Kansas Quitclaim Deed With Life Estate Clause

Description

How to fill out Kansas Quitclaim Deed From Individual To Individual?

Steering through the red tape of official documents and templates can be difficult, particularly if one does not engage in that professionally. Locating the appropriate template for the Kansas Quitclaim Deed With Life Estate Clause can be labor-intensive, as it must be valid and accurate to the very last detail. Nonetheless, you will need to invest significantly less time selecting a suitable template if it originates from a source you can trust. US Legal Forms is a platform that streamlines the process of finding the correct forms online.

US Legal Forms is a singular location you need to discover the latest examples of forms, seek guidance on their usage, and download these examples to complete them. This is a repository with over 85K forms that are relevant in diverse sectors. When searching for a Kansas Quitclaim Deed With Life Estate Clause, you will not have to doubt its authenticity as all of the forms are validated.

Having an account at US Legal Forms will guarantee you have all the required examples at your fingertips. Keep them in your history or add them to the My documents collection. You can access your saved forms from any device by clicking Log In on the library website. If you still don’t possess an account, you can always search for the template you need. Acquire the correct form in a few straightforward steps.

US Legal Forms can save you time and effort in checking if the form you found online is appropriate for your requirements. Create an account and gain unrestricted access to all the templates you need.

- Input the document name in the search field.

- Locate the appropriate Kansas Quitclaim Deed With Life Estate Clause from the list of outcomes.

- Examine the outline of the example or view its preview.

- When the template aligns with your requirements, click Buy Now.

- Advance to select your subscription plan.

- Utilize your email and create a security password to register an account at US Legal Forms.

- Choose a credit card or PayPal payment option.

- Download the template file onto your device in the format of your preference.

