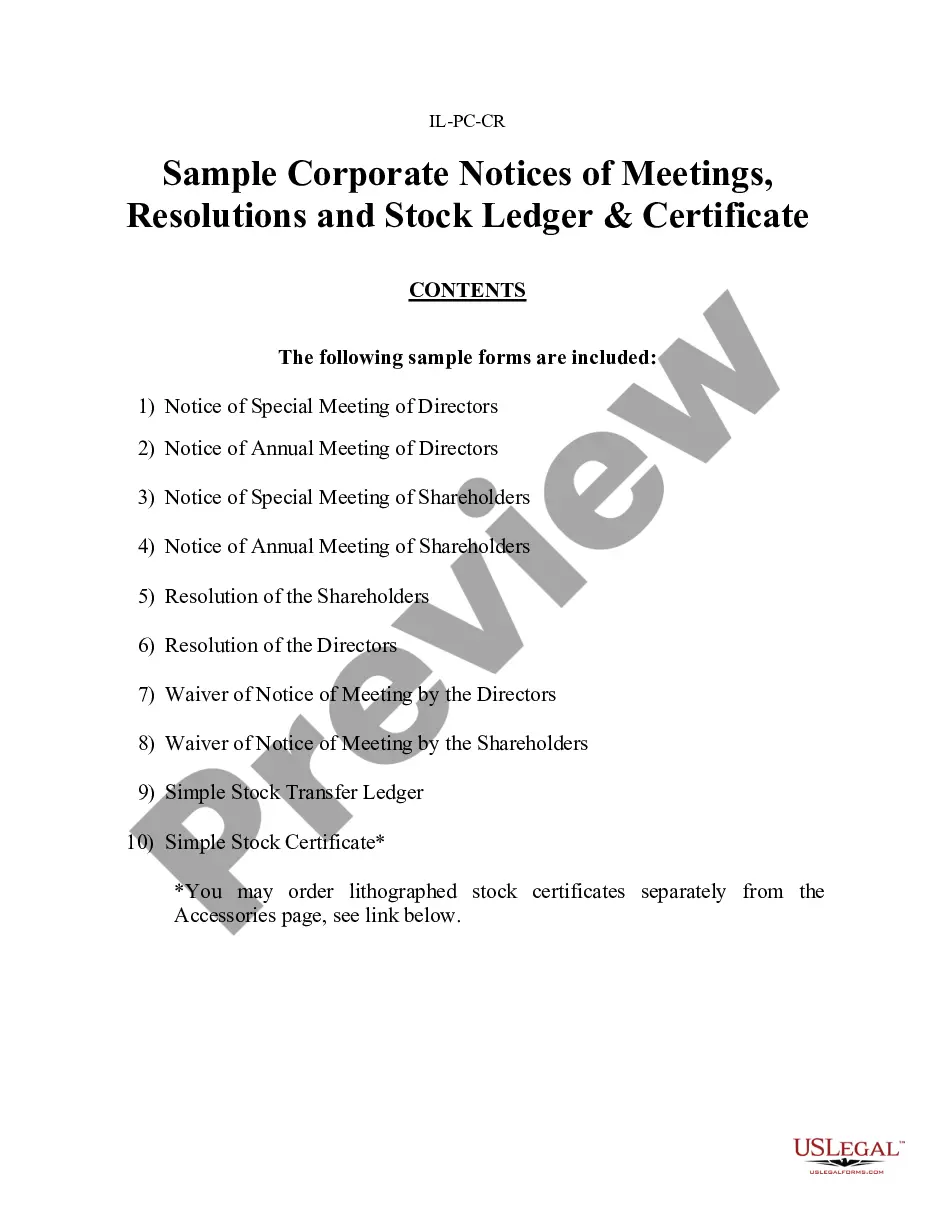

Sample Corporation Certificate With Compensation

