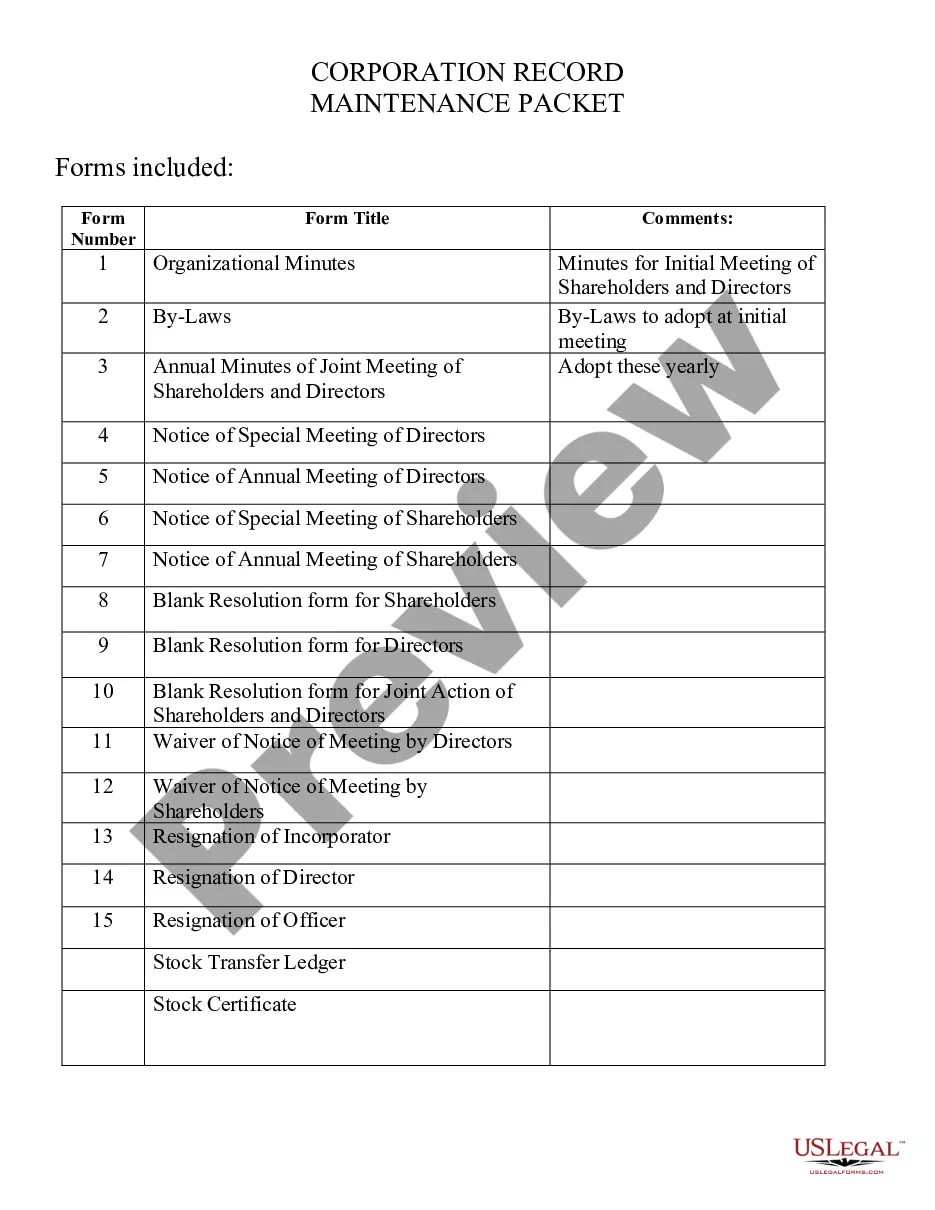

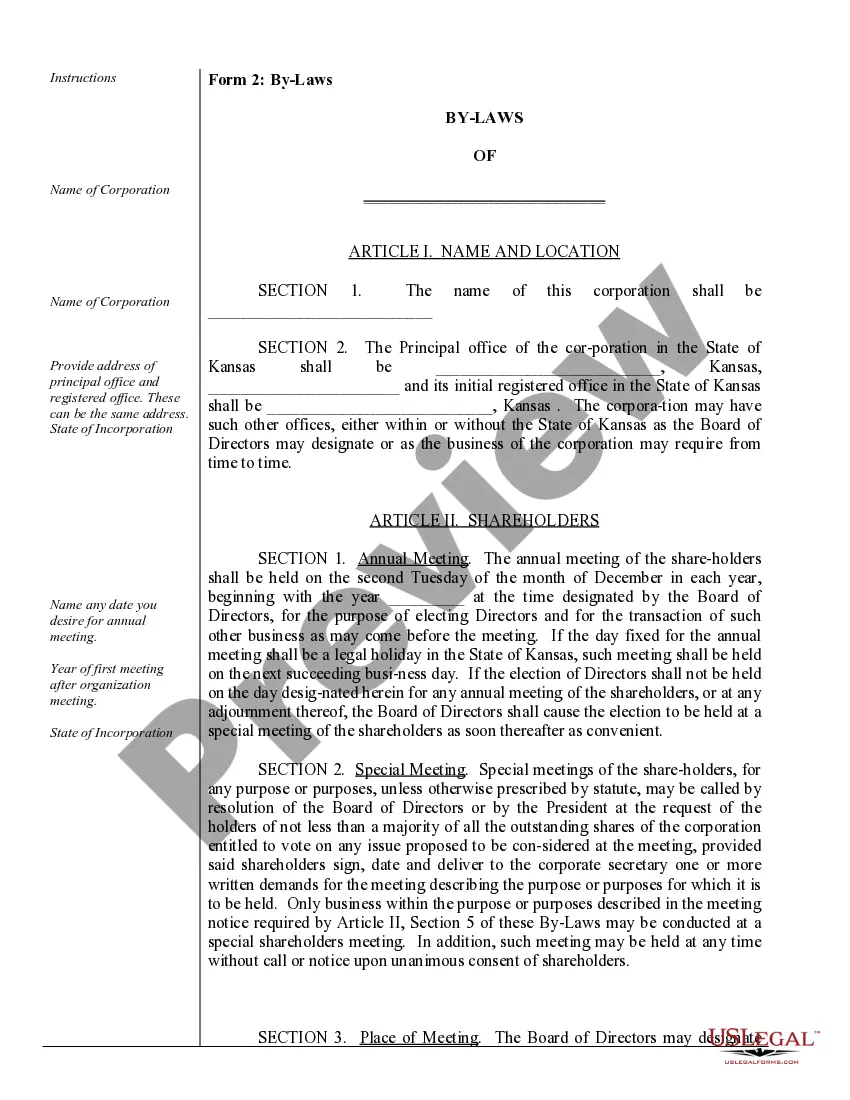

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.

Kansas Corporations For Sale

Description

How to fill out Kansas Corporate Records Maintenance Package For Existing Corporations?

- Visit the US Legal Forms website and sign in to your existing account, ensuring that your subscription is up to date. If you are new, click on 'Sign Up' to create an account.

- Browse the extensive library and use the Preview mode to verify if the selected form meets the legal requirements of your jurisdiction and suits your needs.

- If needed, utilize the Search tab to find additional forms. Make sure to rectify any inconsistencies before proceeding.

- Choose the document you require by clicking the 'Buy Now' button and selecting an appropriate subscription plan.

- Complete your purchase by entering your payment information or using PayPal for a secure transaction.

- Download the form directly to your device for easy access and completion. You can also find it later in the 'My Forms' section of your profile.

By following these straightforward steps with US Legal Forms, you can ensure that you are equipped with the right legal documents promptly.

Don’t hesitate—visit US Legal Forms today and get the assistance you need to securely navigate the legal landscape!

Form popularity

FAQ

Any individual or business entity operating in Kansas must file a tax return if their income exceeds specific thresholds. This includes corporations, partnerships, and individuals. As you navigate tax obligations, consider how adjusting your business structure with Kansas corporations for sale might be beneficial.

To dissolve a corporation in Kansas, begin by convening the board to discuss and vote on the dissolution. After receiving approval, you need to file Articles of Dissolution with the Kansas Secretary of State. This formal process allows you to explore new ventures, including opportunities with Kansas corporations for sale.

Any partnership entity in Kansas is required to file a partnership return if it conducts business activities or has gross receipts. This requirement also applies if there are multiple partners involved. If you are navigating partnerships, consider how Kansas corporations for sale could offer new business pathways.

