Unemployment In Chicago 1920

Description

How to fill out Illinois Unemployment Insurance Registration Package?

Legal document managing can be frustrating, even for the most experienced professionals. When you are looking for a Unemployment In Chicago 1920 and do not get the a chance to commit searching for the right and up-to-date version, the procedures could be stress filled. A robust web form catalogue might be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available at any time.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms covers any demands you could have, from personal to business paperwork, in one location.

- Utilize advanced resources to finish and manage your Unemployment In Chicago 1920

- Access a resource base of articles, tutorials and handbooks and materials connected to your situation and requirements

Help save effort and time searching for the paperwork you need, and make use of US Legal Forms’ advanced search and Review tool to locate Unemployment In Chicago 1920 and download it. For those who have a membership, log in in your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to find out the paperwork you previously downloaded as well as manage your folders as you can see fit.

Should it be your first time with US Legal Forms, make a free account and acquire unrestricted access to all benefits of the library. Listed below are the steps to take after accessing the form you want:

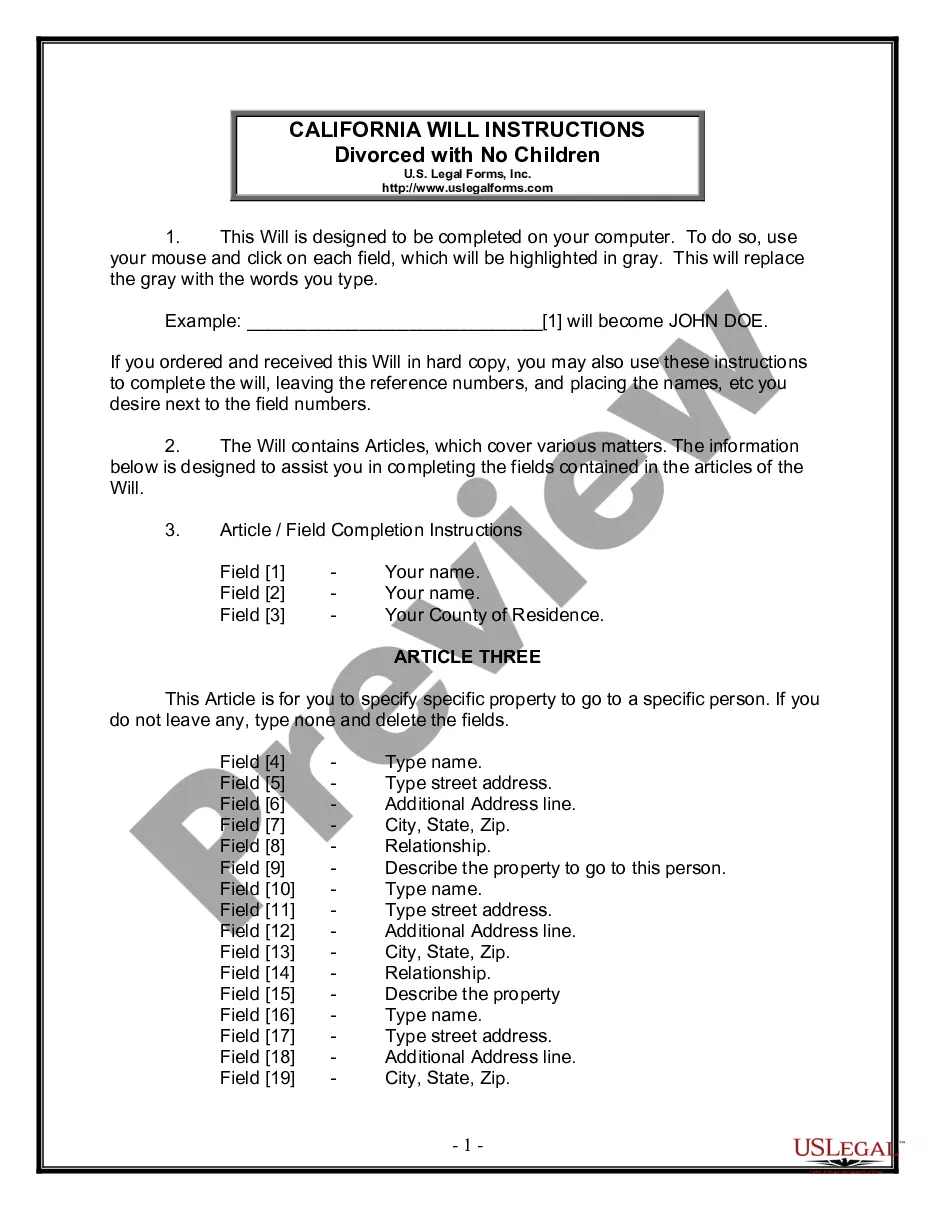

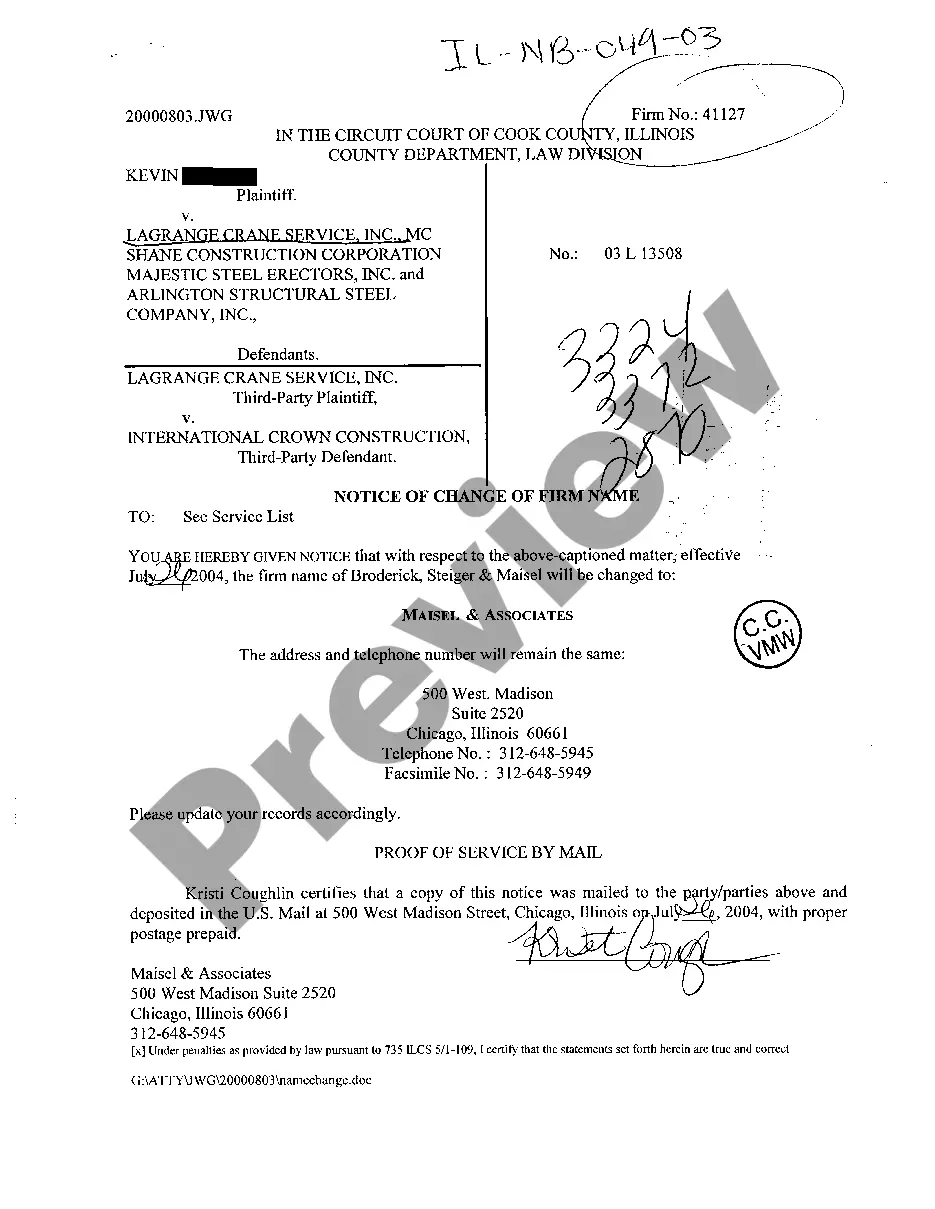

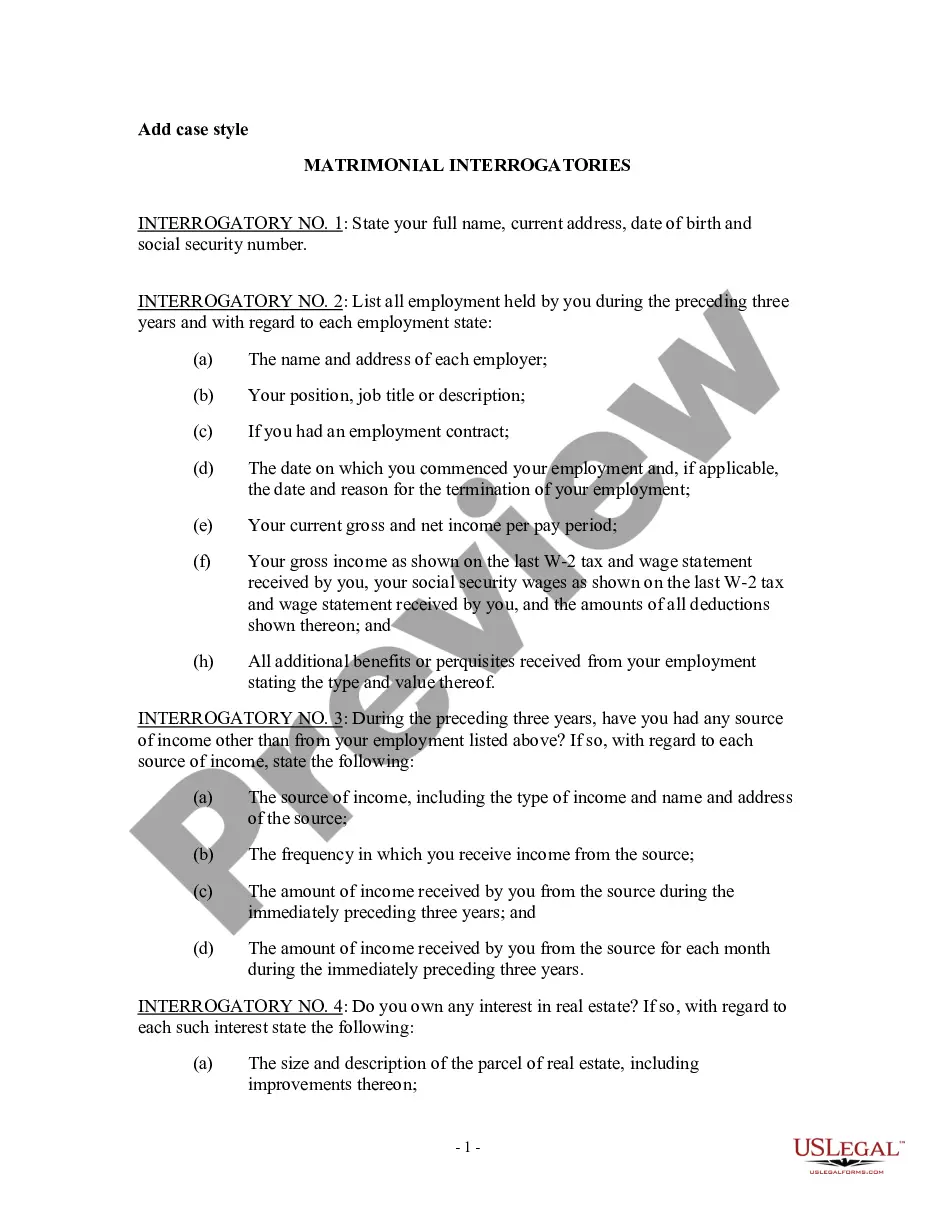

- Validate it is the proper form by previewing it and reading its description.

- Ensure that the sample is approved in your state or county.

- Select Buy Now once you are ready.

- Select a subscription plan.

- Pick the formatting you want, and Download, complete, eSign, print out and send out your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and stability. Enhance your everyday papers administration in a smooth and user-friendly process today.

Form popularity

FAQ

If you become unemployed, you may file a claim online at IDES.Illinois.gov or at an IDES office. Office locations can be found online or by calling IDES Claimant Services. File your claim during the first week after you have become unemployed or as soon thereafter as possible.

You must file a benefits claim by the end of the first week in which you are unemployed. If you file later and do not request backdating, your claim will start the week it was filed. If you file after your first week of being unemployed but within a year, you can request the IDES backdate your claim.

When can benefit payments be denied? Voluntarily leaving work without good cause. ... Being discharged for misconduct connected with work. ... Not being able to work or available for work. ... Refusing an offer of suitable work. Knowingly making false statements to obtain benefit payments.

A weekly benefit amount is determined by: ? Adding the amount of the two highest earning quarters from a base period; ? Taking 47% of the total received from adding the two highest earning quarters; and ? Dividing the result by 26. The maximum individual weekly unemployment benefit is currently $484.00.

You may be disqualified if you: a. quit your job voluntarily without good cause attributable to your employer; b. were discharged for misconduct in connection with your work; c. were discharged for a felony or theft in connection with your work; or d.