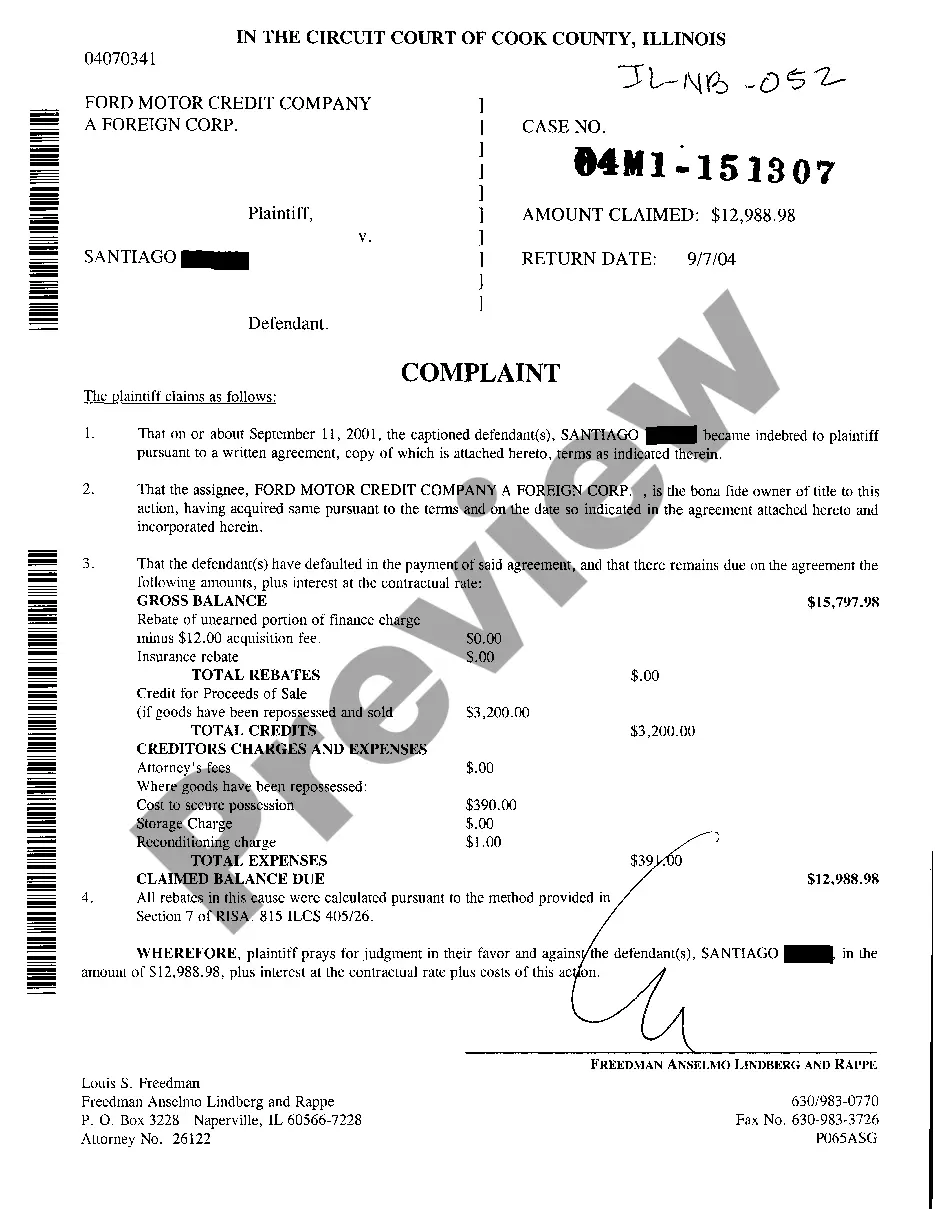

Deficiency Balance Letter Format

Description

How to fill out Illinois Complaint To Collect Deficiency Balance After Repossession Sale Of Automobile?

Acquiring legal document templates that adhere to national and local regulations is essential, and the internet provides numerous options to select from.

But what’s the point in spending time looking for the properly composed Deficiency Balance Letter Format template online if the US Legal Forms online database has such resources consolidated in one location.

US Legal Forms is the largest digital legal directory with over 85,000 fillable templates created by attorneys for any business and personal situation.

Review the template using the Preview feature or through the text description to confirm it suits your needs.

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal advancements, so you can always be assured that your documents are current and compliant when obtaining a Deficiency Balance Letter Format from our platform.

- Acquiring a Deficiency Balance Letter Format is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you require in your desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

You can obtain a deficiency balance statement by contacting your lender directly and requesting it. They may require you to fill out a form or provide specific information to process your request efficiently. Utilizing a deficiency balance letter format can streamline this process, ensuring you get all the necessary details in a clear manner. This statement will help you understand your financial situation and plan your next steps.