Form popularity

FAQ

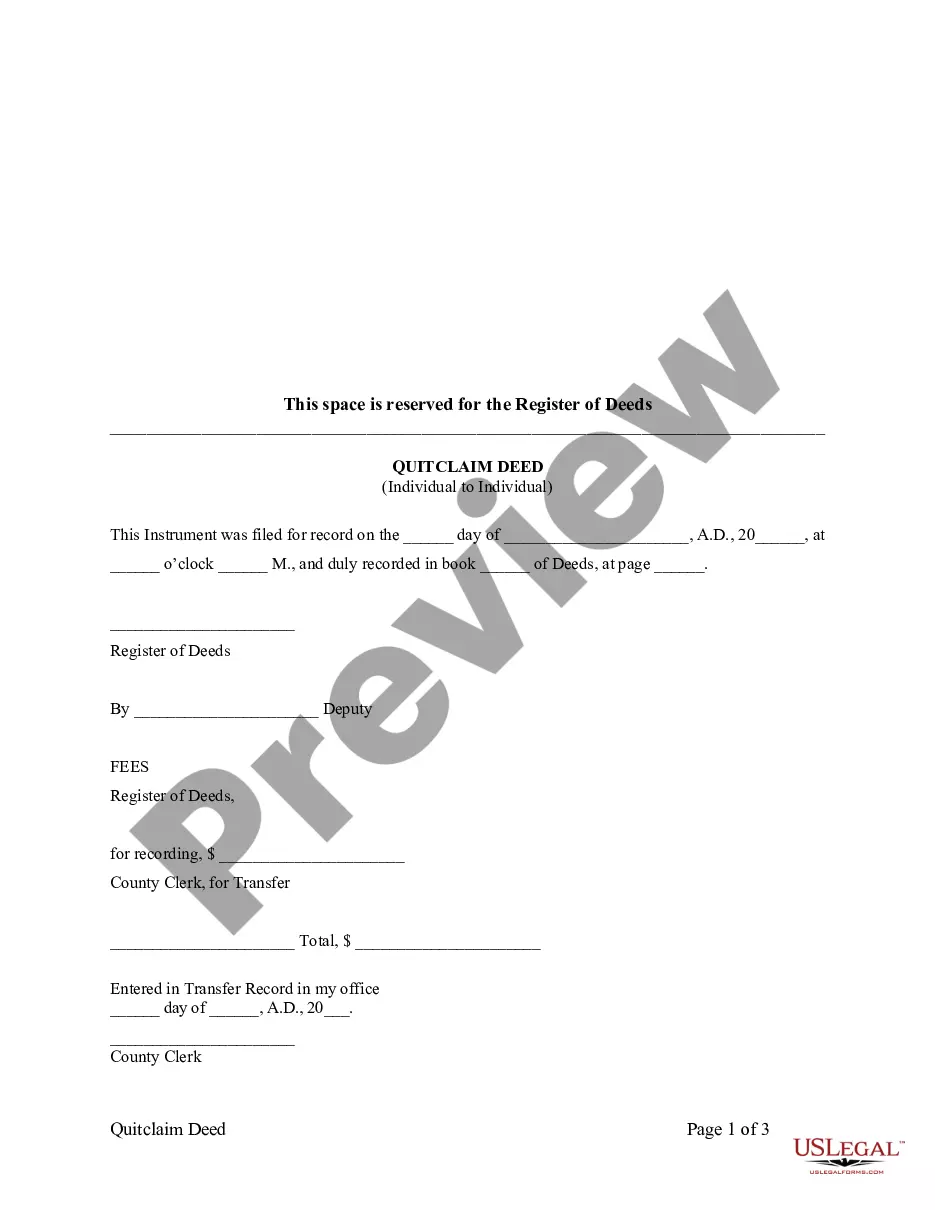

Filing a quitclaim deed in Kansas involves several clear steps. First, create the quitclaim deed document, incorporating the necessary details, particularly if you are including a life estate clause. Next, have the deed notarized and then submit it to the county register of deeds. Alternatively, consider using USLegalForms for a straightforward way to handle the entire process effectively and ensure compliance with state requirements.

To file a quitclaim deed in Kansas, you must first complete the document, ensuring it includes the Kansas quitclaim deed with life estate clause if applicable. Once completed, you should sign the deed before a notary. Following this, file the deed with the county register of deeds in the appropriate county where the property is located. Ensure you check local requirements, as they may vary slightly.

You can prepare your own quitclaim deed in Kansas, but doing it correctly is vital. While some resources and templates are available online, the specificity of a Kansas quitclaim deed with life estate clause requires careful attention to detail. Even minor errors could lead to potential disputes. Therefore, utilizing platforms like USLegalForms can help ensure your deed is accurate and compliant with state laws.

The Lady Bird deed, or enhanced life estate deed, allows the property owner to transfer ownership while retaining control during their lifetime. This deed enables individuals to give their property to beneficiaries upon their passing, bypassing the probate process. While a Kansas quitclaim deed with life estate clause provides similar life estate rights, the Lady Bird deed offers additional benefits, making it an innovative option for estate planning. For those seeking to simplify their affairs, the Lady Bird deed is an excellent alternative.

The strongest form of deed is a general warranty deed, as it provides the highest level of protection for the buyer. It guarantees that the seller will defend the title against any claims, ensuring peace of mind. Although a Kansas quitclaim deed with life estate clause is simpler and quicker, it lacks these protections. If you prioritize security in your transaction, a general warranty deed is the way to go.

