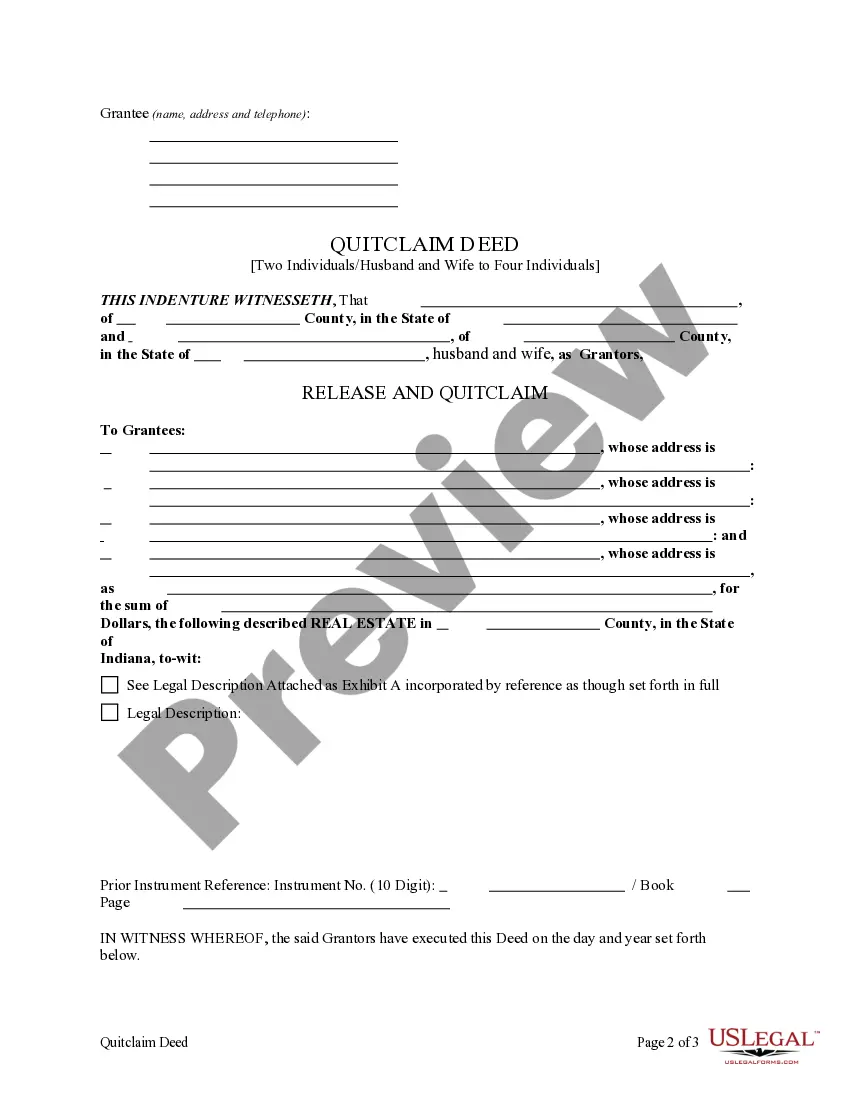

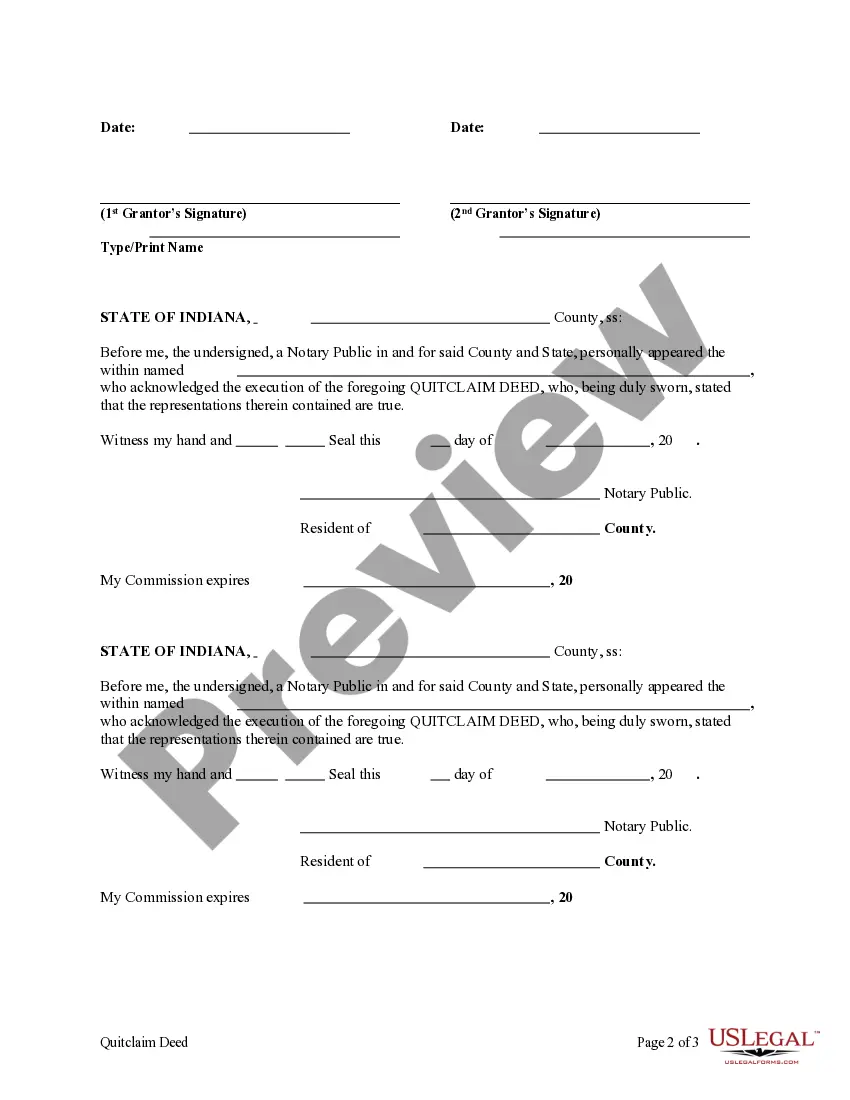

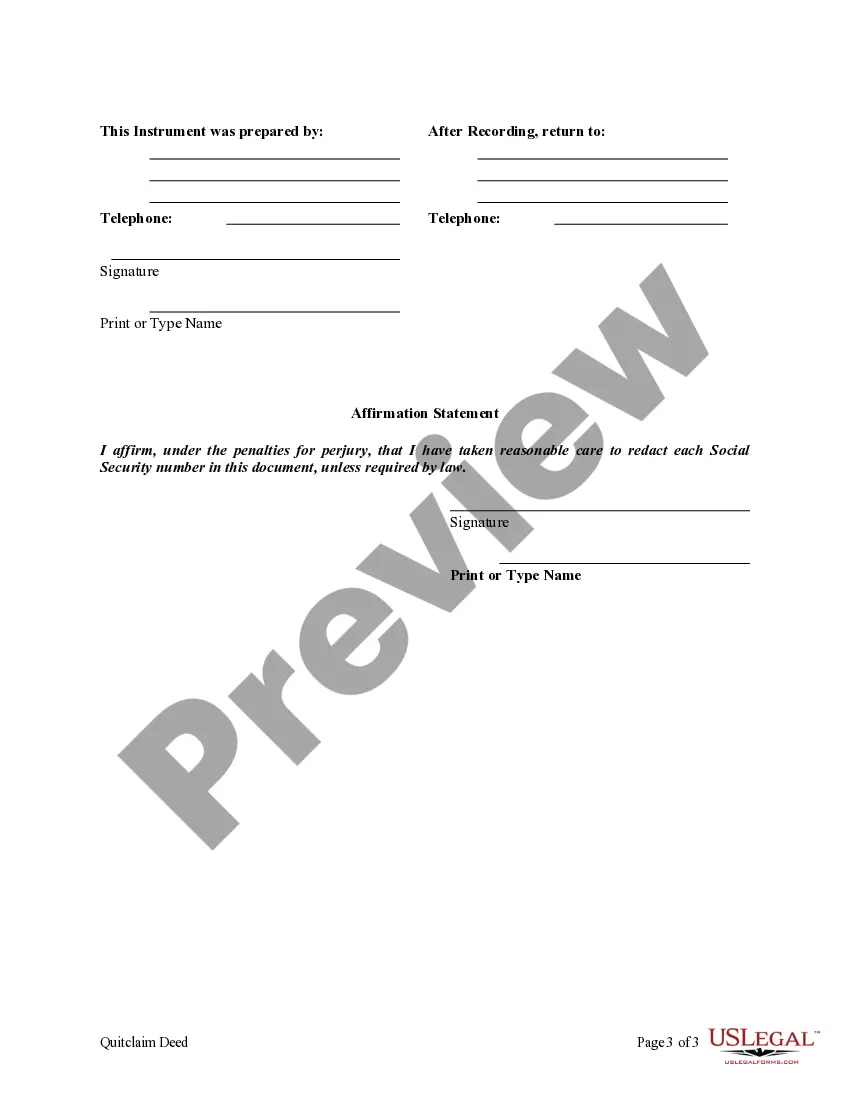

This form is a Quitclaim Deed where the Grantors are two individuals or husband and wife and the Grantee are four individuals. Grantors convey and quitclaim the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

In Quitclaim Deed With Life Estate Clause

Description

How to fill out Indiana Quitclaim Deed From Two Individuals / Husband And Wife To Four Individuals?

