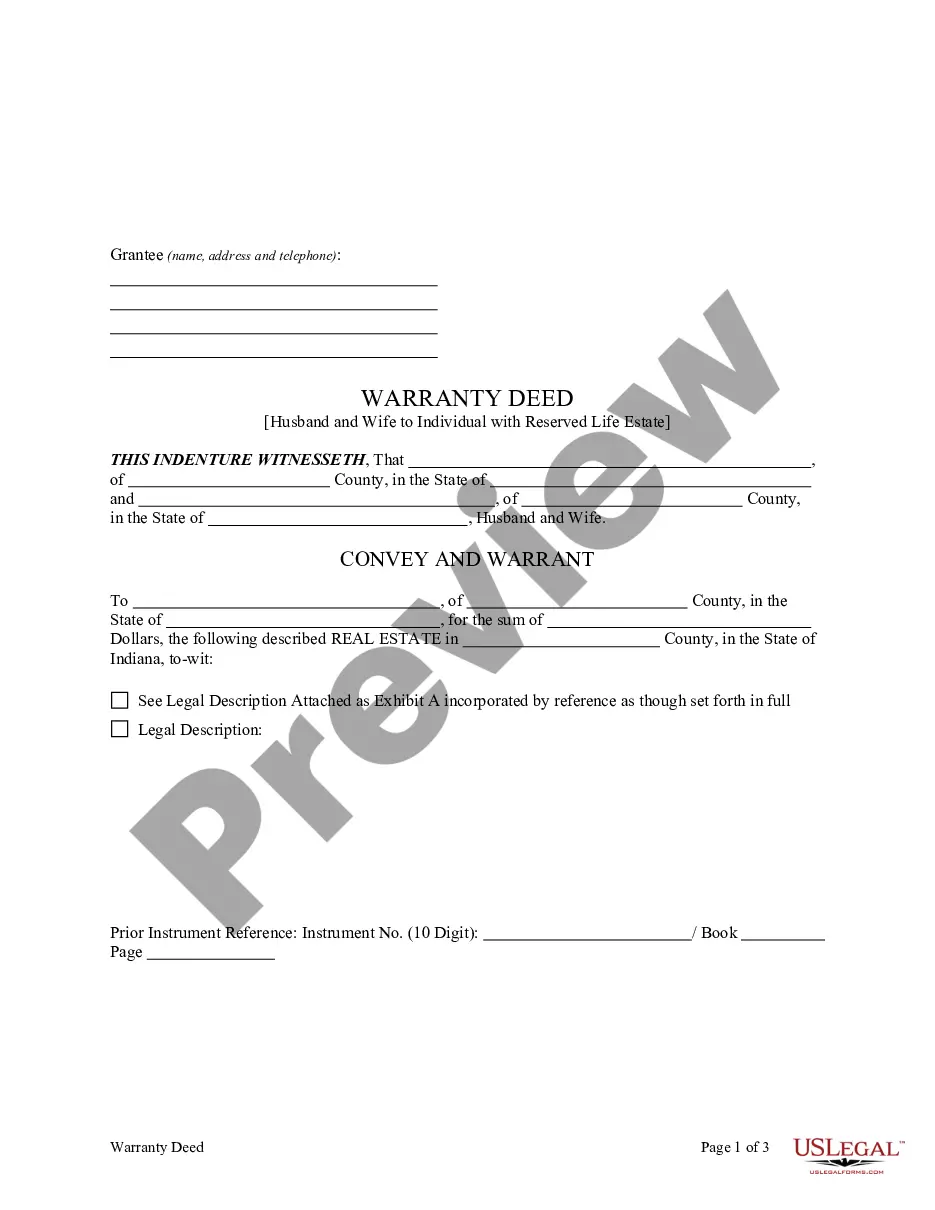

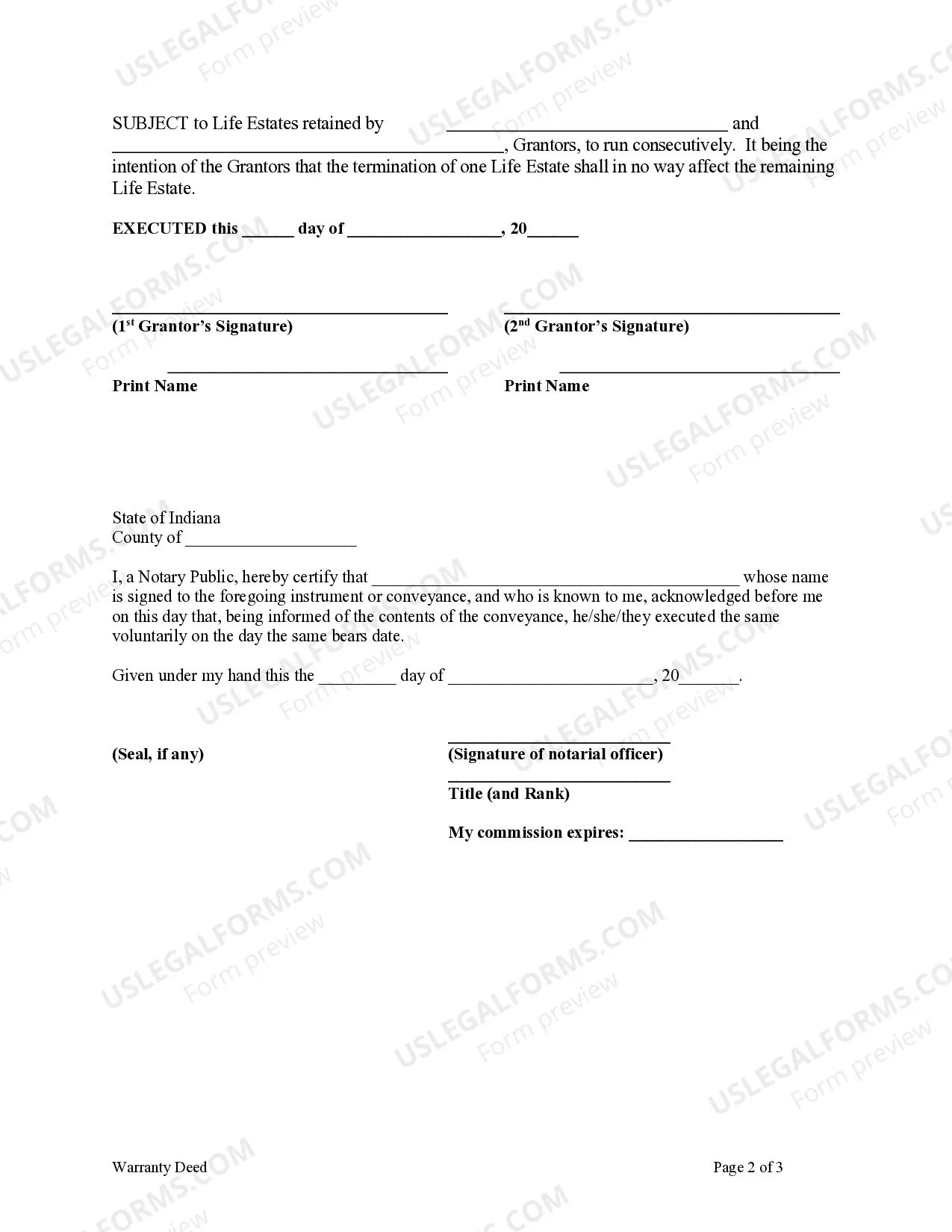

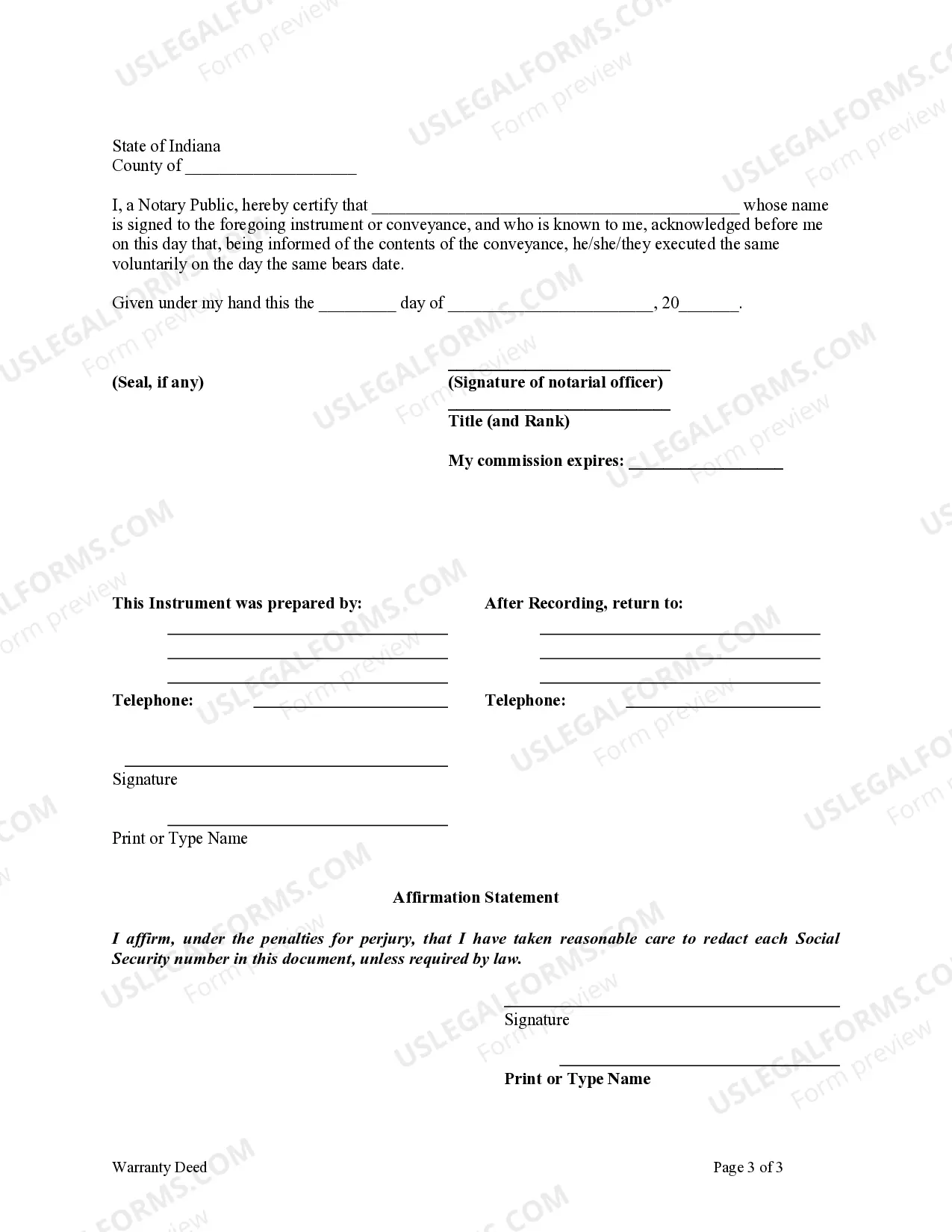

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life Estate Deed Indiana Without Probate

Description

How to fill out Indiana Warranty Deed To Child Reserving A Life Estate In The Parents?

Creating legal paperwork from the ground up can frequently be intimidating.

Certain situations may necessitate extensive research and significant financial investment.

