Lien Release Kansas Withholding Tax

Description

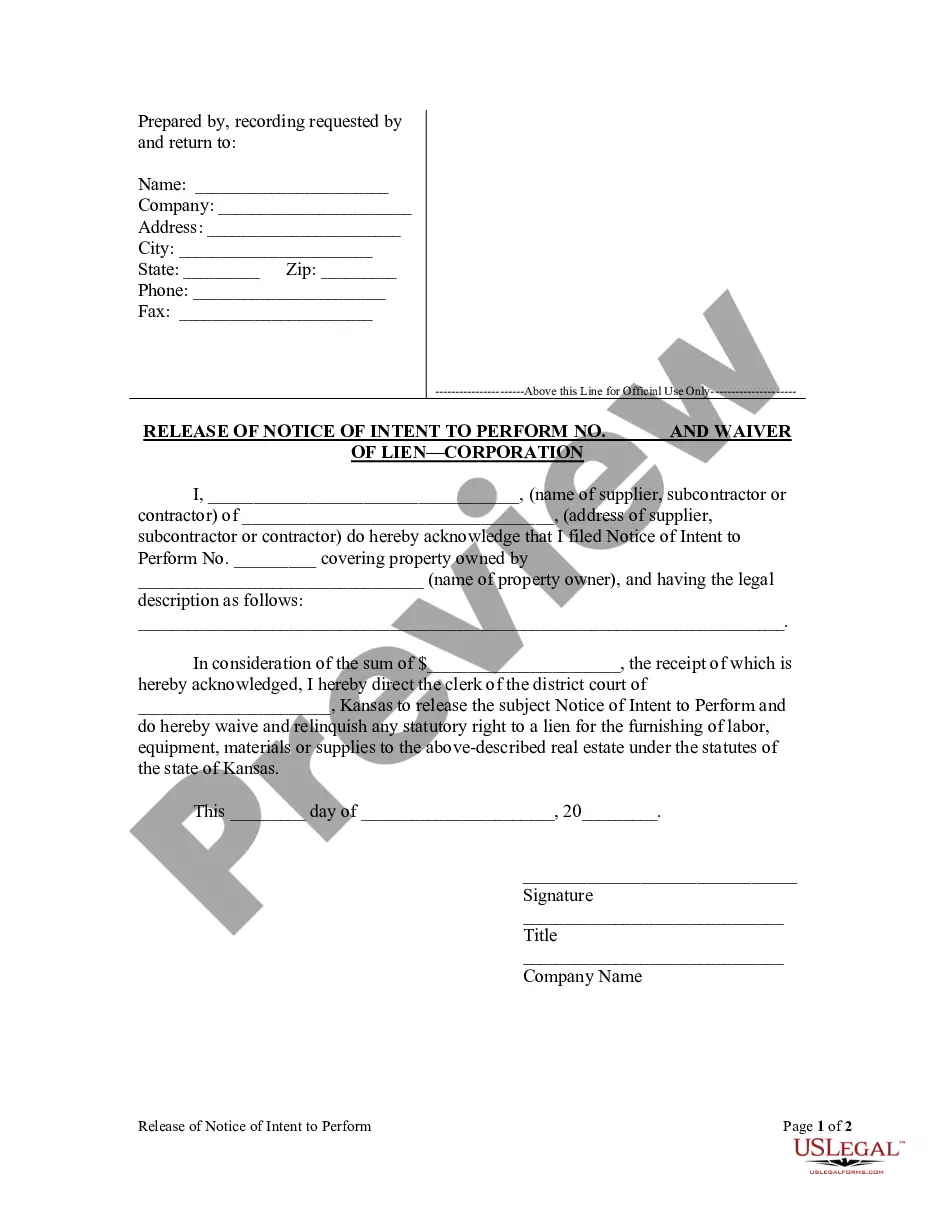

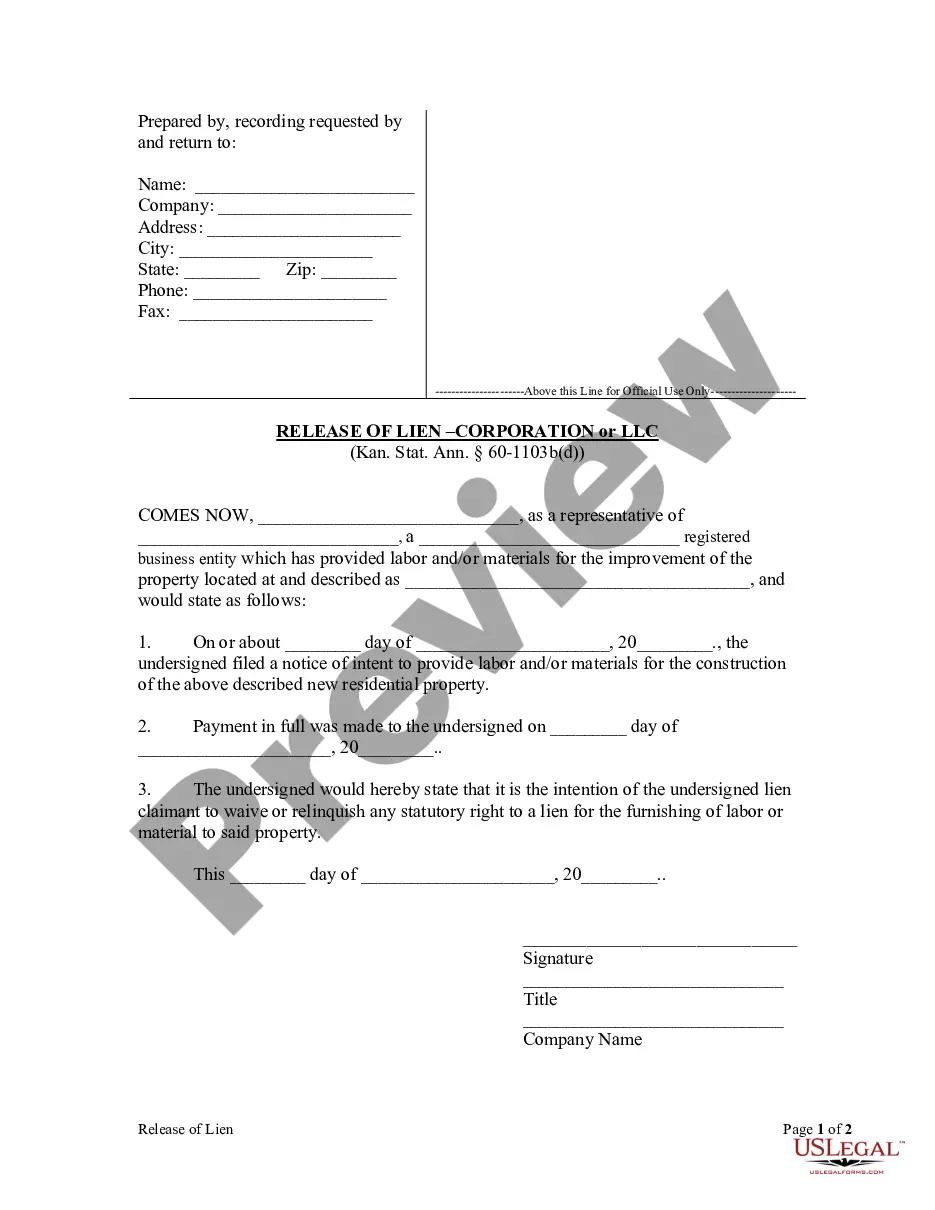

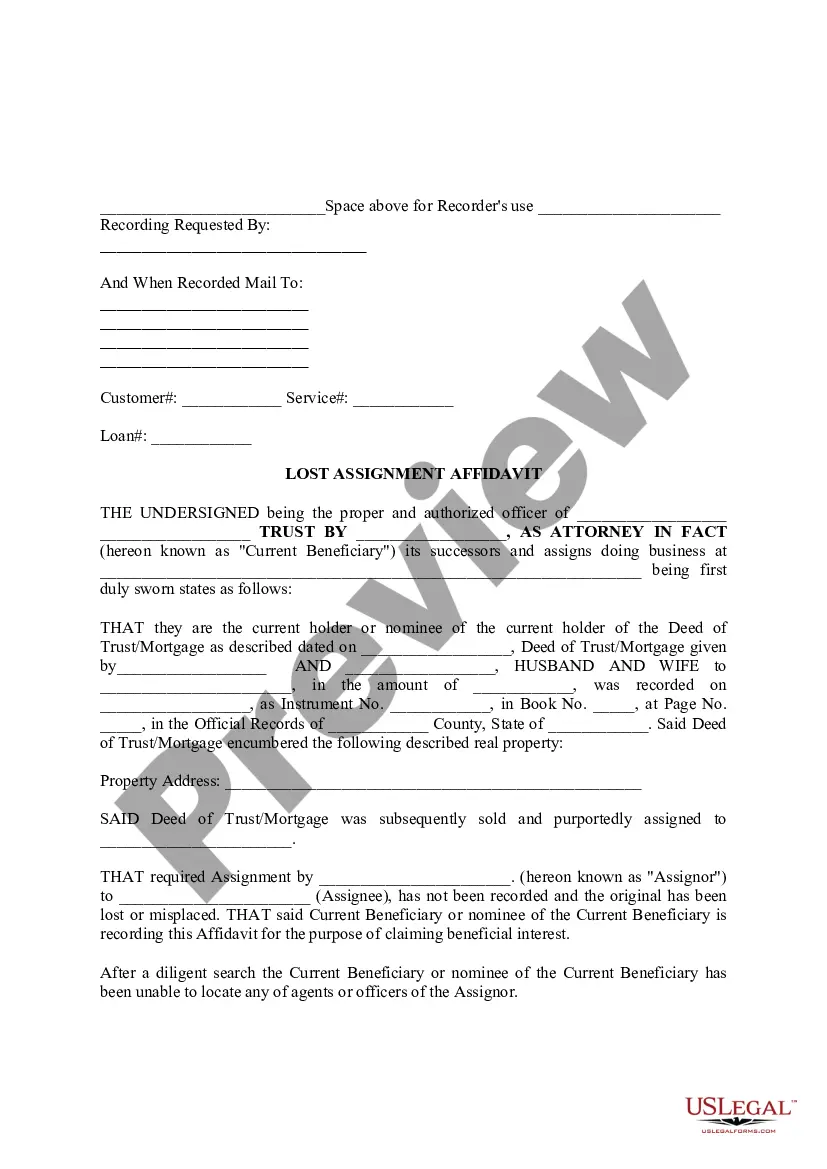

How to fill out Kansas Release Of Notice And Waiver Of Lien By Corporation Or LLC?

Individuals often link legal documentation with something complex that only an expert can handle.

In a way, this is accurate, as crafting Lien Release Kansas Withholding Tax requires extensive knowledge of subject matter, including regional and county statutes.

Nonetheless, with US Legal Forms, everything has become simpler: pre-made legal templates for any personal and business situation tailored to state regulations are assembled in a single online directory and are currently available for everyone.

Select a subscription plan that aligns with your needs and financial considerations.

