

- If you find inconsistencies or need different forms, use the Search tab to locate the appropriate document.

- Select the Buy Now button to purchase your form. Choose a suitable subscription plan, and create an account for full access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Once processed, download the form directly to your device for completion. You can access it anytime from the My Forms section of your profile.

In conclusion, using US Legal Forms simplifies the process of obtaining crucial legal documents for handling remainder estates. With a vast selection of forms and the option to consult with legal experts, you can ensure your documentation is accurate and legally robust.

Start securing your assets today by visiting US Legal Forms and exploring the resources available to you!

Form popularity

FAQ

Yes, a remainderman can be removed from a life estate, but the process often requires legal action. This typically involves revoking the existing arrangement through proper channels, including consent from involved parties or a court order. Removing a remainderman alters the interest in the property, which can impact estate planning strategies. It's wise to consult a legal expert to assess the implications of making such changes.

If a remainderman dies, their share in the remainder estate is passed on to their heirs or designated beneficiaries. This transfer occurs under the laws of inheritance or the directives outlined in their will. Consequently, the property remains part of the original estate, awaiting the eventual passing of the life tenant. To navigate this process smoothly, legal assistance may be helpful, especially if the situation is complex.

When a remainderman dies, their interest in the remainder estate does not disappear. Instead, ownership of that interest typically transfers to the remainderman's heirs or beneficiaries, according to their will or local laws. This transfer ensures that the property will ultimately pass to the intended heirs when the life tenant eventually passes away. It's beneficial to consult with an estate planning attorney for clarity on specific situations.

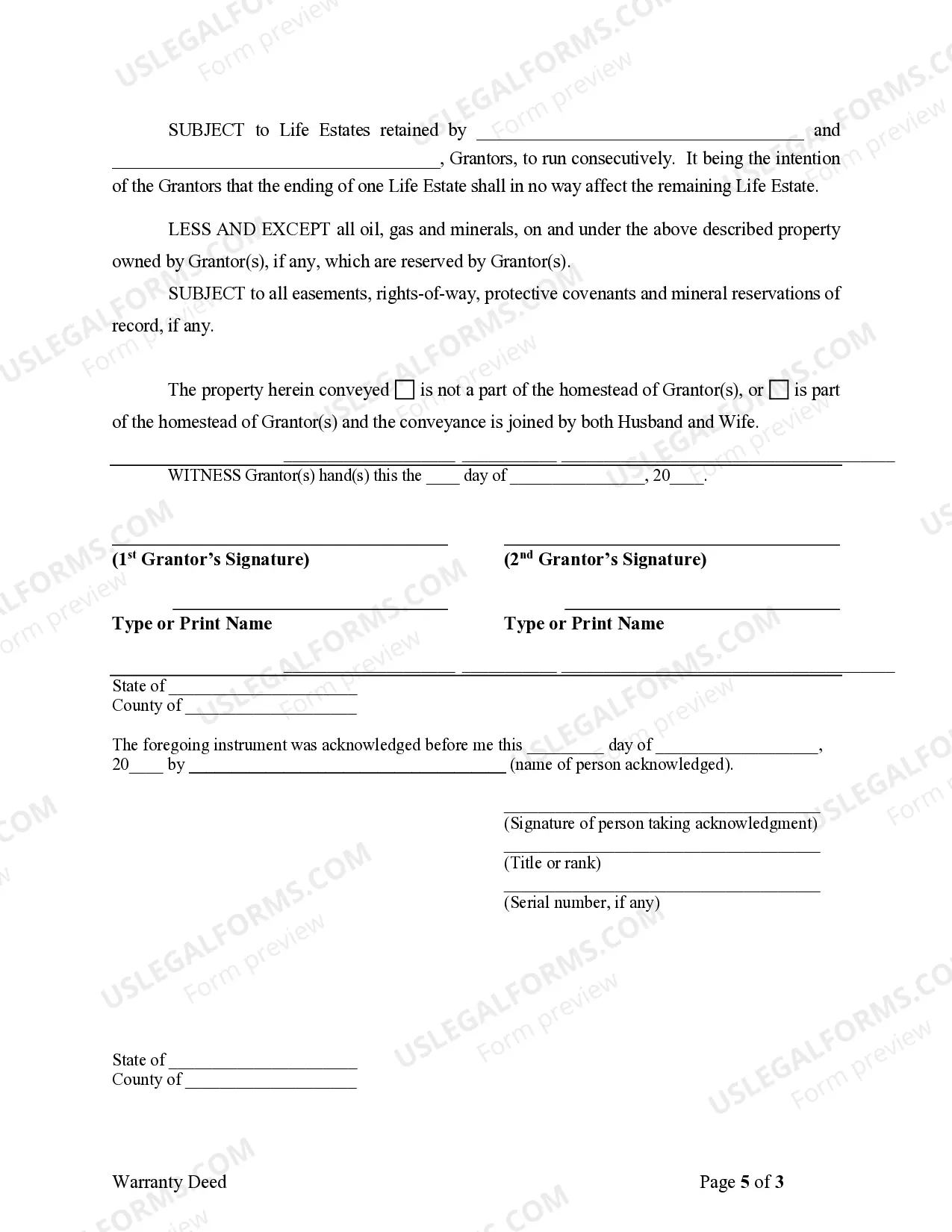

In a remainder estate setup, a remainderman does not own the property outright while the life tenant is alive. Instead, the remainderman holds a future interest in the property, meaning they will gain ownership only after the life tenant passes away. This arrangement helps clarify ownership rights and responsibilities among parties involved. Therefore, understanding the role of a remainderman is crucial in estate planning.

To file an estate tax return related to a remainder estate, individuals typically need to gather several important documents. First, collect the death certificate, as it serves as proof of the person's passing. Additionally, you will need a copy of the will, a list of assets and debts of the estate, along with any previous estate tax returns, if available. All these documents help ensure a smooth filing process.

A remainder estate is a future interest held by someone other than the original grantor, which takes effect after the termination of a prior estate. In contrast, a reversion occurs when the original owner retains an interest in the property, which automatically returns to them after a certain event, such as the expiration of a lease. Understanding these differences can clarify your estate planning choices. For more detailed guidance on remainder estates and related concepts, consider exploring resources on the USLegalForms platform.

To calculate the remainder interest in a life estate, you first need to determine the value of the property and the life tenant's life expectancy. You use actuarial tables to estimate the probability of the life tenant's lifespan, which helps you ascertain the present value of the life estate. From there, you subtract the present value of the life estate from the property value to find the current value of the remainder estate, providing clear insights into future ownership.

To calculate the value of an estate, you need to assess the total worth of all assets within it, including real estate, personal property, and other investments. You then subtract any debts or liabilities associated with the estate. A remainder estate's value can often be determined by considering the current market value of the property and the lifespan of the individual holding the life estate, factoring in the time until the remainder estate transfers.

An estate in remainder refers to a future interest in property that becomes possessory after a prior estate ends. For example, if a property owner grants a life estate to one person while specifying that the remaining rights go to another person upon the first person's death, the second person's interest is the remainder estate. This arrangement ensures that the property passes smoothly from the life tenant to the remainderman.

A remainder interest exists when one person’s ownership of property is contingent on another person's right over the property ending first. For example, if a grandfather leaves a cabin to his wife for her lifetime, with the cabin passing directly to his son afterward, the son holds a remainder interest. This arrangement allows the grandfather to ensure his legacy continues through his son while providing for his wife's needs during her life.