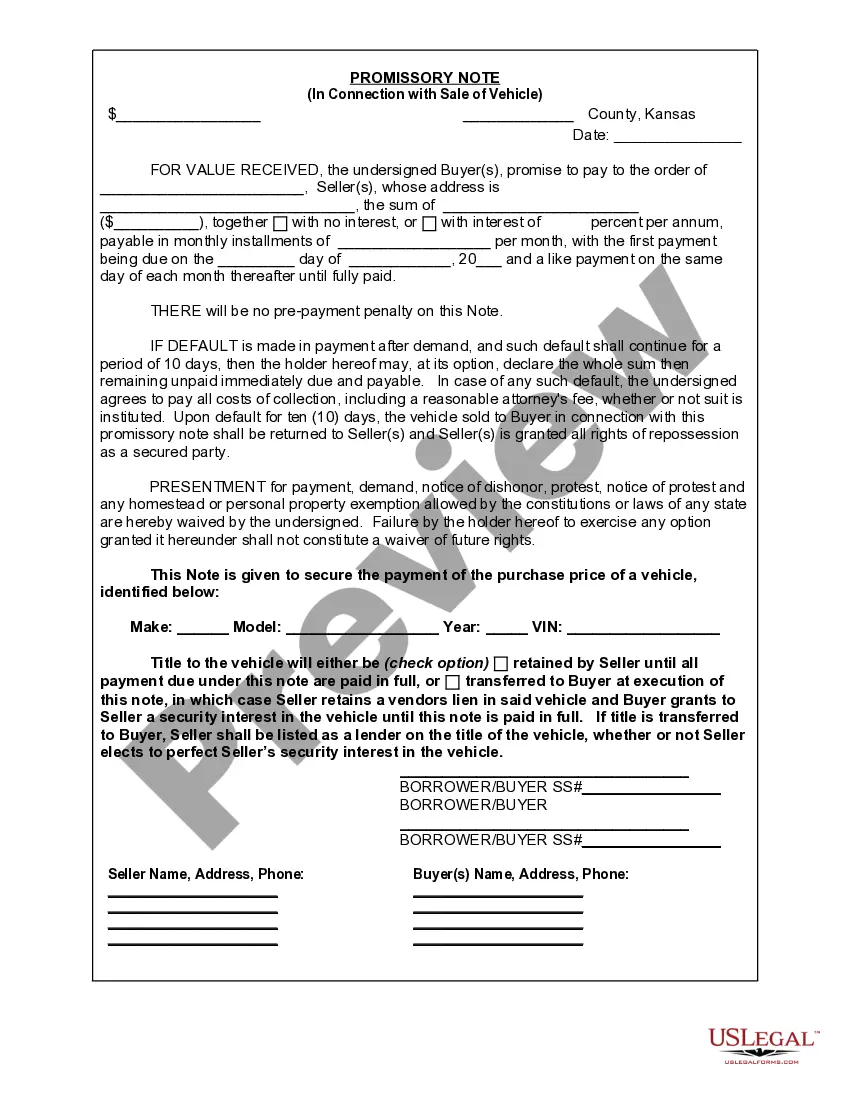

Promissory Note With Vehicle As Collateral

Description

How to fill out Kansas Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Individuals often link legal documentation with something intricate that only an expert can manage.

In a sense, this holds true, as creating a Promissory Note Using Vehicle as Security requires substantial knowledge in subject matter, including local and regional laws.

However, with US Legal Forms, everything has become simpler: pre-prepared legal documents for any life and business circumstance specific to state legislation are compiled in a singular online repository and are now accessible to all.

Create an account or sign in to move on to the payment page. Process your subscription payment through PayPal or with your credit card. Choose the format for your document and click Download. You can print your document or upload it to an online editor for a quicker completion. All templates in our library are reusable: once obtained, they are saved in your profile and can be accessed at any time via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents classified by state and usage area, making it easy to search for a Promissory Note Using Vehicle as Security or any other particular template in just a few minutes.

- Previously registered users with an active membership need to sign in to their account and click Download to retrieve the form.

- New users will have to create an account and subscribe before they can save any documents.

- Here’s a detailed guide on how to obtain the Promissory Note Using Vehicle as Security.

- Examine the page content carefully to verify it meets your requirements.

- Review the form description or look at it through the Preview option.

- If the previous template does not meet your needs, search for another example using the Search field in the header.

- Once you locate the appropriate Promissory Note Using Vehicle as Security, click Buy Now.

- Select a subscription plan that suits your needs and budget.

Form popularity

FAQ

Collateral ensures that the borrower will repay a loan as agreed or, if the borrower defaults, provides the lender with a way to recoup its losses. On a mortgage, for instance, the collateral is the home the mortgage was used to buy; on an auto loan, the collateral is the car the buyer drives home from the dealership.

You can use anything that holds value as collateral for a personal loan, as long as that value matches or exceeds the loan amount and will be accepted by the lender. Common forms of collateral for a personal loan include things like cars, investments, real estate and more.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank based on the two parties' agreement.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts. Retirement accounts are not usually accepted as collateral.