Trust Amendment In Budget 2020

Description

Form popularity

FAQ

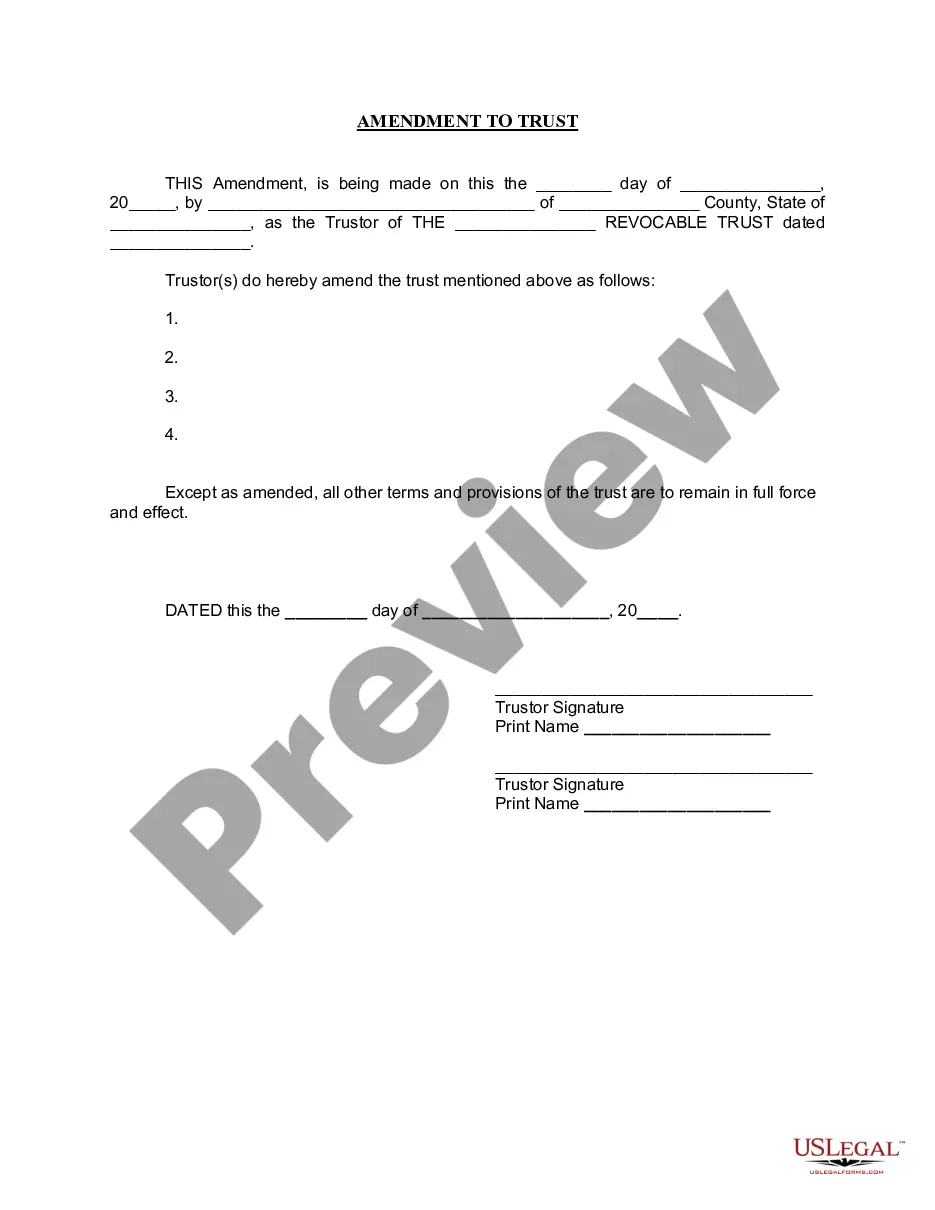

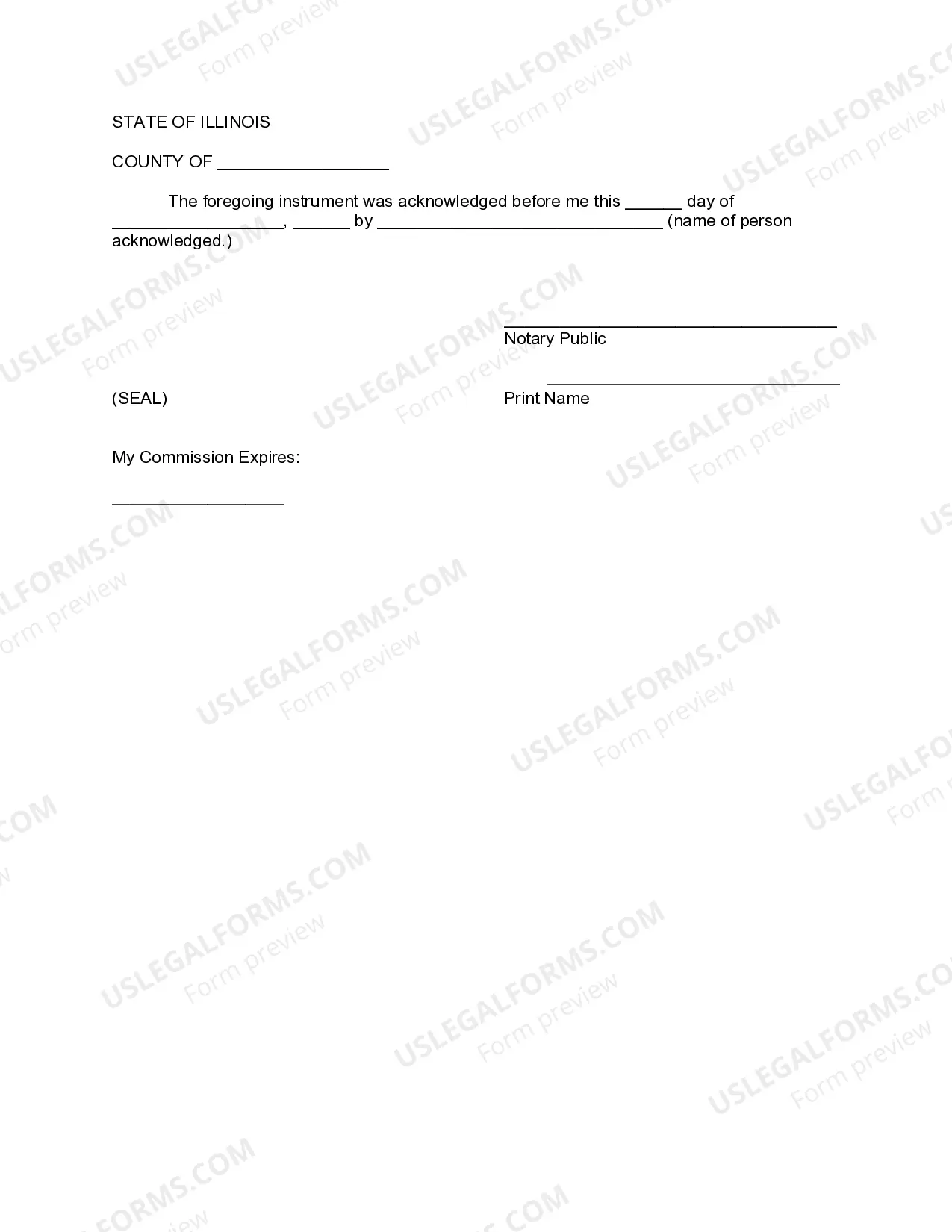

To write an amendment to a trust, you should create a document that specifies the changes you wish to make and ensure it is signed and dated by the person who created the trust. It's important to reference the original trust document and clarify how the amendment affects it. A trust amendment in budget 2020 can be essential for keeping your wishes aligned with changing circumstances. USLegalForms provides templates that can guide you in drafting a legally sound amendment.

The tax consequences of terminating a trust can include capital gains taxes and distribution taxes for the beneficiaries. It is essential to ensure that all tax obligations are met before finalizing the termination. If you have made a trust amendment in budget 2020, it may influence these tax implications. For tailored assistance, consider utilizing USLegalForms to understand your tax obligations clearly.

When you close a trust, all the assets are distributed to the beneficiaries according to the trust document. This process often involves settling debts, paying taxes, and filing necessary forms with the IRS. A trust amendment in budget 2020 may affect how assets are distributed, so it's crucial to ensure everything is in order. Consider using USLegalForms to manage the closing process seamlessly.

To file a final tax return for a trust, you must complete IRS Form 1041 and indicate that this is a final return. Ensure you report all income earned by the trust during its final year. Incorporating a trust amendment in budget 2020 can help clarify the trust's status and improve the filing process. USLegalForms offers easy-to-follow templates to assist you in preparing and filing the return correctly.

The time it takes for the IRS to close an estate can vary based on several factors, including the complexity of the estate and whether there are outstanding tax issues. Typically, the IRS may take anywhere from six months to a year to process an estate. If you have made a trust amendment in budget 2020, planning ahead can simplify this timeline. Utilizing platforms like USLegalForms can help you navigate the necessary documentation efficiently.

