Indiana Identity Theft With Credit Cards

Description

How to fill out Indiana Identity Theft By Known Imposter Package?

Well-prepared official paperwork represents one of the crucial assurances for preventing disputes and lawsuits, though obtaining it without a legal expert's support may consume time.

Whether you seek to swiftly locate an updated Indiana Identity Theft With Credit Cards or any other forms for employment, family, or corporate scenarios, US Legal Forms is consistently ready to assist you.

The process is even more straightforward for existing users of the US Legal Forms collection. If your subscription is active, you need only to Log In to your account and select the Download option beside the chosen file. Moreover, you can retrieve the Indiana Identity Theft With Credit Cards at any time, as all documents previously obtained on the platform are accessible under the My documents section of your profile. Conserve time and resources on drafting formal paperwork. Experience US Legal Forms today!

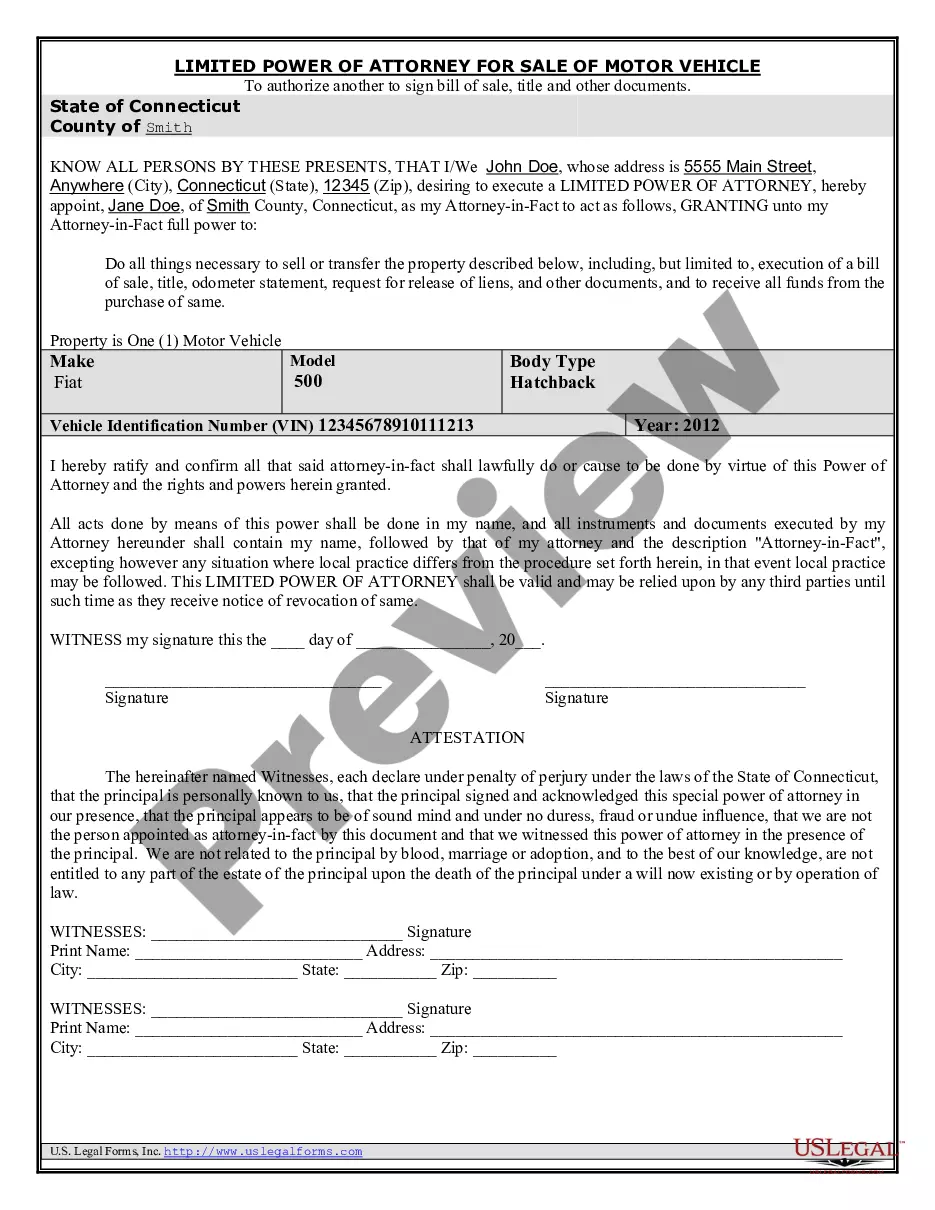

- Confirm that the document is appropriate for your situation and area by reviewing the description and preview.

- Search for an alternative example (if necessary) using the Search bar at the top of the page.

- Press Buy Now once you identify the correct template.

- Select the pricing option, sign in to your account or create a new account.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Indiana Identity Theft With Credit Cards.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

If someone has your credit card information, they can make unauthorized purchases, accrue debt in your name, and even affect your credit rating negatively. It is crucial to act quickly by reporting the theft to your credit card company and monitoring your accounts for suspicious activity. Additionally, consider seeking legal advice through trusted resources like US Legal Forms, which can assist you in managing the situation effectively.

Yes, it is possible for someone to steal your identity using a credit card. This crime occurs when someone acquires your credit card information without your permission and uses it for unauthorized purchases. This form of identity theft can lead to significant financial loss and damage to your credit score. Staying vigilant about your credit card activity can help you catch potential theft early.

To find out if someone is using your identity with your credit card, regularly monitor your credit card statements and credit report. Look for unfamiliar transactions or accounts, as they can be signs of identity theft. You can also place a fraud alert on your credit report, which adds an extra layer of protection. Utilizing the US Legal platform can help you navigate the steps to safeguard your identity.

