Divorce List Of Assets

Description

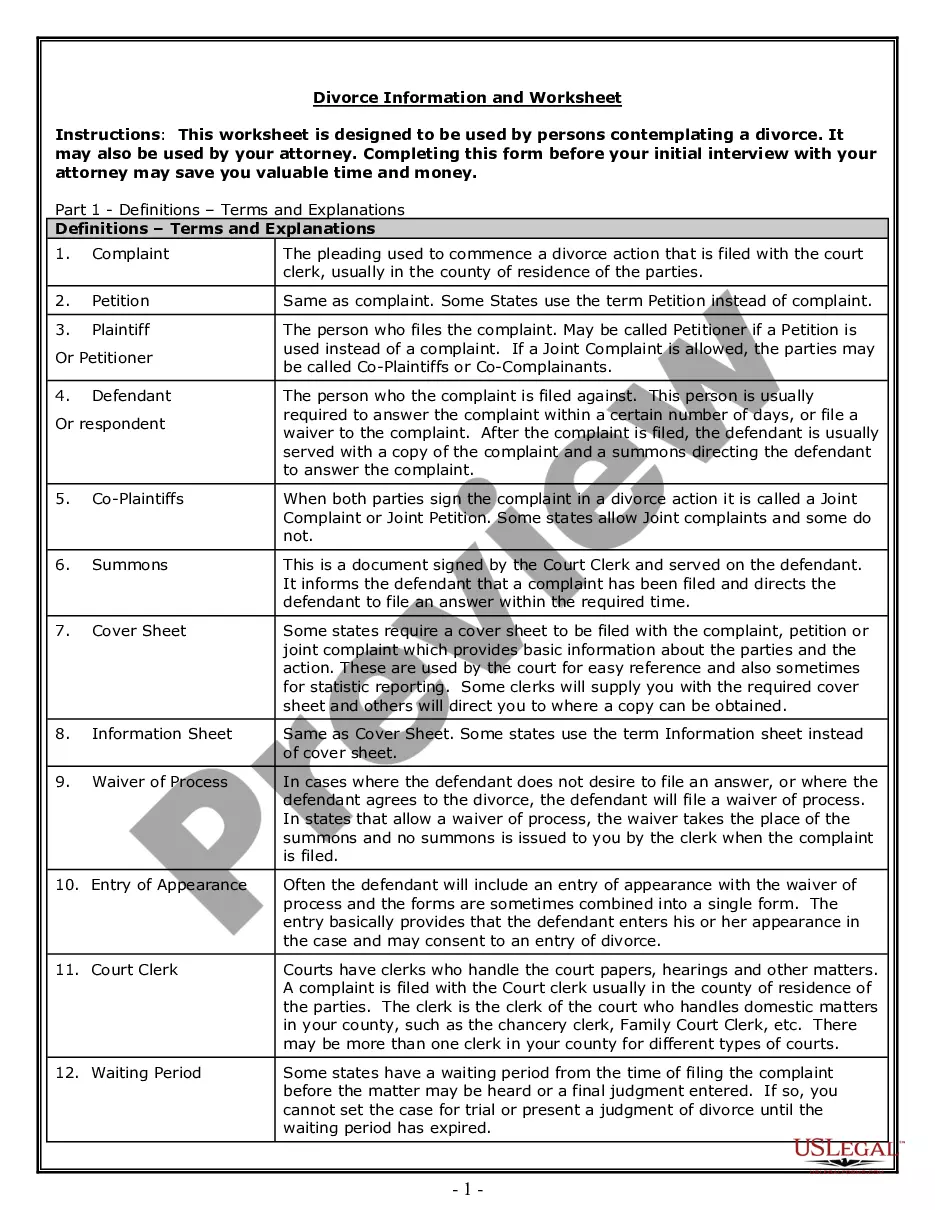

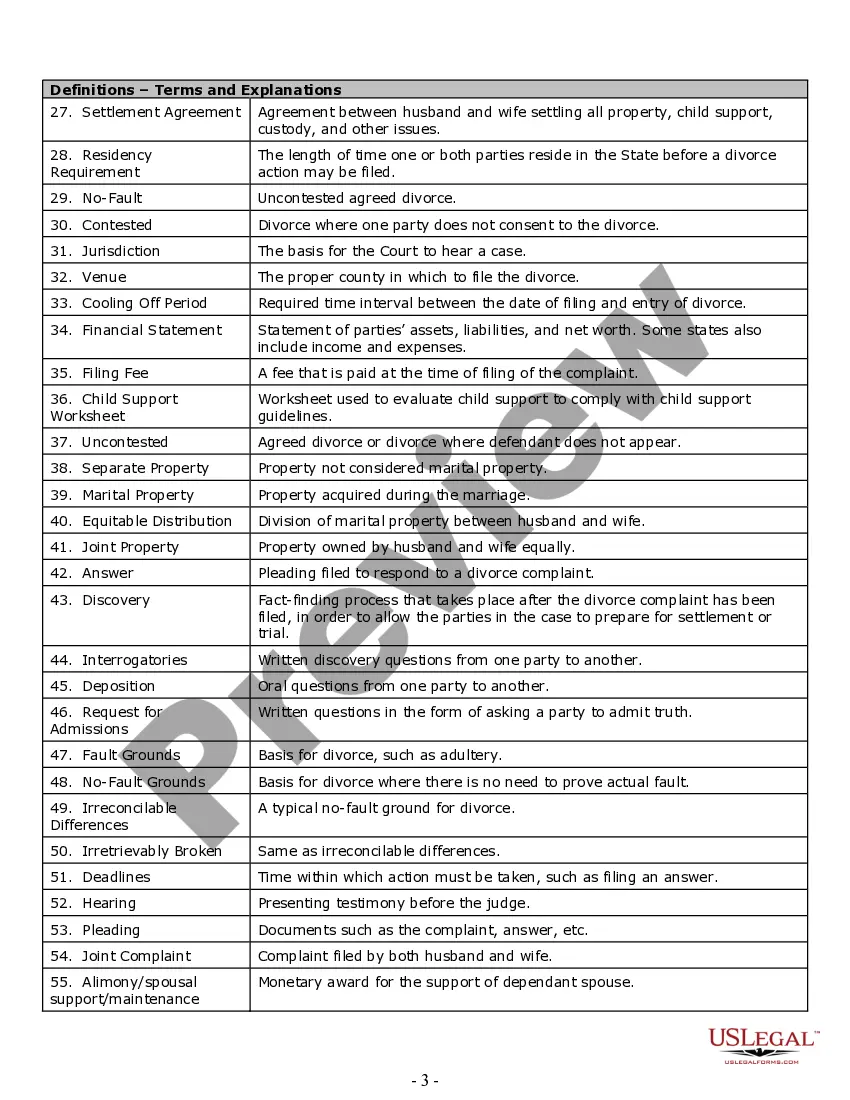

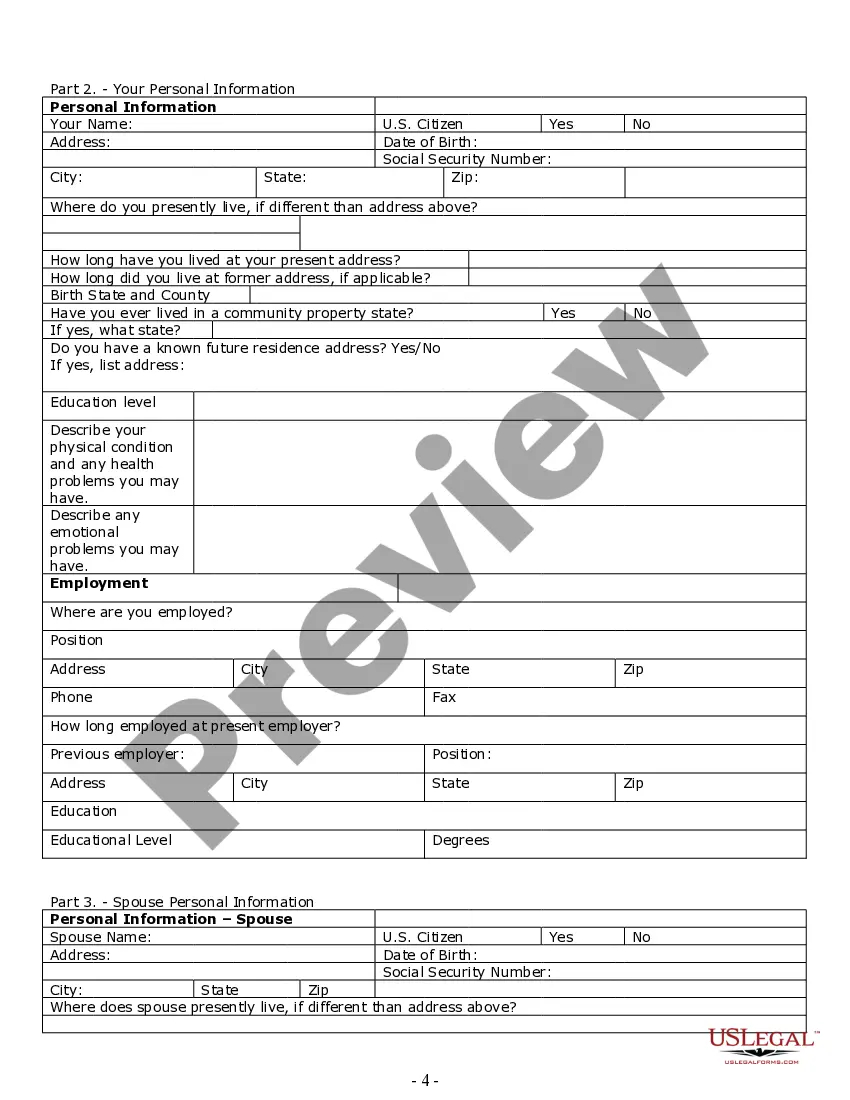

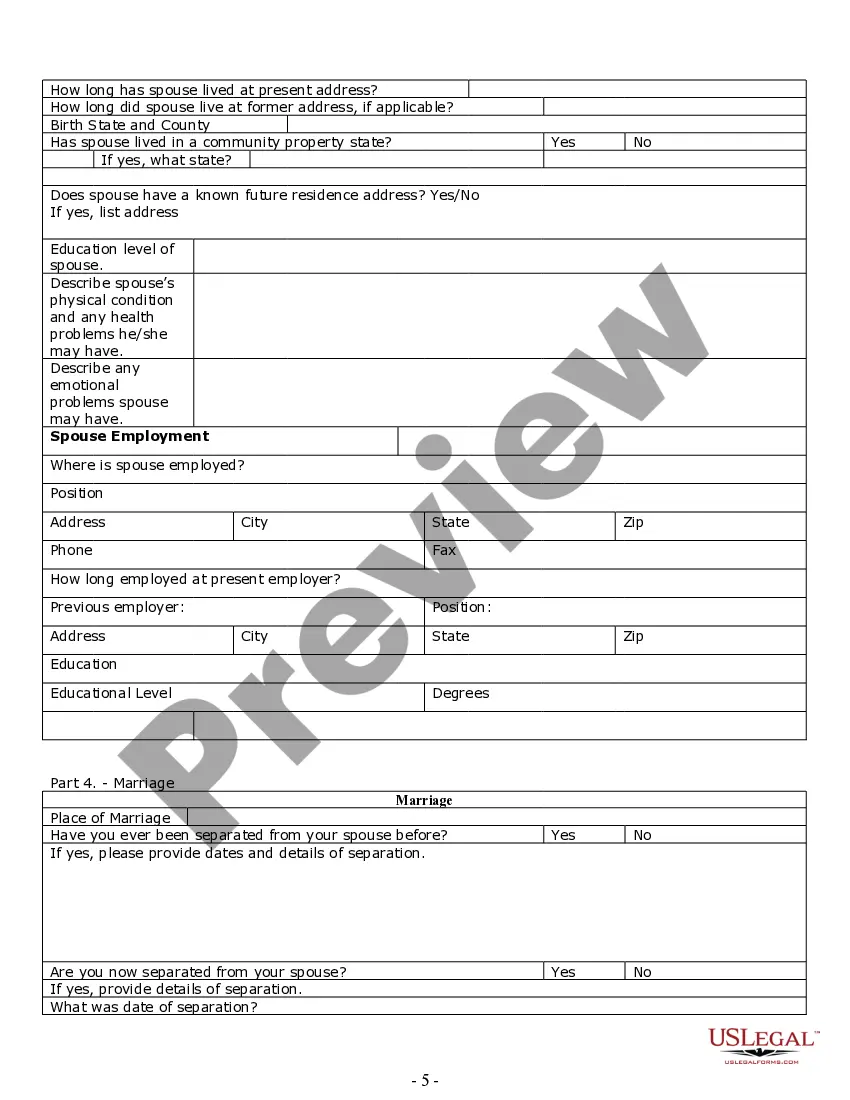

How to fill out Indiana Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Regardless of whether it's for professional reasons or personal issues, everyone must confront legal circumstances at some point in their lives.

Completing legal documents requires careful consideration, starting with choosing the appropriate form template.

With an extensive catalog of US Legal Forms available, you do not need to waste time searching for the appropriate template online. Utilize the library’s user-friendly navigation to find the correct form for any situation.

- Locate the template you require through the search bar or catalog browsing.

- Review the document’s details to ensure it matches your circumstances, jurisdiction, and county.

- Click on the document’s preview to examine it.

- If it is the incorrect document, return to the search feature to locate the Divorce List Of Assets template you need.