- US Legal Forms offers over 85,000 current documents organized by state and type of use, making it quick to search for Lien Release Kansas Withholding Tax or any other specific form.

- Previously registered users with an active subscription must Log In to their account and select Download to access the form.

- New users will need to create an account and subscribe before downloading any documents.

- Here’s a step-by-step guide on obtaining the Lien Release Kansas Withholding Tax.

- Carefully review the page content to ensure it fits your requirements.

- Read the form description or view it using the Preview feature.

- If the initial sample does not meet your needs, find another one through the Search field above.

- After locating the appropriate Lien Release Kansas Withholding Tax, click Buy Now.

Form popularity

FAQ

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDORlienrelease@ks.gov .

The 2002 Kansas Legislature authorized electronic lien and title by passing Senate Bill 449, making Kansas a paperless title state. As of January 1, 2003, Kansas vehicle owners who borrow money for their cars, trucks, motorcycles, trailers and other motor vehicles will not receive printed, paper titles.

For Titles Being Held Electronically (E-Title) If the title is an e-title and you want to get a 60 day permit, you must have an Electronic Title Sales Agreement, Form TR-39A, a copy of the Seller's Current Registration Receipt and current proof of insurance. A Lien Release is required to get a clear paper title.

When a lien has been paid off (satisfied) by cash, intra-bank transfer or wired funds, the lienholder will then have 3 business days after the receipt of payment and a request for the release of the lien, form TR-155, to deliver the lien release to the requester.