Kansas Corporation Extension Form

Description

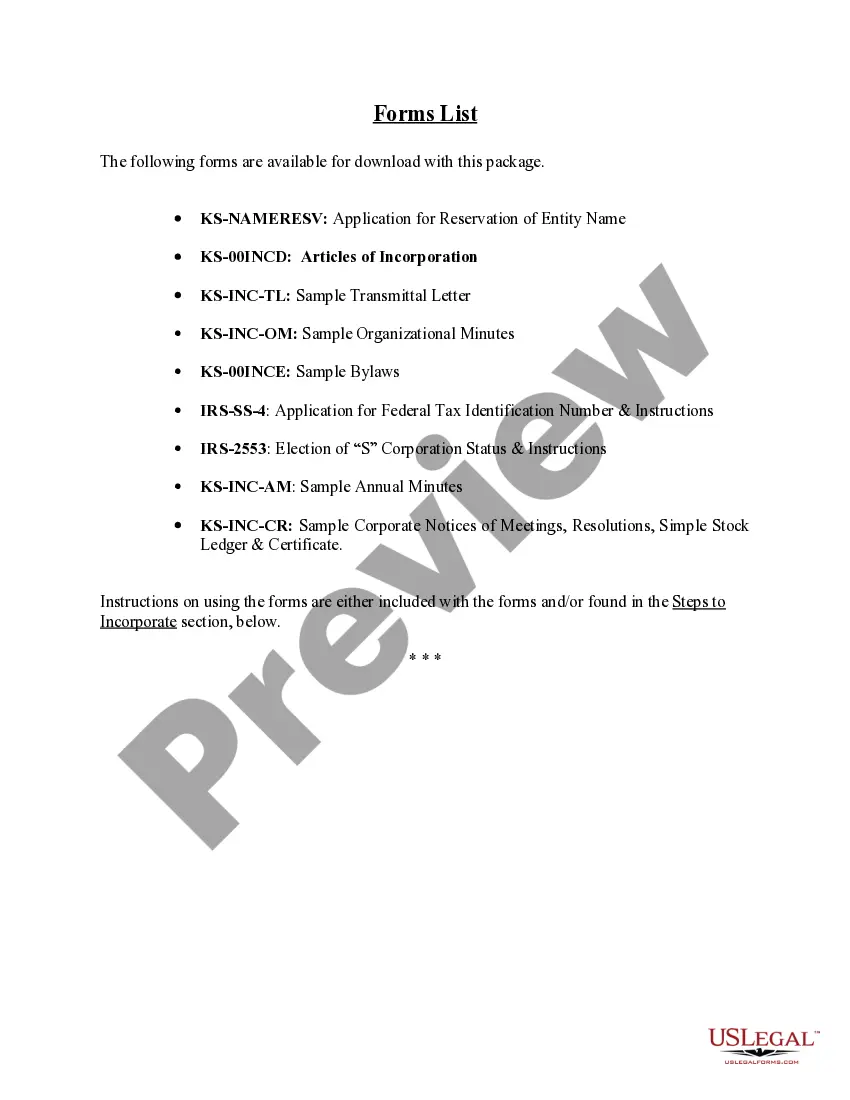

How to fill out Kansas Corporation Extension Form?

What is the most reliable platform to obtain the Kansas Corporation Extension Form and other updated versions of legal documents.

US Legal Forms is the solution! It boasts the largest repository of legal forms for any purpose. Each template is meticulously crafted and verified for adherence to federal and local statutes. They are organized by category and state of application, making it easy to find exactly what you need.

US Legal Forms is an outstanding resource for anyone handling legal documentation. Premium members can even fill out and electronically sign previously saved documents at any time using the built-in PDF editing feature. Give it a shot today!

- Experienced users of the site simply need to Log In to their account, verify the validity of their subscription, and click the Download button next to the Kansas Corporation Extension Form to access it.

- Once saved, the template will be accessible for future use under the My documents section of your account.

- If you haven't created an account with our repository yet, follow these steps to set one up.

- Check form compliance. Before acquiring any document, ensure it aligns with your intended use and complies with your state or county’s rules. Review the form description and utilize the Preview option if offered.

Form popularity

FAQ

Yes, Kansas offers an extension form for taxpayers who need additional time to file their returns. This form allows you to extend your filing deadline without facing immediate penalties. When you use the Kansas corporation extension form, you can handle any outstanding documents or tax computations with ease, ensuring compliance with Kansas tax regulations through services like USLegalForms.

The Kansas K-9 form is a specific state form related to tax reporting for certain business entities. It typically deals with income earned and needs to be submitted on time to avoid penalties. If you find yourself needing more time, the Kansas corporation extension form is a practical option, and platforms like USLegalForms simplify this process.

The K9 tax form is commonly associated with the Kansas tax reporting system for certain types of income. It often involves businesses that need to report income from specific activities or transactions. To ensure your K9 form is filled out correctly, consider the benefits of using a Kansas corporation extension form to give yourself extra time for preparation.

The Schedule K form is used to report income, deductions, and credits from partnerships and S Corporations. This form provides each partner with their share of the income, which is then reported on their personal tax returns. Filing the Kansas corporation extension form allows more time to gather this information accurately, simplifying tax filing.

A 1099k tax form reports payment card and third-party network transactions to the IRS. This form is especially important for businesses that accept credit cards or online payments. It ensures accurate reporting of income, and if you file a Kansas corporation extension form, you can ensure proper time for reconciling all your transactions before submission.

Any business entity operating in Kansas, including corporations and partnerships, must file a Kansas return. This requirement also applies to any out-of-state businesses earning income within Kansas. Don't forget that if you need more time to prepare your taxes, the Kansas corporation extension form can provide that extension, streamlining your filing process through services like USLegalForms.

The Kansas S Corp form is crucial for businesses electing S Corporation status in the state. This form allows corporations to pass income directly to shareholders, avoiding double taxation at the corporate level. You can find the necessary Kansas corporation extension form to file your taxes correctly on the USLegalForms platform, ensuring you meet all legal obligations without hassle.

An automatic extension is a period granted by the state that allows taxpayers to delay filing their tax return without penalties. In Kansas, this is not automatic; you must submit the Kansas corporation extension form to receive the additional time. This extension does not relieve you of any tax payments owed. It’s essential to understand the requirements to utilize this benefit effectively.

Anyone who earns income in Kansas or meets specific thresholds must file a Kansas tax return. This includes individuals, corporations, and businesses operating within the state. Understanding your obligation can help you stay compliant and avoid penalties. Consulting with a professional or using the Kansas corporation extension form can guide you through the process.

To make a payment for a Kansas extension, you can use the Kansas corporation extension form to report your estimated tax liability. Ensure you include a payment along with the form submission to avoid interest or penalties. Payment methods may vary, including online options or mailing a check. Staying proactive helps keep your tax status in good standing.