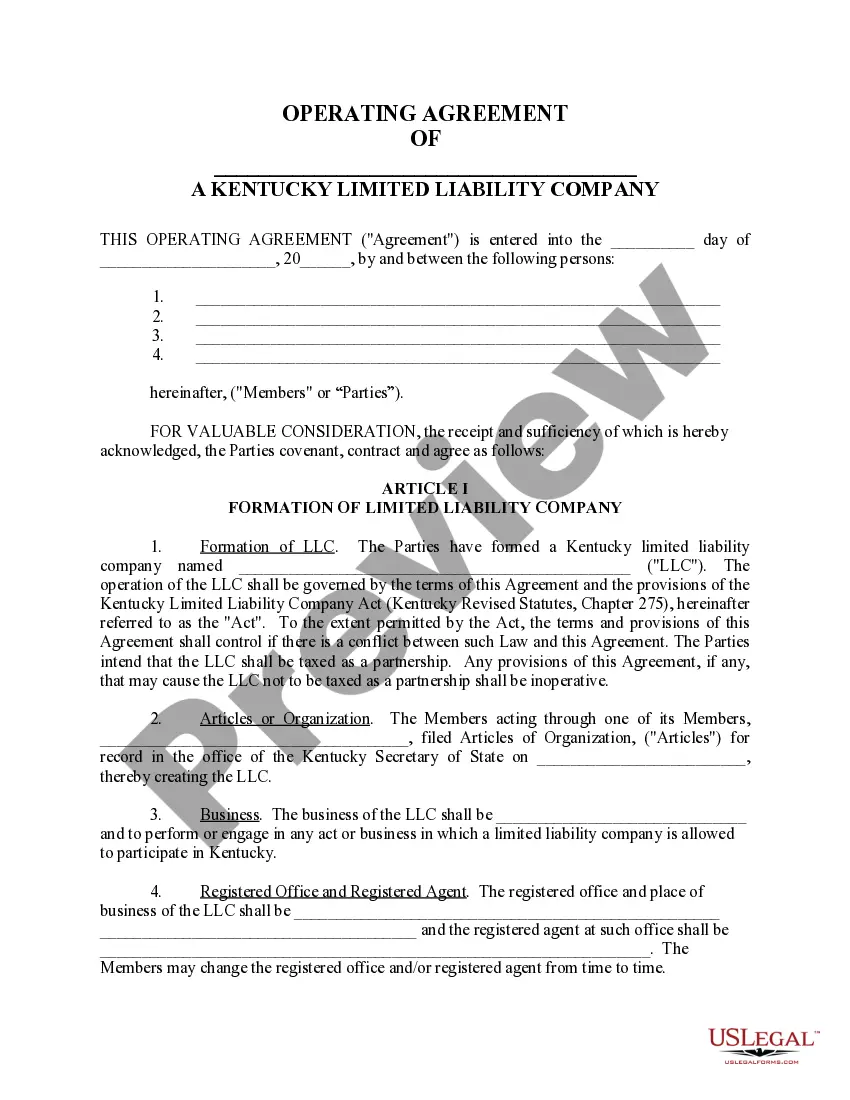

Kentucky Llc Operating Agreement For Rental Property

Description

How to fill out Kentucky Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for personal matters, everybody has to deal with legal situations at some point in their life. Filling out legal documents demands careful attention, beginning from picking the proper form template. For instance, when you pick a wrong version of the Kentucky Llc Operating Agreement For Rental Property, it will be turned down when you send it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you need to obtain a Kentucky Llc Operating Agreement For Rental Property template, stick to these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to find the Kentucky Llc Operating Agreement For Rental Property sample you require.

- Download the template if it meets your requirements.

- If you have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you want and download the Kentucky Llc Operating Agreement For Rental Property.

- After it is saved, you are able to fill out the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the web. Take advantage of the library’s simple navigation to get the proper template for any occasion.

Form popularity

FAQ

Kentucky LLC Cost. To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

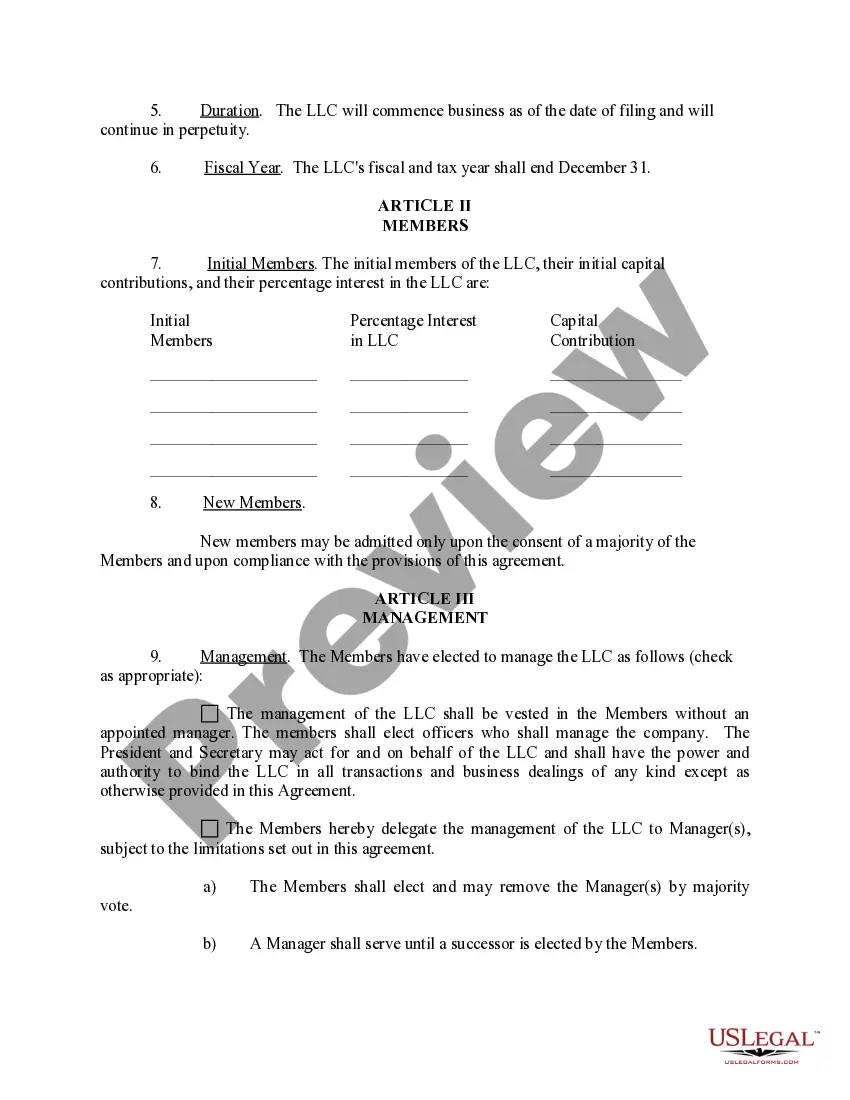

Form a Kentucky LLC: Name Your LLC. Designate a Registered Agent. Submit LLC Articles of Organization. Write an LLC Operating Agreement. Get an EIN. Open a Bank Account. Fund the LLC. File State Reports & Taxes.

What are the requirements to form an LLC in Kentucky? You must file articles of organization, appoint a registered agent, and pay a filing fee of $40 (or $60 for expedited service). An operating agreement is recommended but not required.

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Kentucky Revised Statutes § 275.003: In Kentucky, an Operating Agreement is not a legal requirement to form an LLC. However, having one provides clarity to member responsibilities, business operations, and mitigates potential business disputes.