Lease Modification Agreement With Cosigner

Description

How to fill out Indiana Amendment Of Residential Lease?

Steering through the red tape of official paperwork and forms can be daunting, particularly if one is not engaged in that field professionally.

Even selecting the appropriate template for the Lease Modification Agreement With Cosigner may consume a lot of time, as it needs to be accurate and precise down to the last digit.

However, you will considerably reduce the time spent acquiring an appropriate template if it originates from a reliable source.

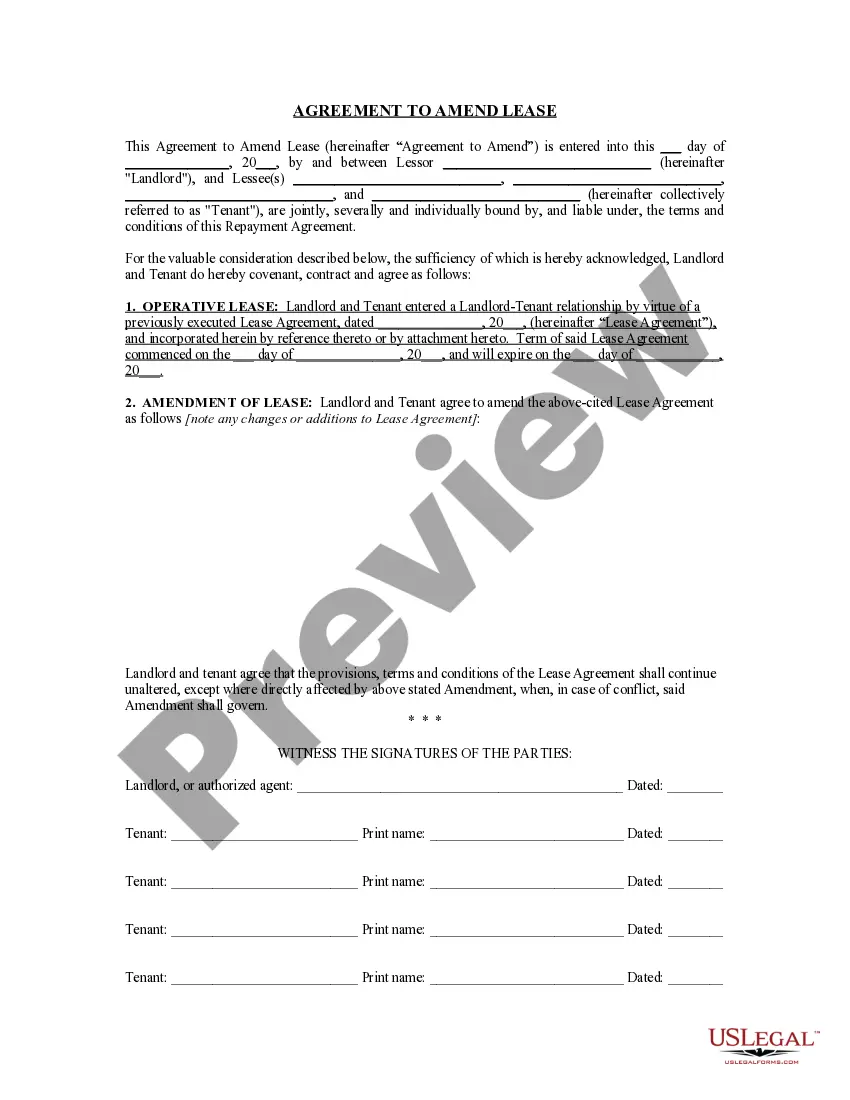

Acquiring the correct form in a few straightforward steps: Enter the document title in the search field, locate the suitable Lease Modification Agreement With Cosigner from the search results, review the sample description or preview, if the template meets your requirements, click Buy Now, choose your subscription plan, use your email to create a password for US Legal Forms account registration, select a payment option via credit card or PayPal, and save the template file onto your device in your desired format.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms is a one-stop shop where you can find the latest document samples, verify their usage, and download them for completion.

- This is a repository housing over 85K forms applicable in numerous fields.

- When searching for a Lease Modification Agreement With Cosigner, there will be no need to question its validity since all forms are verified.

- Having an account with US Legal Forms ensures you have all the essential samples at your fingertips.

- Organize them in your history or add them to the My documents section.

- Retrieve your saved forms from any device by simply clicking Log In on the library site.

- If you haven’t created an account yet, you can still search for the template you require.

Form popularity

FAQ

According to the Experian.com website, cosigning for an apartment lease doesn't normally affect a cosigner's credit. Rental payments aren't normally reported to credit bureaus. Because rental payments aren't usually listed in a person's credit report, there's no affect, good or bad, on a cosigner's credit history.

According to You Check Credit, an appropriate cosigner agreement should make the cosigner jointly responsible for all the financial obligations of the tenant, including the security deposit, rent, fees, and charges related to damages.

Create your state-specific lease agreement outlining the terms of the cosigner and the responsibility of each party and add both parties to the lease agreement. Get all parties to sign so the lease agreement is legally binding. Make sure they both understand when and how rent should be paid every month.

8 steps to remove a co-signer from a leaseMake sure both parties are in agreement.Read the lease thoroughly.Schedule a meeting with the property manager.Prepare for the meeting.Attend the meeting and discuss the desire to remove co-signer.Ask to adjust the lease.Sign the new lease.Understand the length of the lease.

Without the landlord's consent, a co-signer cannot be removed from a lease. With the landlord's consent, a co-signer can be removed from a lease. A lease is a binding contract that cannot be altered unless all the parties to the lease agree...