- Download the file if it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access templates you have previously saved in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Fill out the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you prefer and download the Divorce List Of Assets.

- After it is downloaded, you can complete the form using editing software or print it out and finish it by hand.

Form popularity

FAQ

Both partners can experience significant emotional and financial distress after a divorce. However, individuals with less experience in managing finances and assets may struggle more in the aftermath. Creating a divorce list of assets can help both parties understand what they need to rebuild their financial future.

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

Before creating a partnership, it is important to draft a well-thought-out operating agreement that will cover the following: Name of the partners and the process of adding new partners or removing them. Outline of the company. Each partner's percentage of investment and profit. How the partnership will be dissolved.

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.

9 Legal Documents Required for Business Partnerships Legal requirements for partnership business. Business Partnership Agreement. ... Dissolution of Partnership Deed. ... Confidentiality Agreement. ... Letter of Intent. ... Employment Contract. ... Sale of Goods Agreement or Supply of Services Agreement. Website Terms of Use.

In the United States, filing partnership paperwork with a state is generally not required, though certain registration forms, permits, and licenses may be necessary at the local level. As a pass-through entity, the partnership pays no taxes. No external financial reporting/annual report is required.

You don't have to file any formation paperwork with the state to start a General Partnership in California. Only formal business structures (like LLCs or Corporations) have to file formation documents with the state. However, there are two important business items you must get: EIN Number.

No formal or written agreement among the partners is needed to create a partnership, even though under current law, ?A partnership is an entity distinct from its partners?. Corp. Code § 16201; 9 Witkin, Summary of California Law (10th Ed., 2008), Partnership, § 23.