Indiana Tax Return For Deceased

Description

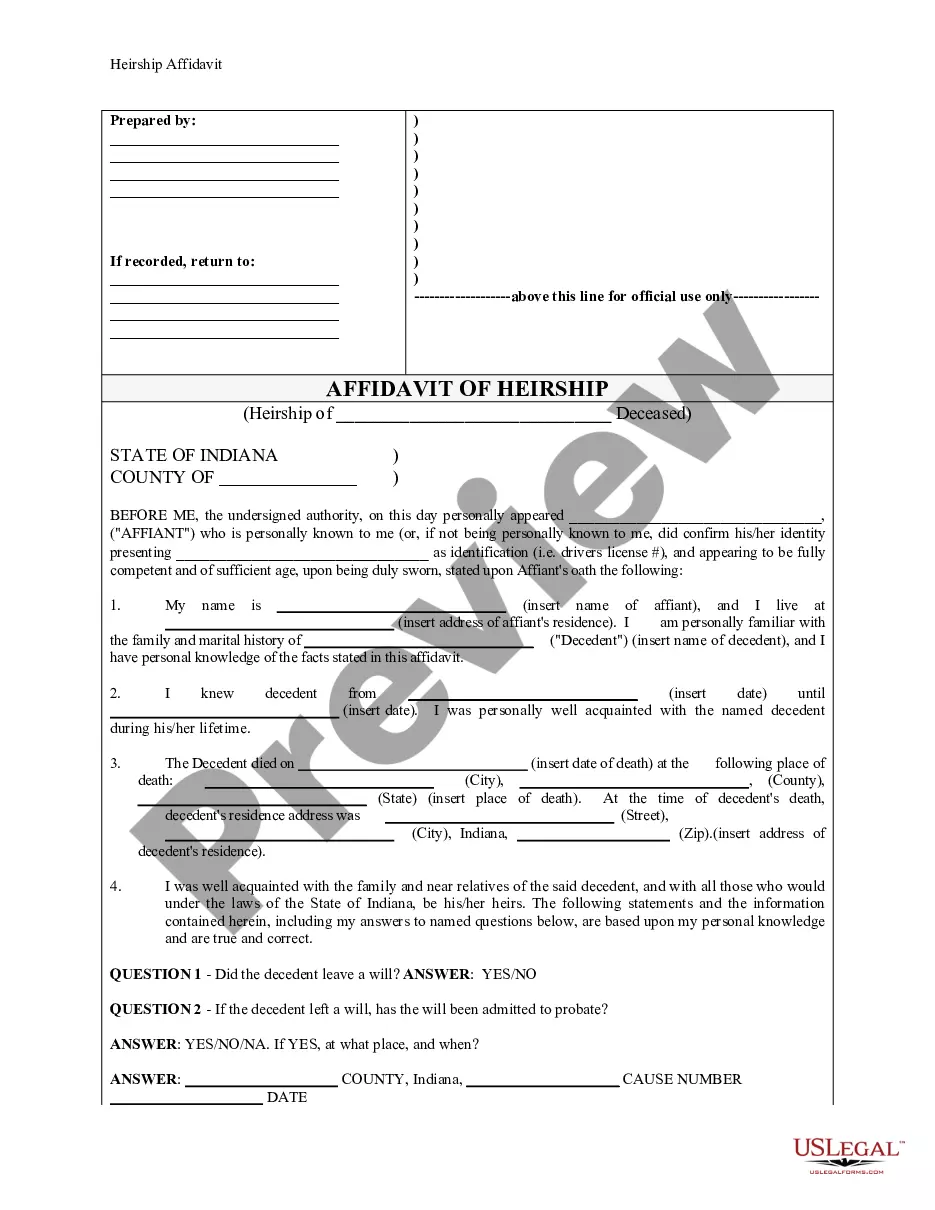

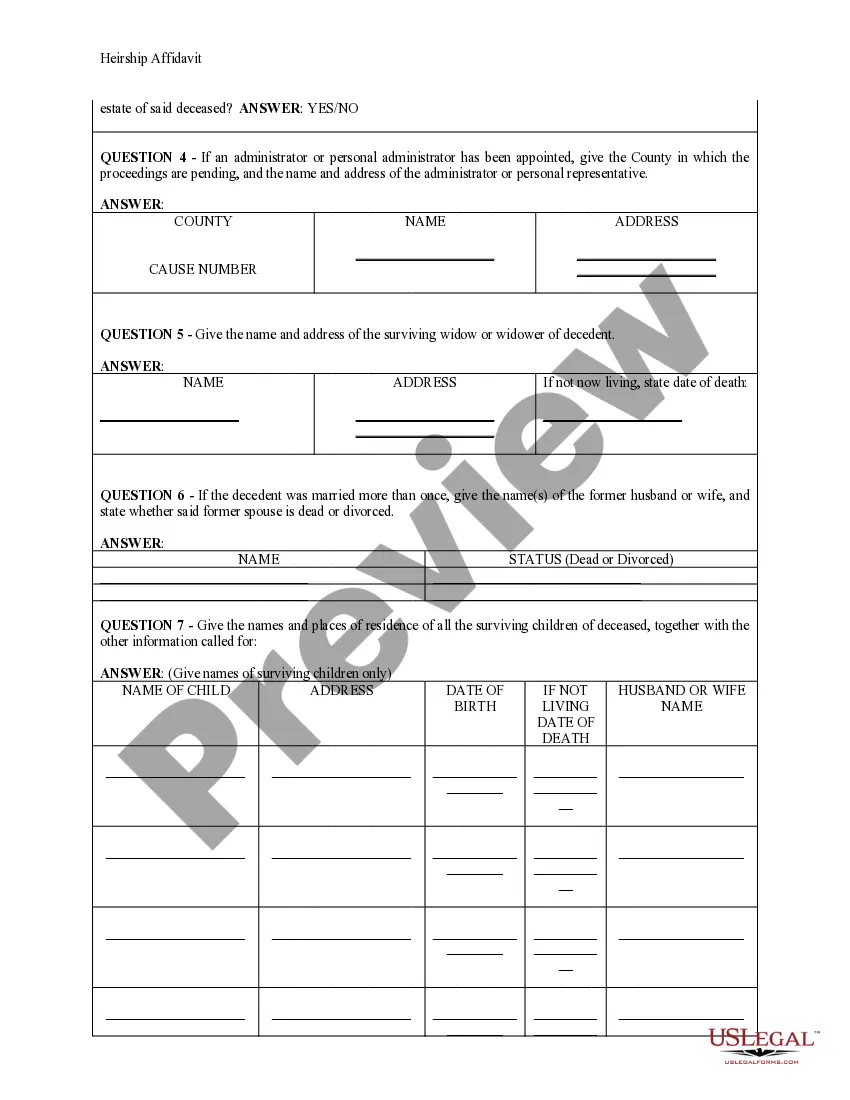

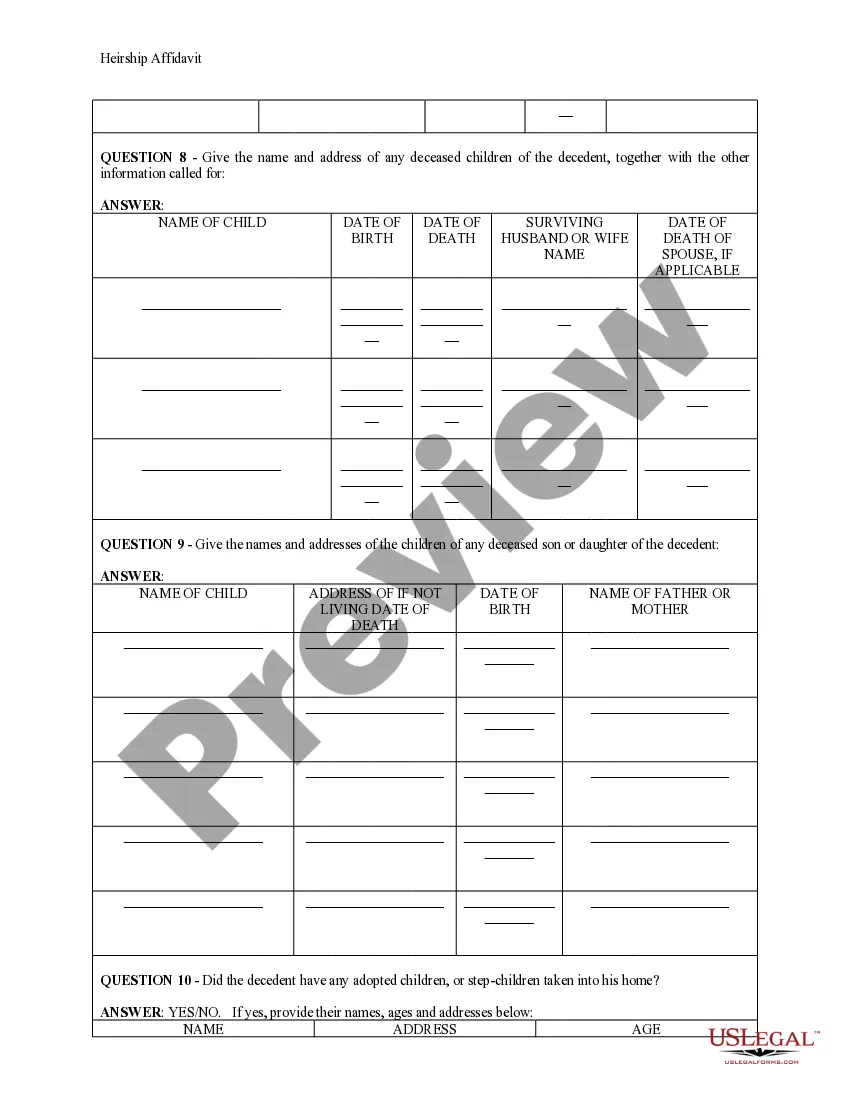

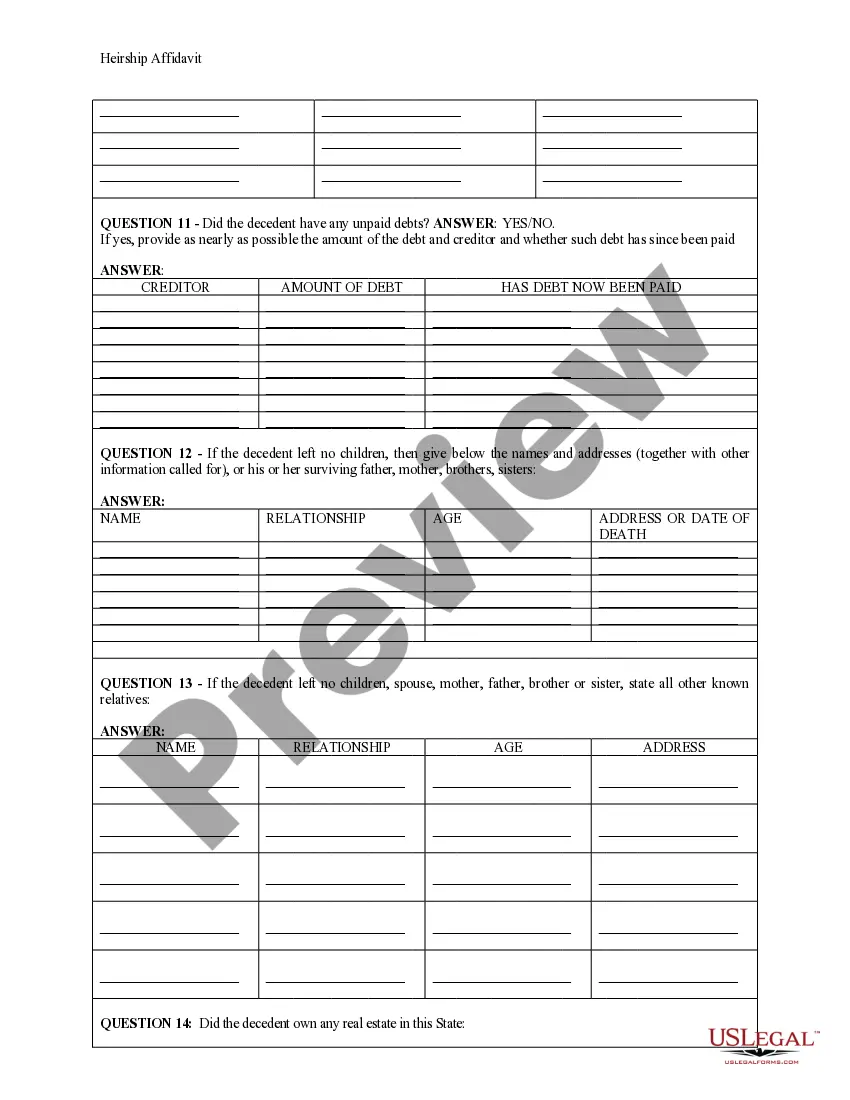

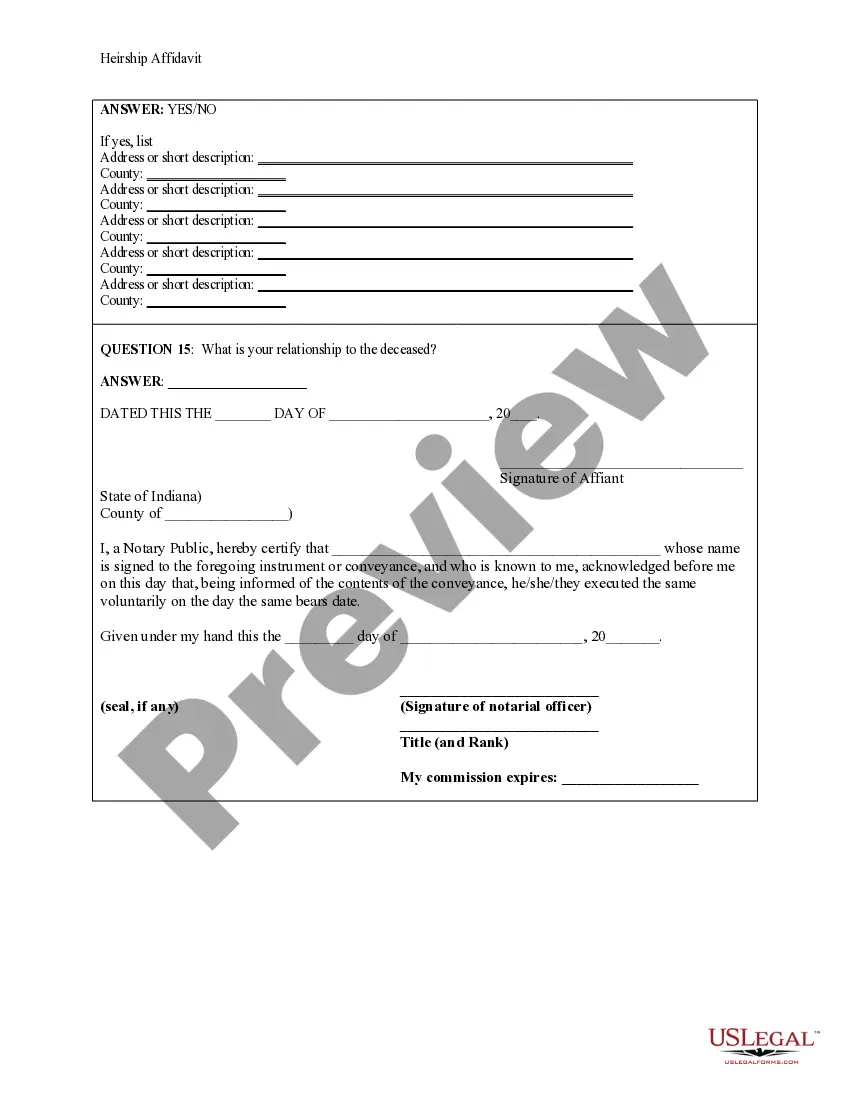

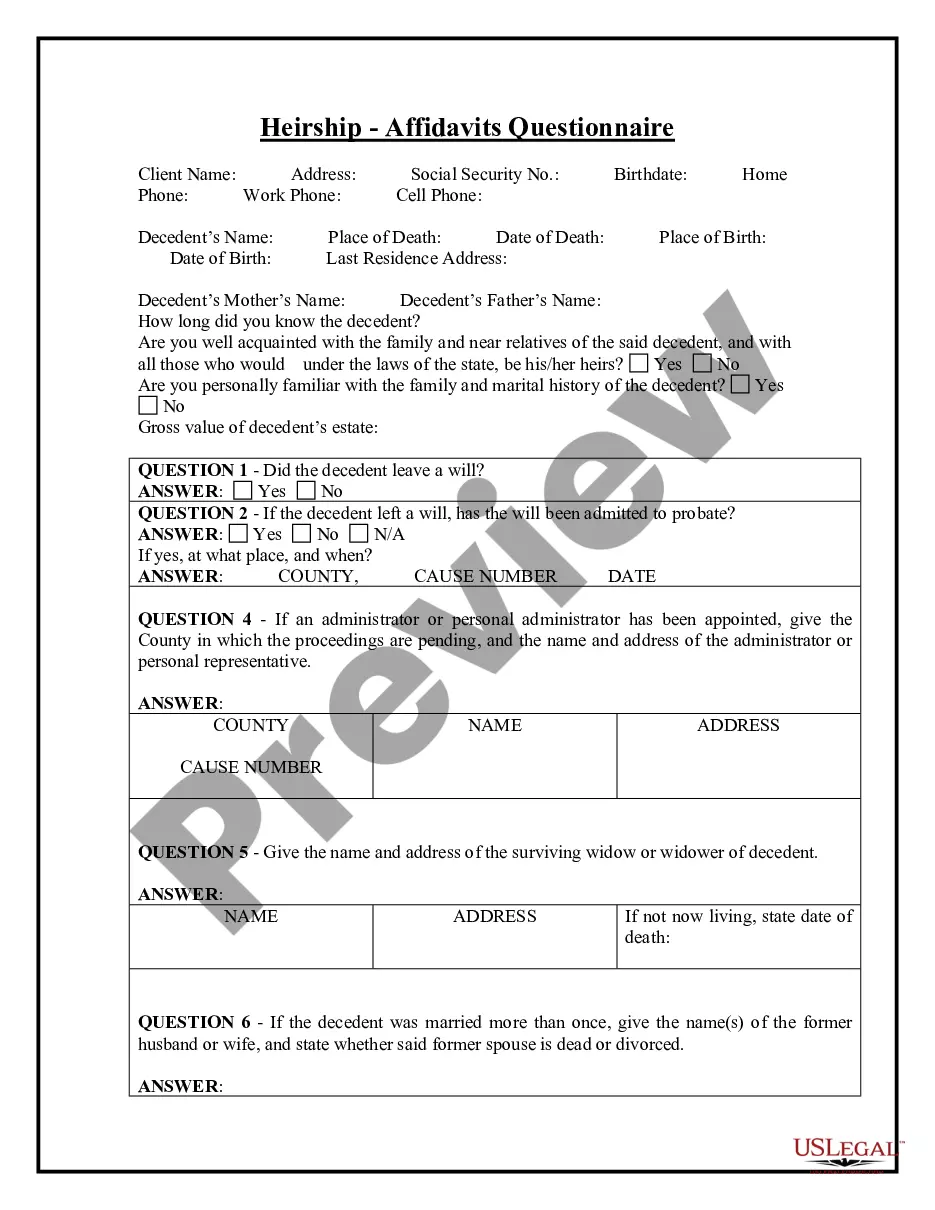

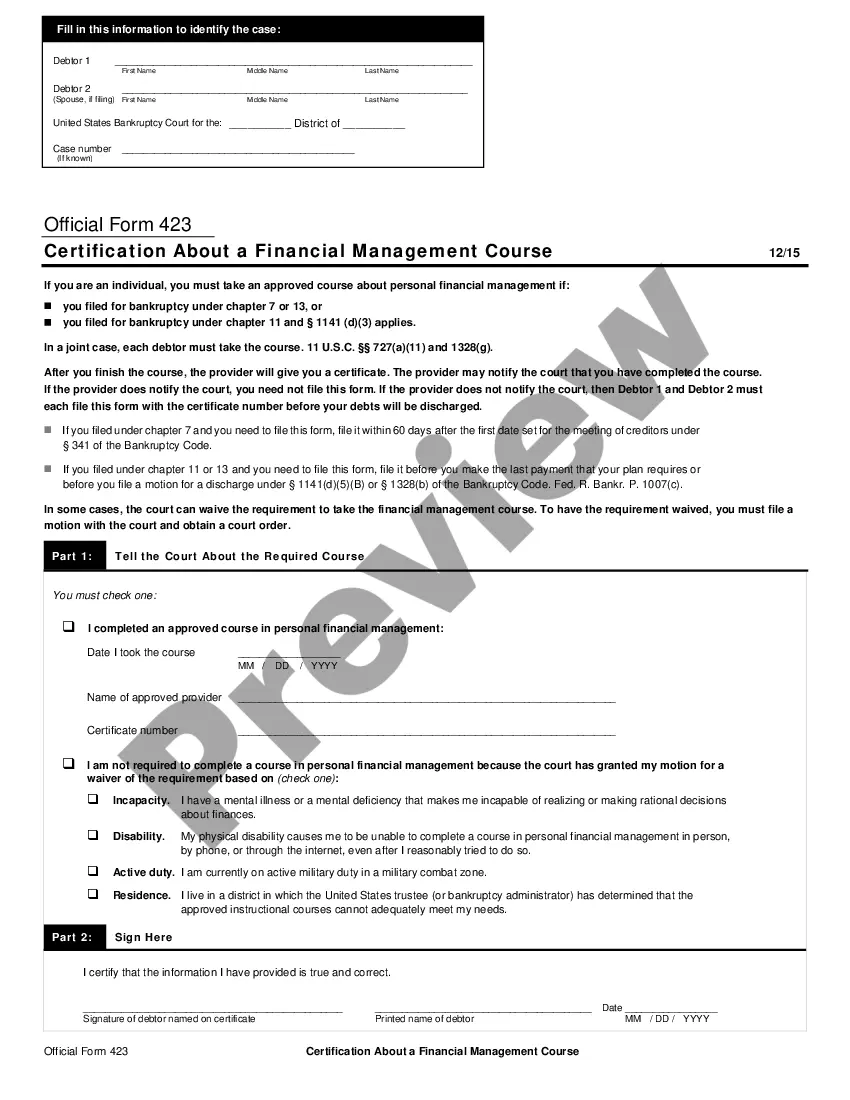

How to fill out Indiana Heirship Affidavit - Descent?

Handling legal documents and procedures might be a time-consuming addition to your entire day. Indiana Tax