Assumption Release Mortgagors With The Title

Description

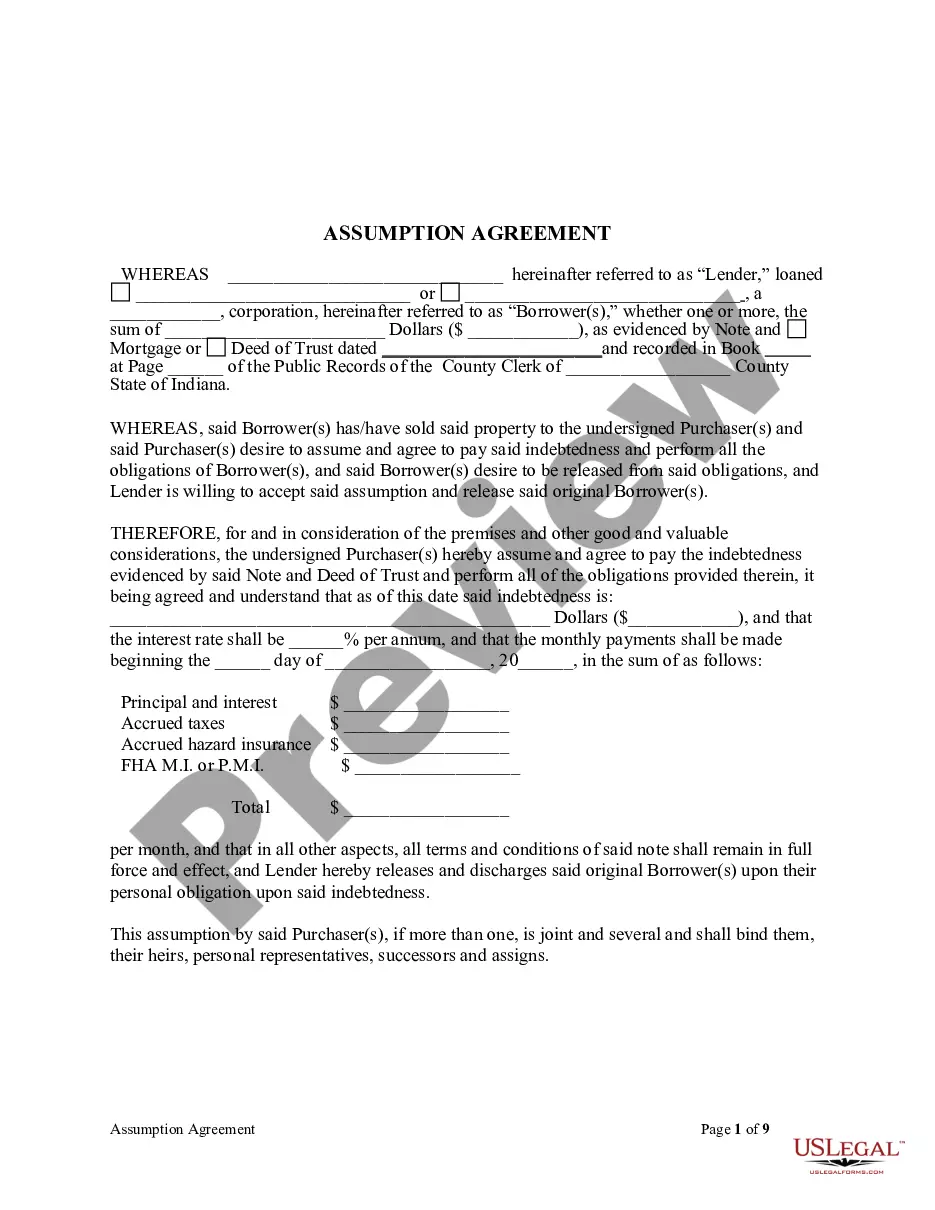

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- If you're returning user, log in to your account, verify your subscription status, and download your form directly.

- For new users, start by exploring the Preview mode and form description to ensure the document aligns with your specific requirements and jurisdiction.

- If the desired template does not meet your criteria, utilize the Search feature to find alternative options.

- Once you find the correct form, click on the Buy Now button, select your preferred subscription plan, and create an account for full access.

- Proceed to make your payment using credit card details or your PayPal account to finalize your subscription.

- After your purchase, download the form to your device. Access it anytime through the My Forms section of your profile.

With US Legal Forms, users benefit from an extensive library featuring over 85,000 fillable and editable forms, substantially more than competitors at a similar cost. Additionally, premium expert assistance is available to ensure documents are completed accurately.

In conclusion, utilizing US Legal Forms simplifies the process of releasing mortgagors, making it accessible and straightforward. Don't hesitate to take advantage of this valuable resource to ensure your legal documents are handled with ease today!

Form popularity

FAQ

A title assumption refers to the transfer of ownership rights and responsibilities from one party to another, usually as part of a property sale. In this context, the new owner assumes the existing mortgage, thereby relieving the original owner of financial obligations. When conducting a title assumption, it's essential to explore how assumption release mortgagors with the title can facilitate this process efficiently.

Assuming a mortgage after divorce can be challenging, but it is also manageable. The departing spouse usually needs to be released from the mortgage through an assumption release. You will need to demonstrate your ability to continue making payments to the lender. Utilizing US Legal Forms can help you navigate the documentation and steps needed for assumption release mortgagors with the title.

Qualifying to assume a mortgage involves several criteria that lenders typically require. You will need to demonstrate a steady income, a healthy credit score, and the ability to make monthly payments. The lender will assess your financial situation and the existing mortgage terms before granting approval. Make sure to use US Legal Forms to access the necessary documents that can simplify this process for assumption release mortgagors with the title.

Assumable mortgages do present some negatives that buyers should weigh carefully. For one, potential buyers may face stricter credit requirements, limiting their options. Additionally, the existing mortgage terms may not be as favorable compared to what is currently available on the market. This consideration leads to the importance of evaluating assumption release mortgagors with the title before making decisions.

While assuming a mortgage can have benefits, it also carries certain downsides. Typically, the buyer must meet the lender's qualifications, potentially excluding some buyers from consideration. Additionally, the original borrower may still be liable if the new buyer defaults on the mortgage. Understanding the implications of these assumptions becomes vital when considering assumption release mortgagors with the title.

Yes, assuming a mortgage can be advantageous for sellers in several ways. First, it potentially attracts more buyers, as they can take over a mortgage with more favorable terms. Furthermore, it simplifies the selling process, as the seller may release themselves from the mortgage obligation sooner. Therefore, considering assumption release mortgagors with the title can lead to a smoother transaction.

The difficulty of assuming a mortgage can vary based on several factors, including lender requirements and the mortgage terms. Generally, potential buyers must undergo a credit check and may need to provide documentation to qualify. By utilizing platforms like US Legal Forms, you can simplify the process and understand the paperwork involved in obtaining an assumption release for mortgagors with the title.

The assumption of title refers to the process where the new owner takes control of the property, along with its existing mortgage obligations. Essentially, when a buyer assumes the mortgage, they also assume the rights associated with the title. This transition can be part of an agreement that ensures all mortgagors receive an assumption release, simplifying ownership transfer and enhancing security for all involved.

A mortgage assumption happens when a new buyer agrees to take on the seller’s mortgage under the same terms. For example, if Sarah wants to buy Tom's home that has a 4% interest rate, she may be allowed to step into his shoes and continue making payments. This scenario can ease the financial burden for both parties, especially if the mortgage is favorable, as it may lead to an assumption release for Tom from the title.