Assumption Release Mortgagors For Sale

Description

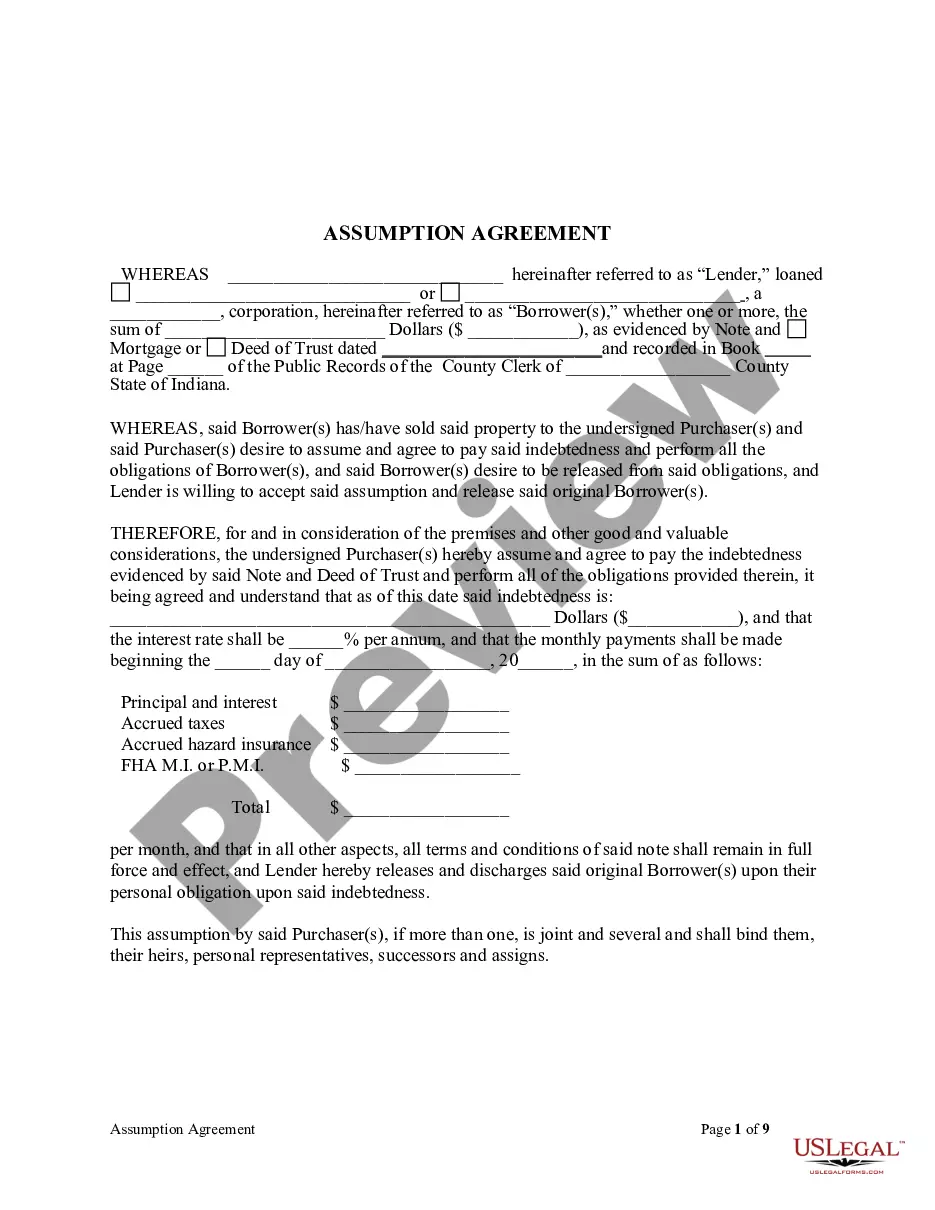

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- Log in to your existing US Legal Forms account and ensure your subscription is active. If you haven't subscribed yet, proceed to the next steps.

