201 K Letter With Reason

Description

How to fill out Illinois Motion To Compel?

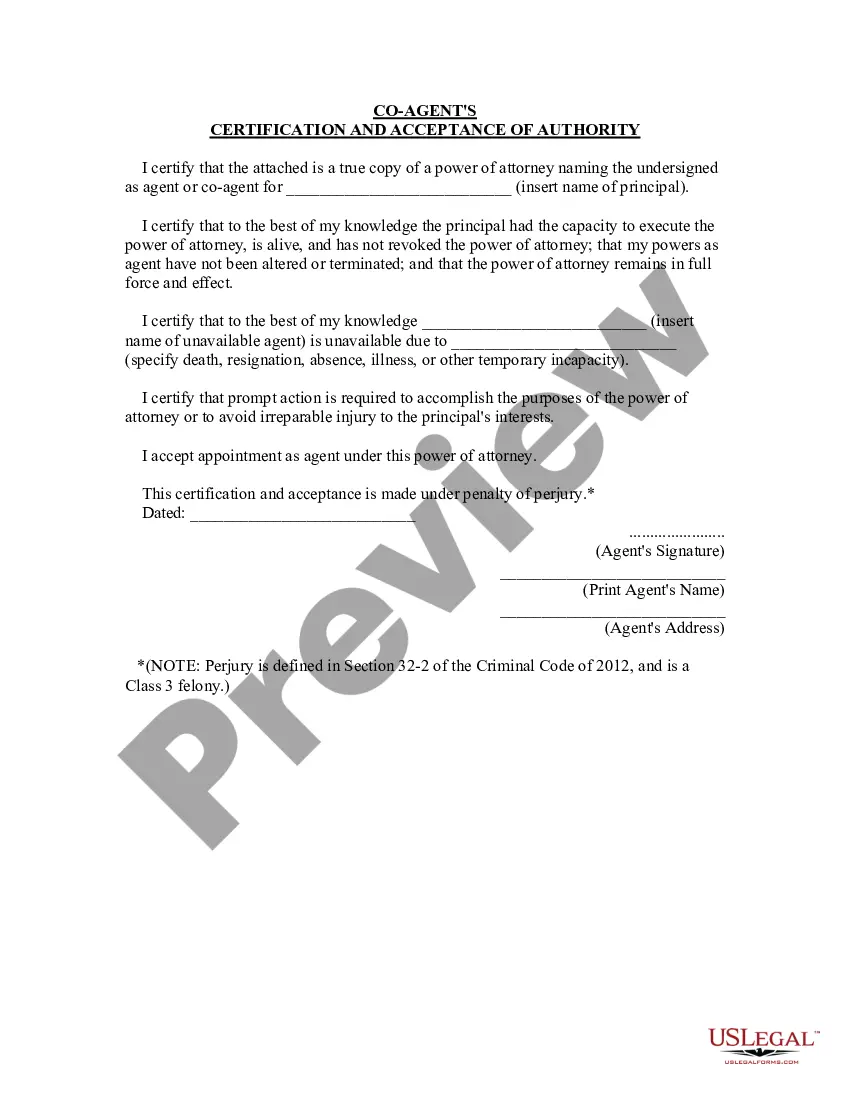

Regardless of whether for professional objectives or personal issues, everyone must confront legal matters at some point in their lives.

Completing legal documentation demands meticulous focus, starting with selecting the correct form template. For example, if you choose an incorrect version of a 201 K Letter With Reason, it will be rejected upon submission. Thus, it is essential to have a reliable source for legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the appropriate template online. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- Obtain the template you require using the search bar or catalog browsing.

- Review the form’s description to verify it aligns with your circumstance, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search tool to locate the 201 K Letter With Reason template you need.

- Acquire the file when it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the correct pricing option.

- Fill out the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you desire and download the 201 K Letter With Reason.

- Once downloaded, you can complete the form using editing software or print it out to fill it in by hand.

