Kansas Life Estate Deed With Full Powers

Description

How to fill out Kansas Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for commercial reasons or personal matters, everyone must confront legal circumstances at some time in their existence.

Completing legal documents demands meticulous attention, starting with selecting the correct form template.

- For instance, if you select an incorrect version of the Kansas Life Estate Deed With Full Powers, it will be rejected upon submission.

- Thus, it is crucial to find a trustworthy source of legal documents like US Legal Forms.

- If you need to secure a Kansas Life Estate Deed With Full Powers template, follow these straightforward steps.

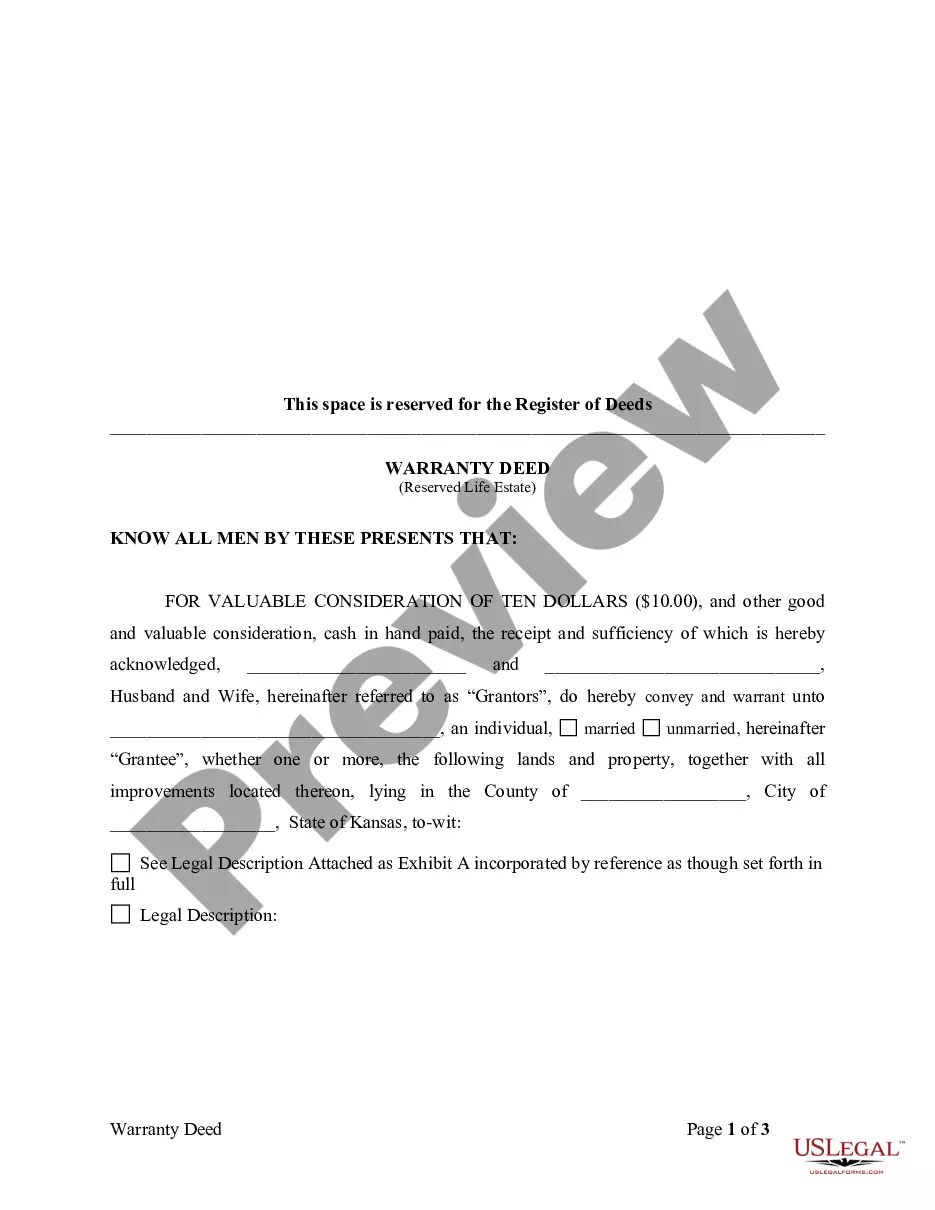

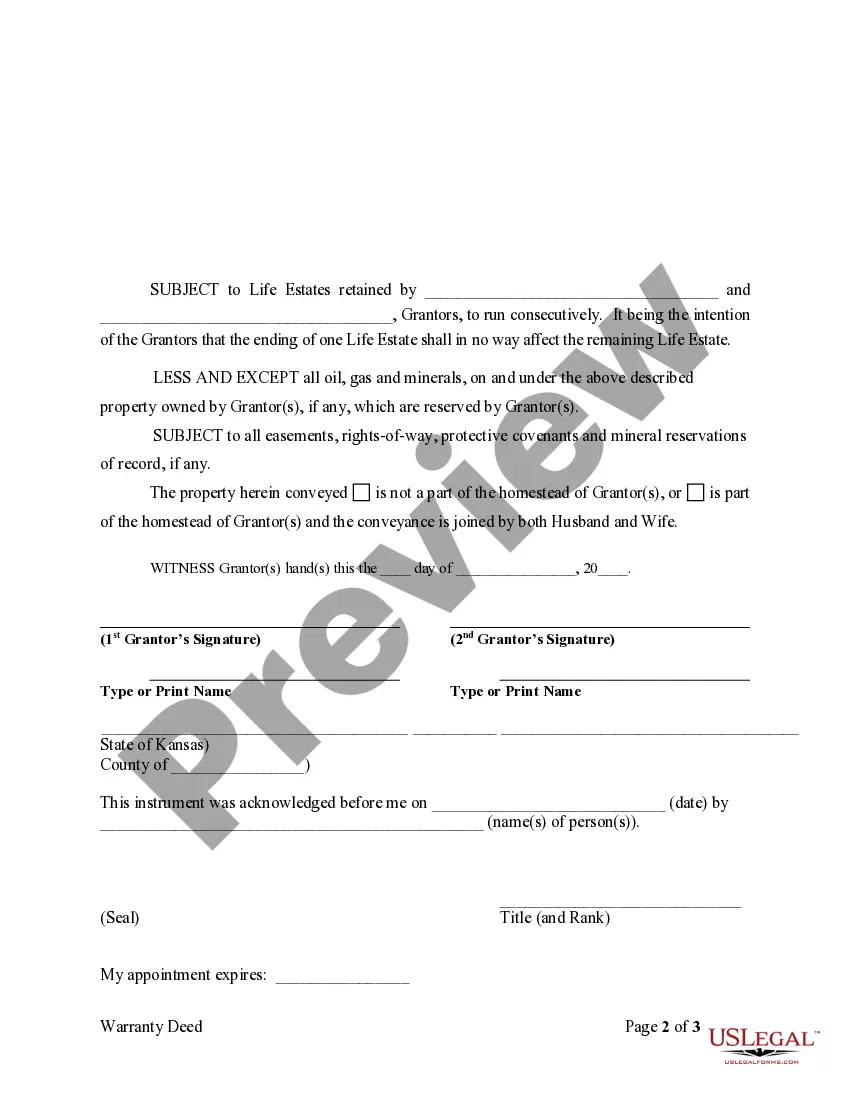

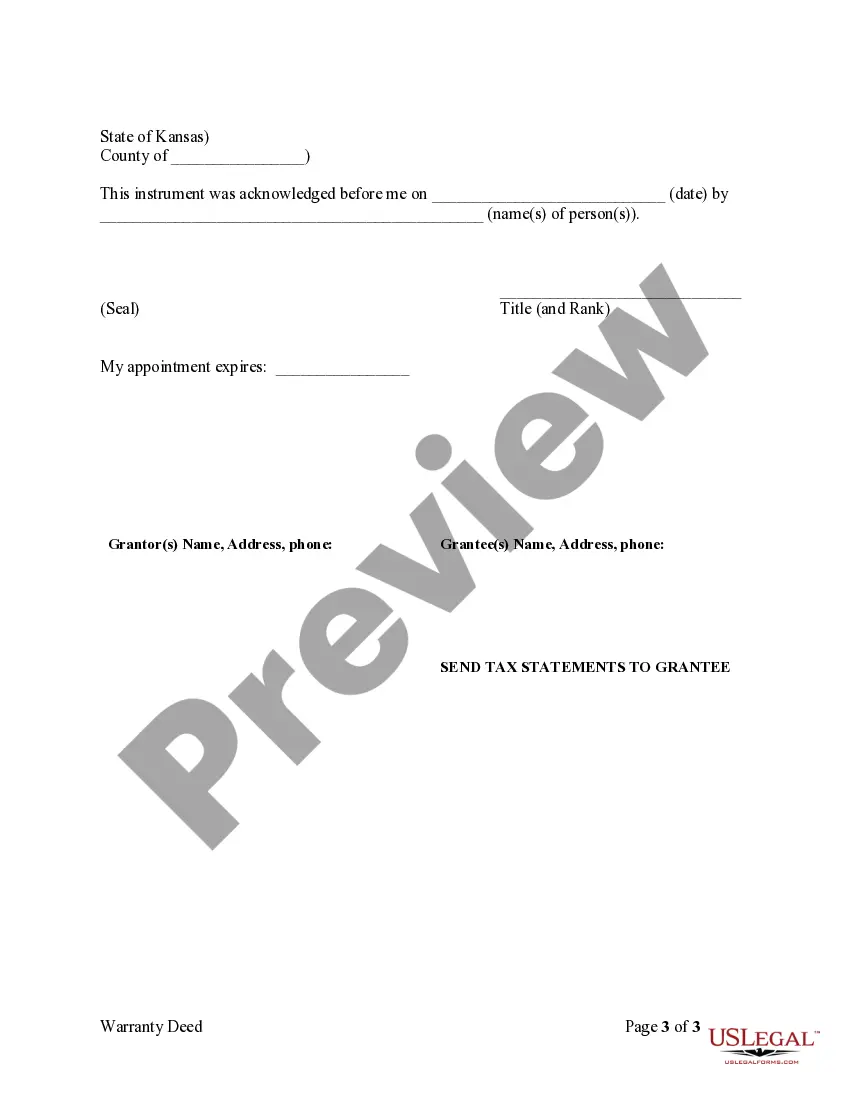

- Acquire the template you require using the search bar or catalog browsing.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is not the right document, return to the search feature to find the Kansas Life Estate Deed With Full Powers template you need.

- Download the file if it fits your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access your previously stored files in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

Form popularity

FAQ

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

Life Interest - Also known as the owner of the life estate, or the life tenant, the person owning the life interest retains the right to use, occupy and receive the income from the property during his or her lifetime. This individual is assumed to be responsible for the mortgage, taxes and insurance on the property.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.