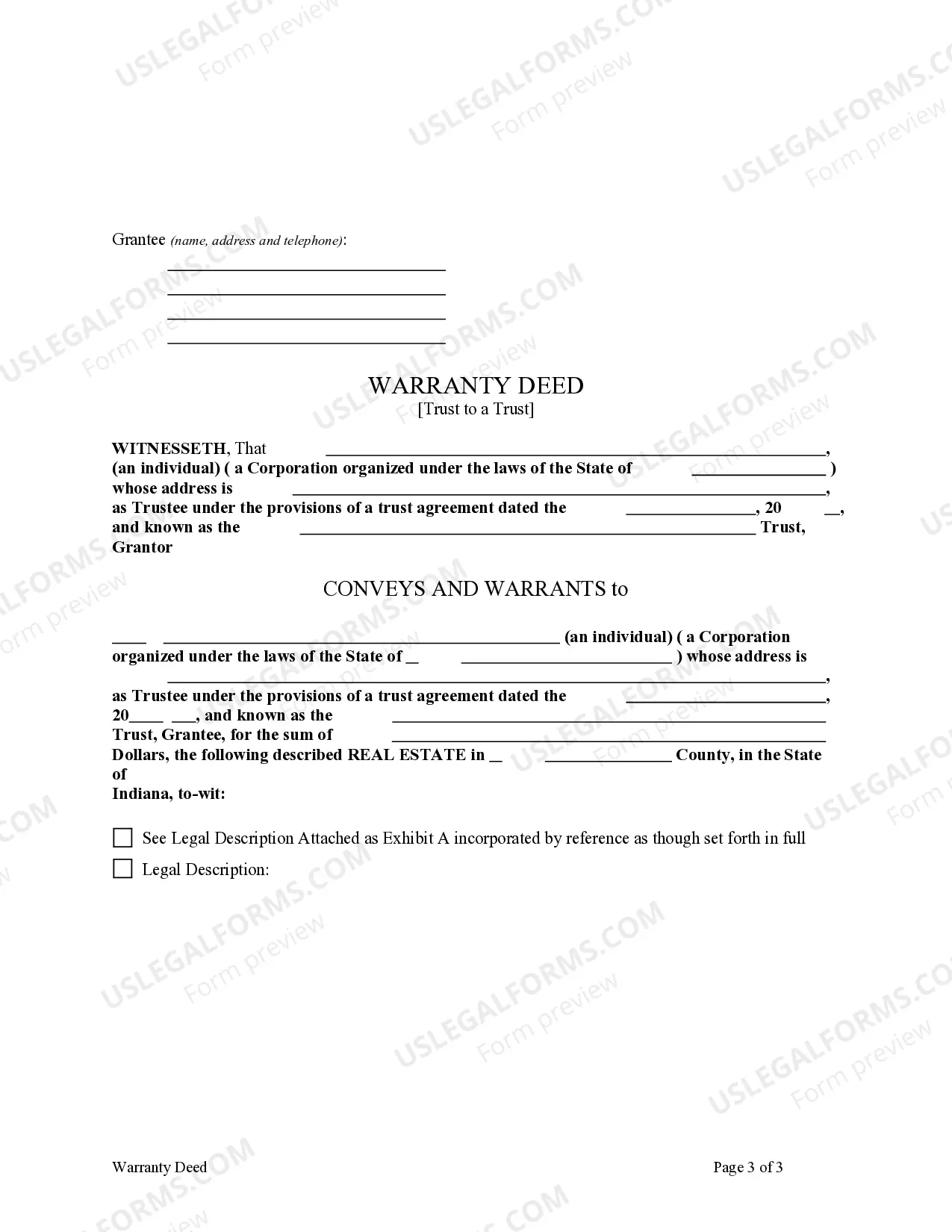

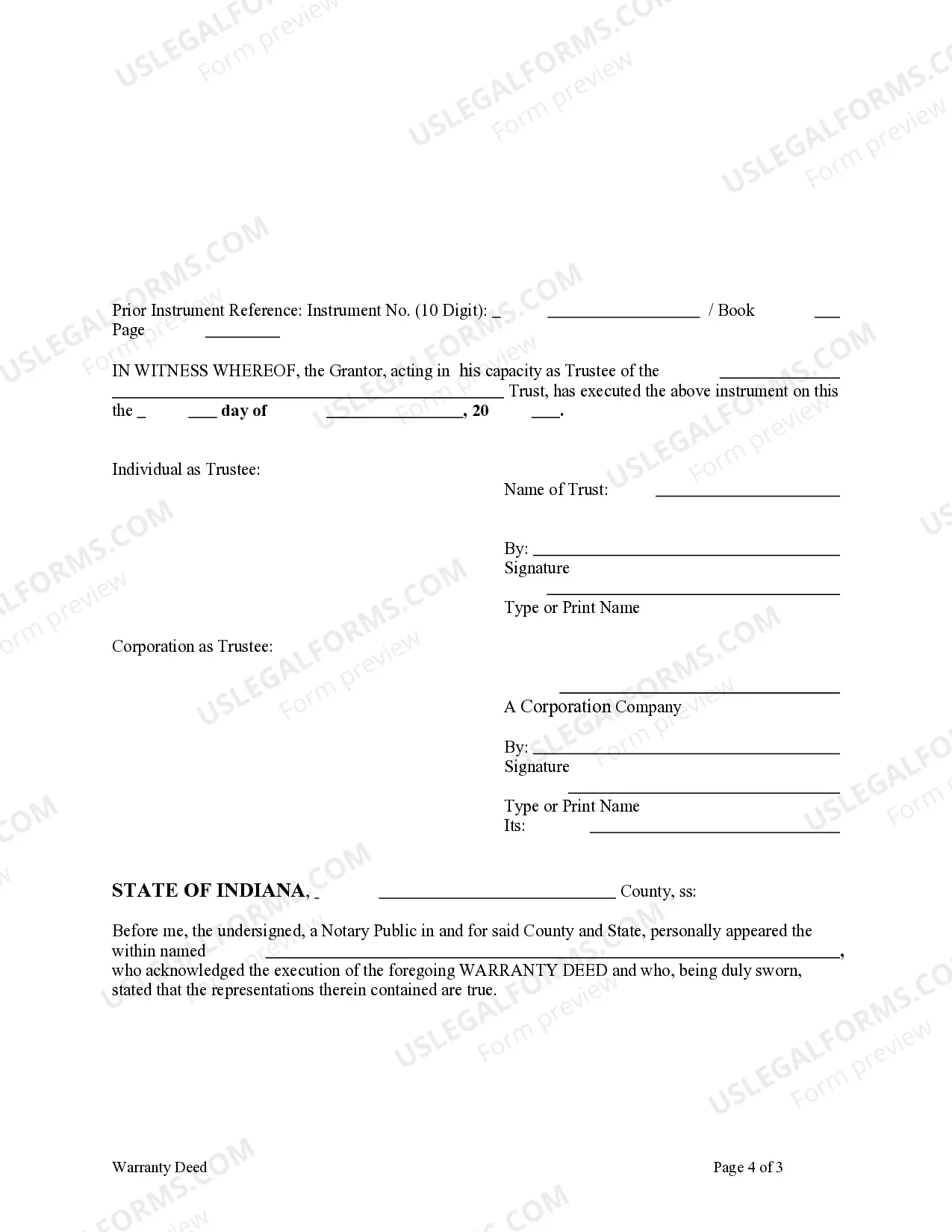

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Trust Grantor Form With Different Trustee

Description

Form popularity

FAQ

Generally, the creator of an irrevocable trust cannot change its terms once established. This is one of the defining features of an irrevocable trust. However, if you need flexibility, consider using a trust grantor form with different trustee options that may offer alternative solutions. For detailed guidance, uslegalforms can provide resources tailored to your specific trust needs.

Not necessarily; a grantor is not automatically a trustee. Depending on how the trust is set up, the roles can be separated. The trust grantor form with different trustee choices can clarify these roles, allowing individuals to designate separate trustees for better management. Understanding these distinctions is essential for effective trust administration.

Yes, a grantor can change the trustee provided the trust agreement allows for such changes. If you have a trust grantor form with different trustee options, it allows flexibility in managing your trust. Typically, you will need to follow specific procedures outlined in your trust document or local laws. If you're unsure, consider reviewing your options or seeking guidance through uslegalforms, which can help you navigate this process smoothly.

Typically, the trust grantor holds the power to replace a trustee as outlined in the trust documents. If you are using a trust grantor form with a different trustee, it makes the replacement process clear and official. Always verify your state’s regulations and consult legal advice to confirm your authority to make this change.

To change a trustee, you require a properly completed trust grantor form with a different trustee. This form must detail the reasons for the change and the powers of the new trustee. Consulting with an attorney can help you ensure all documentation meets legal standards and your specific needs.

