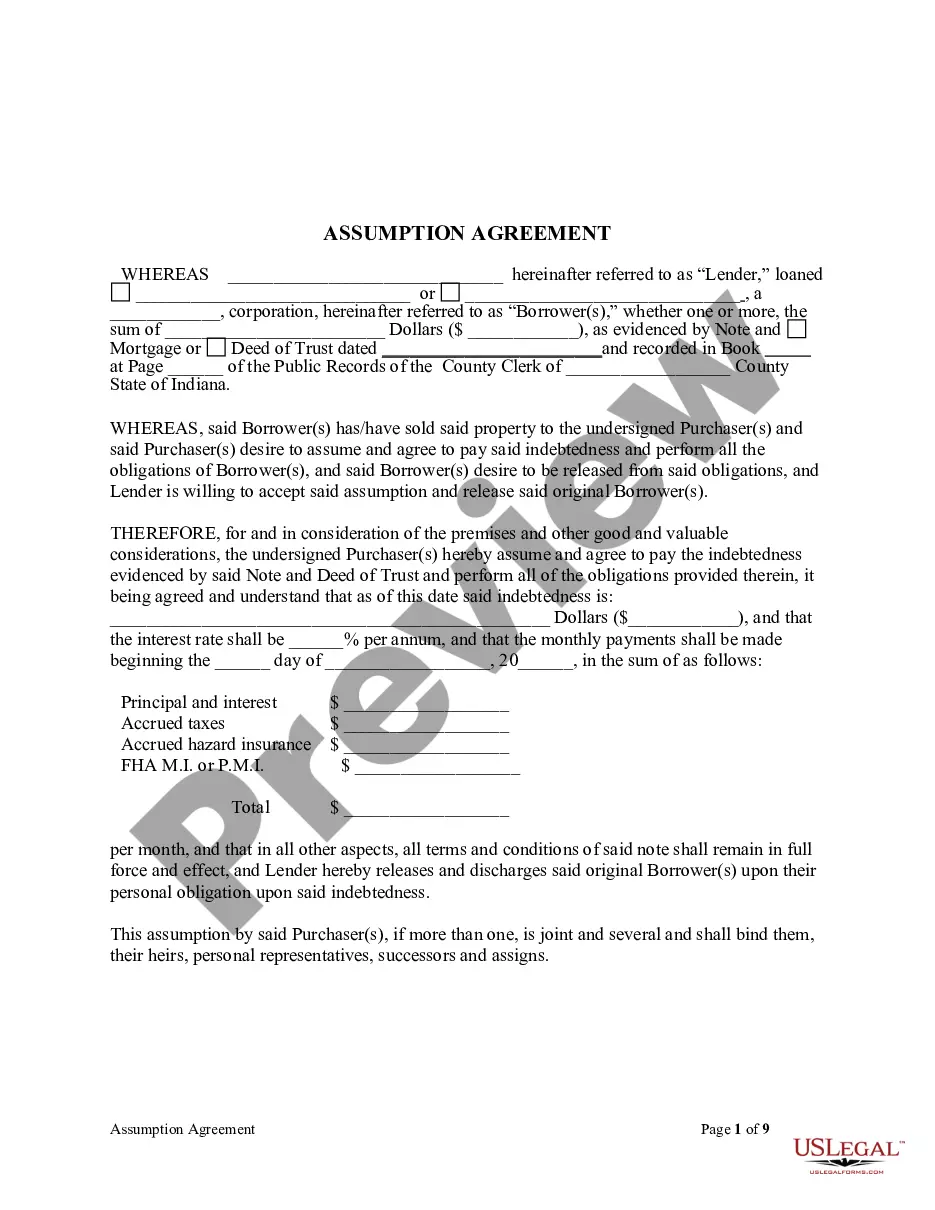

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Agreement Release Mortgagors For Sale

Description

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- Log in to your US Legal Forms account if you're a returning user, ensuring your subscription is active.