- Preview the required form description and ensure it meets your local legal requirements before selecting it.

- Utilize the Search bar to locate any additional templates if necessary, ensuring you find the right document for your situation.

- Select the 'Buy Now' button next to the form you wish to purchase and choose the subscription plan that fits your needs.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download your selected form to your device, and access it anytime through the 'My Forms' section of your profile.

By using US Legal Forms, you gain access to a vast library of over 85,000 legal documents, making it easier to find exactly what you need. Plus, you have the support of legal experts to ensure your documents are accurate and enforceable.

Don't wait any longer—take advantage of US Legal Forms to streamline your legal document process and empower yourself with the right tools today!

Form popularity

FAQ

An example of a mortgage assumption occurs when a family sells their home to a buyer who agrees to take over their 3% mortgage. The buyer benefits from this agreement by securing a favorable interest rate while the seller is relieved of mortgage payments. This process highlights the significance of an assumption release mortgagors for sale, ensuring both parties understand their responsibilities. Such arrangements can simplify transactions and attract more buyers.

In the sale of mortgaged property, an assumption means that the buyer takes over the existing mortgage from the seller. This arrangement often benefits the buyer, as they might secure a lower interest rate. However, it also involves the seller remaining liable in case the buyer defaults. It's essential to understand the terms of the assumption release mortgagors for sale before proceeding.

Finding houses for sale with assumable mortgages requires a proactive approach. Begin by searching online real estate listings, as many will indicate if a mortgage is assumable. You can also work with a real estate agent who has experience in this area. Additionally, uslegalforms provides tools that can help you navigate the complexities of assumption release mortgagors for sale, making your search easier.

To get a mortgage assumption, start by reviewing your existing mortgage documents to determine if it allows an assumption. Then, contact your lender to discuss the process and requirements. They may require you to submit an application and provide information about your financial status. Utilizing resources from uslegalforms can simplify your journey by offering templates and guidance for the assumption release mortgagors for sale.

Closing an assumable mortgage generally takes a few weeks, though this can vary based on the lender's requirements and the transaction's complexity. The timeline largely depends on how quickly the buyer can provide the necessary documentation and how promptly the lender processes the application. With proper planning and organization, you can shorten this timeline. Consider utilizing US Legal Forms to streamline your process for assumption release mortgagors for sale.

When assuming a mortgage, several key documents are typically required. You will need to provide your financial statements, proof of income, and a credit report to the lender. Additionally, you may need to review the original mortgage documents and complete an assumption agreement. Using US Legal Forms can simplify this process by providing templates for necessary paperwork, ensuring you are ready for the assumption release mortgagors for sale.

To assume a mortgage, the buyer needs to meet certain criteria set by the lender. This often includes having sufficient creditworthiness and income to ensure they can take over the payments. Furthermore, it’s essential to review the existing mortgage agreement for any specific assumptions outlined. If you explore solutions like US Legal Forms, you can navigate this process smoothly and understand the requirements for assumption release mortgagors for sale.

Sellers often choose to list their home with an assumable mortgage to attract buyers who may appreciate the opportunity for better financing terms. This strategy can lead to a faster sale, especially if market rates are high, making assumable mortgages more appealing. Additionally, it may provide sellers with a competitive edge in a crowded market, positioning their property favorably.

There are some downsides to assuming a mortgage, including the potential for higher interest rates if the current mortgage is not favorable compared to market rates. Buyers might also need to fulfill specific lender requirements or contingency clauses that can complicate the process. It's wise to weigh these factors carefully and consult with experts when looking into assumption release mortgagors for sale.

To find homes with assumable mortgages, start by searching online real estate listings, focusing on keywords like 'assumable mortgage' or 'assumption' in property descriptions. Additionally, working with a real estate agent who understands your needs can lead you to suitable options. Resources like US Legal Forms offer valuable templates and documents to assist buyers in securing assumable mortgages.