To write a deficiency letter, begin by addressing it to the appropriate recipient with a clear subject line. Outline the specific deficiencies you want to address, providing relevant details or examples. Conclude by specifying the actions expected and a timeline for completion. Utilizing the deficiency balance letter format can help streamline your message and ensure clarity.

A deficient letter serves as an official notice indicating that a submission or application is incomplete. It typically details the specific aspects that need attention and provides a deadline for rectifying the deficiencies. This process helps maintain clear communication between parties. Use the deficiency balance letter format for a structured and professional approach.

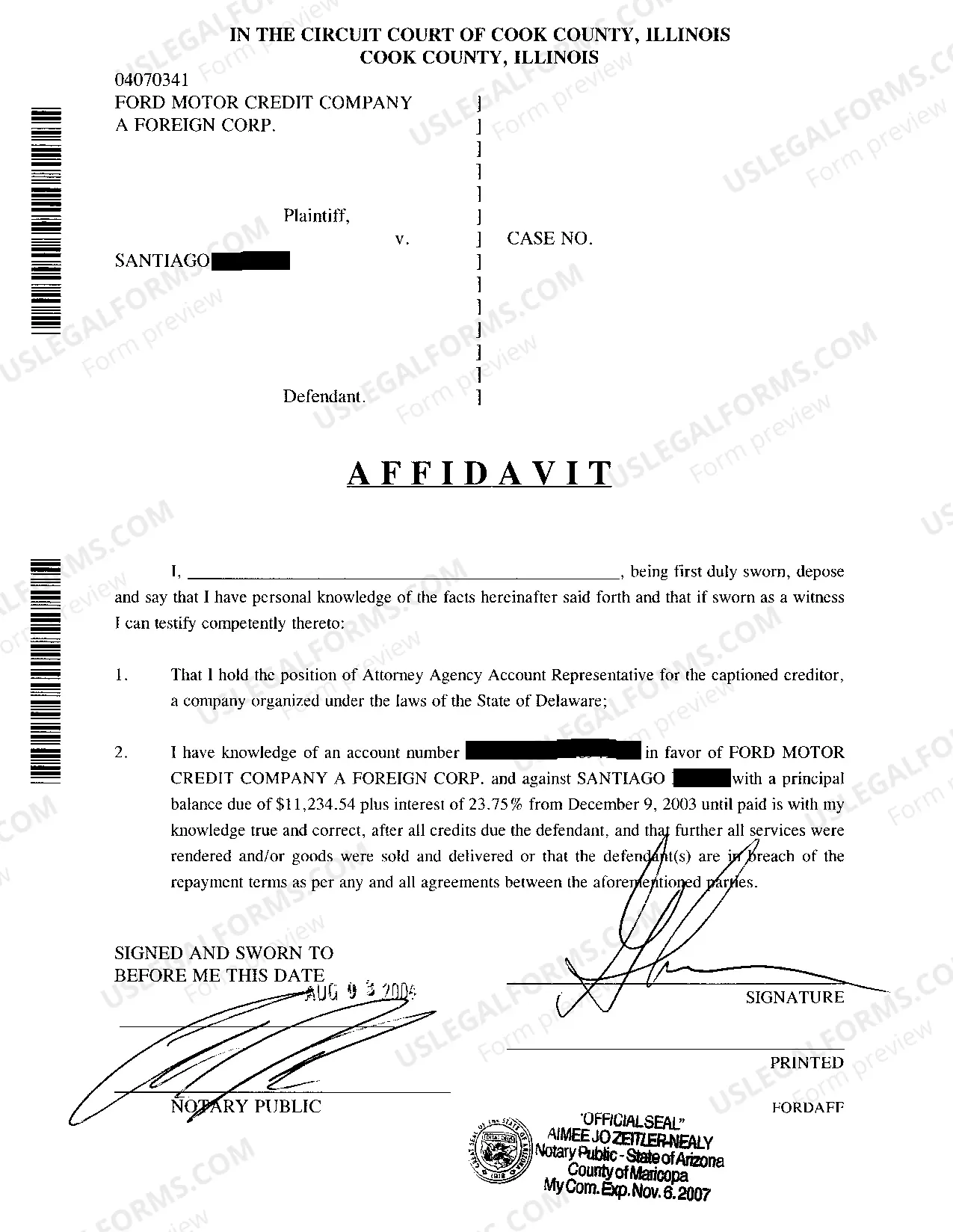

A discovery deficiency letter is a communication used in legal proceedings to address missing information or responses to discovery requests. This letter specifies the items or information that are lacking and requests timely compliance. It ensures that all parties remain informed and engaged in the litigation process. Adhering to a deficiency balance letter format will enhance the effectiveness of this letter.

