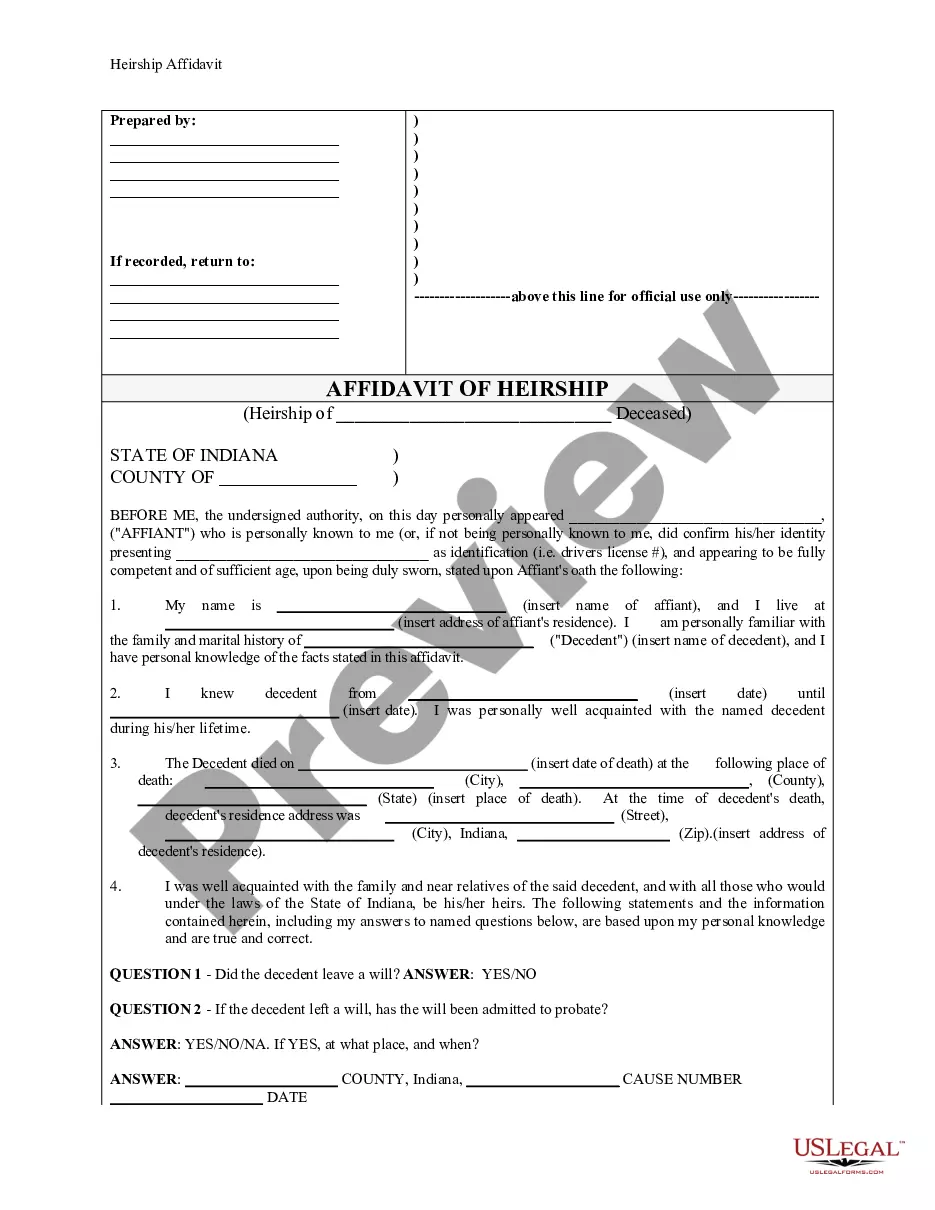

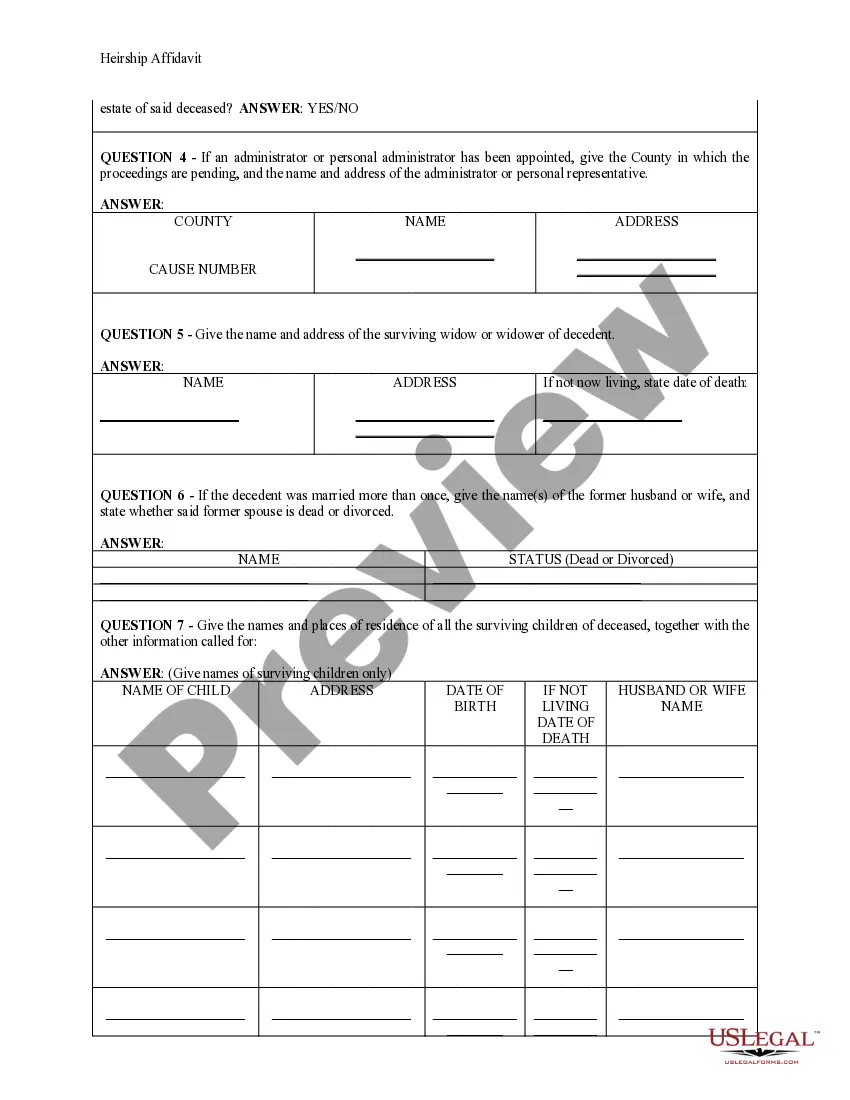

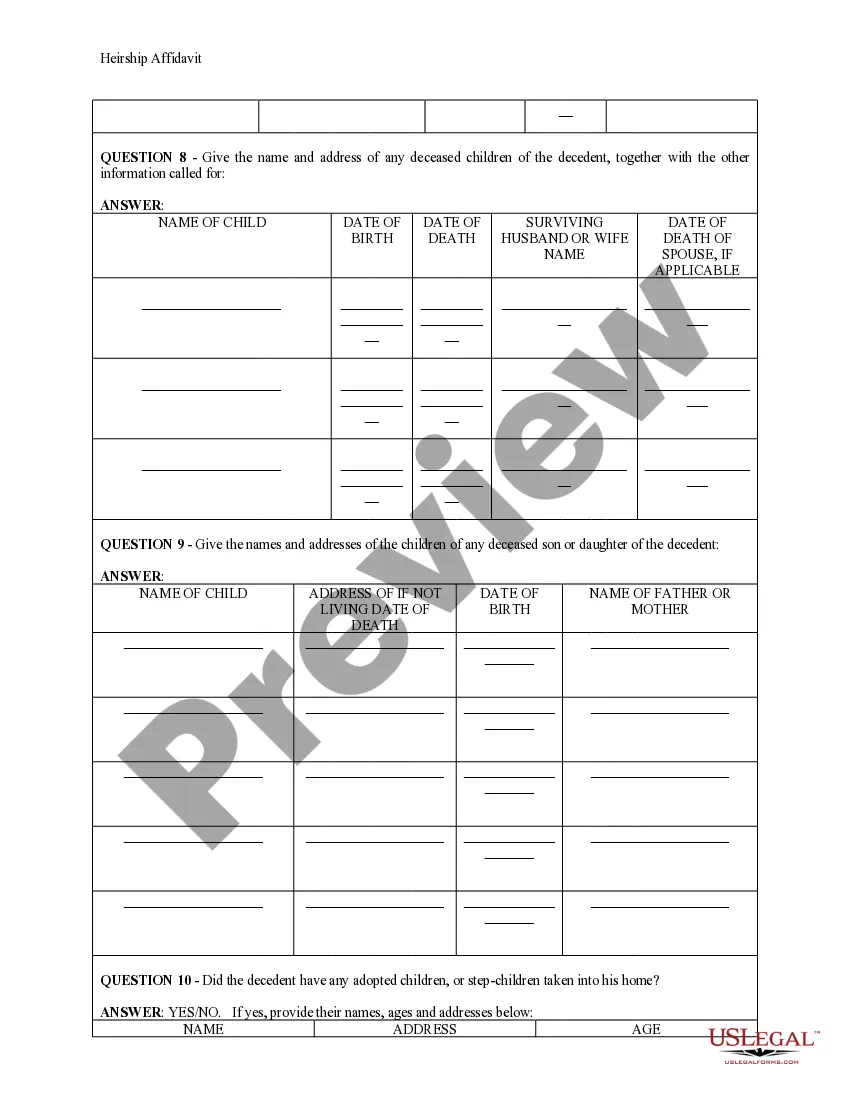

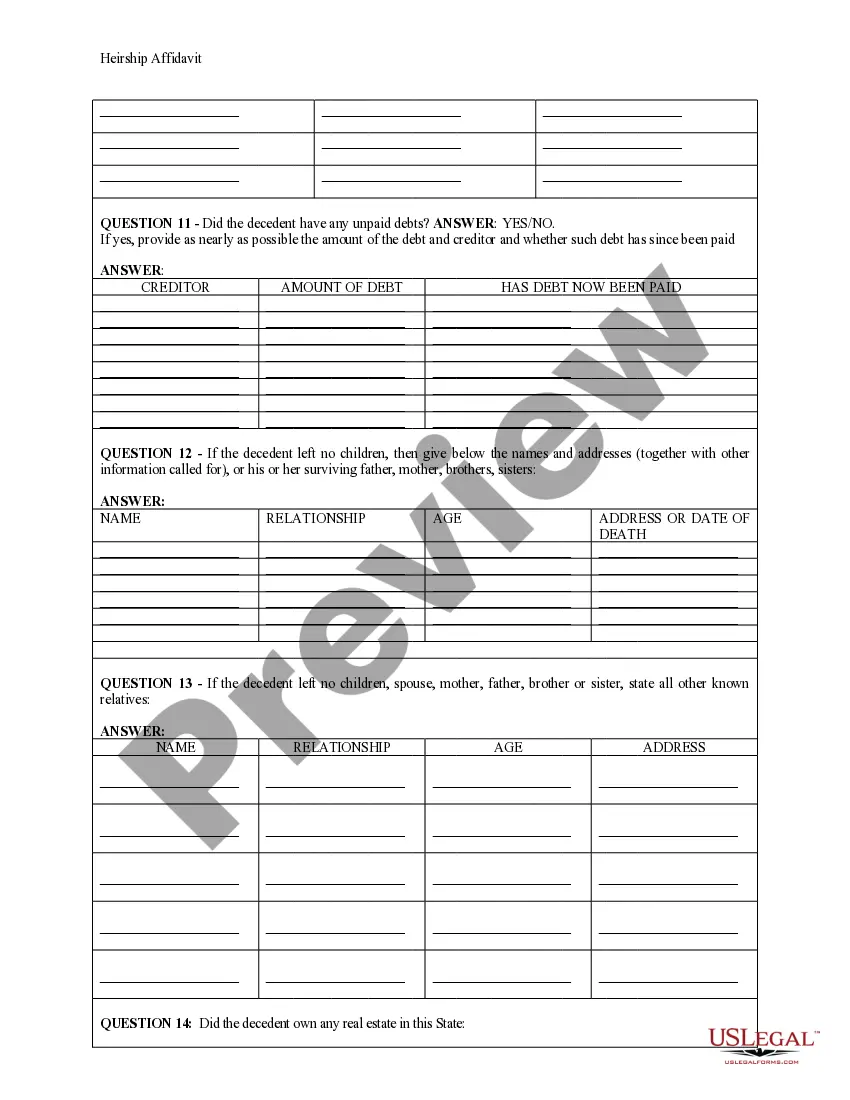

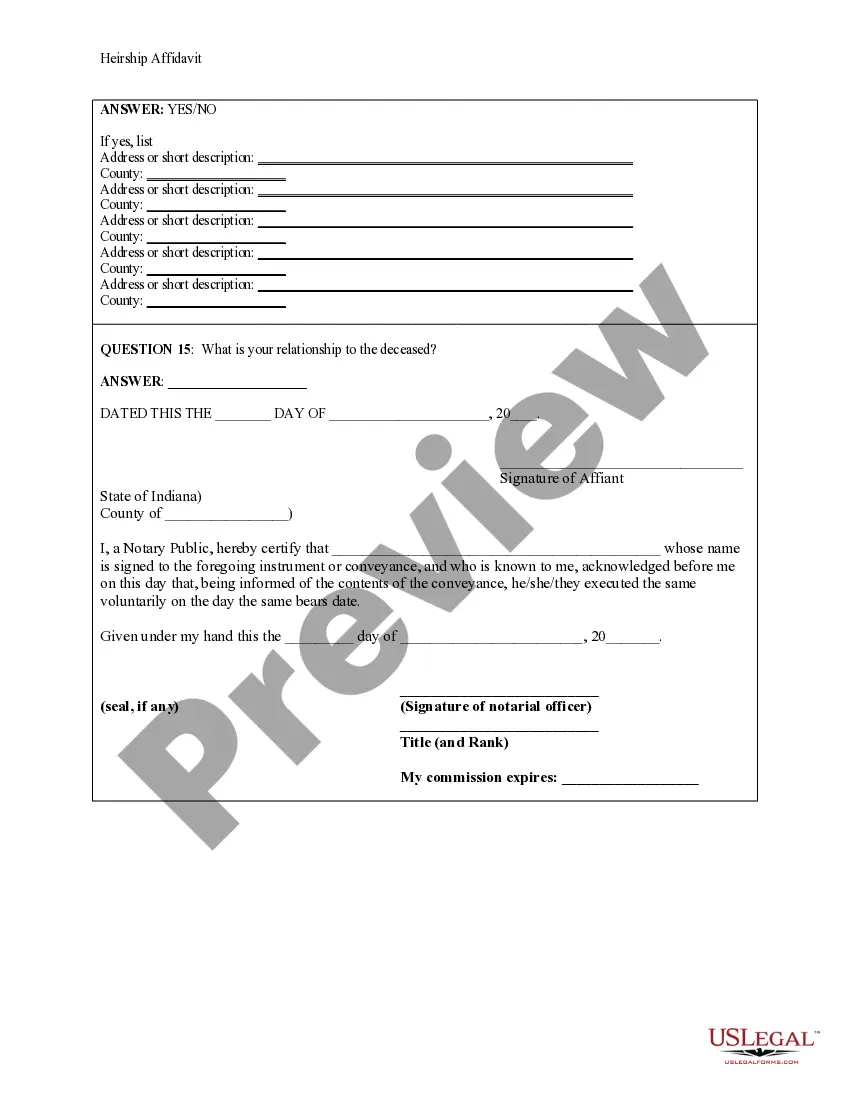

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Indiana Unclaimed Money For Deceased

Description

How to fill out Indiana Heirship Affidavit - Descent?

The Indiana Unclaimed Money For Deceased you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Indiana Unclaimed Money For Deceased will take you only a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or check the form description to verify it suits your needs. If it does not, use the search option to find the correct one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Indiana Unclaimed Money For Deceased (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your paperwork again. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Holders of unclaimed property must perform due diligence to show that they attempted to find the rightful owner of unclaimed property. For any balance greater than $50, written notice must be sent to the owners last known address 60 to 120 days days before the unclaimed property report is filed.

Dormancy periods in Indiana vary by property type. Generally, most property types have a three-year dormancy period. Accounts are considered dormant if the owner of a property has not indicated any interest in the property or if no contact has been made for the allotted dormancy period for that property type.

CLAIM to 46220 to search your name, family, or. business. In addition to the website, you also may contact the. Unclaimed Property Division at 1-866-462-5246 or.

How long do I have to claim the money? ing to the state attorney general FAQ, unclaimed property is held for 25 years, after which it becomes the property of the state.