Rented Apartment

Description

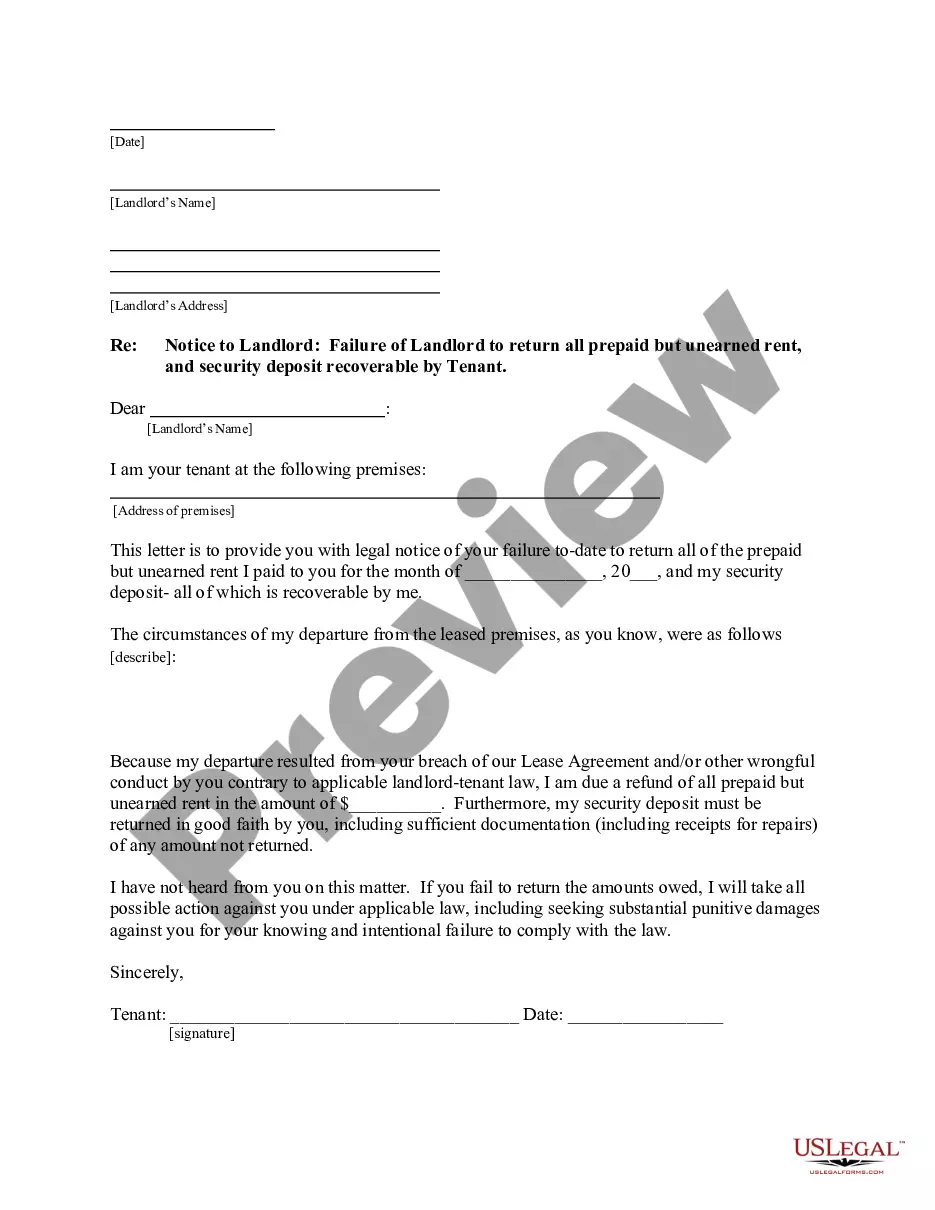

How to fill out Indiana Letter From Tenant To Landlord For Failure Of Landlord To Return All Prepaid And Unearned Rent And Security Recoverable By Tenant?

- Log in to your US Legal Forms account if you’ve used the service before. Ensure your subscription is active; if not, renew it based on your payment plan.

- Browse the form library. Use the Preview mode to check the form description and confirm that it aligns with your local regulations.

- If the desired form does not meet your requirements, utilize the search feature to find an alternative template.

- Purchase the selected form by clicking the Buy Now button. Choose a subscription plan and create an account for full access to the legal library.

- Complete your transaction by providing your payment details, using either a credit card or PayPal.

- Download the completed template straight to your device, ensuring you can access it anytime through the My Forms section of your account.

With these easy steps, you can quickly access essential legal forms tailored for your rented apartment needs. US Legal Forms empowers users with a robust library of over 85,000 fillable documents and premium expert assistance.

Start your journey towards hassle-free legal documentation today—visit US Legal Forms and ensure your rented apartment paperwork is in order!

Form popularity

FAQ

Gaining approval to rent an apartment can be challenging, especially for first-time renters, yet it's not impossible. Factors such as credit history and income requirements significantly impact the outcome. With the right approach and preparation, you can present a strong case to landlords. Remember, persistence pays off when seeking your ideal rented apartment.

If you make $2000 a month, you should aim for a rental budget of around $600 to $800, following the common guideline of spending 30% of your income on housing. This budget can accommodate various options in many markets, but specific areas may differ. Research local apartment prices to understand better what is feasible for your budget. With focus and realistic expectations, you can find a suitable rented apartment.

The approval process for rentals can seem daunting, but it largely depends on individual circumstances. Factors like your credit score, income, and rental history play significant roles in the decision. Being well-prepared with documentation and having a solid application can greatly improve your chances. Stay positive, as many find success in getting their rented apartment.

Most apartments typically require tenants to earn at least three times the monthly rent. This ensures you can comfortably cover rent and expenses. However, exact requirements may vary by landlord or area, so it's wise to confirm specifics before applying. Knowing these details can help you budget for your future rented apartment.

Many first-time renters worry about approval, but it's often manageable with the right preparation. Factors such as your financial status and rental history influence the decision. If you demonstrate steady income and provide all necessary documentation, securing your rented apartment should be within reach. Take proactive steps to strengthen your application.

When applying for a rented apartment, landlords typically check your rental history, credit score, and income verification. These checks help them assess your reliability as a tenant. Additionally, they may ask for references to gauge your behavior and history as a renter. Preparing these documents beforehand can enhance your approval chances.

First-time renters can secure an apartment by researching available listings online or in-person. Creating a checklist of requirements can streamline the process, ensuring you consider factors like location and amenities. Gathering necessary documents, such as identification and proof of income, will help you during the application. Utilizing platforms like USLegalForms can assist with the paperwork to make obtaining your rented apartment easier.

Apartment units are often called residential units or rental units. Each unit typically functions independently, offering privacy and amenities for tenants. Knowing the terminology can assist you when searching for a rented apartment or discussing options with landlords and property managers.

A rental apartment is simply referred to as a leasehold unit or a leased apartment. It signifies a dwelling that a tenant occupies by paying rent rather than owning. Rental apartments are popular choices for those who seek flexibility and lower financial commitment compared to buying a home.

Another name for an apartment is a flat, commonly used in different English-speaking regions. Regardless of terminology, a rented apartment provides similar benefits, such as shared amenities and maintenance support. Understanding these terms can help you navigate rental agreements more easily.