A letter of deficiency is a formal notice that informs a recipient about missing information or documentation. This letter typically outlines the specific deficiencies and the necessary steps to address them. It can be essential in legal or financial contexts where compliance is critical. For legal documentation, consider using the deficiency balance letter format to ensure clarity.

To write a risk letter, start by clearly stating the purpose of your communication. Highlight the potential risks associated with a specific situation or decision. Use a straightforward and professional approach, ensuring you include any relevant details. Finally, refer to the deficiency balance letter format if specific documentation is required.

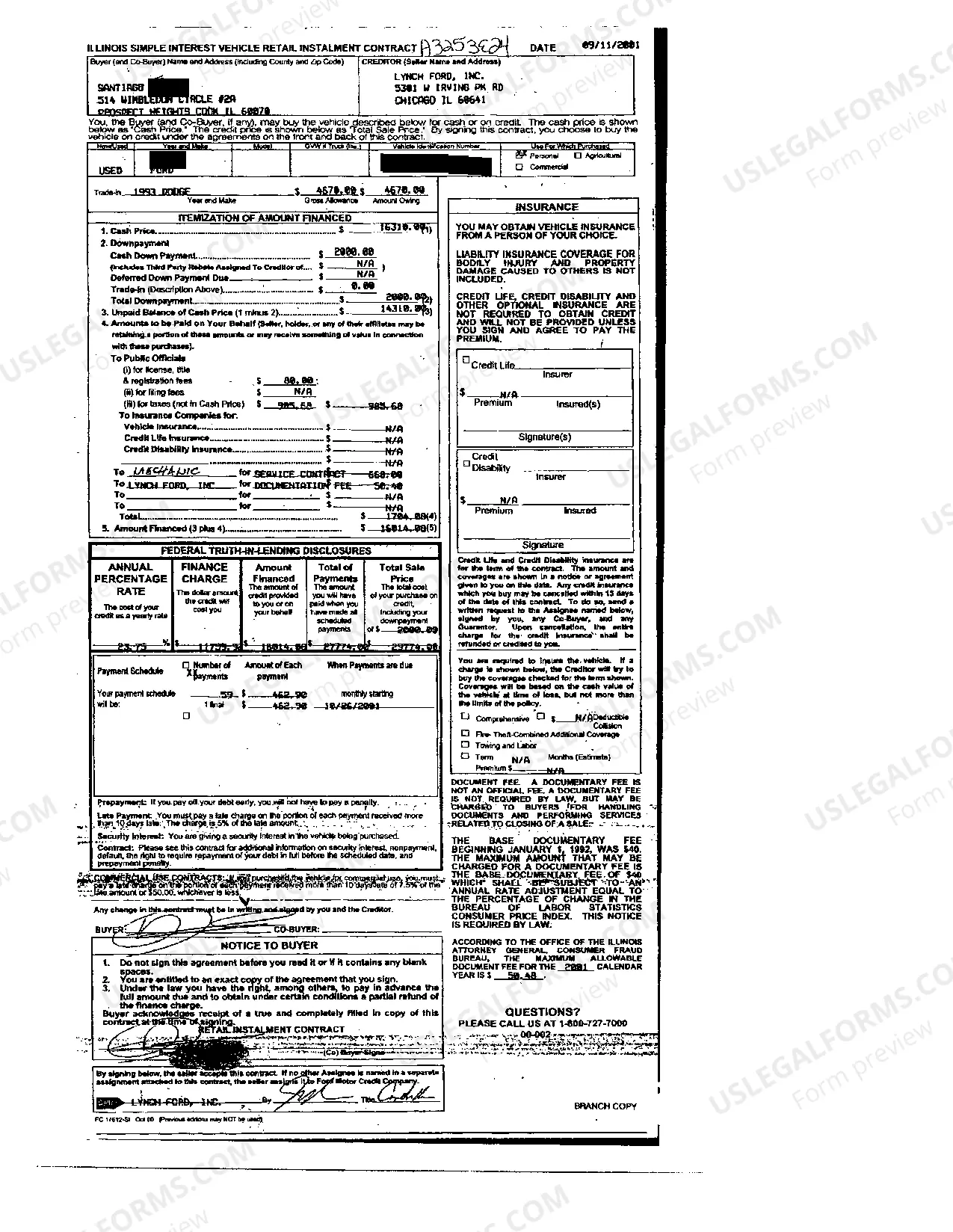

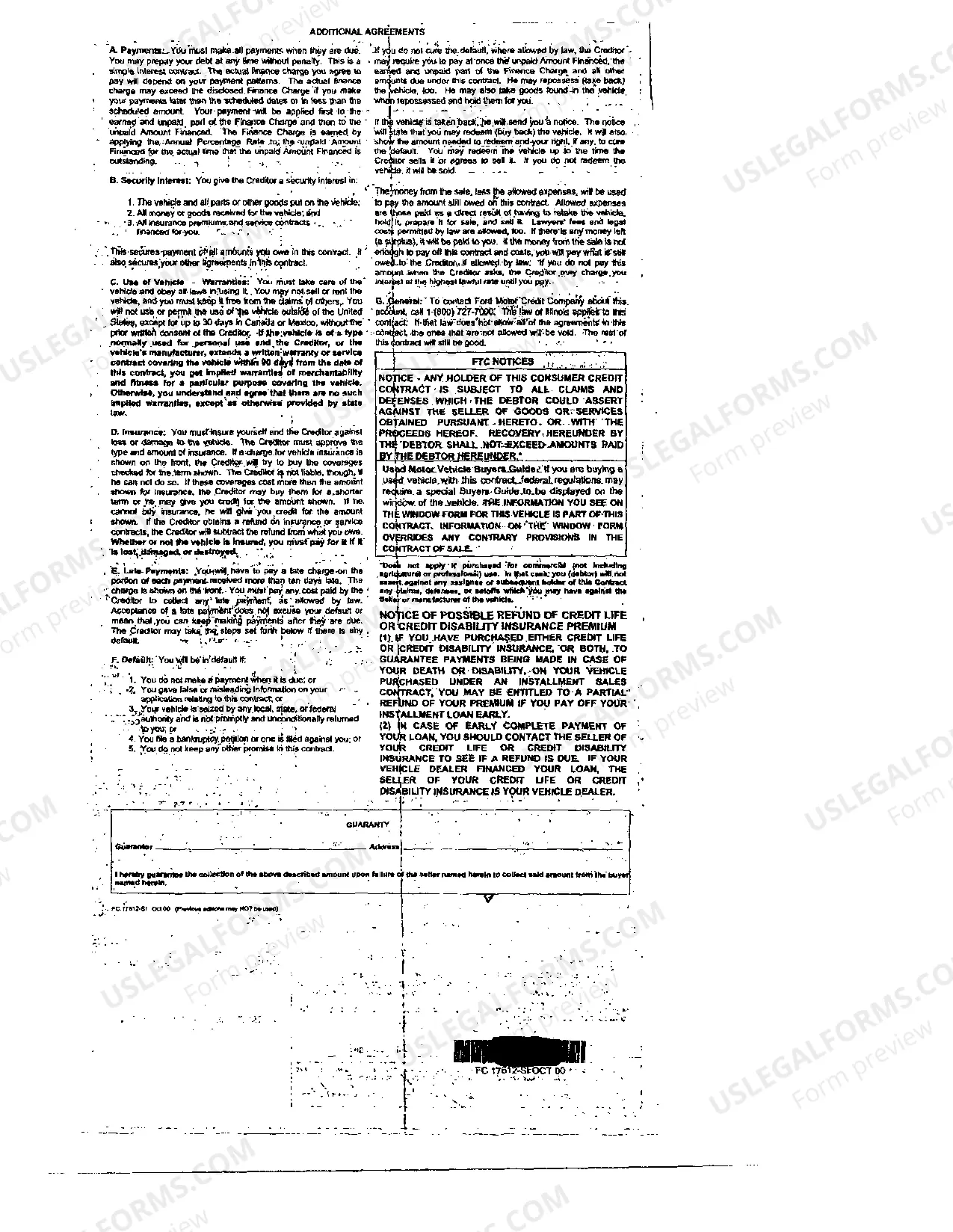

Returning a financed car is possible, but it often involves specific conditions. You may need to write a deficiency balance letter to your lender to clearly express your intention. This letter format includes necessary details about your situation and can involve the return process. Additionally, consider options like refinancing or selling the car to mitigate financial strain.

A deficiency balance letter is a document sent by a lender outlining the remaining amount owed after a property has been sold, typically at a loss. This letter details how the deficiency balance was calculated and serves as an official notice of your obligation. Understanding this letter is crucial for addressing your debt effectively, and knowing the deficiency balance letter format can help you navigate your next steps.

Begin by researching your rights and understanding the terms outlined in your deficiency balance letter format. When you contact your lender, clearly explain your financial circumstances, and propose a reduced settlement amount. Maintain open communication and recognize that negotiation might take time. You might also consider engaging a professional who specializes in debt negotiation for added support.

Absolutely, negotiating a deficiency balance is feasible. You should review the deficiency balance letter format to understand the specifics of what you owe. Knowledge and preparation are key, so collect all pertinent information about your financial situation. Contact your lender to discuss possible adjustments or payment alternatives.