To close a corporation, first, gather your company’s records and hold a formal meeting to vote on dissolution. After gaining approval, file the necessary dissolution documents with the state. Once completed, you can focus on new opportunities, such as acquiring Kansas corporations for sale.

A Kansas partnership return must be filed by any entity that qualifies as a partnership under state law. This includes general partnerships and limited partnerships that have engaged in business. If you operate a partnership and wish to explore options such as Kansas corporations for sale, ensure you meet the filing requirements.

Notify the IRS of your corporation's dissolution by filing the final tax return, marking it as 'final'. Include a statement that indicates the effective date of dissolution. Keeping the IRS informed helps you avoid tax obligations tied to business activities, especially if you’re interested in Kansas corporations for sale.

To close a corporation in Kansas, you must first hold a meeting with your board of directors and obtain approval for the dissolution. Next, file the Articles of Dissolution with the Kansas Secretary of State. This process ensures all obligations are settled, protecting you when considering other options like exploring Kansas corporations for sale.

Kansas does, in fact, piggyback on federal extensions, allowing you to utilize your federal extension for state tax purposes. However, it is essential to file the necessary Kansas forms to confirm this. For anyone interested in Kansas corporations for sale, this provision can be very advantageous in managing your tax obligations smoothly.

Yes, Kansas requires corporations that may need extra time for filing tax returns to submit a corporate extension request. This helps you avoid late fees and maintain compliance, particularly important if you're involved in Kansas corporations for sale. It's beneficial to know this to plan your tax filings effectively.

Reporting a sale of an S Corporation involves filing IRS Form 1120S and potentially other state forms. You should report the sale in the year it occurs, detailing any profits or losses experienced. This aspect is especially important for those considering Kansas corporations for sale, as it impacts your tax situation and future business decisions.