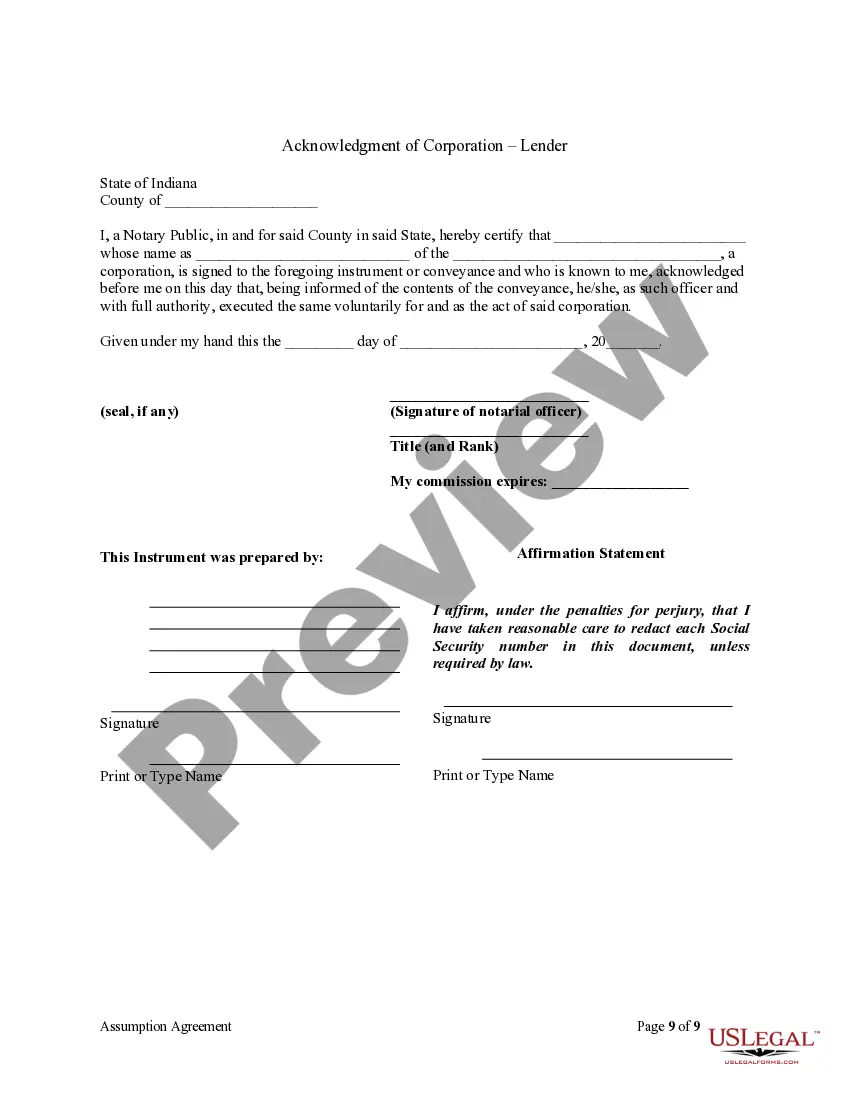

- If it's your first time, start by checking the Preview mode and form details to confirm you've selected the correct template that fits your needs.

- Utilize the search function to explore additional templates in case you need further options.

- Once you've found the right document, click on the Buy Now button and choose your preferred subscription plan.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After the transaction, download your form and save it on your device so you can access it anytime via the My Forms section.

In conclusion, US Legal Forms streamlines the process of acquiring essential legal documents like the Agreement release mortgagors for sale. Enjoy a robust library with over 85,000 forms, ensuring you find exactly what you need with professional assistance available.

Start your journey towards efficient legal documentation today by visiting US Legal Forms!

Form popularity

FAQ

You can back out of a sales agreement, but it often comes with legal consequences, such as forfeiting a deposit or facing litigation. It's essential to review the terms of the agreement to understand your rights and obligations. If you are considering an agreement release for mortgagors for sale, be sure to discuss your situation with a legal expert. Platforms like US Legal Forms can assist you in understanding your options, making the process clearer.

To get out of an agreement of sale, you'll need to refer to the terms outlined in the contract. Many agreements include clauses that specify how either party can withdraw. Communication with the other party and possibly negotiating terms can help resolve the situation. Consulting with legal resources like USLegalForms can provide you with guidance and necessary documents to effectively navigate the agreement release mortgagors for sale.

To obtain a release of liability from a lender, you must formally request the release, often accompanied by specific documentation showing it is appropriate. The lender will review your financial situation and your request before making a decision. This process can protect you from future liabilities tied to the property. Utilizing platforms like USLegalForms can help you gather necessary forms and ensure you meet all requirements for the agreement release mortgagors for sale.

To remove someone from your mortgage without refinancing, you can pursue a mortgage release agreement. This document allows the lender to remove a borrower's obligation while keeping the mortgage intact. It’s crucial to ensure the other party agrees to the release, as this protects both of your interests. Consulting with a legal expert can streamline the process and help you understand the implications of the agreement release mortgagors for sale.

To obtain a partial release from your mortgage, contact your lender and explain your situation. You will likely need to provide details about the property involved and your reasons for the request. Your lender will review your proposal, which could lead to a favorable outcome if your account is in good standing. An Agreement release mortgagors for sale can assist you in understanding and executing this process effectively.

You can typically obtain a copy of your mortgage note by reaching out to your lender or servicer. They maintain records and can provide you with the document upon your request. Be prepared to verify your identity and provide necessary details. If you face difficulties, consider utilizing resources available through an Agreement release mortgagors for sale to facilitate the process.

To obtain a release of liability from your lender, start by contacting them directly to request the necessary forms. Be clear about your intentions, whether it's for selling the property or restructuring your financing. Providing documentation that supports your request can streamline the process. An Agreement release mortgagors for sale may simplify your dealings by ensuring all parties understand their responsibilities.