Bureaucracy necessitates exactness and correctness.

Unless you engage with completing documents such as the In Quitclaim Deed With Life Estate Clause on a daily basis, it may lead to some misconceptions.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avoids any troubles related to re-sending a file or performing the same task entirely from the beginning.

If you are not a subscribed user, finding the necessary sample would require a few additional steps: Locate the template using the search feature. Ensure that the In Quitclaim Deed With Life Estate Clause you have found is valid for your state or territory. Review the preview or consult the description that includes details on the template's usage. When the search result meets your requirements, click the Buy Now button. Select the suitable option from the offered subscription plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal payment method. Obtain the form in your preferred file format. Discovering the correct and up-to-date samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your document handling.

- You can always find the suitable sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online collection of forms that provides over 85 thousand samples for diverse fields.

- You can discover the latest and most suitable version of the In Quitclaim Deed With Life Estate Clause by simply searching for it on the platform.

- Find, save, and download templates in your profile or verify the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can conveniently obtain, store in one location, and navigate the templates you save for quick access.

- While on the website, click the Log In button to authenticate.

- Then, go to the My documents page, where your document history is kept.

- Review the descriptions of the forms and download those you need at any time.

Form popularity

FAQ

In Florida, a life estate deed enables a homeowner to retain the right to live in and use the property for their lifetime. After their death, ownership passes directly to the pre-selected beneficiaries without going through probate. By incorporating a quitclaim deed with life estate clause, property owners can ensure their wishes regarding property distribution are fulfilled while avoiding probate delays. This strategy is beneficial for both the life tenant and the remaindermen.

In Indiana, a life estate allows a person to use and enjoy the property for the duration of their life. When the individual passes away, the property transfers automatically to the designated beneficiaries. Utilizing a quitclaim deed with life estate clause provides clear ownership rights for the life tenant while also ensuring a seamless transition of property to heirs. It is an effective tool for estate planning and managing property interests.

Assets that are not part of an estate in Canada typically include joint accounts, life insurance payouts, and retirement accounts with designated beneficiaries. These assets bypass the estate and go directly to the named individuals, which can be beneficial for estate planning. Including provisions, like a quitclaim deed with life estate clause, can clarify the distribution of properties in your estate. It's important to understand these distinctions to effectively manage your assets and avoid unintended complications.

A life estate in Canada allows a person to possess property during their lifetime, while ensuring that the property will pass to another designated individual upon their death. This type of arrangement can often be detailed in a quitclaim deed with life estate clause, providing clear instructions on property transfer. It helps individuals retain control of their property while also allowing for efficient estate planning. Understanding this concept can simplify legacy planning and ensure your wishes are honored.

Yes, you can sell a house while in probate in Florida, but there are specific steps you must follow. The personal representative may need court approval before finalizing the sale, depending on the estate's complexity. Using a quitclaim deed with a life estate clause can help streamline the process as you navigate the legal requirements, but professional help is always wise.

To terminate a life estate in Florida, the life tenant and the remainderman must typically agree to end the arrangement. This often involves executing a deed that reflects the termination, such as a quitclaim deed with life estate clause. Consulting an attorney can provide clarity and ensure all legal notice requirements are fulfilled correctly.

Selling a property with a life estate in Florida is possible, but it requires careful consideration. The life tenant retains the right to live on the property until their death, so any sale may need to involve their consent. Utilizing a quitclaim deed with a life estate clause can facilitate this process, but legal advice is crucial to navigate the complexities involved.

Yes, you can homestead a life estate in Florida, but there are specific requirements to qualify for homestead exemption. The life tenant must occupy the property as their primary residence, and the property must meet the state's eligibility criteria. To ensure you maximize your benefits, consider seeking guidance on the implications of a quitclaim deed with a life estate clause.

Yes, a life estate can be changed in Florida, but the process may vary depending on the circumstances. Typically, you may need to execute a new deed, such as a quitclaim deed with life estate clause, to reflect the changes. Always consult a legal professional to ensure that your new deed complies with state laws and properly documents your intentions.

In California, once a spouse signs a quitclaim deed, they typically relinquish their interest in the property, which can affect their rights to that property. However, rights may vary if the property is community property or if there was a marital agreement in place. Therefore, it is crucial to consider these nuances when executing a quitclaim deed with life estate clause. Consulting with a real estate attorney can provide clarity and protect your legal rights in such situations.