Limited Liability Company For Dummies

Description

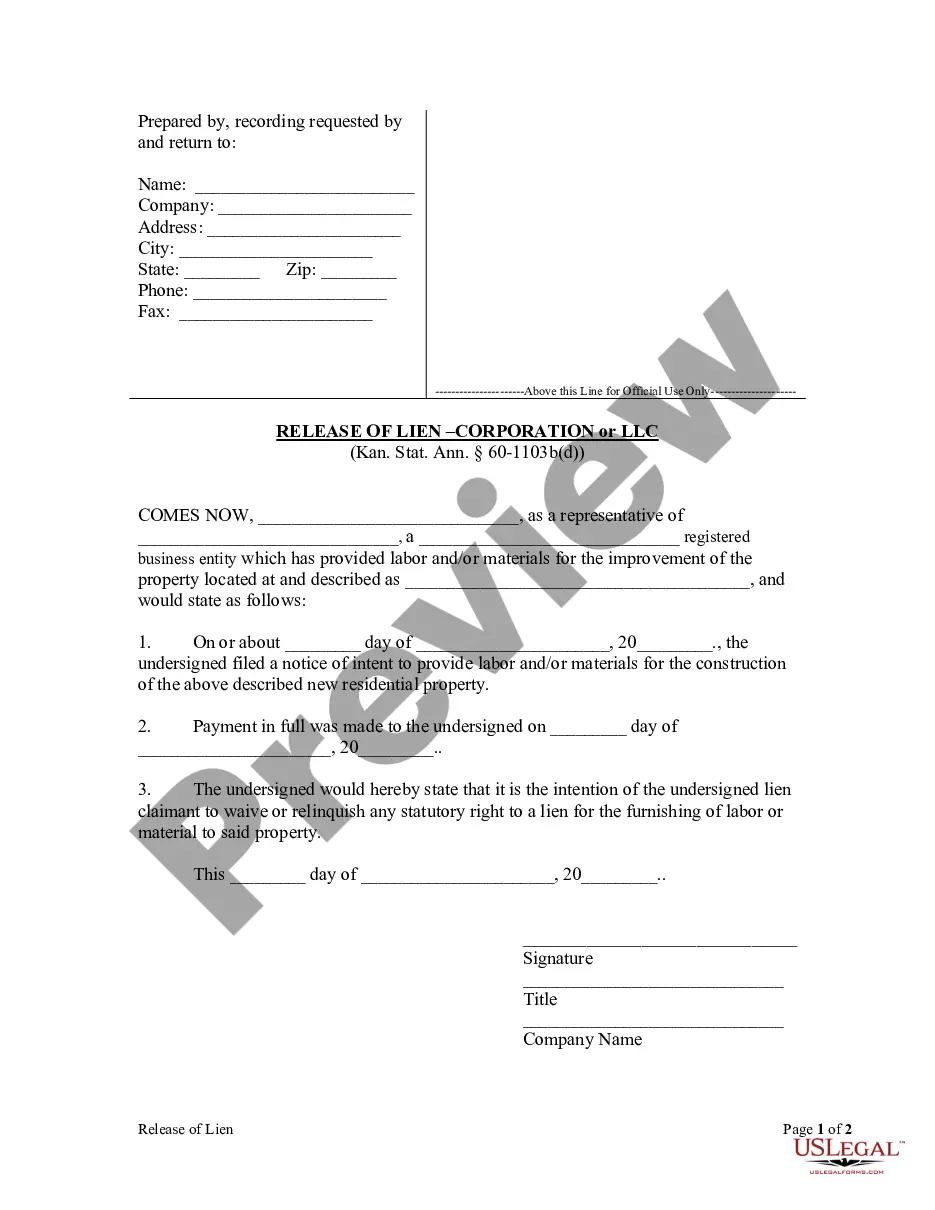

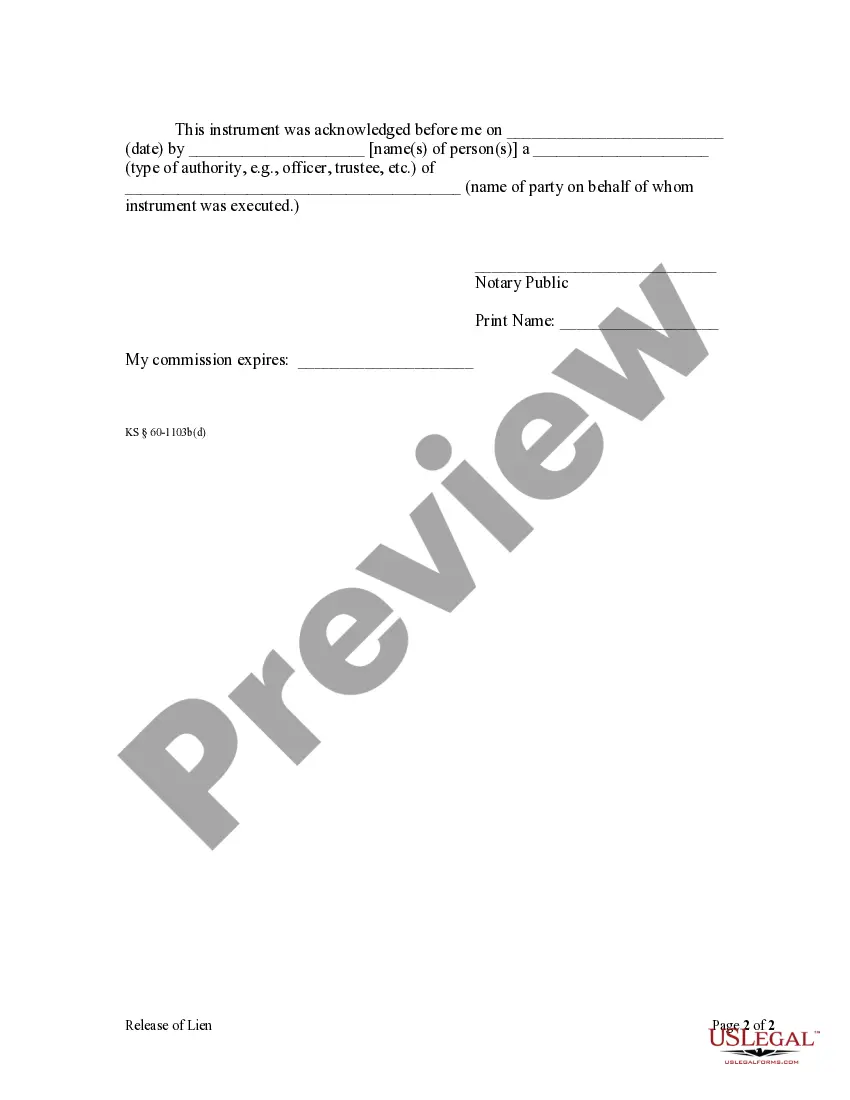

How to fill out Kansas Release Of Lien By Corporation Or LLC?

- If you're a returning user, simply log in to your account and locate the form template you need. Ensure your subscription is current; otherwise, renew as necessary.

- For first-time users, start by previewing the form description. Make certain you've selected the appropriate form that fits your jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the correct form. Once you've verified it meets your needs, proceed to purchase.

- Click the Buy Now button, then choose your preferred subscription plan. Registration is required to access the extensive library of resources.

- Complete your purchase by entering your payment details using a credit card or your PayPal account.

- Download your chosen form and save it to your device. You can access it anytime through the My Forms menu in your profile.

US Legal Forms not only streamlines this process but also empowers users with expert assistance, ensuring that your legal documents are filled accurately and meet all legal standards.

In conclusion, forming an LLC has never been easier with US Legal Forms. Take the first step towards your business goals today by accessing their extensive library of legal forms.