Form popularity

FAQ

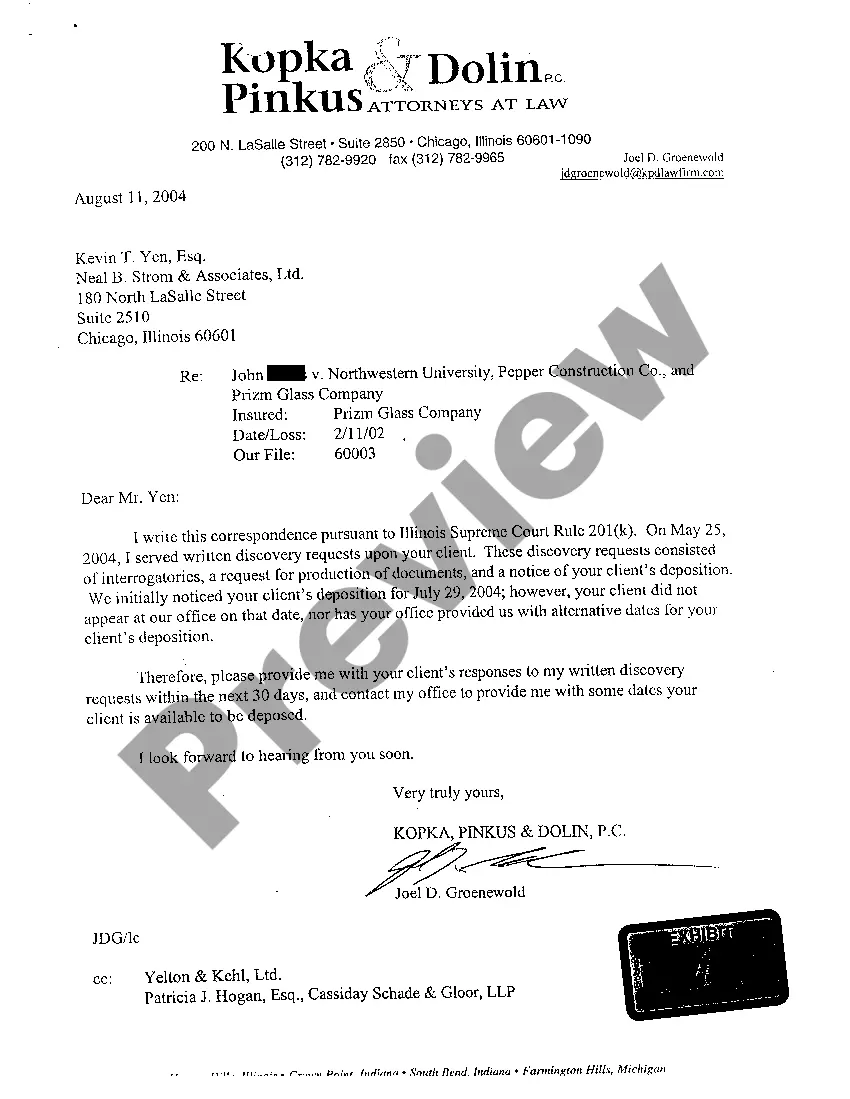

A 201k letter in Illinois serves as a formal notification regarding the intent to file a motion related to discovery issues. It outlines the reasons for the motion, providing clarity and context to the other party. This practice helps foster communication and may lead to resolution without court intervention. Understanding the significance of the 201 k letter with reason can greatly benefit your legal strategy.

Writing a motion to compel discovery involves clearly stating what information you seek and why it is relevant to your case. You should include the specific requests you made previously and any responses received. Additionally, a 201 k letter with reason can accompany your motion, reinforcing your position and demonstrating your effort to resolve the matter amicably. Following these steps can strengthen your motion.

In Illinois, grounds for a motion to reconsider typically include new evidence, changes in the law, or factual errors in the initial ruling. You must clearly outline these reasons in your motion to persuade the court. This process can be complex, so consulting with a legal professional is advisable. Including a 201 k letter with reason can help set the stage for your motion.

Yes, you can and should ask your lawyer for discovery if you believe it is necessary for your case. Your lawyer can guide you through the process and help you understand what information you need. This can lead to a more robust case and better outcomes. A 201 k letter with reason may be a part of this discussion, ensuring both parties are aligned on what is needed.

Discovery Rule 201 in Illinois outlines the procedures for obtaining evidence in a legal case. It establishes the obligations of parties to disclose relevant information and documents. This rule is essential for ensuring fairness in the legal process. Utilizing a 201 k letter with reason can help clarify any disputes regarding discovery obligations.

The 201k Rule in Illinois governs the process of motions to compel discovery in legal cases. This rule requires parties to provide notice before filing a motion, ensuring that the opposing party has an opportunity to address any outstanding issues. By following the 201k Rule, you can foster a more cooperative legal environment. Knowing the 201 k letter with reason can enhance your understanding of this rule.

A 201 k letter is a formal communication used in legal proceedings to notify parties about the intent to file a motion. This letter includes the reason for the motion, which helps streamline the process. It serves as a courtesy to inform the other party and allows for potential resolution before escalation. Understanding the 201 k letter with reason is crucial for maintaining clear communication in legal matters.