The penalties for identity theft in Indiana can be severe. If someone is convicted of identity theft with credit cards, it can be charged as a Class A felony, which may result in up to 30 years in prison. Additionally, financial restitution may be ordered to compensate the victims for their losses. It is crucial to take preventive measures against identity theft to avoid these penalties.

Yes, credit card theft is considered a felony in Indiana. When someone unlawfully takes or uses someone else's credit card, they face significant legal consequences. Indiana classifies this crime under identity theft with credit cards, and a conviction can lead to substantial fines and prison time. Therefore, it is vital to understand the seriousness of this offense.

To report identity theft in Indiana, begin by contacting your local law enforcement. It's also necessary to file a report with the Federal Trade Commission (FTC). If you've experienced Indiana identity theft with credit cards, consider utilizing resources such as USLegalForms for templates and advice on filing reports and taking further legal action. Prompt reporting is critical to mitigate damage and recover from the incident.

Credit card theft is a serious crime that can lead to extensive financial damage. Victims of Indiana identity theft with credit cards often experience difficulty restoring their credit, along with potential legal complications. This crime can also impact your ability to securely conduct financial transactions in the future. Taking measures to protect your information is essential.

Yes, identity theft can certainly occur with credit cards. Thieves can use stolen personal information to open accounts or conduct transactions. Victims of Indiana identity theft with credit cards can face financial repercussions and emotional stress. Hence, being vigilant and monitoring your accounts regularly can help prevent such situations.

Liability for credit card theft often falls on the individual who committed the crime. However, if you are a victim of Indiana identity theft with credit cards, your liability may be limited to a certain amount, depending on how quickly you report the theft. Credit card companies usually have measures in place to protect consumers. It's crucial to understand your rights in these situations.

In Indiana, the threshold for theft to be classified as a felony is generally $750. When the value of stolen property exceeds this amount, it is considered a serious offense. This includes cases involving Indiana identity theft with credit cards, where stealing higher amounts can lead to significant legal consequences. Always consult with a legal expert if you're involved in such a situation.