Unearned

Description

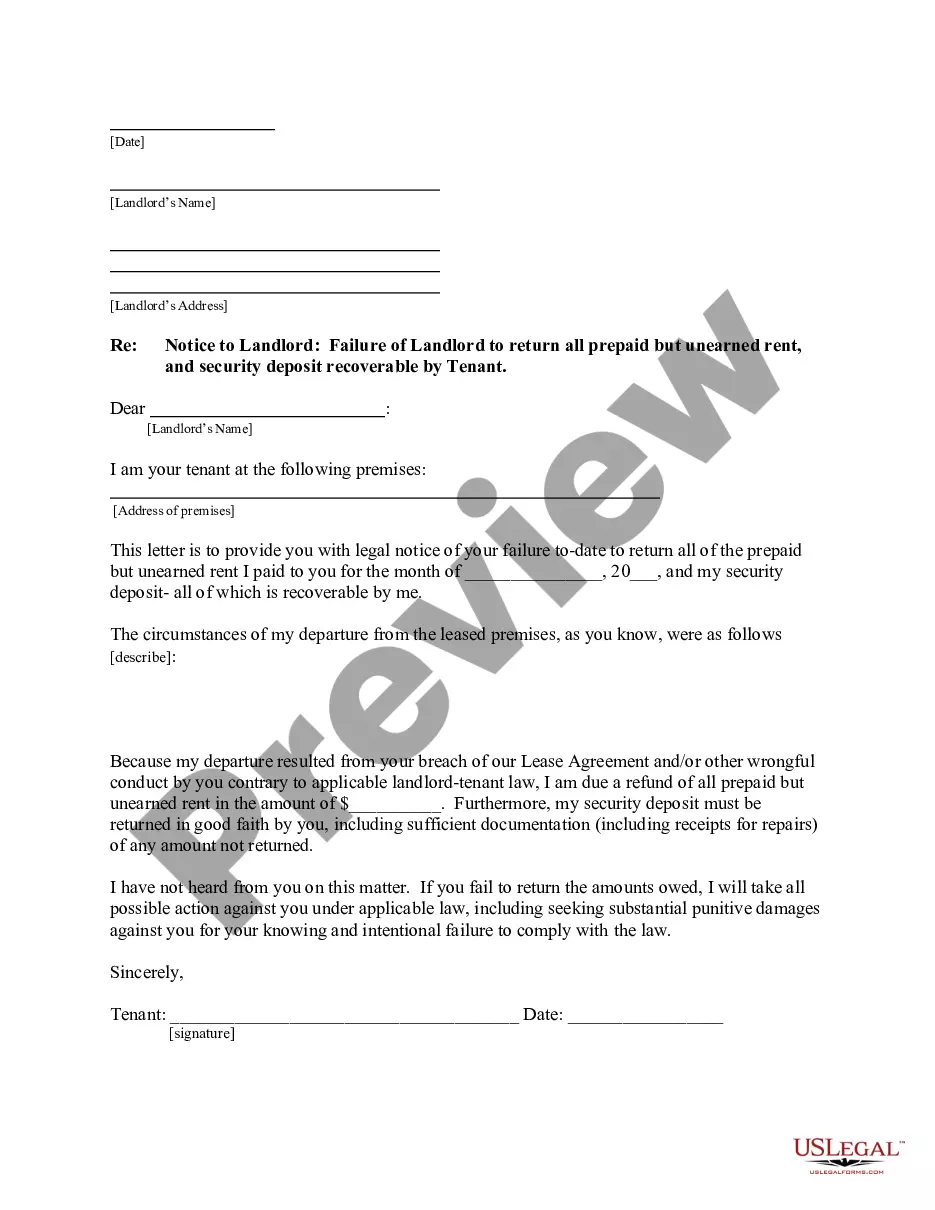

How to fill out Indiana Letter From Tenant To Landlord For Failure Of Landlord To Return All Prepaid And Unearned Rent And Security Recoverable By Tenant?

- For returning users, log into your account to download your necessary form template. Ensure your subscription is active; otherwise, renew it as per your payment plan.

- If you are using US Legal Forms for the first time, begin by checking the Preview mode and form description to confirm you have selected the correct document that meets your needs and local jurisdiction requirements.

- If needed, search for alternative templates using the Search tab above. Should any discrepancies arise, locate the proper form before proceeding.

- After finding the suitable document, click on the Buy Now button, select your preferred subscription plan, and register your account to unlock access to the vast library.

- Complete your purchase by entering credit card information or utilizing your PayPal account for the subscription fee.

- Finally, download your form and save it on your device. You can access it anytime through the My Forms section in your profile.

By following these steps, you can quickly obtain the legal forms you require. US Legal Forms provides a robust collection of over 85,000 editable legal forms.

Start utilizing these unearned benefits today and experience seamless legal documentation. Visit US Legal Forms now!

Form popularity

FAQ

Not earning refers to failing to receive rewards or income due to a lack of work or contribution. It often points to situations where individuals do not fulfill conditions necessary for compensation. Understanding this concept is vital, especially in examining cases like unearned payments that may come into play in legal discussions.

Another phrase that describes not earned is 'unwarranted.' This term points to benefits or accolades that one does not merit, implying that they lack justification. When discussing matters related to unearned rewards, 'unwarranted' perfectly embodies the feeling of receiving something without proper acknowledgment of effort.

A fitting term for something not earned is 'undeserved.' This word highlights situations where individuals receive benefits that do not correlate with their efforts. Considering unearned benefits, 'undeserved' encapsulates the disconnect between reward and effort effectively.

A more diplomatic term for unemployed individuals is 'seeking opportunities.' This phrase conveys a proactive stance towards finding suitable employment without implying negativity. It emphasizes the journey of searching for work while maintaining respect and positivity around the situation.

Unearned payment refers to compensation received without fulfilling the necessary conditions or work associated with it. It often appears in contexts like bonuses or advances that occur before the completion of obligations. This type of payment can create potential issues if expectations are not aligned, so understanding it is essential.

A common word that describes something unearned is 'unjustified.' It reflects the essence of receiving benefits without merit. This term captures the notion of gain received without a fair exchange, resonating with the concept of unearned advantages.

Unearned income covers various sources, such as interest from savings accounts, dividends from investments, rental income from property, and pensions or annuities. It is crucial to recognize what constitutes unearned income, as it can impact your tax return and possible deductions. Understanding your unearned income helps you manage your finances more effectively. Use platforms like USLegalForms to assist you in clarifying your income types.

You do not necessarily need to earn $2,500 to qualify for the child tax credit. However, your income must fall within specific thresholds, and the amount of the credit can also depend on other qualifying factors. If your income is low, you may still receive a refund through the additional child tax credit. This relationship between earned and unearned income can make tax planning more advantageous.

The earned income credit (EIC) primarily benefits low to moderate-income workers, and specific qualifications must be met to claim it. You must have earned income from work, such as wages or self-employment, and meet income limits based on your family size. Interestingly, certain types of unearned income may affect your eligibility for the EIC. Resources like USLegalForms can provide you with clear guidance on how to secure your earned income credit.

Receiving a $10,000 tax refund often results from overpaying taxes throughout the year. This can occur through paycheck withholdings, estimated tax payments, or qualifying for various tax credits. If you have children or specific deductions, you might boost your refund significantly. Keep in mind that understanding your unearned income's impact on your taxes can help you project your refund more accurately.