Description

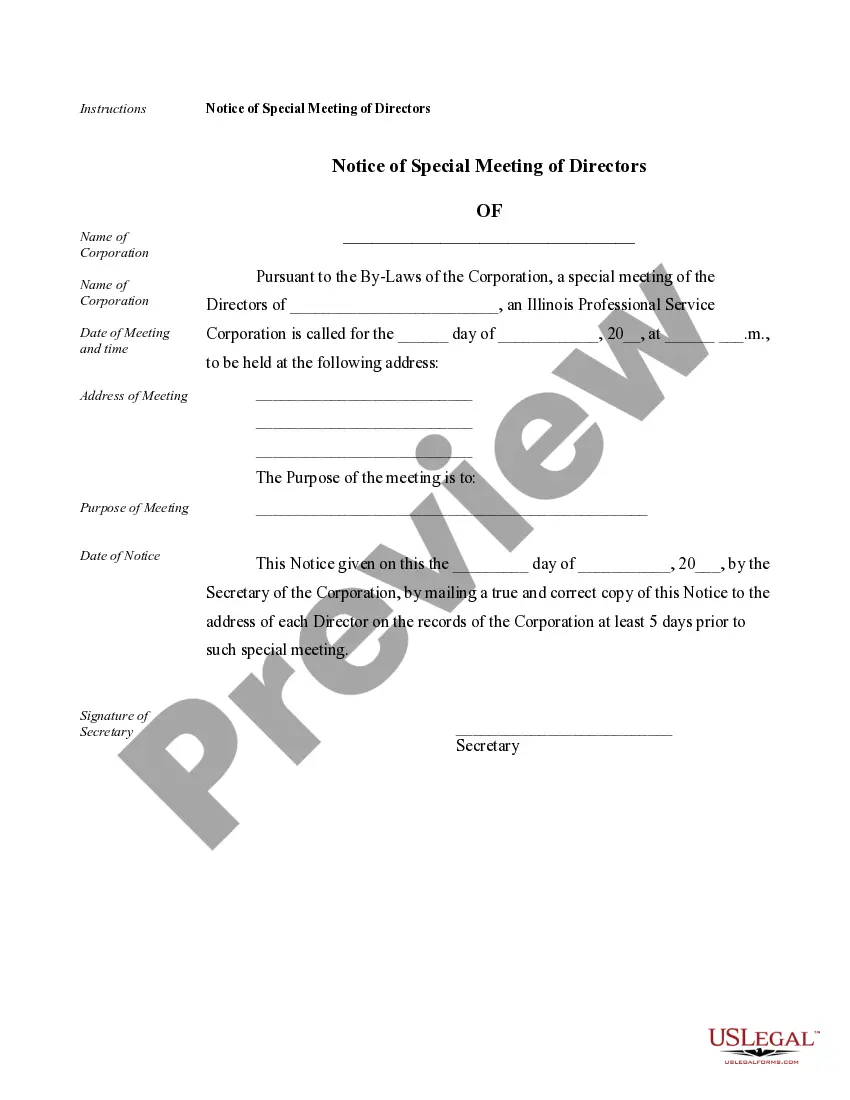

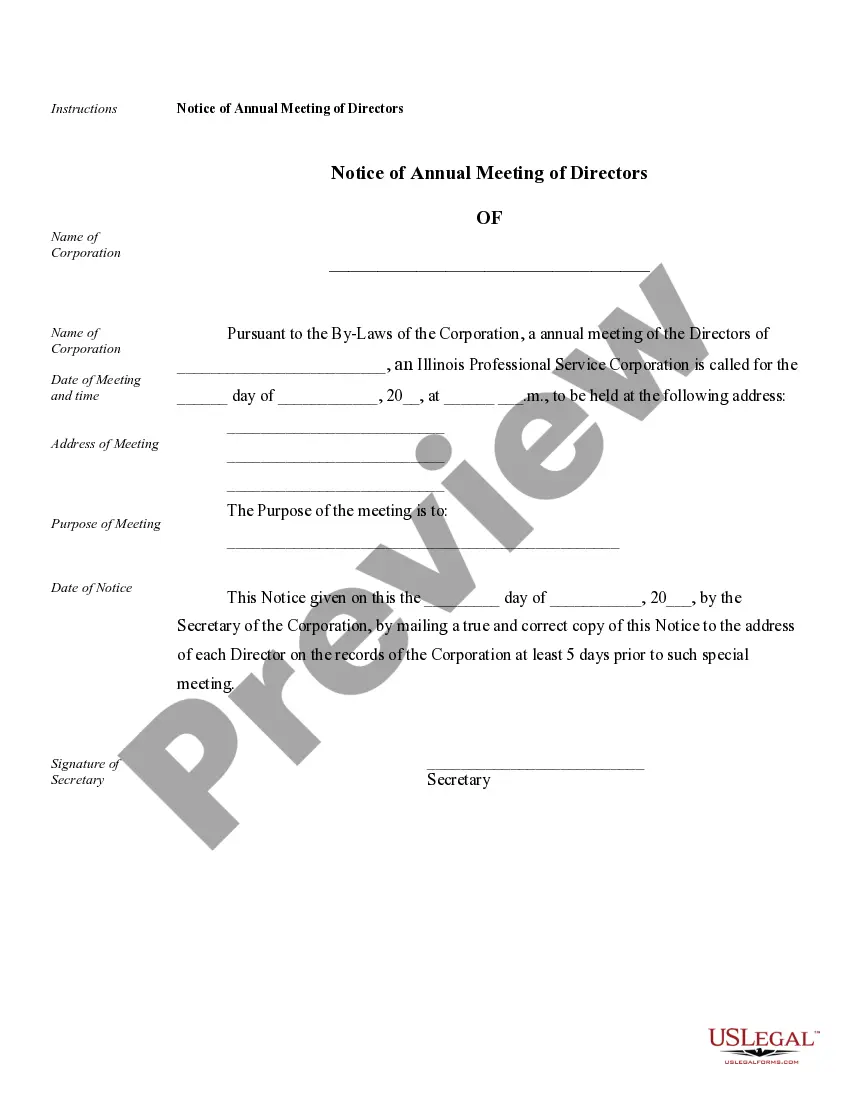