Return For Deceased and forms like it usually need you to search for them and navigate the way to complete them properly. Therefore, regardless if you are taking care of economic, legal, or individual matters, using a thorough and practical web catalogue of forms on hand will help a lot.

US Legal Forms is the number one web platform of legal templates, featuring over 85,000 state-specific forms and numerous tools to assist you complete your documents easily. Discover the catalogue of appropriate papers available with just one click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Shield your document management procedures using a high quality services that lets you put together any form within minutes without having extra or hidden cost. Just log in in your profile, find Indiana Tax Return For Deceased and acquire it right away within the My Forms tab. You can also access previously saved forms.

Would it be the first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you’ll get access to the form catalogue and Indiana Tax Return For Deceased. Then, adhere to the steps below to complete your form:

- Ensure you have found the correct form by using the Review option and reading the form information.

- Choose Buy Now once ready, and choose the monthly subscription plan that is right for you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise assisting consumers handle their legal documents. Discover the form you need today and streamline any operation without having to break a sweat.

Form popularity

FAQ

The administrator, executor, or beneficiary must: File a final tax return. File any past due returns. Pay any tax due.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.

The Canada Revenue Agency requires you to fill out the terminal tax return either six months after the time of death or on April 30 of the year following the date of death. For example, if the person died on February 2, 2023, you must file the terminal tax return by July 30, 2023, or April 30, 2024.

What if an individual who has since deceased receives an Automatic Taxpayer Refund check? The widow or executor of the estate will need to file a State Form 57193 Reissuance Of Refund Issued To A Deceased Person with the State Comptroller's Office.

If paper-filed, write ?Deceased,? the taxpayer's name, and the taxpayer's date of death across the top of the final return. If e-filed, follow the directions provided by the tax software and be sure to indicate the taxpayer is deceased and the date of death.