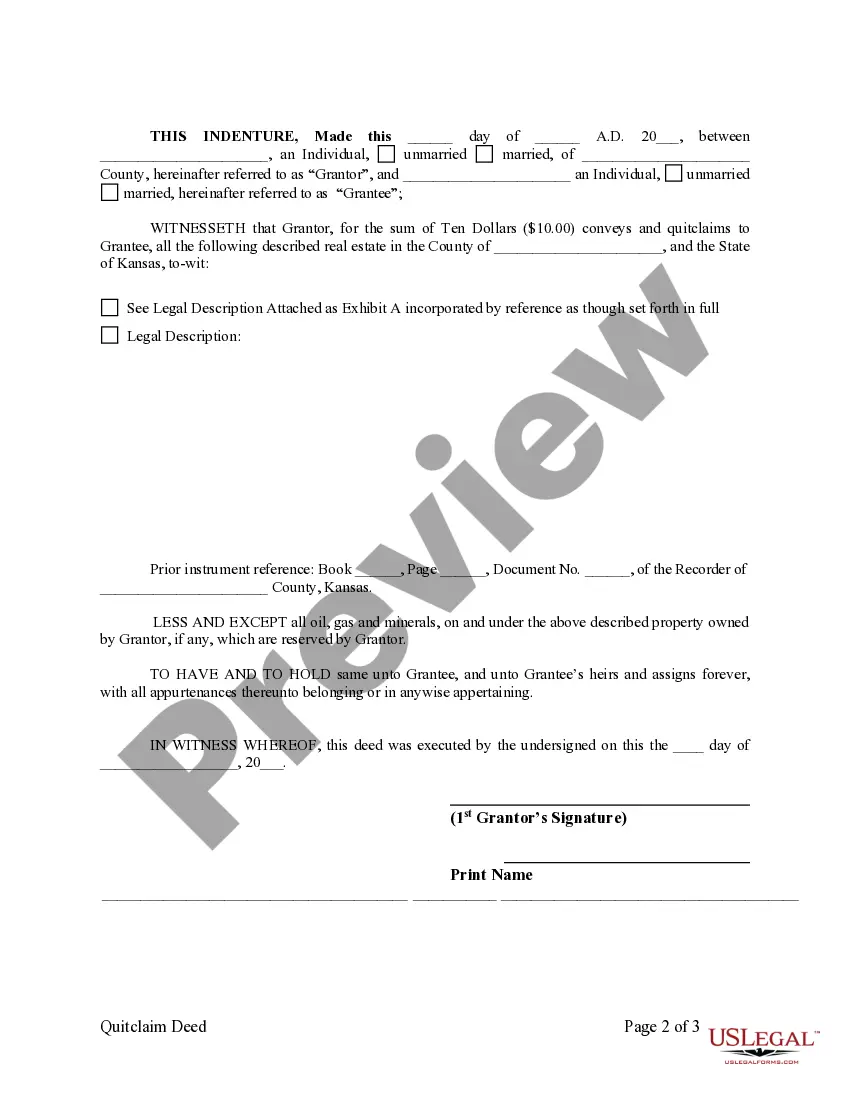

The best deed for transferring property often depends on your specific circumstances. For straightforward transfers without warranties, a Kansas quitclaim deed with life estate clause can be effective, especially among family members. Alternatively, if you seek more security and protection, consider using a warranty deed. Each option has its benefits, so evaluate your needs carefully.

The warranty deed offers the greatest protection to the buyer compared to other types of deeds, including a Kansas quitclaim deed with life estate clause. A warranty deed guarantees that the seller holds a clear title to the property and provides assurance against any future claims. Unlike quitclaim deeds, where the seller offers no such guarantees, warranty deeds build trust in property transactions. When protecting your investment is a priority, a warranty deed is generally the better choice.

Quitclaim deeds are commonly used to transfer property between family members or in divorce settlements. They serve as a simple method for changing ownership without involving complex legal procedures. If you're considering a Kansas quitclaim deed with life estate clause, it can help you facilitate transfers while still retaining rights in the property. This makes quitclaim deeds a practical choice for various personal situations.

A Kansas quitclaim deed with life estate clause allows a property owner to transfer ownership without making any guarantees about the title. This means that the recipient receives the property 'as is', with no warranties regarding potential claims against it. The life estate clause enables the original owner to retain certain rights, such as living in the property for the duration of their life. This deed is a straightforward and popular option for property transfers.

Transferring a property title to a family member in Kansas can be easily achieved using a Kansas quitclaim deed with life estate clause. First, prepare the deed with accurate property details and ensure it is signed and notarized. After that, file the quitclaim deed with the appropriate county office to finalize the transfer, ensuring legal recognition.