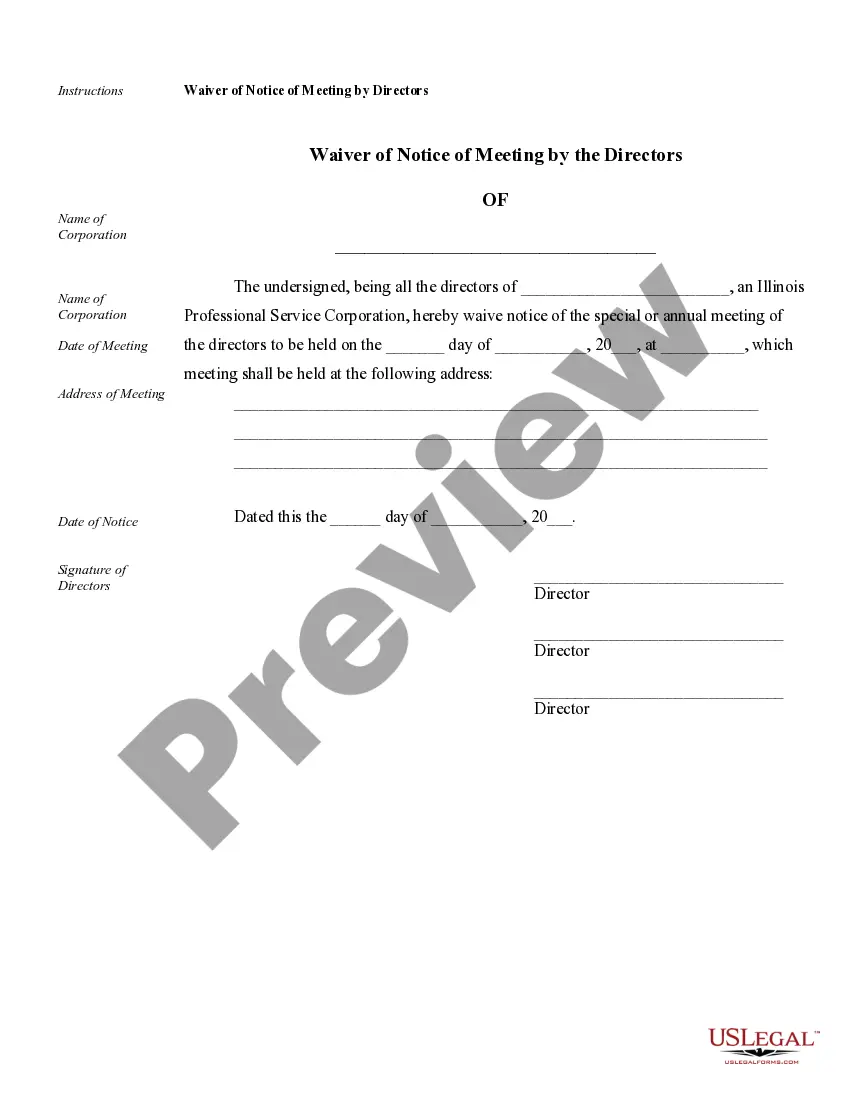

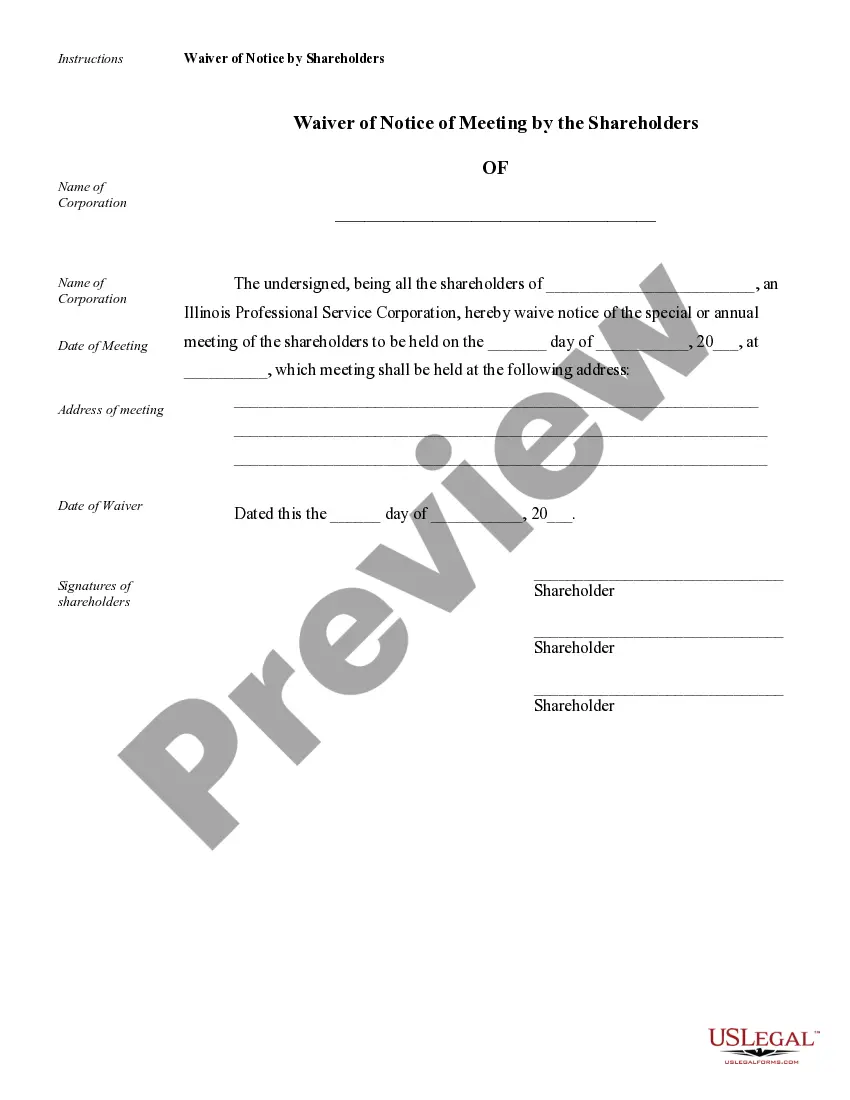

How to fill out Annual Minutes For An Illinois Professional Corporation?

