Power Of Attorney Grantor With Balance

Description

How to fill out Indiana Warranty Deed - Individual Grantor, By Attorney In Fact, To Individual?

Bureaucracy necessitates exactness and correctness.

If you do not manage the completion of documentation like Power Of Attorney Grantor With Balance regularly, it can lead to some misunderstanding.

Choosing the appropriate example from the outset will guarantee that your document submission proceeds smoothly and avert any troubles of resending a file or repeating the same task from scratch.

If you are not a subscribed member, finding the needed sample will require a few additional steps.

- Acquire the appropriate example for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms directory housing over 85 thousand samples for various fields.

- You can obtain the latest and most pertinent version of the Power Of Attorney Grantor With Balance by simply searching for it on the platform.

- Locate, save, and store templates in your account or review the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can seamlessly obtain, keep in one location, and navigate through the templates you save for quick access.

- When on the website, click the Log In button to authorize.

- Next, proceed to the My documents page, where the history of your forms is maintained.

- Review the descriptions of the forms and save those you need at any time.

Form popularity

FAQ

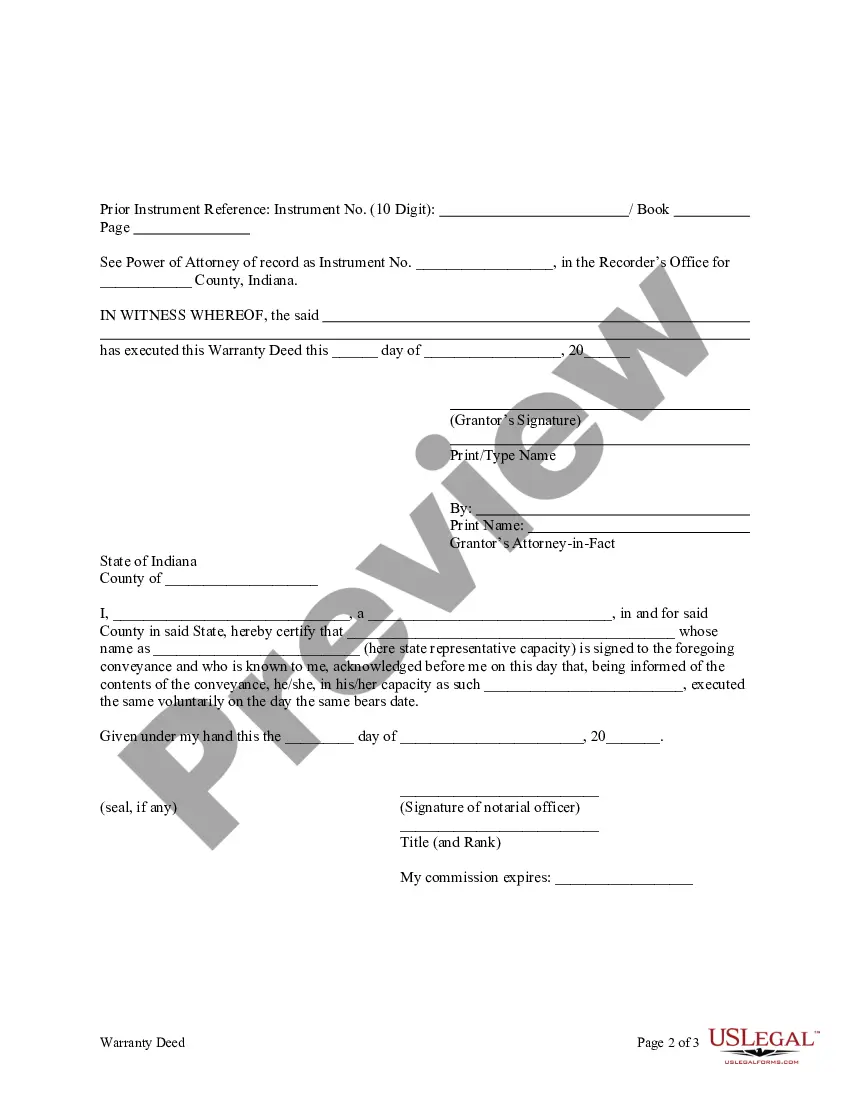

Can Power of Attorney pay themselves? In short, lay attorneys such as family and friends are not usually paid for their work as an attorney. The job is typically done out of love for the donor. However, as an attorney, you are fully entitled to reclaim any expenses that you may incur in the performance of your duties.