Filing an amended 1041 involves a few important steps. First, fill out Form 1041-X with accurate information regarding the original return and the corrections needed. In light of a trust amendment in budget 2020, ensure that your changes effectively reflect the updated terms of your trust. Consider using the tools and insights available at USLegalForms for guidance in this process.

Writing a trust amendment involves drafting a legal document that details the specific changes you wish to make. Ensure you clearly identify the trust and the sections being amended. When discussing a trust amendment in budget 2020, it’s critical that you articulate your intentions precisely. Resources like USLegalForms can provide templates to help you create your amendment properly.

Yes, many taxpayers can now electronically file amended returns through their tax software. This option streamlines the process and often speeds up your refund if you are due one. When addressing items like a trust amendment in budget 2020, e-filing can save you time and provide peace of mind. Remember to double-check that you are using the correct forms and resources, such as USLegalForms.

To file an amended 1041, start by completing Form 1041-X. You will need to outline your original return information and make detailed changes clearly. In the context of a trust amendment in budget 2020, this is a great opportunity to ensure that your trust's tax information reflects the necessary updates. USLegalForms can assist in providing the exact forms and instructions needed to file successfully.

Generally, you can file an amended return within three years of the original return's due date. This flexibility allows taxpayers to correct errors or update information as needed, including trust amendments in budget 2020. However, some situations may impose specific deadlines. It's wise to consult resources like USLegalForms for guidance specific to your circumstances.