When you need to complete the Sample Corporation Certificate With Compensation that adheres to your local state's laws and regulations, there are various alternatives to select from.

There's no necessity to scrutinize every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy resource that can aid you in acquiring a reusable and current template on any subject.

Utilizing expertly crafted official documents becomes effortless with US Legal Forms. Furthermore, Premium users can also take advantage of the powerful integrated features for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with an archive of over 85k ready-to-use documents for business and personal legal matters.

- All templates are affirmed to comply with each state's regulations.

- Hence, when downloading the Sample Corporation Certificate With Compensation from our website, you can trust that you have a legitimate and up-to-date document.

- Obtaining the needed sample from our platform is remarkably simple.

- If you already possess an account, just Log In to the system, verify your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and retrieve the Sample Corporation Certificate With Compensation at any time.

- If it's your initial encounter with our library, kindly follow the steps below.

- Review the suggested page and verify it against your requirements.

Form popularity

FAQ

Articles of Incorporation are typically kept on file with the state agency that manages corporate filings, such as the Secretary of State. These documents are public records and can often be accessed online. When seeking a Sample corporation certificate with compensation, US Legal Forms can help streamline your access to this information efficiently.

Yes, California has Articles of Incorporation, which are required for forming any corporation within the state. These documents must be filed with the California Secretary of State to legally establish a corporation. If you are looking for a Sample corporation certificate with compensation, you can find resources and templates on US Legal Forms to simplify the process.

You can obtain a PDF copy of the Articles of Incorporation in California by visiting the Secretary of State's website and using their online document request system. Alternatively, you can request a copy by mail, ensuring you include all required information. US Legal Forms can assist you in preparing the necessary documentation for a Sample corporation certificate with compensation.

To obtain a certificate of corporation, you'll need to provide details such as the corporation's name, the names and addresses of the directors, and the purpose of the business. Additionally, you may be required to submit the original Articles of Incorporation. US Legal Forms guides you through this process, ensuring you have a complete Sample corporation certificate with compensation.

To find the original Articles of Incorporation, you can start by checking with the state where the corporation was formed. Many states maintain an online database where you can search for corporate filings. Additionally, US Legal Forms offers a range of resources that provide guidance on how to acquire a Sample corporation certificate with compensation.

Choosing between an LLC and a C corporation depends on your business goals. LLCs offer greater flexibility and pass-through taxation, while C corporations can attract investors and have more potential for growth. Assess your business plans and consult with professionals to determine what best suits your needs. US Legal Forms provides resources to help you decide and draft necessary documents efficiently.

A certificate of formation is an official document required to establish a corporation legally. It typically includes essential information like the corporation’s name, registered agent, and purpose. This document is often filed with the state’s Secretary of State, marking the formal start of your corporation. Consider utilizing a sample corporation certificate with compensation to ensure you capture all necessary information.

Applying for a C corporation involves formalizing your business structure by submitting Articles of Incorporation to your state’s authorities. You'll need to provide critical details, such as your business name, address, and the names of directors. Once approved, obtain an EIN from the IRS to facilitate tax reporting. Using US Legal Forms can streamline this process with easy-to-follow templates.

To change from an S corporation to a C corporation, you must revoke your S corporation election by filing a statement with the IRS. Additionally, inform your shareholders and update your state registration if necessary. This transition may affect your taxes, so it is advisable to consult with a tax advisor. Preparing a sample corporation certificate with compensation can also be beneficial during this process.

To report C Corp income, file Form 1120 with the IRS, including information about your corporation's income, deductions, and credits. It is essential to keep accurate records of all financial transactions throughout the year. By doing this, you ensure compliance while benefiting from the deductions available to your corporation. If you need assistance, consider platforms like US Legal Forms for helpful resources.