Illinois Lead Based Paint Disclosure With Be Signed

Description

How to fill out Illinois Lead Based Paint Disclosure For Sales Transaction?

Accessing legal document examples that adhere to federal and local regulations is essential, and the web provides numerous options to choose from.

However, why spend time searching for the correct Illinois Lead Based Paint Disclosure With Be Signed template online when the US Legal Forms online library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 customizable templates created by attorneys for every business and personal situation. They are easy to navigate with all documents categorized by state and purpose.

All documents you discover through US Legal Forms are re-usable. To re-download and complete forms previously acquired, visit the My documents section in your account. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Our experts keep up with legal updates to ensure your documents are current and compliant when you obtain an Illinois Lead Based Paint Disclosure With Be Signed from our platform.

- Acquiring an Illinois Lead Based Paint Disclosure With Be Signed is straightforward and swift for both existing and new clients.

- If you have an account with an active subscription, Log In and download the document sample you need in the appropriate format.

- If you're new to our site, follow the steps below.

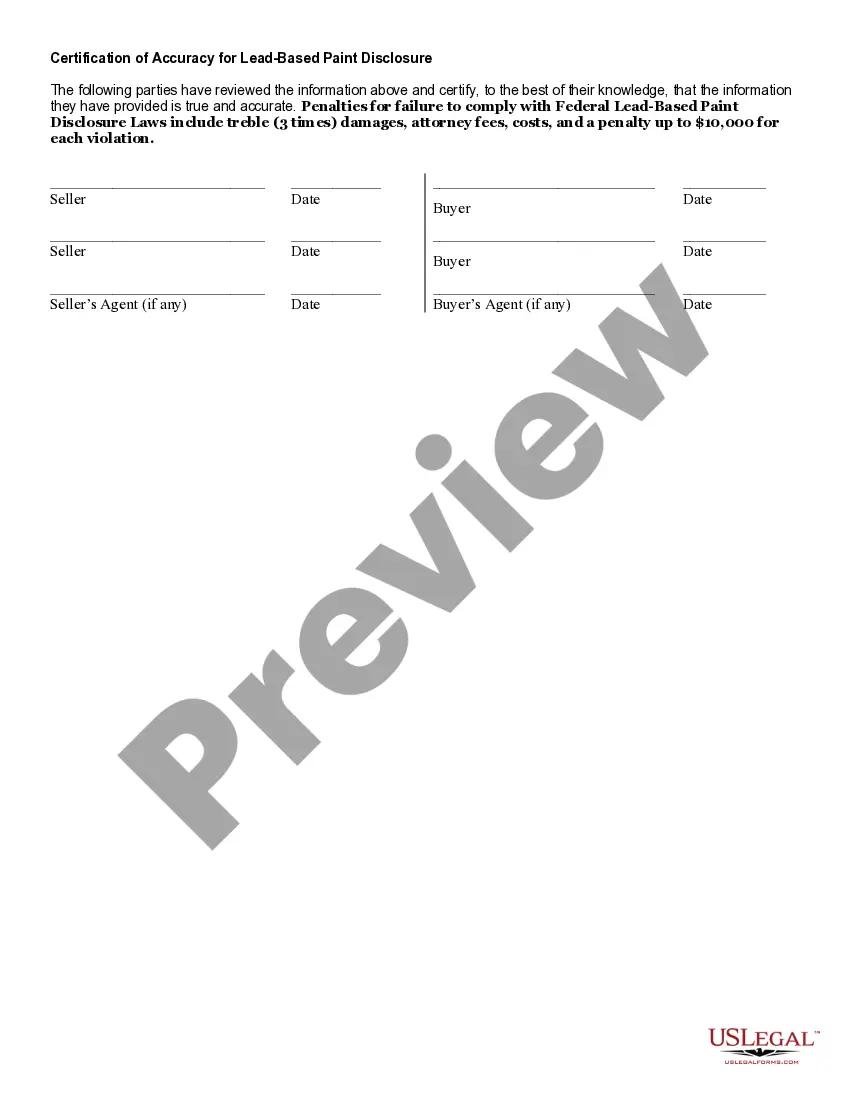

- Review the template using the Preview feature or through the text description to ensure it meets your requirements.

Form popularity

FAQ

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Though it's not required by Pennsylvania law, any good lawyer will recommend having a written operating agreement for your LLC.

However, by forming a single-member LLC, the sole owner of a business can retain the simplicity of a sole proprietorship while still obtaining the full liability shield afforded under Pennsylvania corporate law.

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

The document required to form an LLC in Pennsylvania is called the Articles of Organization.

Search OpenCorporates for Pennsylvania (click here for Pennsylvania specific link). Look at the address and date in parentheses next to each company to find the one that's right for you. The bolded text is the legal name of the company. Click it to see all the information about the company.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report). However, starting in 2025, the new Annual Report requirement will replace the old Decennial Report.

You'll need to choose a name to include in your articles before you can register your LLC. Names must comply with Pennsylvania naming requirements. The following are the most important requirements to keep in mind: Your business name must include the words Limited Liability Company, LLC, or L.L.C.

To operate in Pennsylvania, businesses must register their business structure ? such as an LLC, partnership, corporation, or other structure ? with the Pennsylvania Department of State.