Unless the PoA excludes compensation, an attorney for property is generally entitled to compensation at the following rates: - 3% of income and capital receipts - 3% of income and capital disbursements - 0.6% per year of assets under management.

In some provinces, unless you state otherwise in the power of attorney, a person appointed under a continuing power of attorney may have a right to be paid.

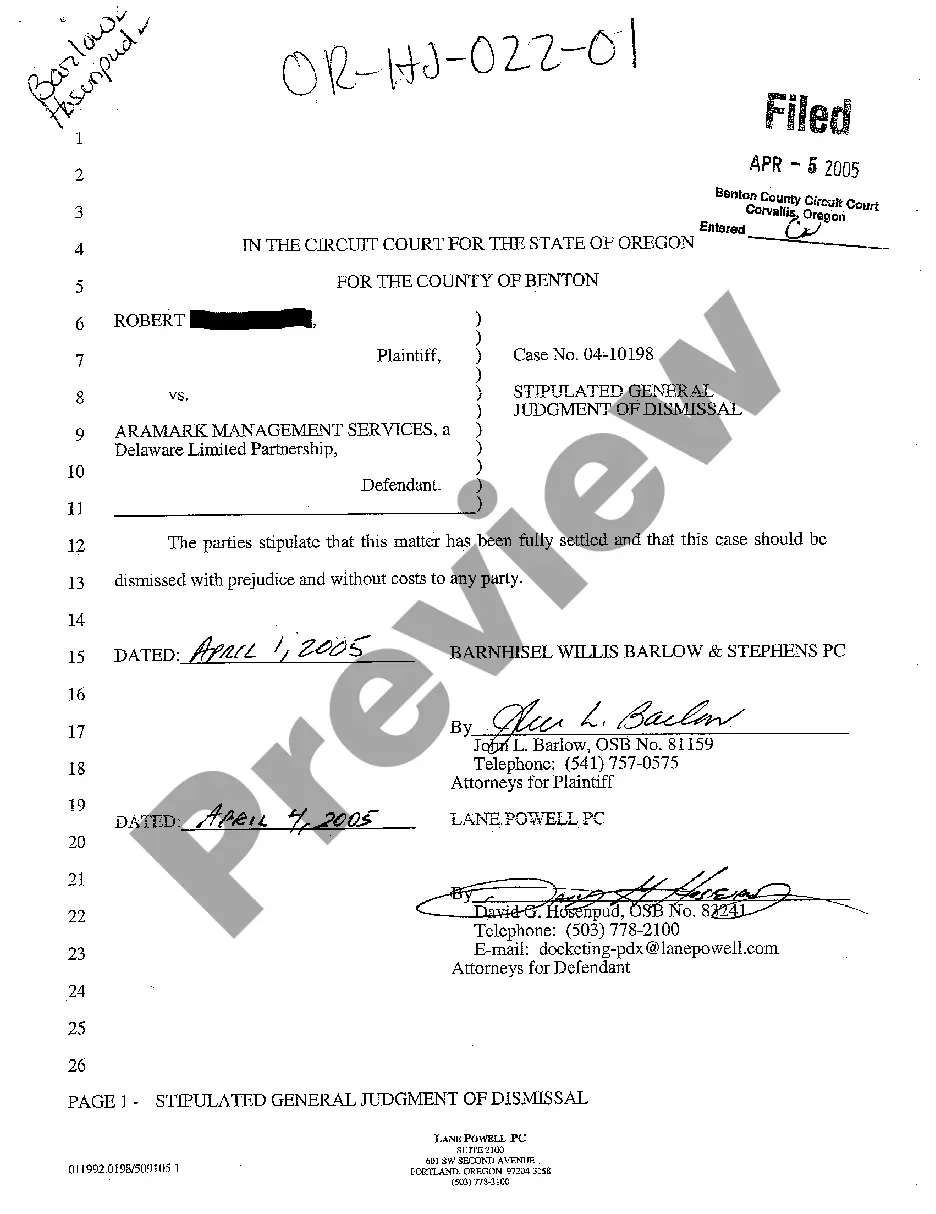

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.

Am I liable for the Donor's Debts? In a word, no. As an Attorney you do not act as a guarantor and should only pay debts from the Donors own resources. If the resources fall short you may have to get debt advice on their behalf.