If you're looking for an easier and more economical method of drafting a Life Estate Deed Indiana Without Probate or any other documents without the hassle, US Legal Forms is always available to you.

Our online library of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

- With just a few clicks, you can swiftly acquire state- and county-specific documents meticulously prepared for you by our legal specialists.

- Utilize our platform whenever you require dependable and credible services through which you can effortlessly find and download the Life Estate Deed Indiana Without Probate.

- If you're a returning user with an established account, simply Log In to your profile, choose the form, and download it or re-download it anytime in the My documents section.

- Are you not yet registered? No problem. It only takes a few minutes to create your account and browse the catalog.

Form popularity

FAQ

Yes, bank accounts can go through probate in Indiana if they are only in the deceased person's name. However, accounts with designated beneficiaries or those held jointly may avoid probate. Utilizing a life estate deed in Indiana without probate can also be part of a broader strategy to safeguard your assets and streamline the distribution process. By planning appropriately, you help ensure that your financial affairs remain straightforward for your heirs.

Probate is not always mandatory in Indiana, but it is often necessary for larger estates or when assets are solely in the deceased's name. There are cases where a life estate deed in Indiana without probate can be used to transfer property directly, thereby avoiding the probate process altogether. Each situation is unique, so it is wise to consult with a legal professional to determine the best course of action for estate planning. This proactive approach can simplify matters for your loved ones after your passing.

Yes, it is possible to avoid probate in Indiana. Strategies include establishing living trusts, holding assets jointly, and using a life estate deed in Indiana without probate to designate beneficiaries for property. These methods grant you control over your estate and eliminate the need for the court's involvement in asset distribution. By planning ahead, you can ensure your heirs receive their inheritance quickly and efficiently.

Probate in Indiana typically occurs when a person passes away and leaves behind assets that are solely in their name. This process can be triggered by certain factors, especially if wills are involved or if there are disputes among heirs. One way to avoid probate is by utilizing a life estate deed in Indiana without probate to transfer property directly to beneficiaries. This option allows you to bypass a lengthy probate process and ensures a smoother transition of your estate.

Not all estates in Indiana must go through probate. Certain assets, like those held in joint tenancy or secured by a life estate deed, can transfer directly to heirs. This allows for a more straightforward process and can help avoid the often complicated probate system. Understanding your estate’s structure is crucial, which is where platforms like USLegalForms can assist with tailored legal solutions.

While a life estate deed allows for a smooth transition of property, it has some drawbacks. For instance, once the deed is in place, the owner cannot sell or refinance the property without the consent of the remainderman. Additionally, this type of arrangement does not provide the same flexibility or control as traditional ownership. Evaluating your long-term goals is essential before deciding on this path.

In Indiana, real estate does not necessarily have to go through probate if certain steps, like using a life estate deed, are taken. By implementing this deed, property ownership can pass directly to designated individuals without undergoing probate. This approach ensures a timely transfer and reduces the burden on your heirs. However, seeking guidance on the best approach to your situation is always wise.

Yes, a Transfer on Death (TOD) deed avoids probate in Indiana. With a TOD deed, the designated beneficiary receives the property automatically upon your passing, eliminating the need for probate court involvement. This provides a direct and efficient transfer process, keeping the estate out of probate. It’s a popular choice for many looking to simplify the transfer of real estate.

To transfer ownership of a house in Indiana after death, you can utilize a life estate deed. This method allows you to designate who will receive your property while avoiding probate. It provides a straightforward way to ensure your loved ones inherit your home without the lengthy procedure typical of probate. Consulting with a legal professional can ensure the deed is properly executed.

To transfer real estate without probate in Indiana, consider using a life estate deed. This legal document allows you to designate a remainderman who will automatically receive full ownership upon your death, eliminating probate delays. Additionally, you can explore other options like transferring property into a trust. For a comprehensive guide and assistance, using resources like uslegalforms can help clarify the process and ensure all legal factors are addressed.