Kansas Foreign Corporation Withdrawal

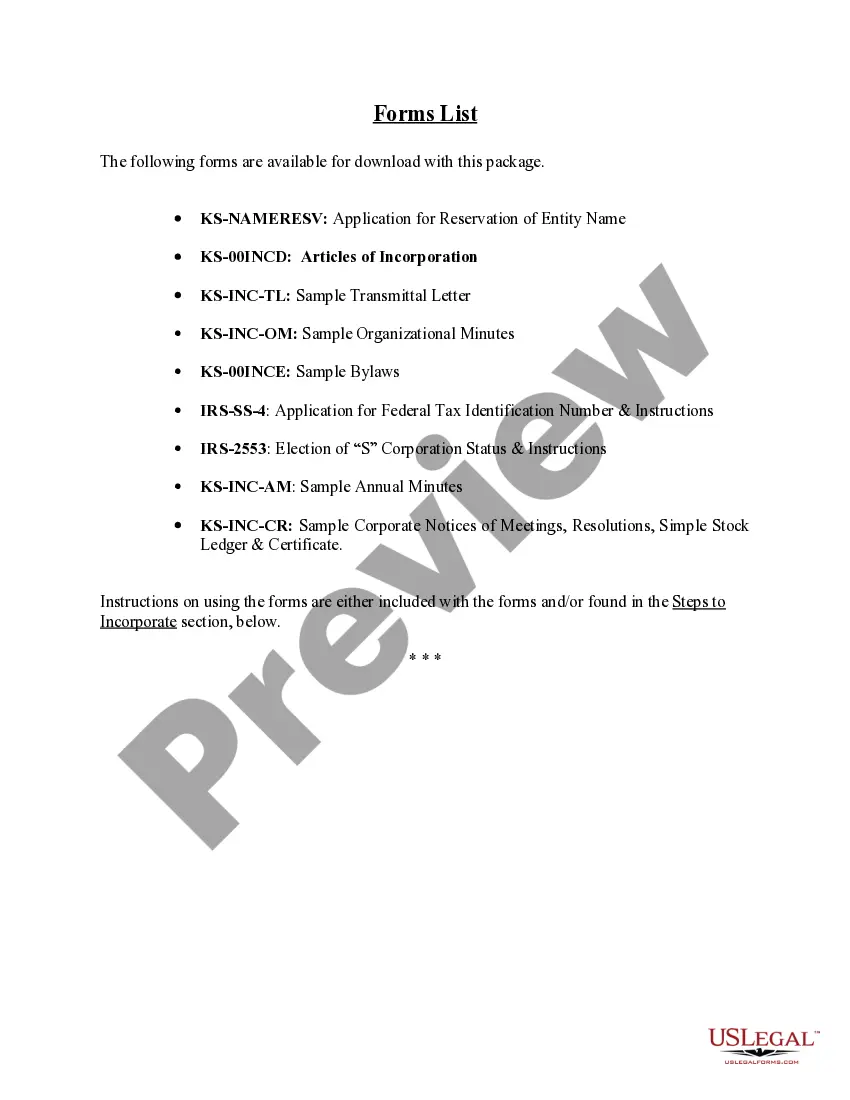

Description

How to fill out Kansas Foreign Corporation Withdrawal?

Well-crafted formal paperwork is among the essential assurances for preventing issues and legal disputes, but obtaining it without the assistance of a lawyer may require time.

If you need to quickly secure a current Kansas Foreign Corporation Withdrawal or any other forms for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Additionally, you can access the Kansas Foreign Corporation Withdrawal at any time later on, as all the documents ever obtained on the platform remain accessible within the My documents tab of your profile. Save time and resources on preparing official documents. Give US Legal Forms a try today!

- Verify that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for an alternative example (if necessary) using the Search bar in the page header.

- Press Buy Now once you discover the suitable template.

- Select the pricing plan, sign into your account or create a new one.

- Choose your preferred payment method to complete the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Kansas Foreign Corporation Withdrawal.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

A corporation closes by filing Articles of Dissolution with the state where it was registered. Ensure to comply with any outstanding liabilities and follow state-specific closure procedures. If your corporation cross-functions in Kansas, relate this to your plans for Kansas foreign corporation withdrawal.

To end an LLC in Kansas, you need to file Articles of Dissolution and ensure all debts and obligations are settled. This filing cancels the LLC's registration with the state. Be mindful of how this process interacts with any Kansas foreign corporation withdrawal actions.

To remove someone from a limited company, consult your company’s governing documents for specific procedures. Often, a vote from the other members may be required. If you ever contemplate a Kansas foreign corporation withdrawal, maintaining clear records of member status is beneficial.

Yes, businesses operating in Kansas must register with the state. This registration ensures compliance with local laws. If you operate as a foreign corporation, you should also be aware of the Kansas foreign corporation withdrawal regulations for future reference.

Transferring ownership of an LLC in Kansas requires amending the operating agreement to reflect the new ownership structure. You may also need to update state records with the Secretary of State. If you eventually withdraw, note how this affects the Kansas foreign corporation withdrawal process.

Removing someone from your LLC in Kansas involves following the procedures outlined in the operating agreement. If your LLC does not have an agreement, the decision may require a vote from remaining members. Following these steps is crucial, especially during a Kansas foreign corporation withdrawal.

To register a foreign entity in Kansas, file an Application for Certificate of Authority along with the required documents from your home state. This ensures you can operate legally within Kansas. If you ever decide to withdraw, you’ll need to follow the Kansas foreign corporation withdrawal procedure.

Withdrawing from a foreign LLC in Kansas requires filing a Certificate of Withdrawal with the Secretary of State. Be sure to settle all financial obligations before filing to avoid complications. Documenting this step is essential if you are involved in a Kansas foreign corporation withdrawal.

To register a foreign entity in California, you must file a Statement and Designation by Foreign Corporation with the California Secretary of State. Ensure compliance with California regulations, as they may differ from Kansas. If you plan to withdraw from California later, consider the Kansas foreign corporation withdrawal aspects.

If a business is forfeited in Kansas, it means it has lost its legal status due to non-compliance with state regulations, often related to tax filings or annual reports. This status complicates any actions, including a Kansas foreign corporation withdrawal, as all obligations must be settled first.