Changing a trustee can be straightforward when you have a trust grantor form with a different trustee ready. The complexity usually lies in following the proper procedures dictated by your trust document and state law. With the right guidance, you can navigate this process smoothly.

You can definitely change your trustees using a trust grantor form with a different trustee. This form allows you to formally designate a new trustee while establishing clear terms for their responsibilities. Consider consulting with a legal professional to ensure all modifications comply with your state laws.

Yes, it is entirely possible to change trustees when using a trust grantor form with a different trustee. A grantor can initiate the process by following the appropriate legal steps outlined in their trust document. It's important to ensure that all parties involved understand the change, as proper communication helps prevent disputes.

Form 56 is a notification to the IRS indicating a change of trustee for a trust. This form is essential when a Trust grantor form with different trustee is completed, allowing the new trustee to act on behalf of the trust. It plays a vital role in ensuring the IRS recognizes the new trustee's authority. To obtain the necessary forms and guidance, you can access US Legal Forms for streamlined solutions.

A grantor trust generally does not require a new EIN when the grantor passes away, as the trust continues to exist. However, a Trust grantor form with different trustee may need to be filed to update the trustee's details with the IRS. It's crucial to review the specific terms of the trust as they may dictate different requirements. To navigate this smoothly, consider utilizing US Legal Forms for correct documentation.