Form popularity

FAQ

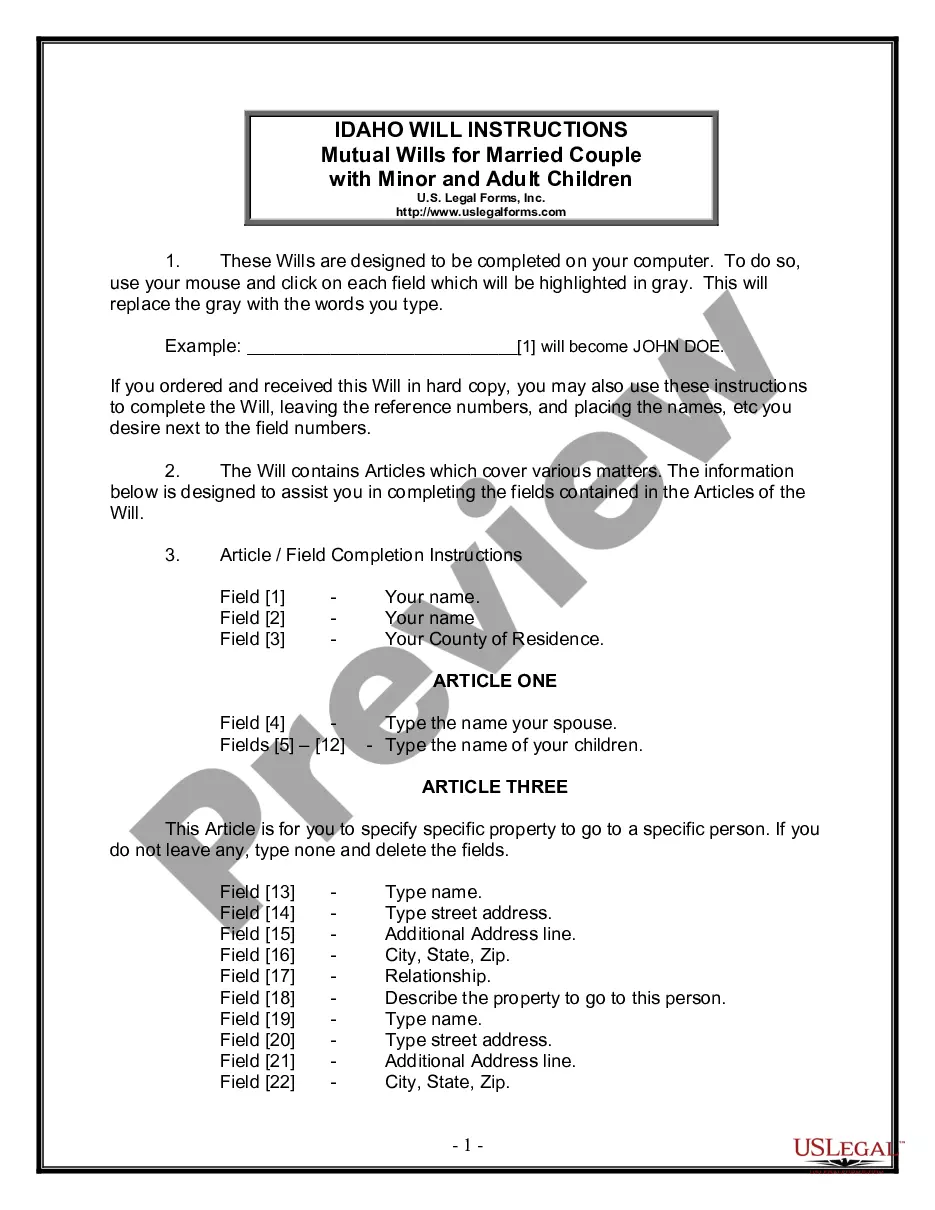

The best program to start a Limited Liability Company for dummies often combines ease of use with comprehensive features. Look for platforms that offer user-friendly templates and robust customer support, such as USLegalForms. These tools not only help you file the necessary paperwork but also provide ongoing resources to manage your LLC efficiently.

The best filing status for a Limited Liability Company for dummies largely depends on your business goals. LLCs can be taxed as sole proprietorships, partnerships, or corporations. Choosing the right status affects your personal liability and tax implications. It is wise to analyze your business structure and consider seeking advice from professionals, or use resources like USLegalForms for better clarity.

Filing taxes for a Limited Liability Company for dummies is relatively simple. Generally, an LLC can choose how it wants to be taxed: as a sole proprietorship, partnership, or corporation. Each option has different implications for tax reporting, so it’s helpful to consult with a tax professional. Many resources, including USLegalForms, offer guidance on tax responsibilities specific to your LLC.

Yes, you can file your Limited Liability Company for dummies by yourself. It is a straightforward process as long as you gather the necessary information and complete the required forms. Consider using a service like USLegalForms to assist you, which can help clarify any questions and make sure you stay compliant with state laws.

Filing for a Limited Liability Company for dummies often involves deciding how and when to submit your paperwork. Online filing is typically quicker and more efficient than mail. You might also want to consult resources like USLegalForms that provide templates and detailed guidance. This can help you understand the requirements specific to your state.

The best way to file for a Limited Liability Company for dummies is to follow a step-by-step process. First, choose a unique name for your LLC that complies with state regulations. Then, prepare your articles of organization, which you can submit online or by mail. By using platforms like USLegalForms, you can streamline this process and ensure all required forms are correctly completed.

Some individuals might avoid a limited liability company for dummies due to complexities in management and compliance. While LLCs offer invaluable protections, they come with rules and regulations that may overwhelm some entrepreneurs. Additionally, those who plan to keep their business operations simple might find that an LLC is more than they need. It's essential to assess your business goals before deciding on the structure.

The easiest limited liability company for dummies to start typically involves minimal paperwork and low fees. Most states have streamlined processes for forming LLCs, allowing you to complete applications online. Utilizing a service like US Legal Forms can make the registration process smoother. With their resources, you can focus on running your business instead of getting bogged down in legalities.

Limited liability means that your personal assets are protected from business debts and liabilities. When you operate a limited liability company for dummies, you are not personally responsible for the business’s financial obligations. This protection allows you to take business risks without the fear of losing your home or personal savings. Understanding this concept helps beginners appreciate the security an LLC provides.

Owning a limited liability company for dummies does impact your taxes, but it often offers advantages. An LLC allows for pass-through taxation, meaning business income is reported on your personal tax return. This can simplify the tax process and potentially reduce your tax burden. Additionally, LLCs can choose to be taxed as a corporation if that benefits them in their tax planning.